Valuation Assumptions Influence Valuation Conclusions: How to Understand the Reasonableness of Individual Assumptions and Conclusions

In contested divorces where one or both spouses own a business or a business interest with significant value, it is common for one or both parties to retain a business appraiser to value the marital business interest(s). It is not unusual for the valuation conclusions of the two appraisers to differ significantly, with one significantly lower/higher than the other.

What is a client, attorney, or judge to think when significantly different valuation conclusions are present? The answer to the reasonableness of one or both conclusions lies in the reasonableness of the appraisers’ assumptions. However, valuation is more than “proving” that each and every assumption is reasonable. Valuation also involves proving the overall reasonableness of an appraiser’s conclusion.

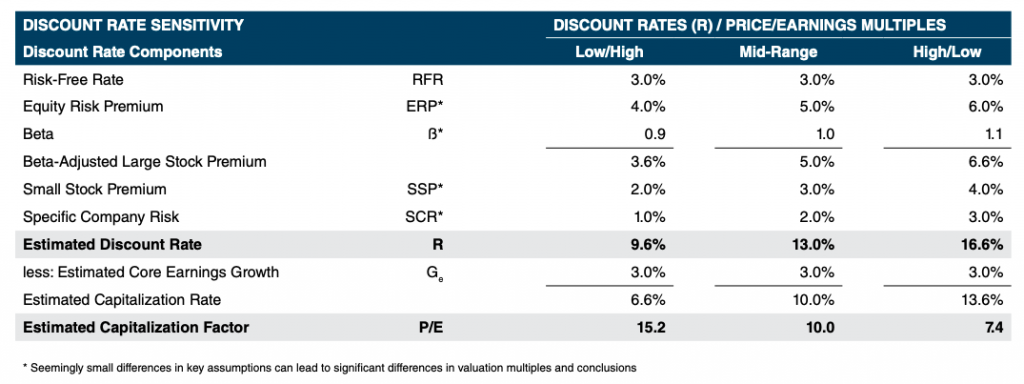

A short example will illustrate this point and then we can address the issue of individual assumptions. In the following example, we see three potential discount rates and resulting price/earnings (“P/E”) multiples. Let’s assume that for the subject company in this example, there is significant market evidence suggesting that similar companies trade at a P/E in the neighborhood of 10x earnings.

In the figure below, we look at the assumptions used by appraisers to “build” discount rates. We show differing assumptions regarding four of the components, and none of the differing assumptions seems to be too far from the others. So, we vary what are called the equity risk premium (“ERP”), the beta statistic, which is a measure of riskiness, the small stock premium (“SSP”), and company-specific risk.

The left column (showing the low discount rate of 9.6% and a high P/E multiple of 15.2x) would yield the highest valuation conclusion. The right column (showing the high discount rateof 16.6% and the low P/E of 7.4x) would yield a substantially lower conclusion. That range is substantial and results in widely differing conclusions.

However, as stated earlier, market evidence suggests that companies like our example are worth in the range of a 10x earnings. In our example, the assumptions leading to a P/E in the range of 10x are found in the middle column.

In either case, appraisers might have made a seemingly convincing argument that each of their assumptions were reasonable and, therefore, that their conclusions were reasonable. However, the proof is in the pudding. Neither the low nor the high examples yield reasonable conclusions when viewed in light of available market evidence.

So, as we discuss how to understand the reasonableness of individual valuation assumptions in divorce-related business appraisals, know also that the valuation conclusions must themselves be proven to be reasonable. That’s why we place a “test of reasonableness” in every Mercer Capital valuation report that reaches a valuation conclusion.

Now, we turn to individual assumptions.

Growth Rates

Growth rates can impact a valuation in several ways. First, growth rates can explain historical or future changes in revenues, earnings, profitability, etc. A long-term growth rate is also a key assumption in determining a discount rate and resulting capitalization rate.

Growth rates, as a measure of historical or future change in performance, should be explained by the events that have occurred or are expected to occur. In other words, an appraiser should be able to explain the specific events that led to a certain growth rate, both in historical financial statements and also in forecasts. Companies experiencing large growth rates from one year to the next should be able to explain the trends that led to the large changes, whether it is new customers, new products being offered, loss of a competitor, an early-stage company ramping up, or other pertinent factors. Large growth rates for an extended period of time should always be questioned by the appraiser as to their sustainability at those heightened levels.

A long-term growth rate is an assumption utilized by all appraisers in a capitalization rate. The long-term growth rate should estimate the annual, sustainable growth that the company expects to achieve. Typically, this assumption is based on a long-term inflation factor plus/minus a few percentage points. Be mindful of any very small, negative, or large long-term growth rate assumptions. If confronted with one, what are the specific reasons for those extreme assumptions?

Annualization

In the course of a business valuation, appraisers normally examine the financial performance of a company for a historical period of around five years, if available. Since business valuations are point-in-time estimates, the date of valuation may not always coincide with a company’s annual reporting period.

Most companies have financial software with the capability to produce a trailing twelve month (“TTM”) financial statement. A TTM financial statement allows an appraiser to examine a fullyear business cycle and is not as influenced by seasonality or cyclicality of operations and performance during partial fiscal years. The balance sheet may still reflect some seasonality or cyclicality. Note if the appraiser annualizes a short portion of a fiscal year to estimate an annual result. This practice could result in inflating or deflating expected results if there is significant seasonality or cyclicality present. At the very least, the annualized results should be compared with historical and expected future results in terms of implied margins and growth.

Forecasts

Depending on the industry or where the company is in its business life cycle, a forecast may be used in the valuation and the discounted cash flow method (“DCF”) may be used.

Most forecasts are provided to appraisers by company management. While appraisers do not audit financial information provided by companies, including forecasts, the results should not be blindly accepted without verification against the company’s and its industry’s performance.

During the due diligence process, appraisers should ask management if they prepare multiple versions of forecasts. They should also ask for prior years’ forecasts in order to assess how successful management has been in estimations as compared to actual financial results. Be mindful of appraisers that compile the forecasts themselves and make sure there is some discussion of the underlying assumptions.

Divorce Recession

“Divorce recession” is a term to describe a phenomenon that sometimes occurs when a business owner portrays doom and gloom in their industry and for current and future financial performance of the company. As with other assumptions, an appraiser should not blindly accept this outlook.

An appraiser should compare the performance of the company against its historical trends, future outlook, and the condition of the industry and economy, among other factors. Be cautious of an appraisal where the current year or ongoing expectations are substantially lower, or higher for that matter, than historical performance without a tangible explanation as to why.

Industry Conditions

Most formal business valuations should include a narrative describing the current and expected future conditions of the subject company’s industry. An important discussion is how those factors specifically affect the company. There could be reasons why the company’s market is experiencing things differently than the national industry. Industry conditions can provide qualitative reasons why and how the quantitative numbers for the company are changing. Look carefully at business valuations that do not discuss industry conditions or those where the industry conditions are contrary to the company’s trends.

Valuation Techniques Specific to the Subject Company’s Industry

Certain industries have specific valuation methodologies and techniques that are used in addition to general valuation methodologies. Several of these industries include auto dealers, banks, healthcare and medical practices, hotels, and holding companies. It may be difficult for a layperson reviewing a business valuation to know whether the methods employed are general or industry-specific techniques. An attorney or business owner should ask the appraiser how much experience they have performing valuations in a particular industry. Also inquire if there are industry-specific valuation techniques used and how those affect the valuation conclusion.

Risk Factors

Risk factors are all of the qualitative and quantitative factors that affect the expected future performance of a company. Simply put, a business valuation combines the expected financial performance of the subject company (earnings and growth) and its risk factors. Risk factors show up as part of the discount rate utilized in the business valuation.

Like growth rates, there is no textbook that lists the appropriate risk factors for a particular industry or company. However, there is a reasonable range for this assumption.

Be careful of appraisals that have an extreme figure for risk factors. Make sure there is a clear explanation for the heightened risk.

Multiples

Another typical component of a business valuation is the comparison and use of market multiples while utilizing the market approach. Multiples can explain value through revenues, profits, or a variety of performance measures. One critique of market multiples is the applicability of the comparable companies used to determine the multiples. Are those companies truly comparable to the subject company?

Also, how reliable is the underlying comparable company data? Is it dated? How much information on the comparable companies or transactions can be extracted from the source? This critique can be fairly subjective to the layperson.

Another critique could be the range of multiples examined and how they are applied to the subject company. As we have discussed, take note of an appraisal that applies the extreme bottom or top end of the range of multiples, or perhaps even a multiple not in the range. Be prepared to discuss the multiple selected and how the subject company compares to the comparable companies selected.

Time Periods Considered

Earlier we stated that a typical appraisal provides the prior five years of the company’s financial performance, if available. Be cautious of appraisals that use a small sample size, e.g. the latest year’s results, as an estimate of the subject company’s ongoing earnings potential without explanation. The number of years examined should be discussed and an explanation as to why certain years were considered or not considered should be offered.

Some industries have multi-year cycles (further evidence of the importance of a discussion of industry conditions and consideration of recognized industry-specific techniques in the appraisal).

The examination of one year or a few years (instead of five years) can result in a much higher or lower valuation conclusion. If this is the case, it should be explained.

Conclusion

Business valuation is a technical analysis of methodologies used to arrive at a conclusion of value for a subject company. It can be difficult for a client, attorney, or judge to understand the impact of certain individual assumptions and whether or not those assumptions are reasonable. In addition to a review of individual assumptions, the valuation conclusion should be reasonable.

If the divorce case warrants, hire an appraiser to perform a business valuation. If the case or budget does not allow for a formal valuation, it may be helpful to hire an appraiser to review another appraiser’s business valuation at a minimum to help determine if the assumptions and conclusions are reasonable.

Originally published in Mercer Capital’s Tennessee Family Law Newsletter, Second Quarter 2019.