3 Strategic Financial Questions for Family Businesses

Our family business advisory practice is focused on three strategic financial questions that weigh on family business directors. In no particular order, the three questions are:

1. What is the right dividend policy for our family business?

We define dividend policy broadly, encompassing both how family businesses pay regular and special dividends, as well as how they craft shareholder redemption programs.

2. What is the right family business capital structure?

Every family business has a capital structure, whether it is the product of intention or inattention. Capital structure for family businesses often reflects both business fundamentals and family risk tolerances.

3. What is the right asset mix for our family business?

Answering this question requires careful analysis of the company’s strategy, the identification of potential projects, and the use of cash flow projections.

Clients often solicit our advice because they are struggling with one of these questions. However, in our experience, the questions can’t really be tackled in isolation. Each question comprises one leg of the three-legged stool of the family business. As an engineering-minded client recently pointed out to us, while it is impossible for a three-legged stool to wobble, it can be crooked. If the three legs are not designed to work together, the stool won’t be level and won’t hold anything valuable for long.

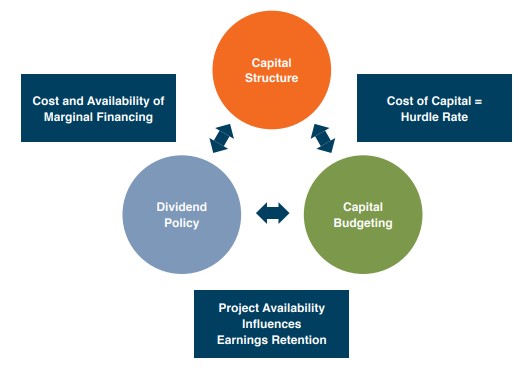

We like to use the following image to illustrate how the three legs of the stool relate to one another.

Relationship between Dividend Policy and Capital Structure

Whether through dividends or share redemptions, returning capital to shareholders affects the capital structure of the family business. This is true if dividends are paid out of operating cash flow, or if a special dividend or redemption is paid out of incremental borrowings. As a result, dividend and redemption decisions cannot be made apart from capital structure decisions. This requires family shareholders to consider the inherent tradeoffs that often arise between the desire for more substantial dividends and a preference for the family business to be conservatively financed.

Relationship between Capital Structure and Capital Budgeting

The mix of debt and equity financing employed by the family business influences the weighted average cost of capital, which serves as the foundation for hurdle rates used in capital budgeting analyses. Setting the appropriate hurdle rate for capital investment requires more than a little finesse on the part of family business directors. Set the rate too high, and the growth of the family business may be stifled as the company continually loses out on investment opportunities to more aggressive bidders. If the hurdle rate is too low, the family business will be willing to make capital investments when returning capital to family shareholders would be the more prudent choice. A too-low hurdle rate can become a self-fulfilling prophecy, ultimately pulling down shareholder returns over time through over-investment in the business.

Relationship between Capital Budgeting and Dividend Policy

Shareholder returns come from two, and only two, sources: dividend yield and capital appreciation (i.e., growth in share price over time). While it may be only natural for family shareholders to want to maximize both sources of return, funds distributed as dividends or used for share redemptions are not available to finance capital investments that support future increases in share price. This tradeoff is unavoidable, suggesting that dividend policy cannot be established in isolation from the investment opportunities available to the family business. Finding the right mix of dividends and reinvestment for future growth requires balancing the often-competing claims and needs of different generations within the family, or even among other branches of the same generation.

Keeping the Stool Level

No, a three-legged stool will never wobble, but it won’t necessarily be level, either. You can only keep the stool level if all three legs are working together. We assist our family business clients in making sure all three legs are working together by helping directors identify what the business means to the family and improving engagement and communication at the shareholder level.

Give one of our senior professionals a call today to discuss how we can help secure a sustainable future for your family business.

Family Business Director

Family Business Director