Brexit Just Accelerates Downward Trend in RIA Valuations

Gimme Shelter

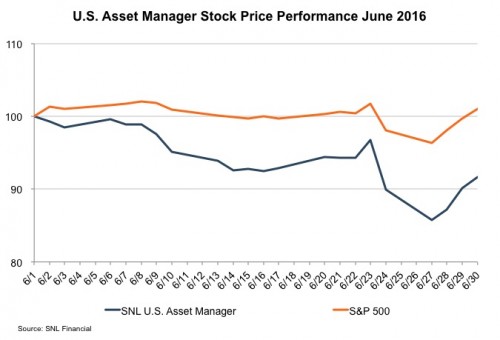

Brexit’s full impact on the market is still to be determined, but a quick review of asset manager pricing reveals a valuation gap with the broader equity market that opened over the past twelve months, got much worse in June, and even accelerated over the past week.

The headline performance comparison is striking. Over the past twelve months, while the S&P 500 rose modestly, the SNL U.S. Asset Manager index underperformed by over 24%.

This trend held for seven of the last twelve months, and accelerated in June with a big blow-out post Brexit. The same asset manager index dropped almost 10% last month, versus a decline of just over 1% for the S&P 500. You can see what last week was like: brutal.

Internally, at Mercer Capital, we’ve speculated as to whether or not publicly traded RIAs were essentially a synthetic futures contract on the financial markets. And if asset management firm valuations are falling, does that imply something about sentiment toward the ultimate direction of the capital markets?

There is, after all, a lot of other noise to consider. AUM is piling up in passive strategies while only treading water across the industry. Equity markets feel stuck – like a helium balloon on a ceiling – in a narrow trading range at uncomfortably high multiples. The market is awash with liquidity, but actual trading activity seems to be trending downward.

So if market valuations in the industry are getting a haircut, what does that mean? If you convert this market activity to some kind of discounted cash flow model, valuations would only drop if a) the cost of capital was rising, b) margins were declining, and/or c) profit growth expectations had dropped.

The Cost of Capital for Asset Managers is Probably Stable

If you think back to your first or second finance class, you’ll remember that the weighted average cost of capital, or WACC, has two components: the cost of equity and the cost of debt. Most asset managers have very little if any debt in their capital structures, so we really only need to be concerned with the cost of equity. The cost of equity is usually considered to be some premium to the risk free rate, represented by the yield to maturity on government debt. Yields on longer dated Treasuries have collapsed over the past month and the past year, which all else equal would reduce the cost of equity. As for the equity risk premium, in theory this should encompass both systematic risk (volatility of returns relative to the market) and non-systematic risk (issues specific to the individual company). Non-systematic risk isn’t the issue here, and industry beta – which we think of as market neutral or a bit north of 1.0 – is always de-beta-ble. All in all, though, I think it’s safe to say the cost of capital for asset managers has not increased; if anything, it should have gone down a bit. In a yield starved world, the recurring revenue stream of asset management represents a coupon-clipping opportunity that should bid the cost of capital down, and the multiple up, unless something else is also at play.

Profit Margins May Have Peaked

Seems like we’ve been reading about job cuts and fund consolidations and position realignments every day for weeks now. No one is acknowledging this publicly, but it feels like Q1 board meetings must have been full of internal profit warnings at RIAs. We’ve been watching fee schedules for some time now – particularly at mutual funds – and with the equity markets more or less flat-lining, it’s easy for costs to creep up. Compliance costs are rising – especially at smaller RIAs. Add to this the risk of a market pull back – especially a sustained one – tugging the wrong way on the inherent operating leverage in investment houses, and you see the risk. Hopefully the Q2 management calls will cover this topic; we’ll be there when they do.

Growth (or lack thereof) May Be the Big Story

Where is the growth in the investment management industry? Major indices are not cheap. Indexing is grabbing market share. Clients are more and more fee conscious. Wealth management firms have the built-in relationship advantage, but need a good market tailwind to offset client spending. Client acquisition is always an opportunity, but industry-wide is a zero sum game. So maybe growth challenges (top line or bottom line – your choice) are what we’re seeing in public asset manager pricing. We’ve sounded this alarm before, but the tone of the alarm is getting louder.

Moves like Jagger

I once saw an interview with Mick Jagger in which he said that, growing up, his most likely career was to be a teacher. His dad taught, and Jagger figured that after he finished with the band-thing he would teach English. By the time he banged up his Aston Martin 50 years ago, Jagger probably knew he didn’t have a future in education. But even then I doubt he foresaw the five decade music career ahead. When ERISA came to be 42 years ago, no one would have expected the asset management industry to grow like it did. As a consequence of that growth, lots of managers got their satisfaction, but after the past eight years many others are probably facing their 19th nervous breakdown.

RIA Valuation Insights

RIA Valuation Insights