U.K. Based Henderson Group Acquires Janus Capital for $2.6 Billion

Coming to America

Though probably not as historic as Plymouth landing or even the Eddie Murphy comedy, Henderson’s purchase of Denver RIA Janus Capital last month is a rare sign of confidence in active managers that have been losing ground to passive investors for quite some time. The era of ETFs and indexing has dominated asset flows for quite some time, so this transaction seems to counter the recent trend.

Last week, we touched on the recent election’s possible impact on active management, and the gist of it is that potentially heightened volatility and lower asset correlations under a Trump presidency could bode well for stock and bond pickers (though most fixed income investors would not agree with that position at the moment). Indeed, a quick look at active manager pricing over the last two weeks shows several industry leaders (Pzena, Diamond Hill, Hennessy, GAMCO, etc.) up 10% to 20% since the election. Investor sentiment seems to be shifting, or is at least less bearish on the sector than just a few months ago.

As for whether JNS or HGG will be more likely to give thanks this Thursday, both sides are up modestly since the deal was announced in early October, though it has been a rocky seven weeks. Janus-Henderson should benefit from the ability to cross-sell each other’s products, though it is often harder to capitalize on this potential in practice. They’ve also both been adversely affected by asset flows out of active strategies, but are now poised to benefit from any semblance of mean reversion. With Janus serving primarily U.S. investors with domestic funds and Henderson having more of a European and global focus, there doesn’t appear to be much product overlap either. Janus CEO Dick Weil recently told analysts that the two companies are “almost mirror images of each other on opposite sides of the Atlantic,” and they certainly do seem to complement one another. Since Janus shareholders will now benefit from a lower (UK) corporate tax rate (and Thanksgiving is not celebrated in England), we suspect they’ll be more inclined to give thanks on turkey day.

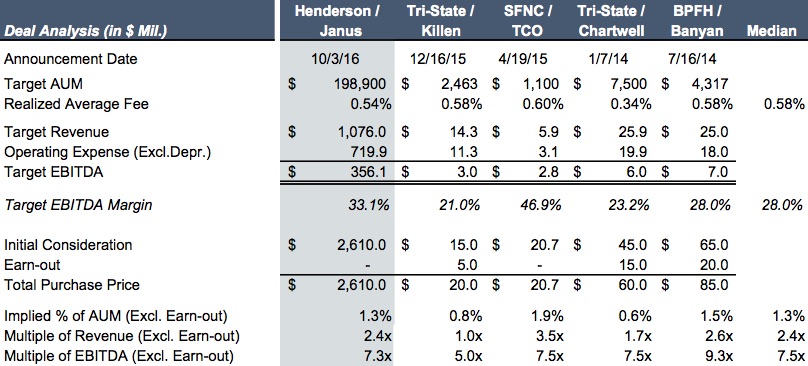

Looking strictly at the economics of the deal in the context of other recent transactions that we’ve analyzed, it doesn’t appear that Henderson overpaid for Janus with earnings and activity (revenue and AUM) metrics reasonably in line with precedent multiples. Given the size of Janus and expected synergies ($110 million in annual net costs savings) of the deal, one might have expected a higher valuation, but recent share price volatility and client outflows likely precluded much of a premium. Putting it all together, the transaction price appears appropriate to both sides from a financial perspective.

One potential wrinkle in the deal is how famed 72 year-old bond investor, Bill Gross, and his new total return fund will be managed by the merged entity. There is also the question of his succession planning and client retention once he finally retires, since there’s certainly the possibility that all those (non-Gross) assets could flow back to PIMCO or another actively managed bond fund. Since Gross’ former co-manager, Kumar Palghat, recently left for another bond fund at Janus and his former boss, Dick Weil, just moved to Henderson’s offices in London (while Gross remains in Newport Beach), investors may hold some concern over the former bond king’s further alienation from the rest of the company.

At this point, we don’t yet know if the Janus-Henderson marriage will end up as happily as Prince Joffer’s, but since Janus is named after the ancient Roman god of change and new beginnings, we’re hopeful for a smooth transition.

RIA Valuation Insights

RIA Valuation Insights