It’s Tax Time: Implications of Tax Reform for Banks

A Memphis establishment long has used the slogan, “It’s Tax Time (… Baby),” in their low budget television advertising. After listening to early fourth quarter earnings calls, banks – and especially their investors – appear to be embracing this slogan as well. Four investment theses undergirded the revaluation of bank stocks after the 2016 presidential election: regulatory reform, higher interest rates, faster economic growth, and tax reform. One year later, regulatory reform is stymied in Congress, and legislative efforts appear likely to yield limited benefits. Short-term rates have risen, but the benefit for many banks has been squashed by a flatter yield curve and competition for deposits. Economic growth has not yet translated into rising loan demand.

Fortunately for bank stock valuations, the tax reform plank materialized in the Tax Cuts and Jobs Act of 2017 (the “Act”).1 The Act has sweeping implications for banks, influencing more than their effective tax rates. This article explores these lesser known ramifications of the Act.2

C Corporations & The Act

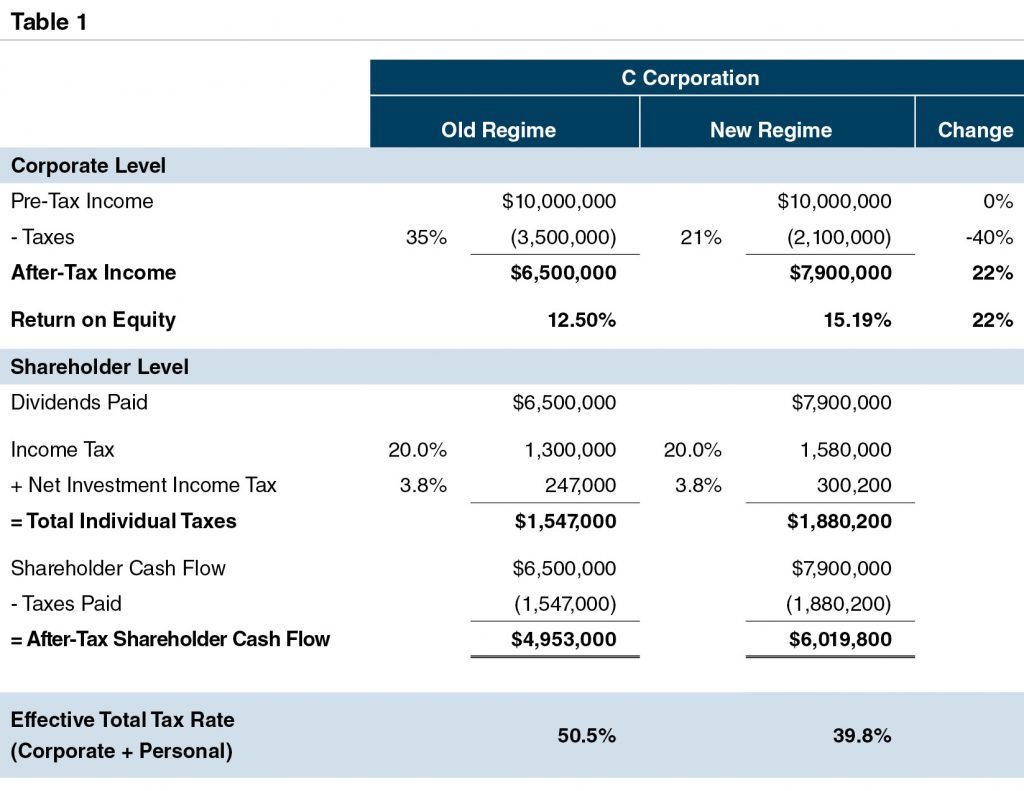

In 2017, the total effective tax rate on C corporation earnings – at the corporate level and, assuming a 100% dividend payout ratio, at the shareholder level – was 50.5%. Under the Act, this rate will decline to 39.8%, reflecting the new 21% corporate rate and no change in individual taxes on dividends. For a hypothetical bank currently facing the highest corporate tax rate, the Act will cause a 40% reduction in tax expense, a 22% increase in after-tax earnings, and a 269bp enhancement to return on equity (Table 1).

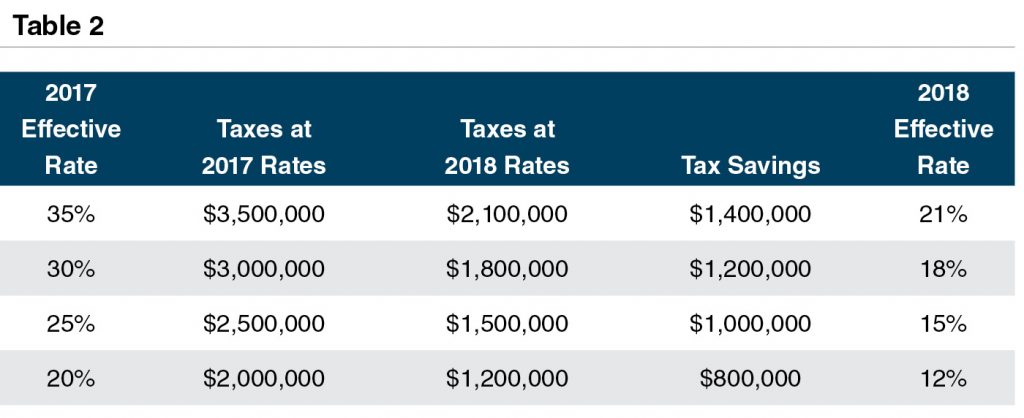

The benefit reduces, however, for banks with lower effective tax rates resulting from, among other items, tax-exempt interest income. Continuing the example in Table 1, which assumed a 35% effective tax rate, Table 2 illustrates the effect on banks with 30%, 25%, and 20% effective tax rates.

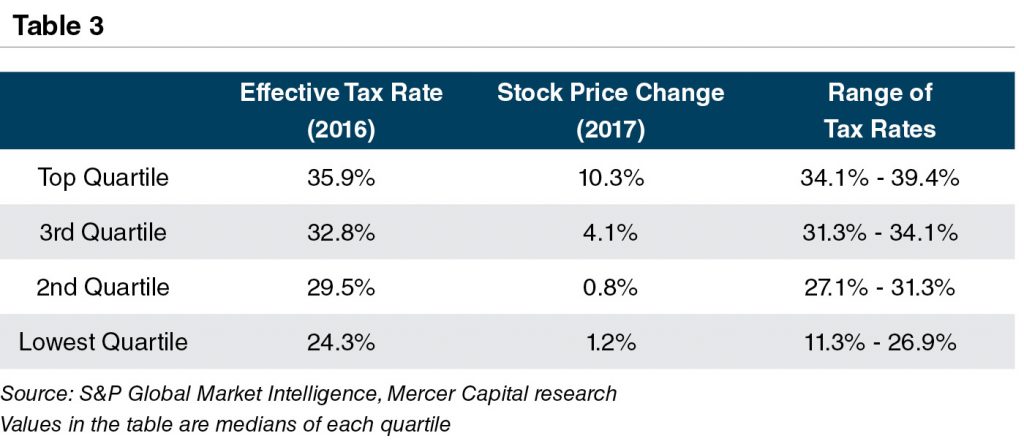

Since investors in bank stocks value after-tax earnings, not surprisingly banks with the highest effective 2016 tax rates experienced the greatest share price appreciation in 2017. Table 3 analyzes share price changes for publicly-traded banks with assets between $1 and $10 billion.

Implications

The preceding tax examples distill a nuanced subject into one number, namely an effective tax rate. The implications of the Act for banks, though, spread far beyond mathematical tax calculations. We classify the broader implications of the Act into the following categories:

- “Allocation” of Tax Savings

- Lending

- Miscellaneous

Implication #1: “Allocation” of Tax Savings

We know for certain that the tax savings resulting from the Act will be allocated among three stakeholder groups – customers, employees, and shareholders.3 The allocation between these groups remains unknown, though.

Customers

Jamie Dimon had a succinct explication of the effect of the Act on customers:

And just on the tax side, so these people understand, generally, yes, if you reduce the tax rates, all things being equal, to 20% or something, eventually, that increased return will be competed away.4

The logic is straightforward. The after-tax return on lending and deposit-taking now has increased; higher after-tax returns attract competition; the new competitors then eliminate the higher after-tax returns. Rinse and repeat. One assumption underlying Mr. Dimon’s statement, though, is that prospective after-tax returns will exceed banks’ theoretical cost of capital. If not, loan and deposit pricing may not budge, relative to the former tax rate regime. Supporting the expectation that customers will benefit from the Act is the level of capital in the banking industry searching for lending opportunities.

Renasant Corporation has noted already potential pressure on its net interest margin.

Not sure [net interest margin expansion is] going to hold. We’ll need a quarter or 2 to see what competitive reaction is to say that we’ll have margin expansion. But we do think that margin at a minimum will be flat and would be variable upon competitive pressures around what’s down with the tax increase.5

Employees

An early winner of tax reform was employees of numerous banks, who received one-time bonuses, higher compensation, and upgraded benefits packages. With falling unemployment rates, economists will debate whether employers would have made such compensation adjustments absent the Act. Nevertheless, the public nature of these announcements, with local newspapers often covering such promises, will create pressure on other banks to follow suit.

Generally, bank compensation adjustments have emphasized entry level positions. An open question is whether such benefits will spread to more highly compensated positions, thereby placing more pressure on bank earnings. For example, consider a relationship manager who in 2017 netted the bank $100 thousand after considering the employee’s compensation and the cost of funding, servicing, and provisioning her portfolio. Assuming that customers do not capture the benefit, the officer’s portfolio suddenly generates after-tax net income of $122 thousand. The loan officer could well expect to capture a share of this benefit, or take her services to a competitor more amenable to splitting the benefit of tax reform.

Shareholders

Mr. Market clearly views shareholders as the biggest winner of tax reform, and we have no reason to doubt this – at least in the short-run. Worth watching is the form this capital return to shareholders takes. With bank stocks trading at healthy P/Es, even adjusted for tax reform, banks may hesitate to be significant buyers of their own stock. Instead, some public banks have suggested higher dividends are in the offing. Meanwhile, Signature Bank (New York), which has not paid dividends historically, indicated it may initiate a dividend in 2018. In the two days after the CEO’s announcement, Signature’s stock price climbed 8%.

Table 4 compiles announced expenditures by certain banks on employees, philanthropy, and capital investments. Click to view Table 4.

Some public market analysts have “allocated” 60% to 80% of the tax savings to shareholders, with the remainder flowing to other stakeholders. Time will tell, but banks will face pressure from numerous constituencies to share the benefits.

Implication #2: Lending

The Act potentially affects loan volume with future possible effects on credit quality.

Volume

Looked at most favorably, higher economic growth resulting from the Act, as well as accelerated capital expenditures due to the Act’s depreciation provisions, may provide a tailwind to loan growth. However, some headwinds exist too. Businesses may use their tax savings to pay down debt or fund investments with internal resources. The Act eliminates the deductibility of interest on home equity loans and lines of credit, potentially impairing their attractiveness to consumers. Last, the Act disqualifies non-real estate assets from obtaining favorable like-kind exchange treatment, potentially affecting some types of equipment finance.

Quality

While we do not expect the Act to cause any immediate negative effects on credit quality, certain provisions “reallocate” a business’ cash flow between the Treasury and other stakeholders (e.g., creditors) in certain circumstances:

- Net Operating Loss (“NOL”) Limitations. Tax policy existing prior to the Act allowed businesses to carry back net operating losses two years, which provided an element of countercyclicality in periods of economic stress. The Act eliminates the carryback provision. Further, businesses can apply only 80% of future NOLs to reduce future taxable earnings, down from 100% in 2017, thereby potentially pressuring a business’ cash flow as it recovers from losses. As a result, less cash flow may be available to service debt.

- Interest Deductibility Limitations. The Act caps the interest a business may deduct to 30% of EBITDA (through 2021) and EBIT (thereafter) for entities with revenue exceeding $25 million.6 Assuming a 5% interest rate, a business’ debt must exceed 6x EBITDA before triggering this provision. Several issues arise from this new limitation. First, community banks may have clients that manage their expenses to achieve a specified tax result, which could face disallowed interest payments. Second, in a stressed economic scenario, cash flow may be diverted to cover taxes on nondeductible interest payments, rather than to service bank debt.

- Real Estate Entities. The Act appears to provide relatively favorable treatment of real estate managers and investors. However, banks should be aware that the intersection of (a) the interest deductibility limitations and (b) the Act’s depreciation provisions may affect borrower cash flow. Entities engaged in a “real property trade or business” may opt out of the 30% interest deductibility limitation. However, such entities (a) must depreciate their assets over a longer period and (b) cannot claim 100% bonus depreciation for improvements to the interior of a commercial property.

Banks should also prepare for reorganizations among business borrowers currently taxed as pass-through entities, especially in certain service businesses not qualifying for the 20% deduction described subsequently. From a tax planning standpoint, it may be advisable for some business clients to reorganize with certain activities conducted under a C corporation and others under a pass-through structure.

Implication #3: Miscellaneous Considerations

Additional considerations include:

Effect on Tangible Book Value

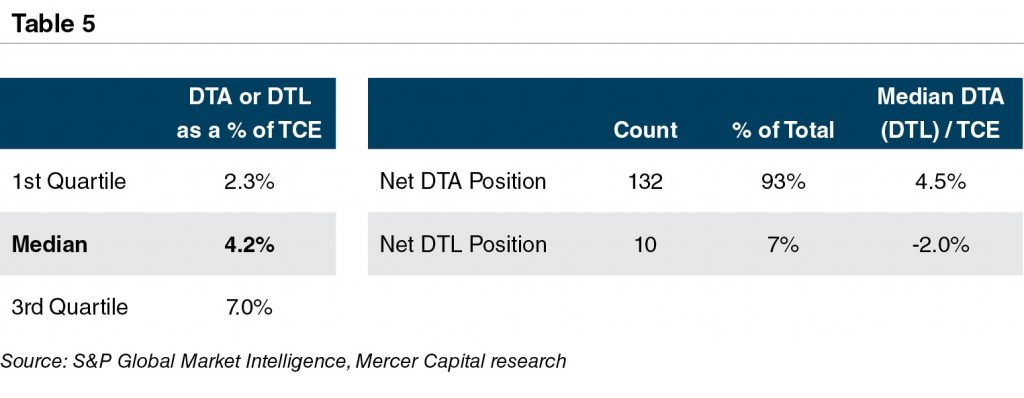

Table 5 presents, for publicly traded banks with assets between $1 billion and $5 billion, their net deferred tax asset or liability positions as a percentage of tangible common equity. Table 5 also presents the number of banks reporting net DTAs or DTLs.

From a valuation standpoint, we do not expect DTA write-downs to cause significant consternation among investors. If Citigroup’s $22 billion DTA revaluation did not scare investors, we doubt other banks will experience a significant negative reaction. In Citigroup’s case, the impairment has the salutary effect of boosting its future ROE, as Citigroup’s regulatory capital excluded a large portion of the DTAs anyway.

Regulatory Capital7

The Basel III capital regulations limit the inclusion of DTAs related to temporary differences in regulatory capital, but DTAs that could be realized through using NOL carrybacks are not subject to exclusion from regulatory capital. As noted previously, though, the Act eliminates NOL carrybacks. Therefore, certain banks may face disallowances (or greater disallowances) of portions of their DTAs when computing common equity Tier 1 regulatory capital.8

Business Investments

An emerging issue facing community banks is their relevance among technology savvy consumers and businesses. Via its “bonus” depreciation provisions, the Act provides tax-advantaged options for banks to address technological weaknesses. For qualifying assets – generally, assets other than real estate and, under the Act, even used assets – are eligible for 100% bonus depreciation through 2022. The bonus depreciation phases out to 0% for assets placed in service after 2026.9

Mergers & Acquisitions

Our understanding is that the Act will not materially change the existing motivations for structuring a transaction as non-taxable or taxable. With banks accumulating capital at a faster pace given a reduced tax rate, it will be interesting to observe whether cash increases as a proportion of the overall consideration mix offered to sellers.

Permanence of Tax Reform

One parting thought concerns the longevity of the recent tax reforms. The Act passed via reconciliation with no bipartisan support, unlike the Tax Reform Act of 1986. As exhibited recently by the CFPB, the regulatory winds can shift suddenly. Like the CFPB, is tax reform built on a foundation of sand?

S Corporations & The Act

At the risk of exhausting our readership, we will detour briefly through the Act’s provisions affecting S corporations (§199A). While the Act’s authors purportedly intended to simplify the Code, the smattering of “lesser of the greater of” tests throughout §199A suggests that this goal went unfulfilled.

Briefly, the Act provides that shareholders of S corporations can deduct 20% of their pro rata share of the entity’s Qualified Business Income (“QBI”), assuming that the entity is a Qualified Trade or Business (“QTB”) but not a Specified Service Trade or Business (“SSTB”).10 That is, shareholders of QTBs that are not SSTBs can deduct 20% of their pro rata share of the entity’s QBI.11 Simple.

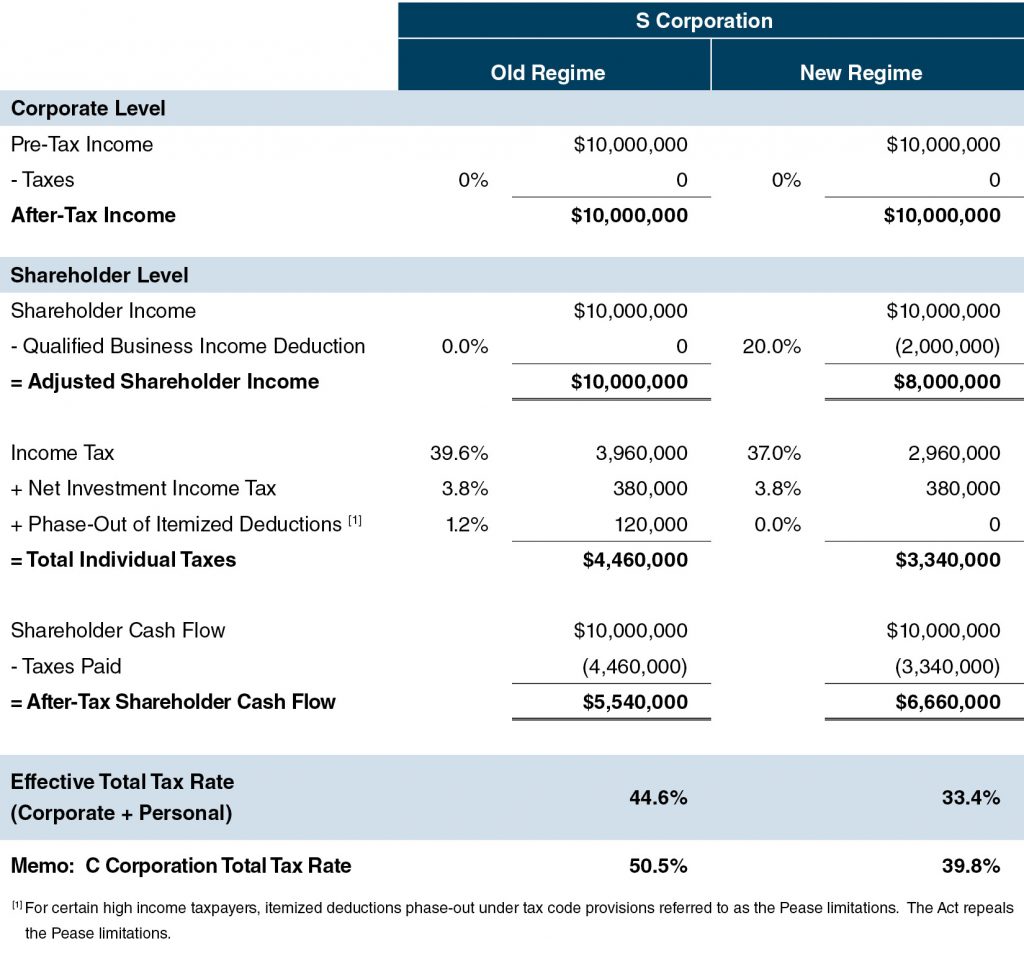

The 20% QBI deduction causes an S corporation’s prospective tax rate to fall to 33.4%, versus the 44.6% total rate applicable in 2017, thereby remaining below the comparable total C corporation tax rate (Table 6).

S corporations should review closely the impact of the Act on their tax structure. The 2013 increase in the top marginal personal rate to 39.6% and the imposition of the Net Investment Income Tax on passive shareholders previously diminished the benefit of S corporation status. The Act implements a $10 thousand limit on the deductibility of state and local taxes, which may further diminish the remaining benefit of S corporation status. While we understand this limitation will not affect the deductibility of taxes paid by the S corporation itself (such as real estate taxes on its properties), it may reduce shareholders’ ability to deduct state-level taxes paid by a shareholder on his or her pro rata share of the S corporation’s earnings. S corporations also should evaluate their projected shareholder distributions, as S corporations distributing only sufficient amounts to cover shareholders’ tax liability may see fewer benefits from maintaining an S corporation election.12

Conclusion

For banks, the provisions of the Act intertwine throughout their activities. Calculating the effect of a lower tax rate on a bank’s corporate tax liability represents a math exercise; predicting its effect on other constituencies is fraught with uncertainty.13 We look forward to discussing with clients how the far reaching provisions of the Act will affect their banks, clients, and the economy at large. It will be Tax Time for quite some time. As always, Mercer Capital is available to discuss the valuation implications of the Act.

This article originally appeared in Mercer Capital’s Bank Watch, January 2018.

End Notes

- Lest we be accused of imprecision, the Act’s formal name is “An act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018.”

- Before proceeding, we include the de rigueur disclaimer for articles describing the Act that Mercer Capital does not provide tax advice and banks should consult with appropriate tax experts.

- We recognize that some of the tax savings may be invested in capital expenditures or community relations, but these expenditures ultimately are intended to benefit one of the three stakeholder groups identified previously.

- Transcript of J.P. Morgan Chase & Co.’s Fourth Quarter 2016 earnings call.

- Transcript of Renasant Corporation’s Fourth Quarter 2017 earnings call.

- Floor plan financing is exempt from this provision.

- See also Federal Reserve, Supervisory & Regulatory Letter 18-2, January 18, 2018.

- Generally, DTAs are includible in regulatory capital up to a fixed percentage of common equity Tier 1 capital.

- In addition, §179 allows entities to expense the cost of certain assets. The §179 limit increases from $500 thousand in 2017 to $1 million in 2018. The Act also expands the definition of assets subject to §179 to include all leasehold improvements and certain building improvements.

- We recognize that the risk of exploding heads is acute with reference to §199A. Therefore, we avoided discussion of the limits on the 20% deduction relating to W-2 and other compensation, “qualified” property, and overall taxable income, as well as the various income thresholds that exist. Suffice to say, §199A is considerably more complex than we have described.

- It does not appear that banks are SSTBs (and, thus, banks are eligible for the 20% deduction), although the explanation is mind numbing. An SSTB is defined in §199A by reference to §1202(e)(3)(A) but not §1202(e)(3)(B). Existing §1202 provides an exclusion from gain on sale to holders of “qualified small business stock.” However, §1202(e)(3)(A) and §1202(e)(3)(B) disqualify certain businesses from using the QSB stock exclusion. Banks are specifically disqualified from the QSB stock sale exclusion under §1202(e)(3)(B). Since §199A’s definition of an SSTB does not specifically cite the businesses listed in §1202(e)(3)(B), such as banks, §199A has been interpreted to provide that banks are not SSTBs. Interested in more SSTB arcana? Architects and engineers are excluded specifically from the list of businesses ineligible for the 20% deduction, apparently speaking to the lobbying prowess of their trade groups (or their ability to build tangible things).

- We are not aware that the Act limits the increase in an S corporation shareholder’s tax basis arising from earnings not distributed to shareholders. However, the tax basis advantage of S corporation status typically is secondary to the immediate effect of an S corporation election on a shareholder’s current tax liability.

- To be fair, we should limit the “math exercise” comment to C corporations; the S corporation provisions in §199A undeniably are abstruse.