Dividend Policy and the Meaning of Life (Or, At Least, Your Business)

The intersection of family and business generates a unique set of questions for family business directors. We’ve culled through our years of experience working with family businesses of every shape and size to identify the questions that are most likely to trigger sleepless nights for directors. Excerpted from our recent book, The 12 Questions That Keep Family Business Directors Awake at Night, we address this week the question, “Does our dividend policy fit?”

Knowing what the business “means” to the family is essential for promoting positive shareholder engagement, family harmony, and sustainability.

Our multi-generation family business clients ask us about dividend policy more often than any other topic. This isn’t surprising, since returns to family business shareholders come in only two forms: current income from dividends and capital appreciation. For many shareholders, capital appreciation is what makes them wealthy, but current income is what makes them feel wealthy.

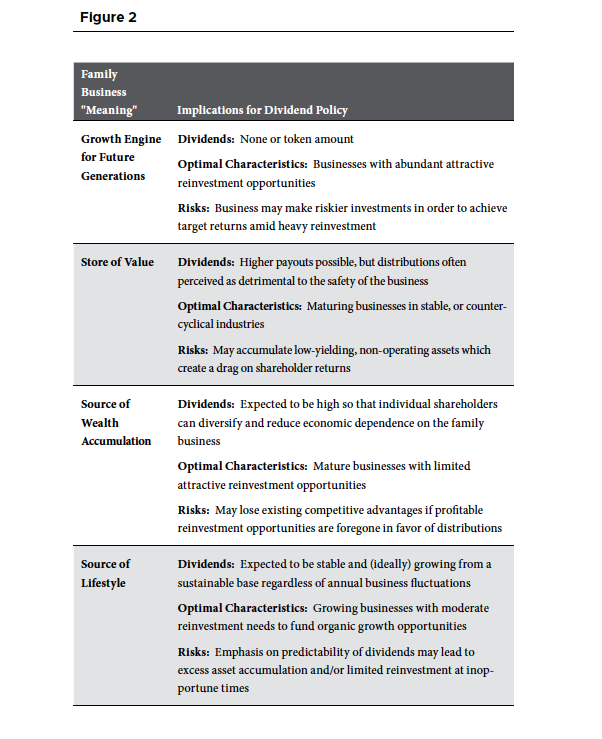

In other words, dividends are the most transparent expression of what the family business means to the family economically. Knowing what the business “means” to the family is essential for promoting positive shareholder engagement, family harmony, and sustainability. The business may “mean” different things to the family at different times (or, to different members of the family at the same time). In our experience, there are four broad “meanings” that a family business can have. These “meanings” are not mutually exclusive, but one will usually predominate at a given time. Importantly, the “meaning” of the business has implications for dividend policy.

- Meaning #1 – The family business is an economic growth engine for future generations. For some families, the business is perceived as a vehicle for increasing per capita family wealth over time. For these families, dividends are likely to take a backseat to reinvestment in the business needed to fuel the growth required to keep pace with the biological growth of the family.

- Meaning #2 – The family business is a store of value for the family. For other families, the business is perceived as a means of capital preservation. Amid the volatility of public equity markets, the family business serves as ballast for the family’s overall wealth. Dividends are generally modest for these families, with earnings retained, in part, to mitigate potential swings in value.

- Meaning #3 – The family business is a source of wealth accumulation. Alternatively, the family business may be perceived as a mechanism for accumulating family wealth outside the business. In these cases, individual family members are expected to use dividends from the business to accumulate wealth through investments in marketable securities, real estate, or other operating businesses. Dividends are emphasized for these families, along with the (potentially unspoken) expectation that distributions will be used by the recipients to diversify away from, and limit dependence on, the family business.

- Meaning #4 – The family business is a source of lifestyle. Finally, the business may be perceived as maintaining the family’s lifestyle. Dividends are not necessarily expected to fund a life of idle leisure, but are relied upon by family shareholders to supplement income from careers and other sources for home and auto purchases, education expenses, weddings, travel, philanthropy, etc. These businesses typically have moderate reinvestment needs, and predictability of the dividend stream is often more important to shareholders than real (i.e., net of inflation) growth in the dividend. Continuation of the dividend is the primary measure the family uses to evaluate management’s performance.

From a textbook perspective, dividends are treated as a residual: once attractive reinvestment opportunities have been exhausted, the remaining cash flow should be distributed to the shareholders. However, at a practical level, the different potential “meanings” assigned to the business by the family will, to some degree, circumscribe the dividend policy alternatives available to the directors. For example, eliminating dividends in favor of increased reinvestment is not a practical alternative for family businesses in the third or fourth categories above, regardless of how abundant attractive investment opportunities may be.

Figure 2 illustrates the relationship between “meaning” and dividend policy.

The textbook perspective on dividend policy is valid, but can be adhered to only within the context of the “meaning” assigned to the family business. In contrast to public companies or those owned by private equity funds, “meaning” will generally trump dispassionate analysis of available investment opportunities. If family business leaders conclude that the “meaning” assigned to the business by the family does not align with the optimal dividend policy, the priority should be given to changing what the business “means” to the family. Once the change in “meaning” has been embraced by the family, the change in dividend policy will more naturally follow.

Once the change in “meaning” has been embraced by the family, the change in dividend policy will more naturally follow.

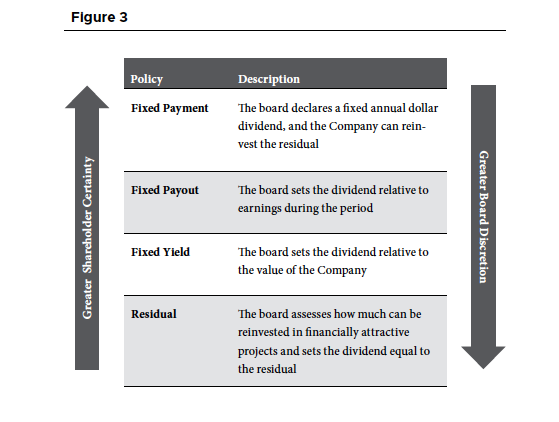

A dividend policy describes how the family business determines distributions on a year-to-year basis. A consistent dividend policy helps family shareholders understand, predict, and evaluate dividend decisions made by the board of directors. Potential family business dividend policies can be arrayed on a spectrum that ranges from maximum shareholder certainty to maximum board discretion.

Family shareholders should know what the company’s current dividend policy is. As evident from Figure 3, knowing the dividend policy does not necessarily mean that one will know the dollar dividend for that year. However, a consistently-communicated and understandable dividend policy contributes greatly to developing positive shareholder engagement.

So what should your family business’s dividend policy be? Answering that question requires looking inward and outward. Looking inward, what does the business “mean” to the family? Looking outward, are attractive investment opportunities abundant or scarce? Once the inward and outward perspectives are properly aligned, the dividend policy that is appropriate to the company can be determined by the board and communicated to shareholders.

Potential Next Steps

- Calculate historical shareholder returns, distinguishing returns attributable to capital appreciation from those attributable to distributions

- Assess what the business “means” to the family economically

- Evaluate how the prevailing “meaning” of the business corresponds to the challenges and opportunities facing the business

- Identify the target capital structure for the family business

- Articulate a predictable dividend policy and communicate that policy to family shareholders

Family Business Director

Family Business Director