The Ultimate Investment Vehicle

Is the Value of your RIA More a Function of Risk or Growth?

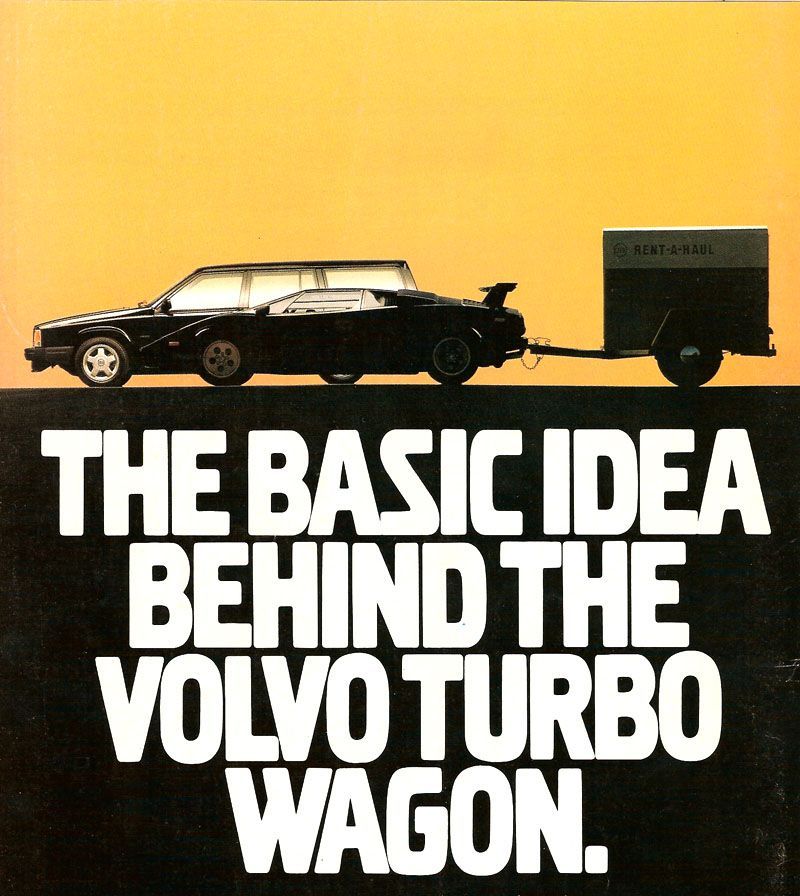

It’ll haul more than groceries: the intercooled, turbocharged Volvo 740 wagon – from the mid-1990s (photo per Jacob Frey 4A on Flickr)

On Mother’s Day several years ago I gave my wife a pale blue t-shirt that read “I used to be cool” on the front; on the back it said “Now I drive a minivan.” Such was her lament until an absent-minded motorist in a Tahoe shortened the rear end of her Honda Odyssey by a couple of feet, and we replaced it with a BMW. Unsurprisingly, the manufacturer of the Ultimate Driving Machine doesn’t offer a minivan.

Automakers have been trying to square the circle of fun with function, and vice-versa, since they started inviting their marketing departments to engineering meetings. Sometimes this quest has produced absurd results. In the 1990s, the folks at “boxy but good” Volvo put an intercooled, turbocharged motor in their mainline station wagon and created a rocket with room for seven. Kind of a cool idea, but hard to answer the “why?” question.

The Ultimate Investment Vehicle

The analogous tradeoff between fun and function in the valuation world is risk and growth. Unlike fun and function, risk and growth aren’t so much a dichotomy as they are co-present, and often in direct proportion to each other. Treasuries pay a modest but reliable coupon – they are essentially a no-risk, no-growth investment vehicle. On the other end of the spectrum, seed stage venture capital investing offers supernormal growth rates, and high expected returns to match. The ultimate investment vehicle is the profitable, high-growth, low-risk security: the Registered Investment Advisor.

Valuation orthodoxy holds that value equates to cash flow priced for risk (downside exposure) and opportunity (growth or otherwise upside exposure). All else equal, the greater the cash flow, the lower the perceived risks associated with that cash flow, and the greater the likelihood of growth or other upside associated with that cash flow, the higher the value. The reverse is also true.

On paper, the RIA model is a value generating machine: a reliable stream of distributable cash flow resulting from sticky, recurring revenues and growing effortlessly with the investment returns available in a diversifiable variety of financial markets. The reality, of course, is more nuanced.

Cash is (Still) King

At a core level, the most attractive feature of the RIA business model is a steady stream of distributable cash flow. This would be true in any market environment; given the low rate circumstance of the past decade-plus, it’s even more so. Unlike many businesses, investment management is not capital intensive, so EBITDA is more or less equivalent to distributable cash flow if an RIA is structured as a tax pass-through entity. RIAs offer the potential for double-digit yields and future growth. There are no fixed income instruments that look anything like that. And it’s for this reason that every week we read a new announcement about capital chasing the RIA space.

You can’t value a revenue stream based on unrealistically high fees.

The catch is that an RIA’s margin needs to be a real margin. By that I mean that you can’t value a revenue stream based on unrealistically high fees, nor is a profit margin reliable when owner compensation is so low that distributions are really being used as a substitute for wages. Segmenting returns to labor (compensation) and returns to capital (profits) can be difficult, but the value of an RIA is necessarily based on cash flows to the capital providers, as if they were not also part of the firm’s leadership.

De-Risking Your Firm

Business risk is inevitable, even for the best RIAs. Markets tumble. Clients die, and their heirs choose different advisors. Investment committees punish outperformance by rebalancing.

Many risks seem avoidable, though. Just look at the headlines. Last week’s announcement that First Republic lost a team responsible for $17 billion in client assets is a potent reminder that revenue producers who see more upside on their own won’t stick around forever, especially if they have a track record of chasing opportunity. And Creative Planning’s breakup with Tony Robbins is a keen reminder of the sort of personality risk that can come with celebrity endorsements, or – thinking back a bit – with founders who want to be celebrities. A lot of times, it seems the big risks that come to bite firms are born out of a growth strategy that soured.

Put another way, when evaluating the various “opportunities” available to RIA owners to increase value, it’s worth remembering that opportunity is a two-way street.

When evaluating the various “opportunities” available to RIA owners to increase value, it’s worth remembering that opportunity is a two-way street.

But it’s not just the usual business risks that bear consideration (client concentration, key manager risk, etc.). These days, I’m thinking more about how prominent the business communities in which RIAs operate have become: consolidators, IBDs, partnerships, and custodians. In a sense, whether you’re talking about Focus Financial, LPL, Fidelity, Raymond James, Goldman Sachs, Charles Schwab, or others, all of these communities act as eco-systems that present support and guardrails to RIAs. Some of these communities will be a better environment for your RIA than others. The biggest risk you face may be the opportunity cost of choosing the wrong one.

Growth as an Offset to Risk

Mathematically, a given increment of growth can mitigate certain business risks. Many years ago we cautioned a buy-side client that they were overpaying for an RIA to tuck into its bank trust department. They wanted the acquisition and did the deal anyway. We weren’t wrong, but the bull market that followed made most of our concerns about the target irrelevant as the growth in the acquired firm gave the bank a handsome return on their investment.

You can’t count on bull markets to bail out bad investments, but (even in a cash flowing business) growth matters because it provides part of the expected return on investment. If a given RIA is valued with a discount rate in the mid-teens, say 15%, and the growth expectation associated with the firm’s model is only a modest premium to inflation, say 3%, then the capitalization rate (also known as earnings yield) is 12% (cost of capital of 15% minus the growth rate of 3%). The earnings multiple is the inverse of the earnings yield, or 1/12%, or 8.5x. That’s an after-tax multiple, and the pre-tax equivalent is roughly equal to an EBITDA multiple, or about 6x. At a 5% growth rate, the earnings yield of 10% converts to an after-tax earnings multiple of 10x, or an EBITDA multiple of roughly 7.5x.

You can’t count on bull markets to bail out bad investments.

That march through the math of cap rates is admittedly dry, but if you’d like to think about how the market values growth, just look at how Focus Financial, an aggregator of mostly wealth management firms, stacks up against Affiliated Managers Group, an aggregator of mostly asset management firms. Since their IPO almost a year ago, Focus has been one of the most, if not the most, acquisitive of the consolidators, and is currently trading at a mid-teens multiple of EBITDA. AMG just announced their first acquisition in two years and has had a tough time growing earnings in these choppy markets. AMG trades for a little less than 10x reported EBITDA, a big discount to Focus.

Just Because You Can, Doesn’t Mean You Should

We get asked, regularly, what we think the best value-maximizing model is for an RIA. We can tell you that there are approximately 20 thousand RIAs, hybrid IBDs, independent trust companies, and unregistered investment management firms in the United States. Any one of them can be very successful, and we’ve had the pleasure of working with many that do very well. There is no one size fits all model or strategy. We can tell you that value is directly proportionate to cash flow and growth, and inversely proportionate to risk. Any strategy or model can be evaluated in terms of these three levers, and all are available as a way to increase the value of your RIA.

Just be careful before you mix and match strategies. Checking the lap time of a carpool carrier is a little like measuring the towing capacity of a Lamborghini. Ridiculous, but some have tried:

RIA Valuation Insights

RIA Valuation Insights