Look out below! As capital market valuations apex, so too will RIA margins

Investment returns and the steady upward drift of equity markets are usually kind to investment management firm profits and valuations. This does not seem to be a “usual” period, however, and it serves as a reminder that profit margins are not simply an allocation of returns to equity holders; they also serve as a margin of safety in bear markets.

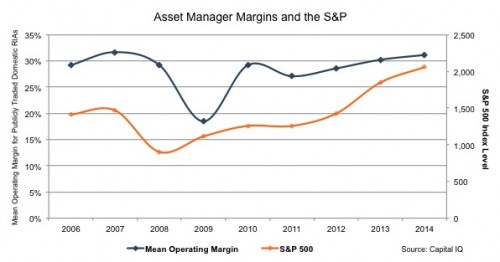

Few industries are as susceptible to market conditions as the typical RIA. With revenues directly tied to stock indexes (in the case of equity managers) and a relatively high percentage of fixed costs, industry margins tend to sway with market variations. While the concept of operating leverage is not new to anyone in the asset management industry, it is easy to forget how easy it is for margins to collapse in a market downturn.

It is, of course, striking to notice how RIA margins have recovered to the previous peak of 2007, a potentially ominous warning for equity markets now. Even more striking is how deep profits can fall in a market meltdown.

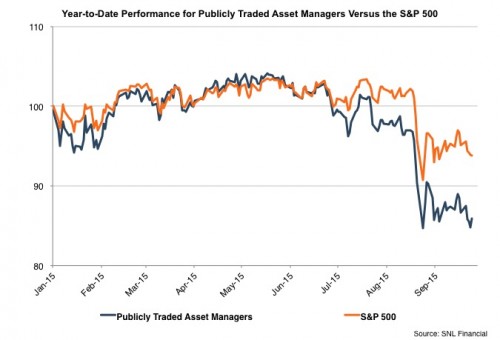

The Qs reflecting the P&L impact from the most recent correction aren’t out yet, but we suspect that profits will be adversely affected for at least the next couple of quarters, depending on the extent of the downturn. Indeed, the market appears to be already anticipating this for most publicly traded asset managers, as they have lost several billion dollars in aggregate market cap over the last six weeks.

On the private end of the spectrum, smaller, closely held RIAs tend to be more susceptible to market conditions than their publicly traded counterparts. Private RIAs don’t typically have the AUM and corresponding profit margins to serve as a cushion against a bear market. Anecdotally, we saw many asset managers with under $1 billion in AUM report negative earnings in 2008 and 2009 (at least for a few quarters) while most of the public RIAs stayed in the black. A healthy, larger RIA with 30% to 40% margins in good times can absorb a bear market event without reporting a loss, but many closely held asset managers with half that margin aren’t so resilient.

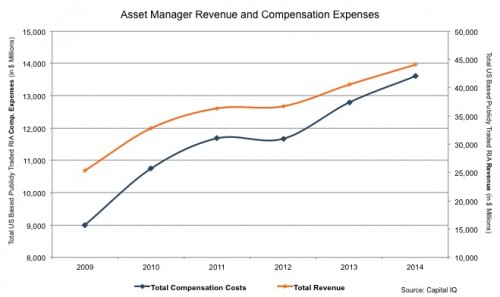

The upward drift in the market from 2009 to 2014 buoyed AUM levels to new highs without the corresponding increase in expenses for many asset managers whose only variable costs tend to be compensation related. As a result, our group of publicly traded asset managers was able to recoup their entire 11% drop in average profit margins in just one year after the financial crisis. Only a few years after 2009, asset manager margins swelled to unprecedented levels; but operating leverage works both ways, and many public RIAs are trading in bear market territory following last month’s correction. The recent downturn should serve as a wake-up call to an industry that hasn’t had much interference in its upward trajectory over the last several years.

As valuations drop and revenues contract, more attention must be devoted to expense controls if margins are to be maintained in the short run. Moving forward, this may be a challenge for many industry participants facing higher regulatory costs, a growing complexity of financial products, and personnel expenses that have moved almost in lockstep with revenue since the credit crisis. All of these costs tend to be fairly sticky on the downside.

Against a backdrop of increasing fee pressure and robo-advisory competition, this correction may have been long overdue for an industry that’s nearly doubled in size since the Great Recession. Though future market performance remains uncertain, it’s hard to imagine that RIA margin expansion will continue its ascent from the prior six years without another bull market tailwind.

Mercer Capital’s RIA Valuation Insights Blog

The RIA Valuation Insights Blog presents a weekly update on issues important to the Asset Management Industry.

RIA Valuation Insights

RIA Valuation Insights