Shaking Things Up: ARCC and ACAS Combine

On May 23, Ares Capital (ARCC) announced the acquisition of fellow business development company, or BDC, American Capital (ACAS) in a cash and stock deal valued at $4.0 billion. The deal is notable from several perspectives. First, the transaction brings closure to the ACAS saga. Second, the deal includes third-party support from ARCC’s management company. Finally, the transaction structure allowed ARCC to raise nearly $2.0 billion in new equity without diluting NAV per share, despite ARCC shares trading at an 8% discount to NAV prior to the announcement.

Culmination of the ACAS Experiment

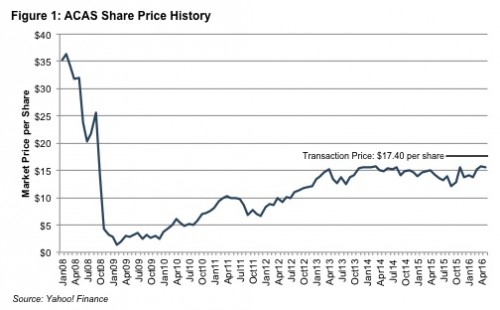

Prior to the 2008 recession, ACAS was one of the two largest BDCs. The other, Allied Capital, was acquired by ARCC in 2010. As shown in Figure 1, ACAS’ share price was (literally) decimated during the recession, losing over 90% of its value during 2008 and 2009.

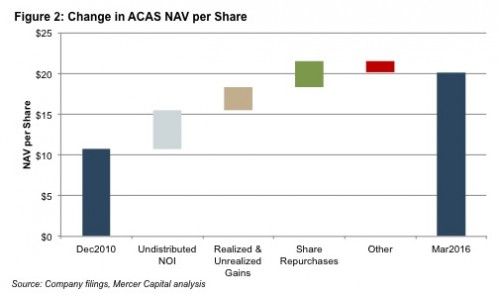

During 2011, ACAS elected to be taxed as a C corporation rather than a registered investment company, or RIC. No longer subject to RIC distribution requirements, ACAS embarked on an aggressive strategy of asset rationalization, debt reduction, and share repurchases. Having suspended dividend payments in 2010, reported NAV per share increased from $10.71 at the end of 2010 to $20.14 at March 31, 2016 (an annualized growth rate of 12.8%).

Over that period, the price/NAV ratio for the shares increased from 70.6% to 77.6%, resulting in a compound annual return for shareholders of 14.8% via a combination of growth in NAV and multiple expansion. The announced purchase price of $17.40 per share, an 11.4% premium to the May 20 closing price, brings the compound annual return up to 17.2%. As shown in Figure 2, the increase in NAV per share reflected not only undistributed operating earnings and asset gains, but also the accretive impact of share repurchases below NAV (cumulative impact of $3.19 per share). With shares trading at persistent discounts to NAV, ACAS repurchased nearly 35% of its outstanding float during the period.

In sum, the positive shareholder returns for ACAS over the period, which beat those of ARCC and its peer BDCs, is a reminder that growth is not the only route to generating shareholder returns. While the company’s investment portfolio shrunk nearly 40%, pursuit of the best risk-adjusted returns delivered a positive outcome for ACAS shareholders.

(I Get By) With a Little Help from My Friends…

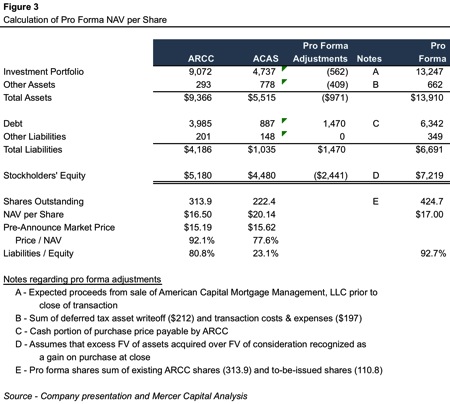

The total reported transaction consideration of $17.40 per ACAS share includes $2.45 per share from the sale of the company’s American Capital Mortgage Management subsidiary prior to transaction close. Of the net purchase price of $14.95, ARCC is providing only $13.75, with the BDC’s external manager Ares Management (ARES) picking up the remaining $1.20 per ACAS share, or $275 million. In addition, ARES pledged to a management fee waiver of $10 million per quarter for the ten quarters following the transaction close. The waiver works out to approximately 0.725% of ACAS’ reported assets of $5.5 billion, or half of ARES’ base management fee of 1.45%. The present value of the fee waiver (at a 12% discount rate) is approximately $86 million, and will accrue to the benefit of both ARCC and ACAS shareholders.

The topic of BDC management fees has been the subject of much comment over the past few years. The transaction structure for this deal highlights the attractiveness of the anticipated management fee stream to ARES (as well as, potentially, other strategic benefits accruing to the broader Ares platform as a result of the transaction).

From the perspective of ARCC shareholders, the contribution by ARES represents approximately $0.65 per share of NAV accretion, and makes the economics of the transaction considerably more palatable. Relative to the pro forma investment portfolio of $13.2 billion, the prospective fee concession represents approximately 30 basis points of incremental return on assets and 55 basis points of incremental return on equity.

Unlocking Incremental Capital

New share issuance is the only sustainable growth mechanism available to BDCs. With share prices mired at discounts to NAV for almost two years, BDCs have been generally been unable to issue new shares absent shareholder authorization, resulting in stagnant balance sheets given leverage restrictions and a statutory requirement to distribute at least 90% of taxable income as RICs. With depository institutions less inclined – or able – to make the sort of leveraged loans that BDCs specialize in, the perceived opportunities for BDCs are potentially substantial, but without access to fresh capital, BDCs have been unable to capitalize.

Prior to the transaction announcement, ARCC shares traded at 92% of NAV, compared to 78% for ACAS. ARCC shareholders would likely have been disinclined to approve a dilutive issuance of 110.8 million shares (which would have resulted in a dilutive impact of $0.34 per share). However, since the shares were issued in exchange for ACAS shares trading at a yet deeper discount, the issuance looks to be potentially accretive to NAV per share. (ACAS management indicated that it may take a couple quarters for NAV per share accretion to be realized).

With no obvious triggers for share prices to resume trading at premiums to NAV beyond a pick-up in the economy and a corresponding narrowing of credit spreads, acquisitions like this may be the best available strategy for more favored BDCs to unlock incremental capital and generate balance sheet growth.

Conclusion

At the close of trading on the first day following the announcement, market response to the transaction has been uninspiring, with ARCC shares trading down 2.4%, and ACAS shares closing at $15.72 per share, or nearly 10% below the nominal deal value of $17.40 per share. Whether this reflects uncertainty regarding the deal actually closing or a lack of enthusiasm for ARCC shares as currency, investors seem unimpressed thus far. A cynic might point out that ARES shareholders (up $0.02) seem unfazed, suggesting that the value of the incremental management fee stream outweighs the deal contribution and prospective fee concession.

The Ares management team has proven adept at managing through various credit cycles and has the experience of folding in the substantial Allied acquisition in 2010. If this deal closes, the pro forma company will be in a class of its own as measured by size, at approximately twice the size of the next largest BDC. Whether the envisioned benefits of scale will accrue to the ARCC shareholders remains to be seen.