Alternative Asset Managers Stumble in 2025 Following Half a Decade of Outperformance

Key Takeaways

-

After years of strong performance, alternative asset managers underperformed in 2025, posting 6.7% price gains compared to the S&P 500’s 18.7%, despite maintaining superior revenue and EBITDA growth.

-

Persistent high interest rates and questions about the sustainability of elevated valuation multiples have contributed to weaker market sentiment toward alternative asset managers.

-

Investors have increasingly favored traditional asset managers offering liquid exposure and immediate returns, as tighter liquidity and higher real yields have reduced the appeal of long-term, illiquid investment vehicles.

-

The Fifth Circuit Court’s 2024 decision to vacate the SEC’s Private Fund Adviser Rules removed potential compliance burdens for alternative managers, particularly benefiting smaller firms.

-

While current market performance reflects cyclical headwinds, the long-term outlook for alternative asset managers remains positive due to their differentiated strategies, scale advantages, and resilience during periods of volatility.

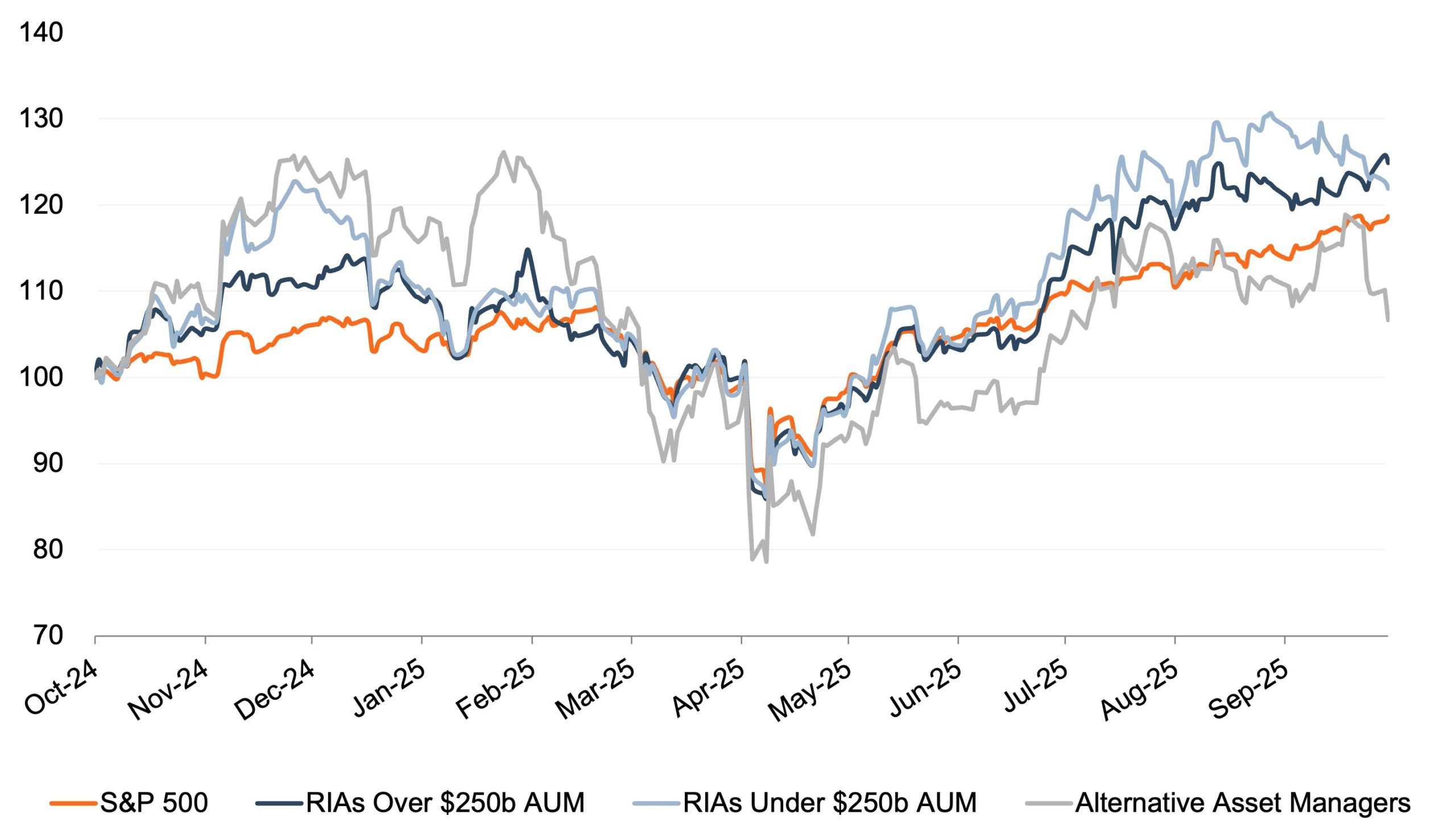

Following years of outperformance relative to other segments of publicly traded RIAs, alternative asset managers have begun to falter. Over the twelve months ending September 30, 2025, price returns of traditional asset and wealth managers exceeded that of the S&P 500, while alternative asset managers underperformed. Alternative asset managers posted 6.7% price gains for the year compared to 18.7% for the S&P 500. These trends come in spite of alternatives outperforming in fundamentals such as revenue and EBITDA growth.

Price Performance – LTM 9/30/2025

Source: S&P Market Intelligence

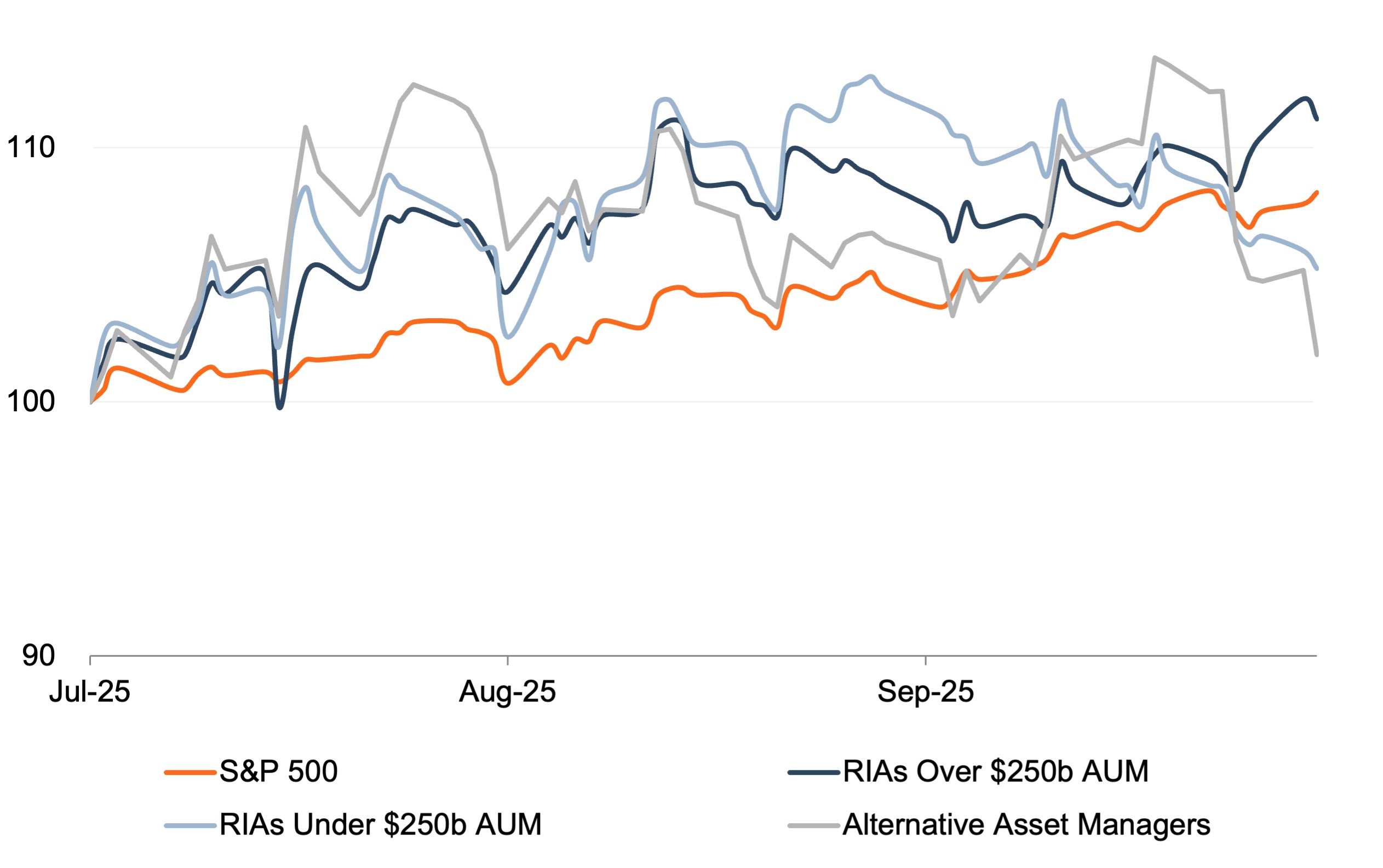

Price Performance – Q3 2025

Source: S&P Market Intelligence

Recent quarterly data shows a similar trend. In the third quarter, alternative asset managers gained only 1.9%, underperforming the S&P 500’s 8.2% gain over the same period. Of the groups reviewed, larger RIAs saw the strongest performance for the quarter, increasing 11.1%, while their smaller counterparts posted an 5.2% increase. The recent underperformance in spite of strong fundamentals may be reflective of higher-for-longer interest rates impacting cost of leverage and market participants reconsidering whether this business model can justify the almost 27x EV/EBITDA multiple these companies held in Q3 2024, which was and continues to be substantially higher than other RIAs.

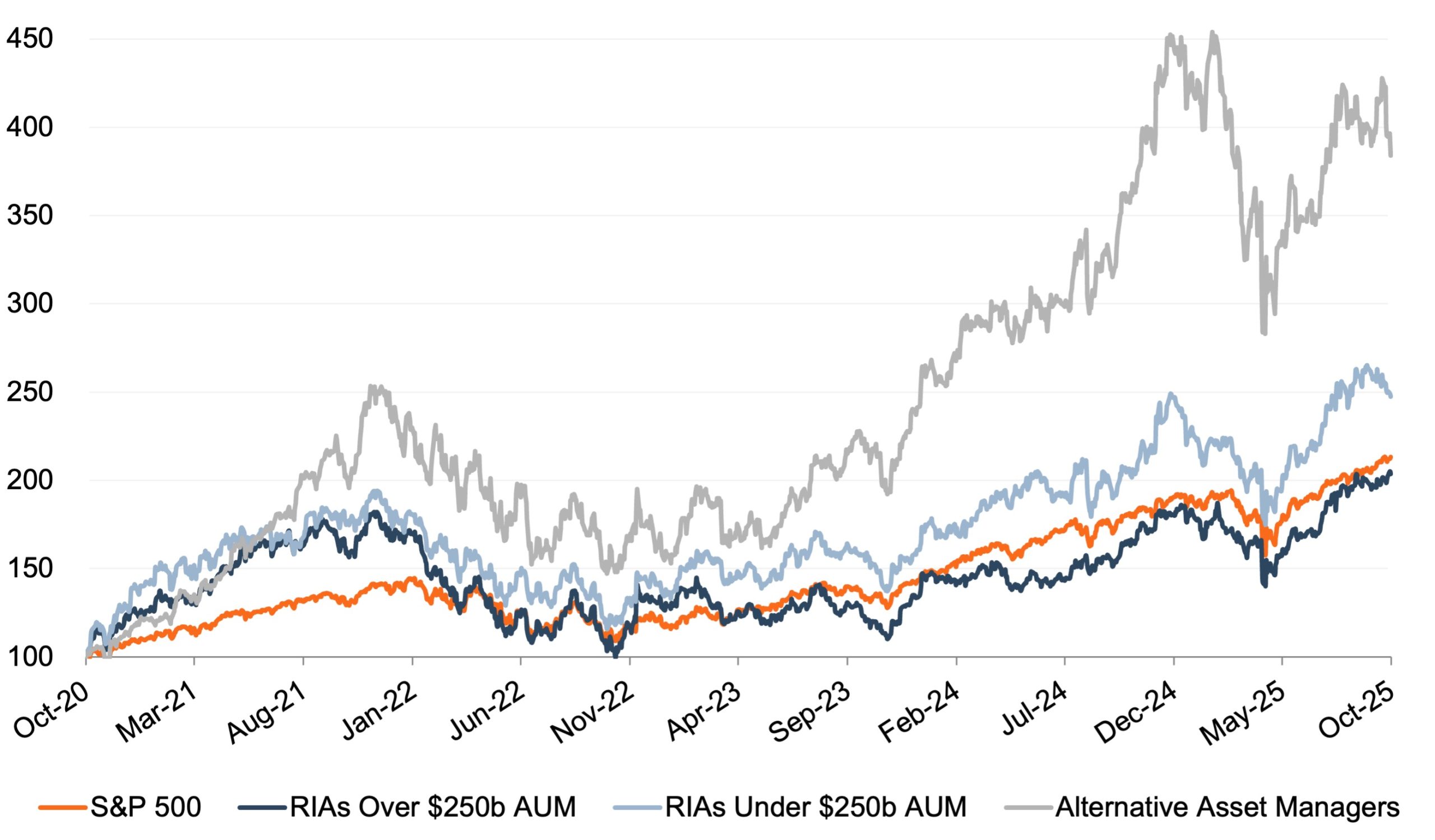

Price Performance – Q4 2020 – Q3 2025

Source: S&P Market Intelligence

Since 2020, increased volatility has driven fluctuations in AUM, drawing heightened interest in the stocks of alternative asset managers. This interest can be attributed to the long-term nature of their investment vehicles, such as private equity funds, which typically lock in capital for extended periods (often 10-12 years). This structure provides a more stable and predictable revenue stream, largely insulated from short-term market fluctuations. As a result, alternative asset managers tend to exhibit lower correlations with broader market conditions, enhancing their appeal during periods of uncertainty.

The attractiveness of these firms lies not only in their ability to weather volatility but also in their capacity to capitalize on it. Many alternative investments, like private equity and hedge funds, are positioned to thrive in environments of market dislocation, offering both downside protection and opportunistic growth when traditional asset classes falter.

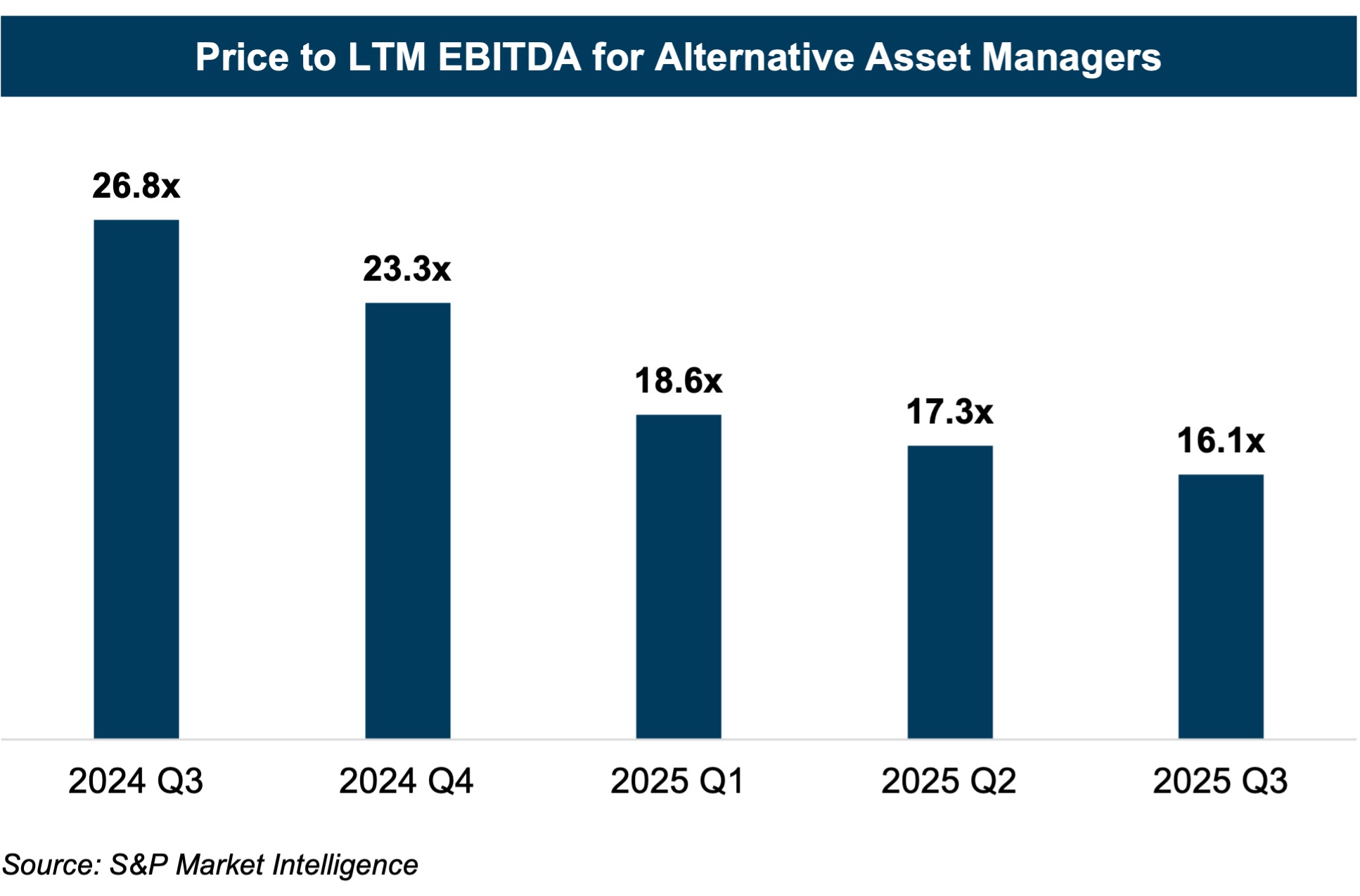

Valuation Trends and Earnings Multiples

From a valuation perspective, the market’s sentiment towards alternative asset managers is clearly reflected in their earnings multiples. After a downward trend throughout much of 2022, EBITDA multiples for alternative asset managers began to rebound in 2023, eventually rising as high as 26.8x in Q3 2024.

Though the Federal Reserve began easing policy in late 2024, higher-for-longer real yields and tighter liquidity conditions have weighed on private market fundraising and exits. Investors have shown renewed preference for liquidity and yield, benefiting traditional asset managers that offer liquid exposure to strong public equity markets. In contrast, alternative managers’ long-dated investment cycles and unrealized balance sheet positions have made them less attractive in a market environment emphasizing immediacy and visibility of returns, particularly as liquid alternatives products become increasingly accessible.

It’s important to note that many publicly traded alternative asset managers carry significant investment assets on their balance sheets—investments in their own funds—which are factored into their stock prices. When comparing firms within this space, it’s often necessary to adjust earnings and implied enterprise values to account for these balance sheet investments.

The near-term underperformance in valuations likely reflects a cyclical adjustment following a period of exceptional price appreciation. Over the long term, the secular case for alternative asset managers remains intact. As investors continue to seek differentiated return streams, scale advantages, and specialized expertise, the largest alternative platforms are well-positioned to benefit once sentiment stabilizes.

SEC’s Private Fund Adviser Rules Vacated

In August of 2023, the SEC adopted new Private Fund Adviser Rules, attempting to tighten the regulatory oversight of private fund advisers. These new rules mandated quarterly performance disclosures, annual audits, and enhanced reporting for certain transactions. These rules were expected to significantly increase compliance costs, especially for smaller alternative asset managers.

However, in June 2024, the U.S. Fifth Circuit Court unanimously vacated the rules, stating that the SEC had overstepped its regulatory authority. This ruling was a significant win for alternative asset managers, removing the prospect of steep compliance costs that could have strained smaller firms. Going forward, this ruling may have set a precedent for future SEC efforts to regulate private funds and may give rise to challenges to other SEC rules that rely on similar authority.

Implications for Your RIA

While the valuation of publicly traded asset and wealth managers offers insights into broader investor sentiment, direct comparisons with privately held RIAs require careful consideration. Publicly traded firms, particularly smaller ones, often focus on active asset management, which remains vulnerable to fee compression and capital outflows toward passive investment products. This trend has put pressure on publicly traded asset managers, especially those who rely heavily on active strategies.

In contrast to public asset/wealth managers, many smaller, privately held RIAs, particularly those focused on wealth management for HNW and UHNW individuals, have been more insulated from industry headwinds. Their fee structures, asset flows, and deal activity reflect this more favorable backdrop.

RIA Valuation Insights

RIA Valuation Insights