2025’s Halftime Performance

When it comes to investor sentiment, 2025 has been a tale of two very different quarters. During the first quarter of 2025, GDP decreased at an annualized rate of 0.2%, consumer spending only marginally increased, and the ongoing risk of recession grew. Following up on a post I wrote earlier this year, it’s July, it’s movie night, and Jerry Maguire is screaming, “Show me the money!”

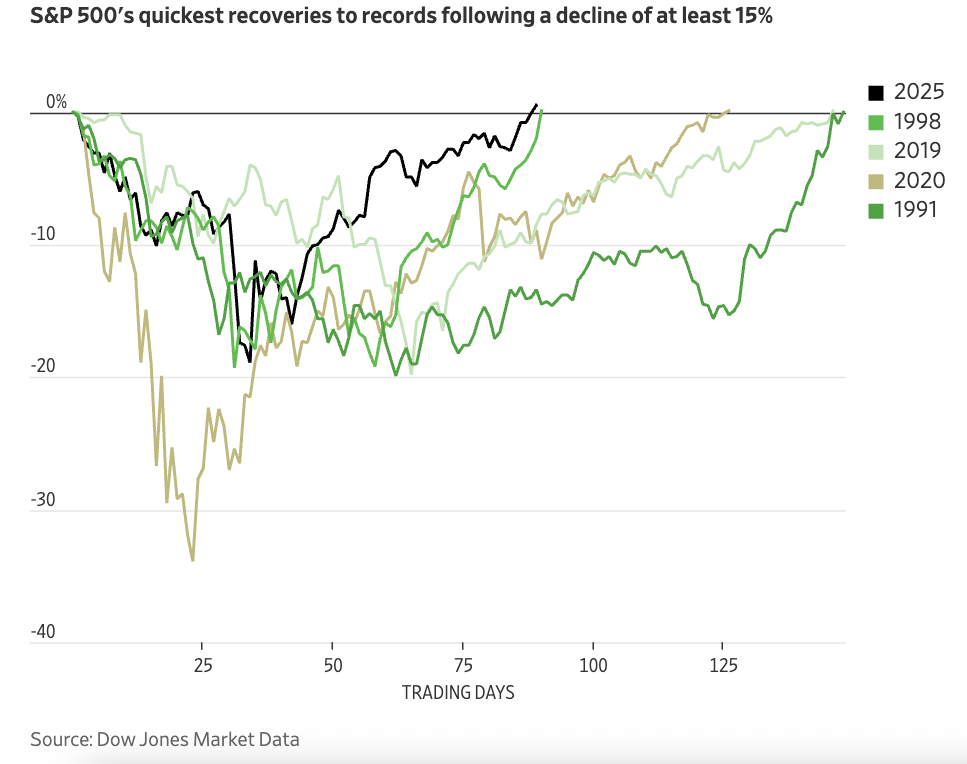

As we officially transition from the first half of the year to the second, investors hope to continue what has been a historic recovery over the last three months. Krystal Hur and Karen Langley, in recent articles for the Wall Street Journal, discuss how solid economic data suggest that growth could continue. Inflation is trending near the Fed’s 2% target, continued trade negotiations are ongoing, and both the S&P 500 and Nasdaq hit all-time highs on Friday, June 27.

Although long-term uncertainty remains, in just a few months, the shift from uncertainty and fear to the rebound in the market came on April 9 as President Trump announced a 90-day pause on the planned tariffs. This triggered a 9.5% daily increase for the S&P 500, its best day since the 2008 financial crisis. And the index did not stop there.

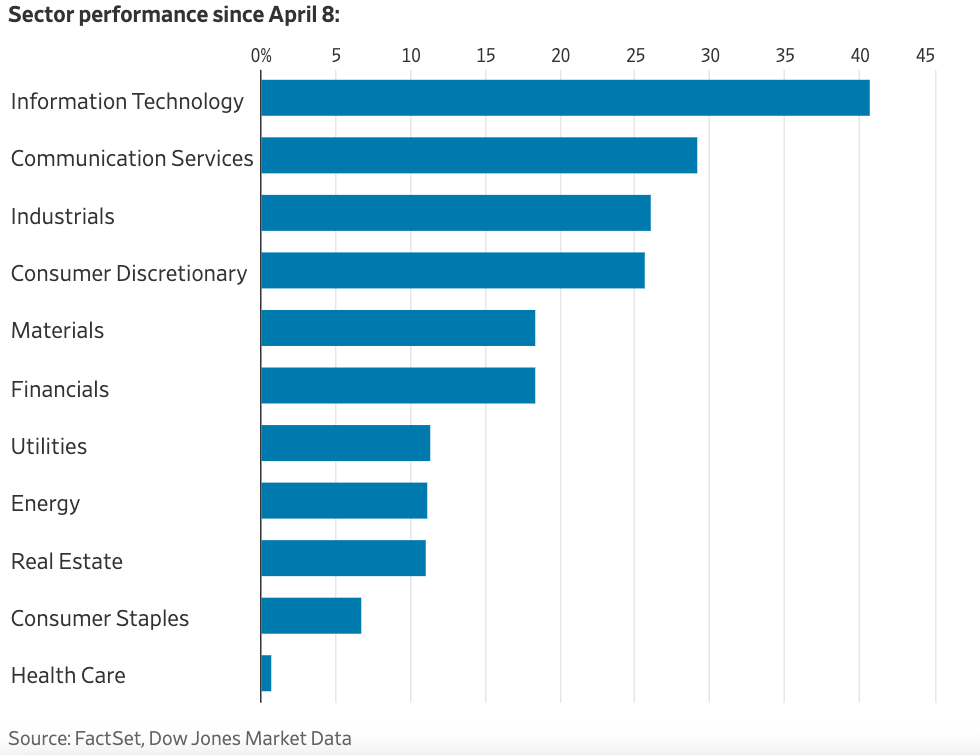

As the pause ends in early July, predicting where the market goes in the second half of the year remains troublesome. Langley and Hur discuss how investor optimism is reflected in the S&P 500’s top-performing sector this year, industrial stocks. This sector is a good representation of the overall economy’s strength, as industrials have increased 11%, compared to a 5% gain by the S&P 500.

Moving Forward

As emerging investor optimism for the rest of 2025 washes away the Q1 uncertainty and pessimism, we want to focus on two key questions related to growth, risk, and the meaning of the family business: investment decisions and distribution policy.

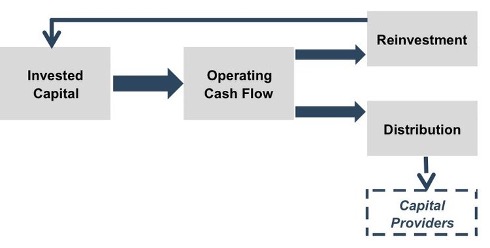

We tend to assign one of the four basic meanings to a family business. The idea is that your family business’s appetite for growth and risk depends on what meaning your family assigns to the business. As shown below, the meaning of the family business influences the company’s dividend policy, investing, and financing decisions.

Investing

How the family business makes investment decisions is tied to how your family shareholders think about risk and growth. Family businesses make investment decisions from a wide range of potential alternatives — both within the business and through diversification. Highlighted below are some of the more common risk-return combinations available to investors. To achieve a higher expected return, investors must be willing to accept greater risk.

But how do family business directors approach the risk-return question? Reflecting on the meaning of your family business provides a valuable backdrop for making that decision. If your family business serves as a “source of lifestyle,” you are less likely to invest in higher-return (higher risk) projects or diversification efforts that could jeopardize current dividends and endanger business predictability.

Alternatively, suppose your family views the business as an “economic growth engine” meant to grow with your family. In that case, you will likely aim to make investment decisions that maximize the expected return (thus, increasing risk) to drive the economic growth of your business for future generations. Ultimately, your goal as a family business director is to reconcile the family shareholders’ risk-return objectives with the business’s growth and risk profile.

Distributing

The flip side of reinvesting in your family business is distributions. Net operating cash flows can either be reinvested into your business or paid out to shareholders.

Companies that understand what the business means to the family can make distribution decisions that reflect shareholder objectives and needs. If family shareholders see the company as a growth engine, they should be willing to accept lower distributions to generate higher growth, just as shareholders seeking consistent distribution checks should be willing to accept more muted long-term growth.

Ultimately, family business directors need to remember their shareholders are just that: shareholders. While their equity may have been earned through familial ties, family business owners deserve the same considerations paid to public company shareholders — a focus on protecting and growing shareholder value through a mix of reinvestment opportunities and distributions.

Conclusion

A disciplined process of analyzing investment choices (we discuss in detail here) informed by an understanding of family shareholder objectives will help private business directors decide on investment and distribution strategies. Evaluating investment decisions for future growth and distribution policies in light of the family’s risk tolerance, growth objectives, and business meaning is critical. Give one of our family business professionals a call today for help with these topics.

Family Business Director

Family Business Director