RIA Consolidators Drive Record Deal Activity in 2019

Asset and Wealth Manager M&A Continues Decade-Long Upward Trend

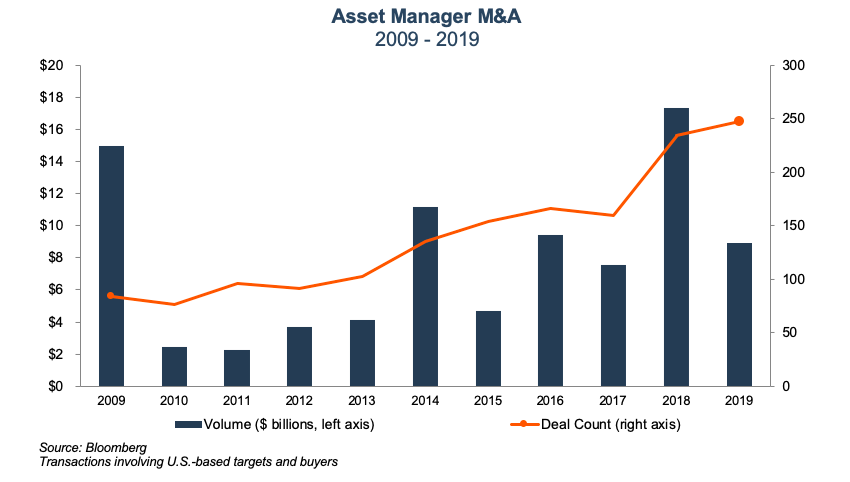

Asset and wealth manager M&A continued at a rapid pace during the fourth quarter of 2019, rounding out a record year by many metrics. Total deal count in 2019 rose 6% over 2018, reaching the highest level seen over the last decade. While reported deal volume declined by 50% in 2019, this metric can be a less reliable indicator of transaction activity given the lack of disclosed deal terms and the influence of large transactions (the Oppenheimer/Invesco deal accounted for about a quarter of 2018 reported deal volume, for example).

The rise of the RIA consolidator model continues to be a theme for the wealth management sector. Wealth management firms saw a significant uptick in consolidation activity during 2019, which was attributable in large part to strategic consolidators. According to Fidelity’s December 2019 Wealth Management M&A Transaction Report, there were 139 wealth management transactions in 2019 (43% more than 2018) representing $780 billion in assets (38% more than 2018). Some of the more active consolidators included Focus Financial, Mercer Advisors, Wealth Enhancement Group, HighTower Advisors, and Dynasty Financial Partners—each of whom acquired multiple RIAs during 2019.

RIA consolidators now account for about half of wealth management acquisition activity—and that percentage has been increasing.

RIA consolidators now account for about half of wealth management acquisition activity—and that percentage has been increasing. These consolidators are, in general, well-funded (often by PE backers) and have a mandate from their investors to grow rapidly via acquisitions. They’re also not shy about knocking on doors to source deals, and given the demographics of the wealth management industry, their pitch for an exit plan often finds a receptive audience.

Sub-acquisitions by consolidator-owned RIAs are a further driver of M&A activity for the sector. These acquisitions are typically much smaller and are facilitated by the balance sheet and M&A experience of the consolidators. For some RIAs acquired by consolidators, the prospect of using buyer resources to facilitate their own M&A may be a key motivation for joining the consolidator in the first place.

There have also been several significant transactions of the consolidators themselves, which illustrates the broad investor interest in the consolidator model. One of the largest deals of 2019 was Goldman Sachs’s bid to enter the mass-affluent wealth management market through its $750 million acquisition of RIA consolidator United Capital Partners. Also during 2019, Mercer Advisors’ PE backers sold a significant interest to Oak Hill Capital Partners.

Consolidation Rationales

Building scale to enhance margins and improve competitive positioning are typical catalysts for consolidation, especially on the asset management side. One way to stem the tide of fee pressure and asset outflows is to cut costs through synergies to preserve profitability as revenue skids. The lack of internal succession planning is another driver as founding partners look to outside buyers to liquidate their holdings.

Consolidating RIAs, which are typically something close to “owner-operated” businesses, is no easy task. The risks include cultural incompatibility, lack of management incentive, and size-impeding alpha generation. Many RIA consolidators structure deals to mitigate these problems by providing management with a continued interest in the economics of the acquired firm while allowing it to retain its own branding and culture. Other acquirers take a more involved approach, unifying branding and presenting a homogeneous front to clients in an approach that may offer more synergies, but may carry more risks as well.

M&A Outlook

The record transaction activity in 2019 marks a decade-long run of steadily increasing consolidation activity in the sector. In 2020, we expect the trend to continue as many of the forces that shaped the industry over the last decade remain in place. Consolidation pressures in the industry are largely the result of secular trends. On the revenue side, realized fees continue to face pressure as funds flow from active to passive and clients become increasingly fee conscious. On the cost side, an evolving regulatory environment threatens increasing technology and compliance costs. The continuation of these trends will pressure RIAs to seek scale, which will, in turn,  drive further M&A activity.

drive further M&A activity.

With over 11,000 RIAs currently operating in the U.S., the industry is still very fragmented and ripe for consolidation. Given the uncertainty of asset flows in the sector, we expect firms to continue to seek bolt-on acquisitions that offer scale and known cost savings from back office efficiencies. Expanding distribution footprints and product offerings will also continue to be a key acquisition rationale as firms struggle with organic growth and margin compression. An aging ownership base is another impetus. The performance of the broader market will also be a key consideration for both buyers and sellers in 2020.

RIA Valuation Insights

RIA Valuation Insights