2021 Transportation Industry Update | COVID in Review

COVID-19 has had a lasting impression on many industries throughout the world, but the U.S. trucking and transportation industry was among the first industries to feel the impact of the pandemic.

Lockdowns in China (initiated in December 2019) began affecting the U.S. trucking industry in very early 2020 as Chinese imports account for nearly 40% of all shipments entering the U.S. By the beginning of March, the U.S. had already begun to see massive declines in incoming freight with an escalation of shipping cancellations. The ports of Seattle and Long Beach experienced 50-60 container shipment cancellations reflecting declines of 9% relative to the prior year.

When discussing the decline of imports in the port of Seattle, Sheri Call of the Washington Trucking Association said, “That’s the kind of decline we’d normally see over the course of an entire year.” Disruption of international trade led to transportation companies reducing capacity as early as the beginning of March. Outbound rail and trucking shipments from LA dropped 25% and 20% respectively, in March 2020.

Due to social distancing requirements throughout the United States, many roadside eateries and rest areas were closed in the first several months of the pandemic, which reduced truck drivers’ access to food and other necessities for long days on the road. Trucking companies were forced to alter their transportation network, frequently carrying empty loads as a result of uneven and declining demand. According to Reuters, “trucks hauling food and consumer products north to the United State are returning empty to Mexico where mass job losses have hit demand, leaving cash-strapped truckers to log hundreds of costly, empty miles.” Empty loads increased nearly 40% worldwide in the immediate aftermath of the lockdown.

An indication of the health of U.S. trucking industry can be seen through the ratio of full north bound trips to full southbound trips at the Mexico-US border. The ratio is typically one full southbound trip to every three full northbound trips, but the ratio began to lean closer to a one to seven ratio during the pandemic with the remainder being empty or partially full. Additionally, new freight contracts have fallen 60% to 90% since the rise of COVID-19 in 2020.

Increased online shopping from consumers has led to a spike in demand for last-mile delivery services. Amazon reported $75.5 billion in 2020 first-quarter sales which was a 26% increase from the first quarter of 2019. Many last-mile delivery companies like FedEx and Amazon continued to hire workers with Amazon seeing an increase in company employment of nearly 175,000 workers from March to April of 2020. Last-mile delivery carriers also eliminated signature requirements so that they can now achieve a “contactless” delivery process.

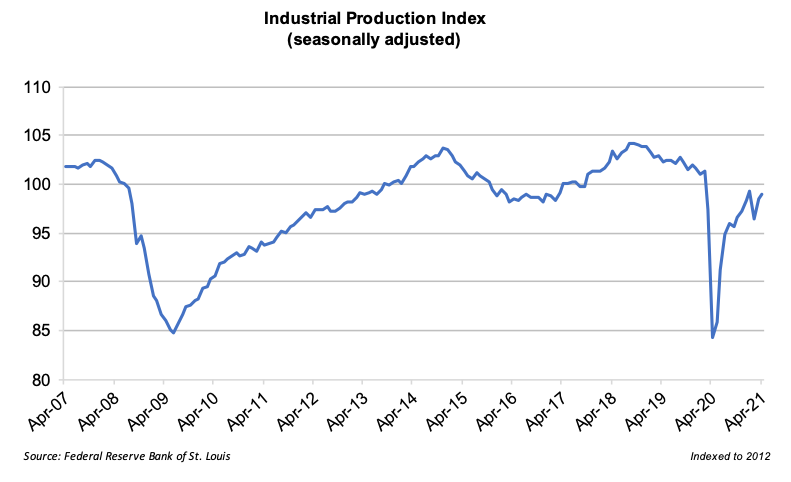

The level of domestic industrial production is correlated to the demand for services within the transportation industry. The Industrial Production Index is an economic measure of all real output from manufacturing, mining, electric, and gas utilities.

Lockdowns that began in March of 2020, as a result of the pandemic, led to a sharp decline in the Industrial Production Index. The index began a rapid recovery during the summer months of 2020. At the end of the first quarter of 2020, the Industrial Production Index saw a quarter-over-quarter decrease of 16.7% while also being down 17.7% on a year-over-year basis. The index rebounded in the second quarter of 2020 with a quarter-over-quarter increase of 12.7%. The index continually increased over the last three quarters of 2020, but it had not reached pre-pandemic levels as of April 2021.

The outlook for the trucking industry at the beginning of 2020 was promising with economists predicting that freight rates would grow 2% over the course of the year. Strong economic growth in the first two months of 2020 was halted by the outbreak of the unforeseen pandemic. The impact was dramatic – though not entirely negative for all carriers. Carriers of essential goods like groceries, cleaning supplies, and medical supplies experienced skyrocketing demand for their services while industrial, manufacturing, and other non-essential carriers are still undergoing lasting effects from the pandemic.

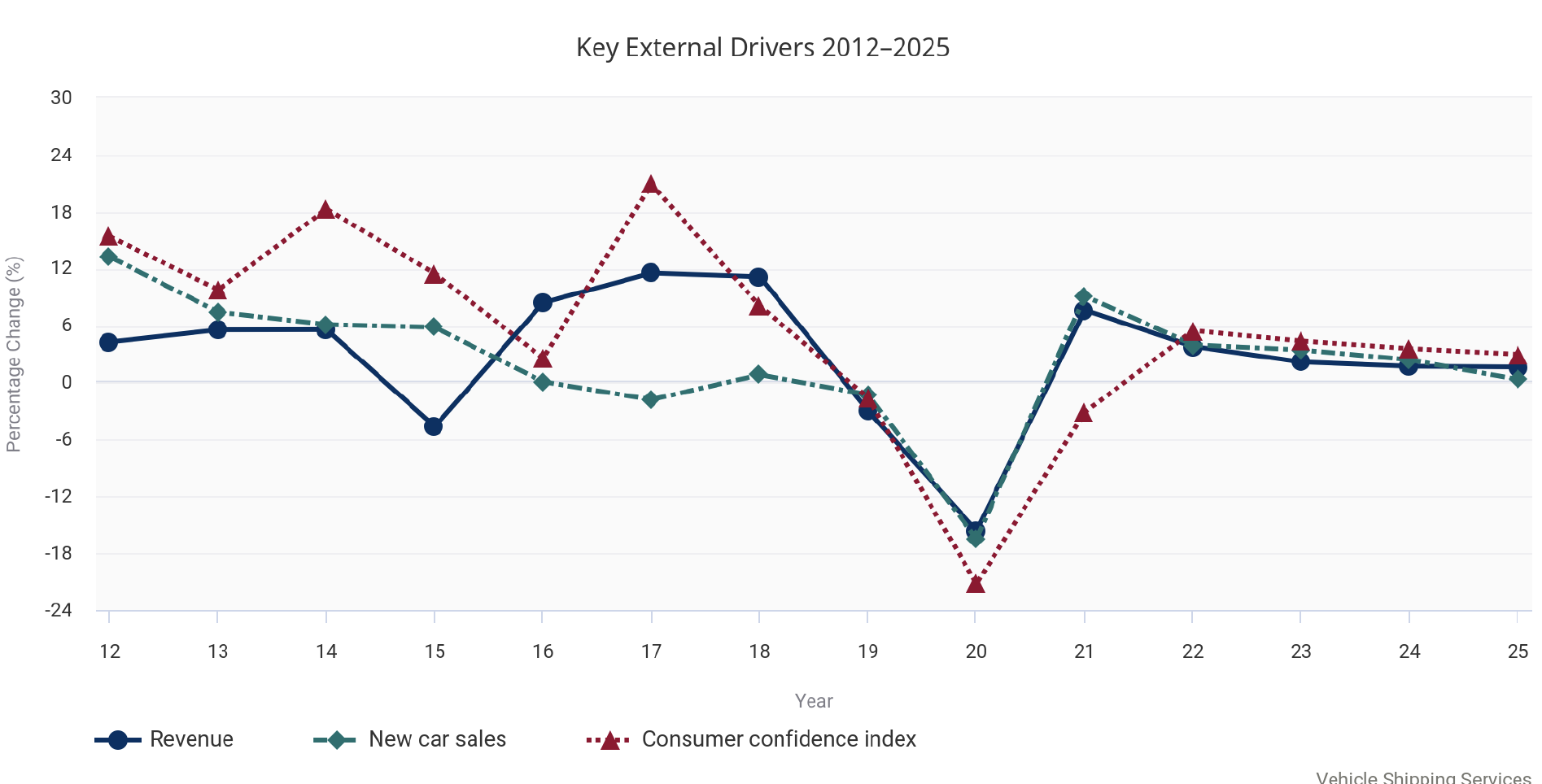

One non-essential industry that experienced a downward turn at the onset of the pandemic was the vehicle shipping services industry. A strong economy with high disposable income and consumer confidence ramped up consumer spending for the American automobile industry in the periods leading up to the pandemic.

The industry’s growth prospects were halted during 2020 due to a high unemployment rate and a drop-off in disposable income. The success of the vehicle shipping services industry is closely intertwined with new car sales and consumer confidence. The graph below shows the relationship between revenue of the vehicle shipping services industry and new car sales and consumer confidence. Overall, decreased consumer confidence in 2020 led to many Americans electing to defer vehicle upgrades, which created a major economic downturn for the vehicle shipping services industry.

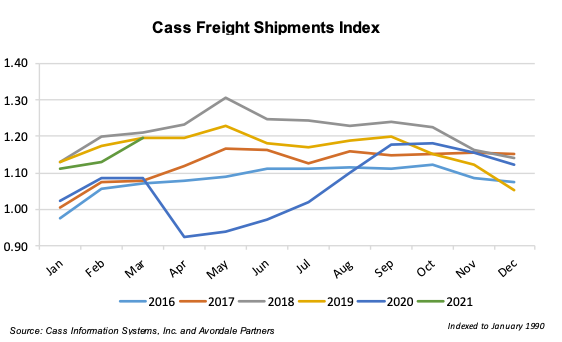

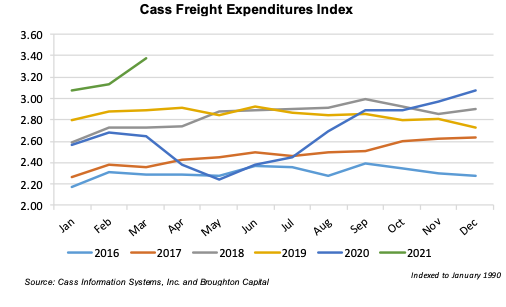

With many businesses closed, overall Cass Freight trucking shipments plummeted, seeing a decrease of 15.1% and 22.7% from April 2019 to April 2020. Truck tonnage also dropped 9.3% on a from March 2020 to April 2020 while declining 8.90% from April 2019 through April 2020.

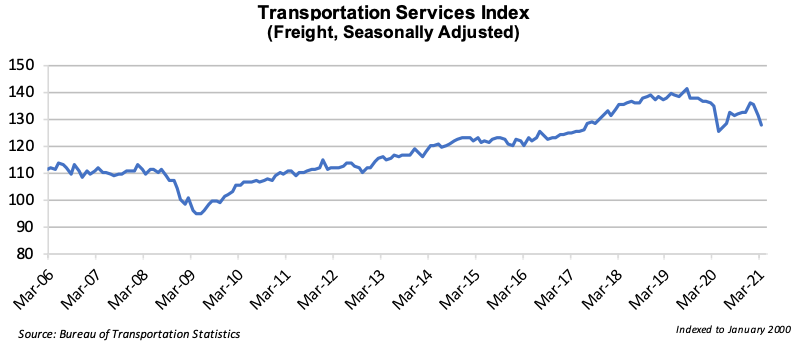

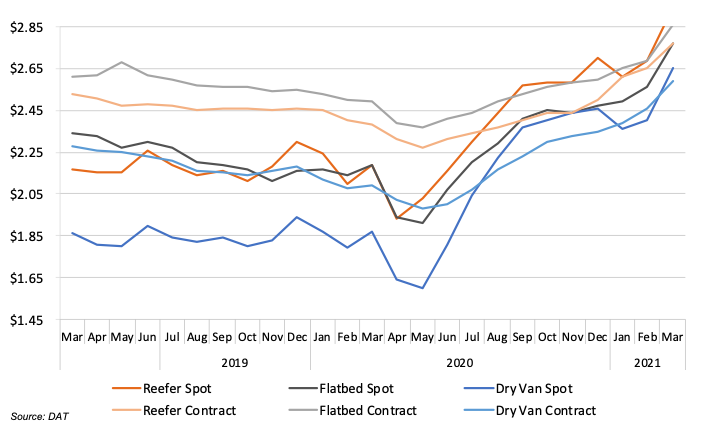

The fall of the number of shipments along with overall truck tonnage caused transportation companies to lower contract and spot rates. Flatbed and reefer rates hit a five-year low in April of 2020, though they rapidly recovered and had surpassed pre-pandemic rates by the fourth quarter of 2020. Truck tonnage has not recovered at the same rate as spot and contract pricing and had not reached pre-pandemic levels by March 2021. These trends are reflected in the Cass Freight and Shipment Indices. While the Shipments index has increased relative to its April 2020 level and has surpassed pre-pandemic levels, the Expenditures index increased over 27% from March 2020 through April 2020.

Even though contract rates did not have as sharp of a decline in March of 2020 as spot rates, both experienced a drop-off at the onset of the pandemic. Spot rates dropped below numbers that had been seen in recent years. After the sharp decline of spot rates in March, rates for all categories began to steadily increase. Rates hit a seasonal decline at the end of December due to decreased consumer spending after the holiday season. Rates resumed their climb during the first months of 2021. Overall, the rising price of contract and spot rates spins a positive image for overall outlook of the trucking industry, while also encouraging new competition to enter the market.

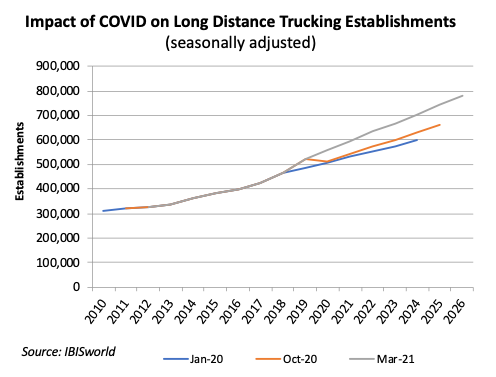

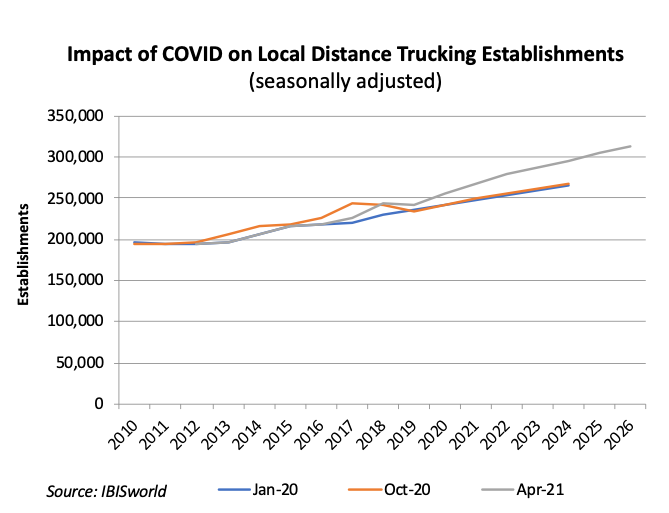

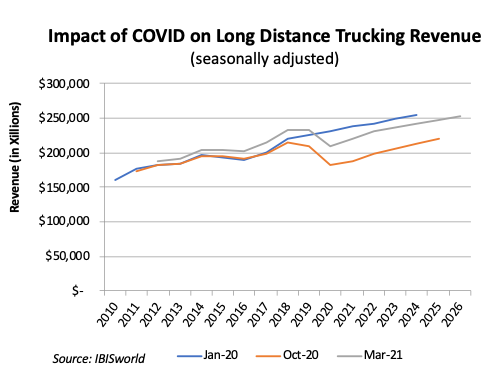

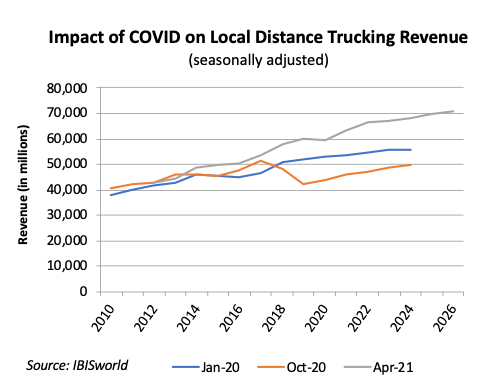

At the beginning of 2020, there were strong predictions for revenue in both the long distance and local trucking industries. Once the COVID-19 pandemic hit, revenues for both parts of the trucking industry dropped along with future revenue predictions. After a few months of lockdowns, the trucking industry began a rapid rebound as a result of businesses reopening and increased online retail. Future revenue predictions from March and April of 2021 from both the long distance and local sectors exceed predictions made in October 2020.

Industrial production and consumer spending, spurred on by the substantial stimulus programs enacted by federal government, have recovered more rapidly than initially expected. This rapid recovery has seemingly reduced the expected long-term impacts of COVID-19 on the long-distance and local trucking industries.

The effects of rising trucking rates and revenues coupled with optimistic outlooks for both categories can be seen in the number of long-distance and local trucking establishments. Lured in by appealing spot and contract rates, March 2021 predictions for the number of establishments in the trucking industry look to be on the rise. Naturally, there was a drop-off in the number of establishments in 2020, but the industry seems to have recovered with numerous new entries into the market in 2021. The long-distance trucking industry is projected to have more than one hundred thousand more establishments than originally forecasted in January of 2020.