A Valuable New Resource: The UHNW Institute’s “Wealthesaurus”

Family business directors understand the importance of having a clear, shared vocabulary when navigating complex issues of governance, strategy, and finance. Without common definitions, conversations can quickly veer off track. That’s why we were intrigued to discover a new resource from the UHNW Institute: the Wealthesaurus.

Despite sounding vaguely dinosaurian, the Wealthesaurus is, in fact, an online glossary of terms that frequently arise in conversations about family enterprise and wealth management. It is a thoughtful resource providing clear, accessible definitions for concepts that matter deeply to enterprising families.

While the collection is extensive, a few entries stand out as especially relevant for family business directors.

- Family Business. The Wealthesaurus highlights the unique blend of ownership, management, and family dynamics that define family enterprises. This is more than just a label—it’s a reminder that governance and finance decisions must be evaluated not only in light of business strategy but also in the context of family priorities and values. Classic financial and economic theory assumes that economic actors are rational robots seeking “maximal” outcomes with no emotional baggage and no cognitive biases. In contrast, actual enterprising families are populated with, well, people. Directors must be attuned to the attributes and needs of both the business and the family.

- Consolidated Reporting. Families with multiple holdings—operating companies, investments, trusts—often struggle to see the “big picture.” Consolidated reporting provides a framework for aggregating disparate financial information into a single, coherent view. For directors, having a broader view of the family’s aggregate balance sheet provides essential context for making informed distribution, investment, and liquidity decisions.

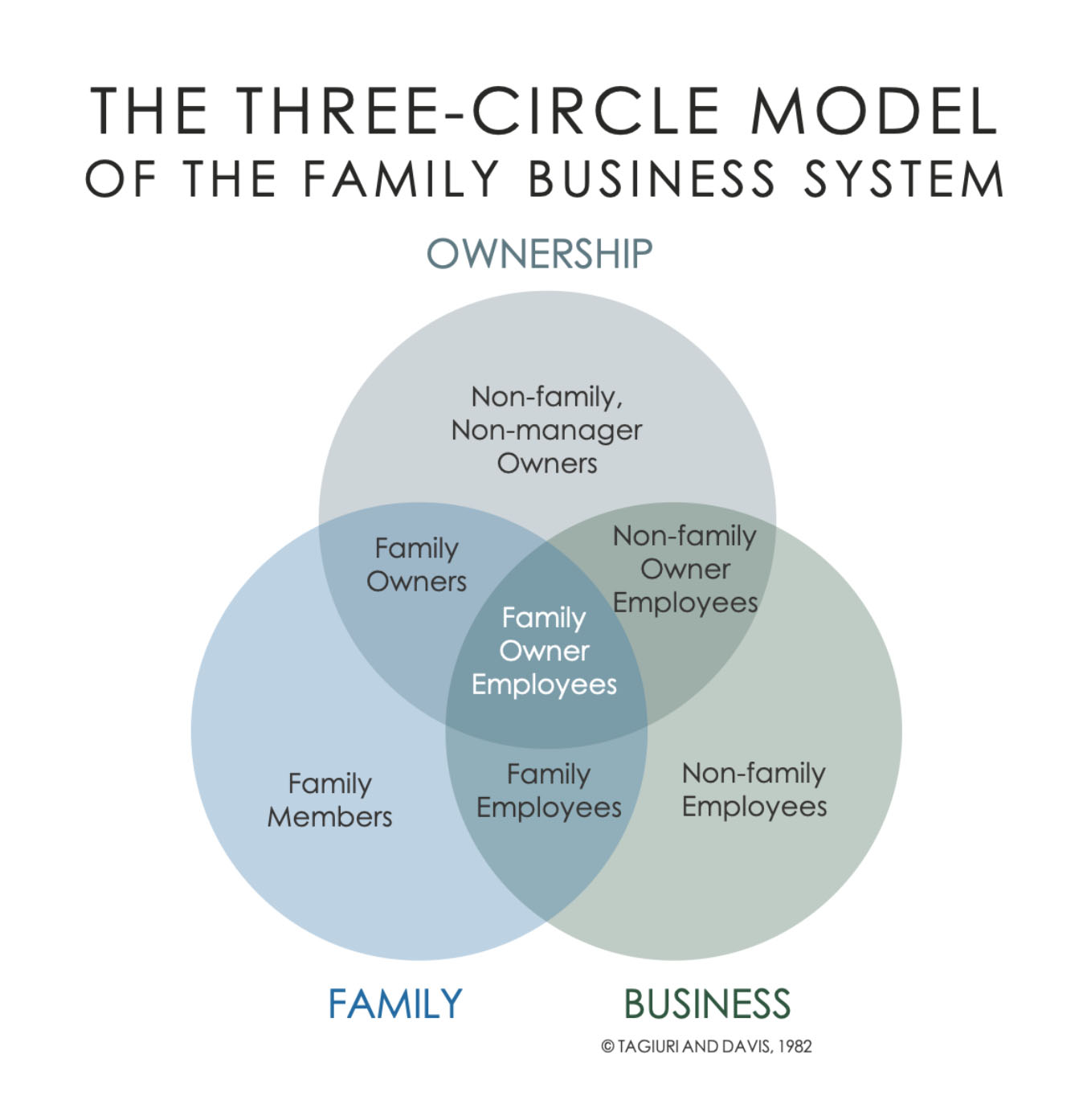

- Three-Circle Model. Many readers will be familiar with this framework, which illustrates the overlapping circles of family, ownership, and business. It’s a simple but powerful tool for thinking through the complex interactions between the enterprising family and the business and explaining why the questions that keep family business directors awake at night so often have more than one “right” answer.

Screenshot - Business Sustainability. The Wealthesaurus defines sustainability in terms of balancing long-term business performance with family continuity. This resonates with our own work helping families evaluate capital structure, reinvestment, and dividend policy decisions in ways that acknowledge the inevitable tradeoffs in such decisions, recognizing both the legitimacy of family needs and preferences and the role of business sustainability in underwriting those needs and preferences over multiple generations.

- Liquidity Event. Whether through a sale, recapitalization, or redemption program, liquidity events are pivotal moments in the life of a family business. The Wealthesaurus definition underscores both the financial and emotional dimensions of these events. For directors, evaluating potential liquidity events is among the most difficult and consequential tasks they face.

Together, these five terms reflect much of what we discuss each week on this blog: how enterprising families can steward their businesses wisely, make informed financial decisions, and communicate effectively across generations.

We encourage you to explore the full Wealthesaurus here. It’s an excellent reference for anyone seeking to deepen their understanding of the language that shapes family wealth and enterprise conversations.

Family Business Director

Family Business Director