Investor Relations for Family Businesses

An Informed and Engaged Shareholder Base is a Strategic Advantage

Family Business Director was in sunny Tampa last week at the spring edition of the Transitions Conference produced by Family Business Magazine. It was a great event, with about 275 attendees representing nearly 100 enterprising families. The perspectives offered from the stage and through intensive workshops highlighted some of the most pressing concerns family business directors have to address, and informal conversations with participants over meals and during breaks confirmed the reality of these issues in day-to-day family and business life.

For family shareholders who are not employed in the business, the family business can be a bit of a mystery.

The sessions offered fresh insights on perennial challenges around succession planning, conflict management, and communication. But the recurring – if not underlying – theme that impressed us was the challenge of shareholder engagement. For family shareholders who are not employed in the business, the family business can be a bit of a mystery. Despite knowing that the family business is important to them economically, many “outside” shareholders are in the dark about how the company works and how the economic benefits of ownership accrue to them.

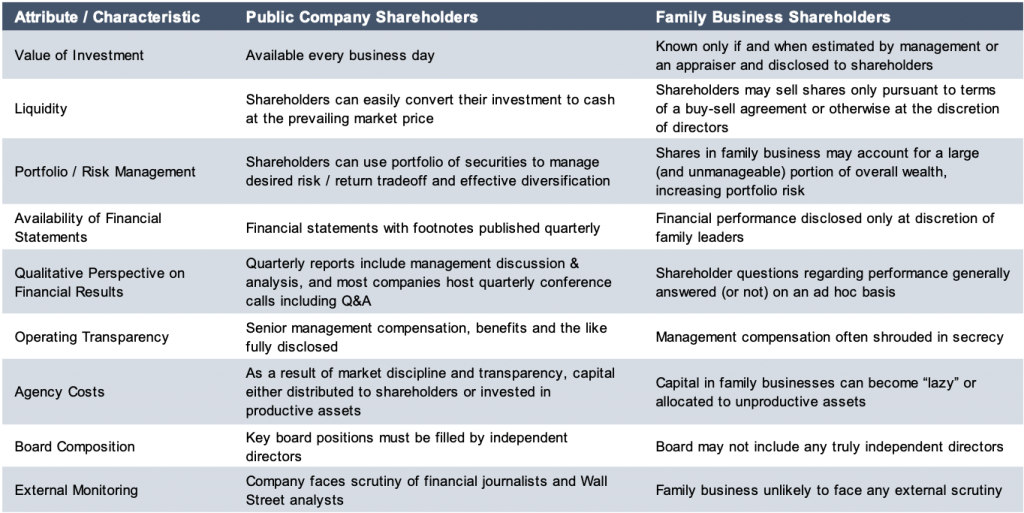

The advantages of family-owned businesses are well-documented. But consider for a minute the perspective of a minority family shareholder that doesn’t work in the business relative to a minority shareholder in a public company.

In view of these comparisons, is it any wonder that “outside” family shareholders are occasionally frustrated? Over time, lack of transparency triggers speculation on the part of shareholders as to what the “real story” must be.

Public companies understand that well-informed shareholders contribute to a lower cost of capital. A company’s cost of capital is the economic hurdle rate for a company, or the minimum return needed to satisfy its lenders and shareholders. The cost of capital is a primary driver of business value and stock price. As a result, most public companies are rather obsessive about keeping shareholders informed about the company’s performance, management, and strategy. Yes, many of the disclosures are mandated by the Securities and Exchange Commission, but public companies often go beyond the bare minimum regulatory disclosures, believing that an informed and engaged shareholder base is a strategic advantage. Public companies refer to this management function as “investor relations.”

We have long found it a bit ironic that many family businesses do not assign the same importance to investor relations that public companies do. After all, the leaders of family businesses are literally related to their shareholders. We suspect the reluctance of many family businesses to take investor relations seriously stems from some combination of three potential beliefs.

- First, the family members working in the business may feel that the “outside” family members should simply trust them to do what is best for the business and the family. From this viewpoint, working in the business grants the family managers a measure of “sweat equity” entitling them to a measure of respect and implicit trust from the rest of the family.

- Second, in contrast to public company shareholders that can take their capital elsewhere, family capital is “captive” capital that cannot easily be reallocated by owners. In other words, some family businesses ignore investor relations because of a perception that they don’t have to.

- Third, the family members working in the business may believe that the “outside” family members are not capable of understanding detailed financial information regarding the performance of the family business.

Family shareholders are most likely to grow suspicious when they perceive that relevant information is being unreasonably withheld from them.

In our view, each of these perspectives is short-sighted. The desire of family shareholders to be informed about their investment is not necessarily attributable to some unhealthy mistrust of the family members managing the business. Rather, family shareholders are most likely to grow suspicious when they perceive that relevant information is being unreasonably withheld from them (i.e., “they must be hiding something”). While family capital may indeed by “captive” to the family business, if the family relations become toxic enough, family shareholders may resort to litigation in an effort to liberate their capital. Defending such litigation is not a good use of management time or business resources. Finally, a robust shareholder education program, coupled with tailored disclosures carefully designed to communicate relevant information rather than merely overwhelm recipients with data can overcome nearly any communication barrier.

In short, we came away from last week’s conference with a renewed appreciation for the value – and challenge – of investor relations for family businesses. We know that many family businesses are very intentional about maintaining positive shareholder engagement, but we also know that many others are mired in perpetual conflict with one or more disengaged shareholders. Forward-thinking family business directors will want to make investor relations a priority in 2019.

Family Business Director

Family Business Director