Asset Managers of All Shapes and Sizes Continue to Underperform the Broader Indices

Nowhere to Hide

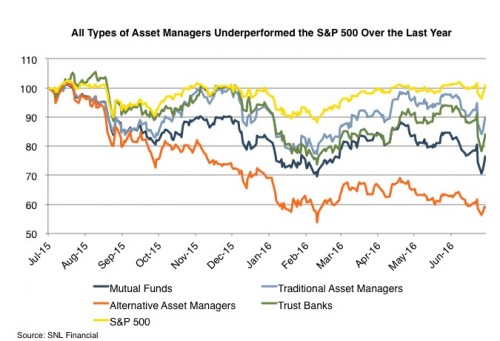

Piggybacking off our post from a couple of weeks back, the downward trend in asset manager pricing has persisted for another quarter, no matter how you slice it. Publicly traded trust banks, alt managers, mutual funds, and traditional RIAs are all down over the last year, with hedge funds and PE firms leading the plunge. Rising compliance costs, fee and margin compression, asset outflows on active strategies, and stalling growth prospects are all culprits for the overall decline, but alternative asset managers have definitely been hit the hardest over the last year.

As a matter of practicality, it shouldn’t be surprising that the most expensive asset class with the worst overall performance would eventually be shunned by investors. This trend is really just a microcosm or more exaggerated example of what’s going on across the entire asset manager landscape – individual and institutional investors no longer have to accept high fees and chronic underperformance, so they’re turning their attention to passively managed products or indexing strategies to boost their effective return. John Oliver certainly didn’t do the industry any favors with his 20 minute rant on advisor fees in his Last Week Tonight episode from a few weeks back.

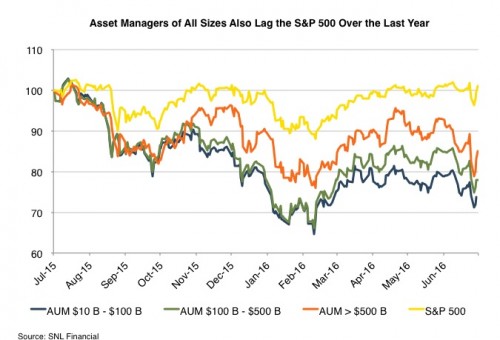

There was also virtually no size effect. Most every asset manager from GROW (U.S. Global) to TROW (T. Rowe Price) has struggled to keep pace with the broader indices. No matter the asset base, a low-fee, passively biased environment is not conducive to most asset managers of any size, shape, or form. Add rising regulatory costs and a market that’s not exactly undervalued, and you get multiple contraction and a bear market for RIAs.

So what’s the market trying to tell us about the future of this business? Probably that fee compression, asset outflows, rising compliance costs, and heightened market volatility will likely have an adverse effect on future earnings for some time to come. For alternative asset managers, the market seems to be pricing in more pronounced cuts to their fee structure and/or continued outflows.

It might also signal a buying opportunity for industry participants looking to add scale since most RIAs have finally gotten cheaper after years of steady growth following the last financial crisis. AMG’s recent acquisition seems to be at least partially motivated by recent declines in hedge fund valuations. Further consolidation seems inevitable and might be the most viable way to restore a depleted asset base and profit margin. We’ll keep you apprised on deal-making trends in future posts.

RIA Valuation Insights

RIA Valuation Insights