How Is Your Family Business Performing in the COVID-19 Pandemic?

One thing in short supply thus far in the pandemic has been perspective. We know that GDP fell by more than 30% during the second quarter, but how does that translate into the actual financial performance of businesses? Family business directors have been flying blind over the past few months, with no reliable way to benchmark the performance of their businesses.

Earnings season for the second quarter of 2020 gives us the first opportunity to see how the COVID-19 pandemic is affecting businesses. We normally don’t get too concerned about reported results for a particular quarter, but this is an obvious exception. By the time the second quarter started on April 1, many regions of the country were already in quarantine, with the rest to follow shortly thereafter. While the pandemic started to weigh on results in 1Q20, it was hard to get an accurate feel for the impact, since January and February were essentially “normal.”

In this post, we elaborate on four themes that emerge from the data.

Theme #1 – Smaller companies have been more adversely affected than larger companies.

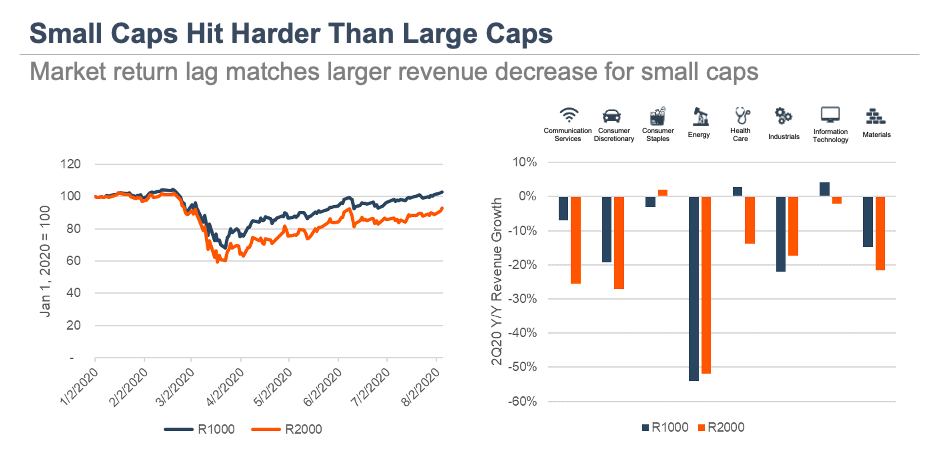

Revenue and earnings for smaller companies fell more sharply than for larger companies. In the aggregate, revenue for the companies in the Russell 1000 fell 12% relative to 2Q19, compared to a 23% shortfall for the companies in the Russell 2000. The size effect is most pronounced for companies in the communication services and health care industries.

It is not possible to tease out from the data precisely why larger companies fared better during the pandemic. However, investors did successfully predict the phenomenon, as returns for the small cap index have lagged those of large cap names since the pandemic struck.

Questions for Family Business Directors

- How does your performance compare to that of the public companies in your industry?

- In your specific industry niche, do the larger players have a natural advantage? If so, what steps can you take to turn your smaller size into a competitive advantage? Can you be more responsive, nimbler, than larger competitors?

- How will your family business preserve profitability if the pandemic-induced recession persists?

Theme #2 – Smaller companies are prioritizing cash flow.

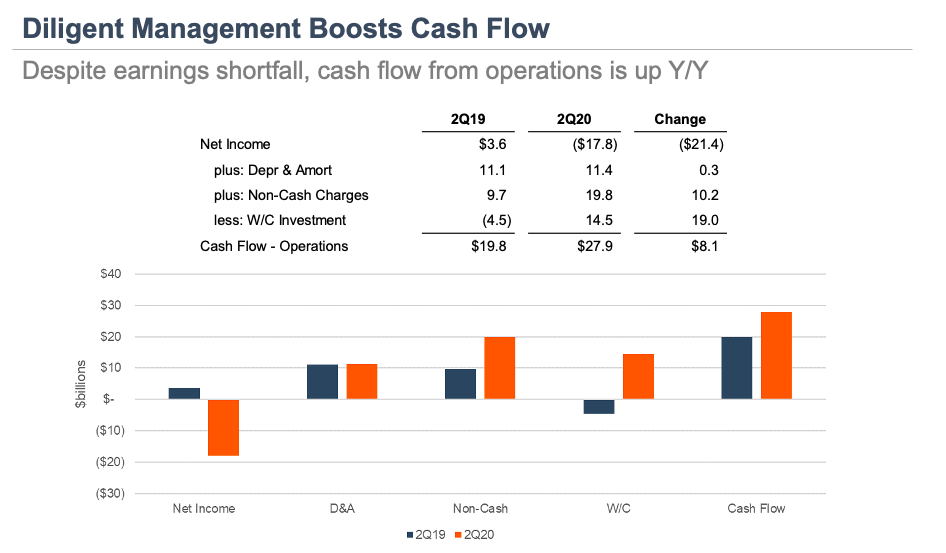

In the aggregate, the Russell 2000 companies in our sample reported a net loss of $17.8 billion during 2Q20, compared to net income of $3.6 billion during the prior year period. The negative effects of the 23% revenue shortfall experienced by those firms cascaded down the income statement, growing to a 58% reduction in EBITDA, and triggering net accounting losses after taking into account impairment charges, depreciation and amortization, and interest expense.

However, when we turn to the statement of cash flows, operating cash flow increased in 2Q20 compared to 2Q19, in large measure to the cash freed up from lower working capital balances. While not a sustainable source of cash flow, careful management of working capital levels is an important source of precious cash flow during a downturn, and the public companies in our sample have been diligent in maximizing cash from working capital.

Questions for Family Business Directors

- How have your cash collections been holding up through the downturn? Are there any problematic accounts lurking in your receivables list? Do you have a strategy for dealing with customers that encounter financial distress of their own?

- How are you managing inventory? Are there specific portions of inventory that have a heightened risk of becoming obsolete?

- What is your strategy for managing payables? Are any vendors offering discounts for prompt payment?

Theme #3 – Smaller companies are building cash.

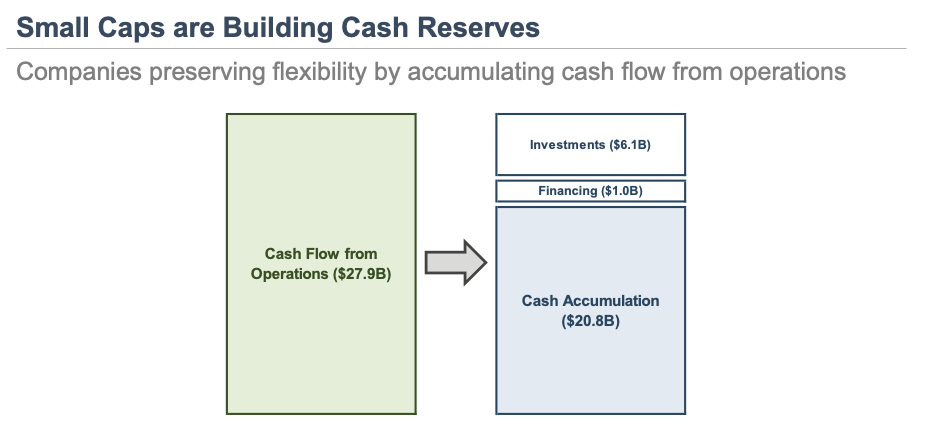

The pandemic has featured a recurring cycle of positive developments followed by setbacks. As a result, no one has a good handle on how long these conditions will persist. Facing this uncertainty, managers and directors of the public companies in our sample have been accumulating cash as a hedge against a potentially extended period of underperformance. If the downturn persists into 2021, financial flexibility will be critical. As one of our long-time family business clients once observed: “You make better decisions when you don’t need the money.”

As shown below, the companies in our sample added to cash balances, in part, by becoming much more selective investors. Cash outlays for M&A activity evaporated, and capital expenditures were cut by 40%. In fact, capital expenditures represented just 75% of depreciation and amortization charges, which are a good proxy for the “maintenance” level of spending. This is not a sustainable practice for family businesses, but deferring non-essential capital expenditures can be a prudent move in the short-term when the outlook for the future is especially cloudy.

Questions for Family Business Directors

- How has the downturn affected the size of your capital budget? Are you using a higher hurdle rate on potential investments, taking a haircut to pre-COVID cash flow projections, or using some other mechanism to ration capital?

- Have you been deferring “maintenance” capital expenditures? If so, it is important to carefully monitor what has been deferred, and identify what the priorities for catching up will be when more normal conditions return.

- Are there any idle assets on the balance sheet that don’t have a strategic role to play in your family business and can be converted to cash?

Theme #4 – Shareholders are being patient (for now).

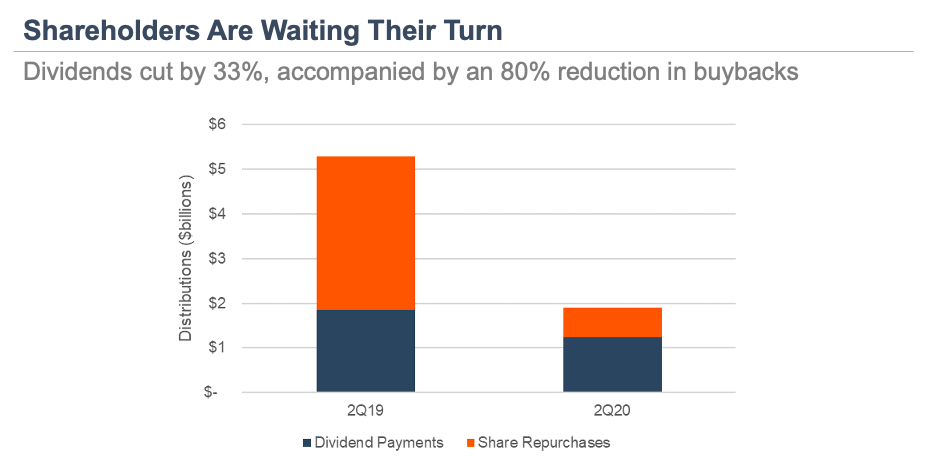

Finally, we can see that the shareholders of the smaller companies in our sample are doing their part as companies seek to conserve cash. Combining dividend payments and amounts spent on share buybacks, total payments to shareholders fell by more than 60% from $5.3 billion in 2Q19 to $1.9 billion in 2Q20. Repurchases fell by more than 80%, while aggregate dividend payments were cut by 33%. Of the 224 small cap companies in our sample paying dividends at this time last year, 44 (20%) have suspended their dividends entirely.

Questions for Family Business Directors

- How have you communicated the business impact of the pandemic to your family shareholders?

- What adjustments to dividends are appropriate/necessary considering the performance of your family business? How can you prepare shareholders for those changes?

- If you have a share redemption program, is the valuation up-to-date? If it is not, the remaining shareholders may end up inadvertently subsidizing the shareholders that elect to cash out.

- Is there consensus within your family regarding what the family business “means”? In other words, do family members view the business as an economic growth engine for future generations, a source of wealth accumulation, a store of value, or a source of lifestyle? How does the prevalent “meaning” of the business influence your dividend deliberations?

Conclusion

It’s a horrible cliché, but these really are pretty unprecedented times. Up to now, family business directors have had little context for evaluating how their companies are performing, and how their strategic decisions are stacking up against those made by others. Give one of our professionals a call today to discuss the benefits of a customized benchmarking analysis for your family business or how the value of your family business has likely changed as a result of the pandemic. For many successful multi-generation family businesses, this a uniquely opportune time for tax-efficient estate planning. Don’t let it pass by without taking advantage – the future generations will thank you.

For a deeper dive, download our COVID Benchmarking Update (August 2020) below.

Family Business Director

Family Business Director