2020 Outlook: Good Fundamentals, Moderate Valuations but Limited EPS Growth

Bank fundamentals, which are discussed in more detail below, did not change a lot between 2018 and 2019; however, bank stock prices and the broader market posted strong gains as shown in Table 1 following a short but intense bear market that bottomed on Christmas Eve 2018. Our expectation is that 2020 will not see much change in fundamentals either, while bank stocks will require multiples to expand to produce meaningful gains given our outlook for flattish earnings.

Fed Drives the Market Rebound

The primary culprit for the 4Q18 plunge and subsequent 2019 rebound in equity prices was the Fed, which has a propensity to hike until something breaks according to a long standing market saw. A year-ago the Fed had implemented its ninth hike in short-term policy rates that it controls despite the vocal protests of the President and, more importantly, the credit markets as reflected in widening credit spreads and falling yields on Treasury bonds and forward LIBOR rates.

One can debate how much weight the Fed places on equity markets, but it has always appeared to us that they pay close attention to credit market conditions. When the high yield bond and leverage loan markets shutdown in December 2018, the Fed was forced to pivot in January and back away from rate hikes after forecasting several for 2019 just a few months earlier. Eventually, the Fed was forced to reduce short rates three times and resume expansion of its balance sheet in the fourth quarter after halting the reduction (“quantitative tightening”) in mid-year.

Markets lead fundamentals. Among industry groups bank stocks are “early cyclicals,” meaning they turn down before the broader economy does and tend to turn up before other sectors when recessions bottom. One take from the price action in banks is that the economy in 2020 will be good enough that credit costs will not rise dramatically. Otherwise, banks would not have staged as strong a rebound as occurred.

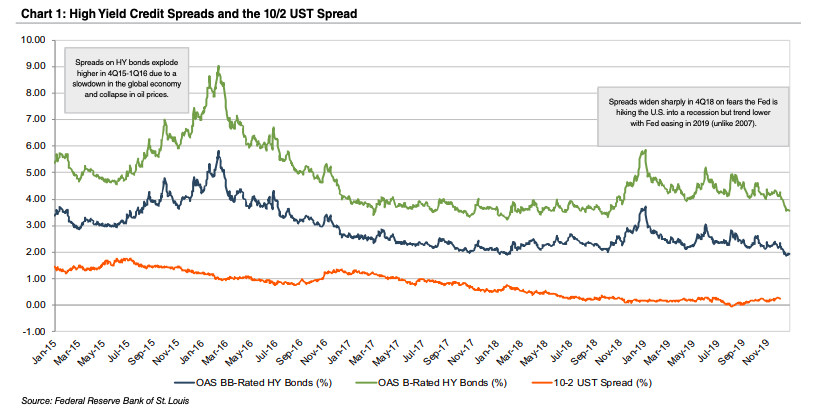

Likewise, somewhat tighter spreads on B- and BB-rated high yield bonds relative to U.S. Treasuries (option adjusted spread, “OAS”) since the Fed eased is another data point that credit in 2020 will not see material weakening. The stable-to-tighter spreads in the high yield market today can be contrasted with 2007 when OAS began to widen sharply even after the Fed began to cut rates and the U.S. Treasury curve steepened as measured by the spread between the yield on the two-year and 10-year notes.

Bank Fundamentals

Bank fundamentals are in good shape even though industry net income for the first three quarters of 2019 increased nominally to $181 billion from $178 billion in the comparable period in 2018. On a quarterly basis, third quarter earnings of $57 billion were below the prior ($63 billion) and year ago ($62 billion) quarters. Not surprisingly, earnings pressure emerged during the year as what had been expanding NIMs during 2017 and 2018 began to contract due the emergence of a flat-to-inverted yield curve, a reduction in 30/90-day LIBOR which serves as a base rate for many loans, and continuation of a highly competitive market for deposits. Also, loan growth slowed in 2019—especially for larger institutions.

As shown in Table 2, core metrics such as asset quality and capital are in good shape, while profitability remains high. Our outlook for 2020 is for profitability to ease slightly due to incrementally higher credit costs and a lower full year NIM although stabilization seems likely during 2H20. Nonetheless, ROCE in the vicinity of 10- 11% and ROTCE of 13-14% for large community and regional banks seems a reasonable expectation.

EPS growth will be lacking, however. Wall Street consensus EPS estimates project essentially no change for large community and regional banks, while super regional banks are projected to be slightly higher at 3%. Money center banks (BAC, C, GS, JPM, MS, and WFC) reflect about 6% EPS growth, which seems high to us even though the largest banks tend to be more active in repurchasing shares relative to smaller institutions where excess capital is allocated to acquisitions, too.

The Fed—Presumably on Hold

In the December 2018 issue of Bank Watch we opined it was hard to envision the Fed continuing to raise short-term rates even though the Fed forecasted further hikes. We further cited the potential for rate cuts. Our reason for saying so was derived from the market rather than economists because intermediate- and long-term rates had decidedly broken an uptrend and were heading lower.

As the calendar turns to 2020, the Fed has indicated no changes are likely for the time being. The market reflects a modest probability that one more cut will be forthcoming, but to do so in an election year probably would require long rates to fall enough to meaningfully invert the Treasury curve unlike the nominal inversion which occurred in mid-2019.

As it relates to bank fundamentals, the impact on NIMs will depend upon individual bank balance sheet compositions. Broadly, however, a scenario of no rate hikes implies NIMs should stabilize in 2H20 as higher cost CDs and wholesale borrowings rollover at lower rates. Also, if the Fed continues to expand its balance sheet (presently it is doing so through only purchasing T-bills through support of the repo market) then assets may remain well bid. All else equal, stable to rising prices in the capital markets usually are supportive of credit quality within the banking system.

Bank Valuations—Rebound from Year-End 2018 “Bargains”

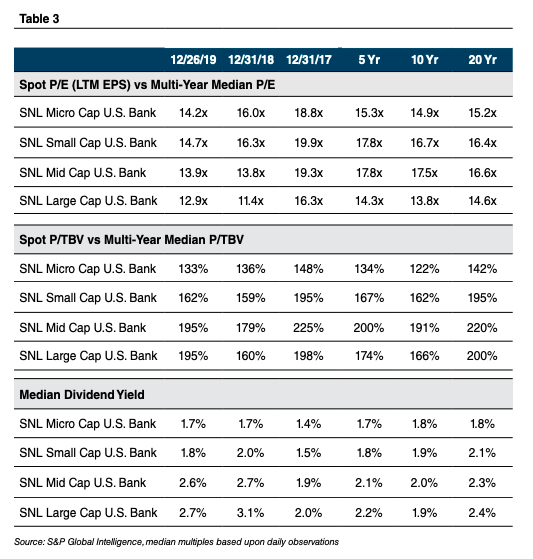

A synopsis of bank valuations is presented in Table 3 in which current valuations for the market cap indices are compared to year-end 2018 and year-end 2017 as well as multi-year medians based upon daily observations over the past 20 years.

The table illustrates the important concept of reversion to the mean. Valuations were above average as of year-end 2017 due to policy changes that occurred with the November 2016 national elections that culminated with the enactment of corporate tax reform in late 2017. One year later valuations were “cheap” as a result of the then bear market that reflected concerns the Fed would hike the U.S. into a recession.

Despite the rebound in prices and valuation multiples during 2019, bank stocks enter 2020 with moderate valuations provided the market (and us) have not miscalculated and earnings are poised to fall sharply. Money center and super-regional banks are trading for median multiples of about 10x and 11x consensus 2020 earnings. Regional and large community banks, which include many acquisitive banks, trade for respective median multiples of 12x and 13x.

An important point is that valuation is not a catalyst to move a stock; rather, valuation provides a margin of safety (or lack thereof) and thereby can provide additional return over-time as a catalyst such as upward (or downward) earnings revisions can cause a multiple to expand or contract. Looking back to last year one might surmise the rebound in valuations reflects the market’s view that the Fed avoided hiking the U.S. into recession.

Bank M&A—2020 Potentially a Great year

M&A activity has been robust with bank and thrift acquisitions since 2014 exceeding 4% of the industry charters at the beginning of each year. It appears once the final tally is made, upwards of 275 institutions will have been acquired in 2019, which would represent almost 5% of the industry. With only a handful of new charters granted since the financial crisis the industry is shrinking fast. As of Sept. 30, there were 5,256 U.S. banks and thrifts, down from about 18,000 in 1985.

While activity was steady at a high level in 2019, the most notable development was market support for four merger-of-equals (“MOE”) in which the transaction value exceeded $1.0 billion. The largest transaction closed Dec. 9 when BB&T Corp. and SunTrust merged to form Truist Financial Corp. Others announced this year include tie-ups between TCF Financial Corp./Chemical Financial Corp., First Horizon National Corp./IBERIABANK Corp., and Texas Capital Bancshares Inc./Independent Bank Group Inc. Although not often pursued, we believe MOEs are a logical transaction that if well executed provide significant benefits to community bank shareholders.

The national average price/tangible book multiple eased to 157% from 173% in 2018, while the median price/earnings (trailing 12 months as reported) declined to 16.8x from 25.4x (~21x adjusted for the impact of corporate tax reform). The reduction was not surprising given low public market valuations that existed at the beginning of 2019 because acquisition multiples track public market multiples with a lag.

We see 2020 shaping up as a potentially great year for bank M&A. The backdrop is an M&A trifecta: buyer and seller earnings will likely be flattish primarily due to sluggish loan growth and lower NIMs; asset quality is stable; and stock prices are higher, meaning buyers can offer better prices (but less value) to would-be sellers. Also, the capital markets remain wide open for banks to issue subordinated debt and preferred equity at very low rates to fund cash consideration not covered by existing excess capital.

Summing it Up

This year appears to be the opposite of late 2018 in which a strong market for bank stocks is predicting continuation of solid fundamentals and possibly better than expected earnings. Nonetheless, an environment in which earnings growth is expected to be modest at best likely will result in limited gains in bank stocks given the rebound in valuations that occurred in 2019.

Originally published in Bank Watch, December 2019.