2024 Mid-Year Market Update

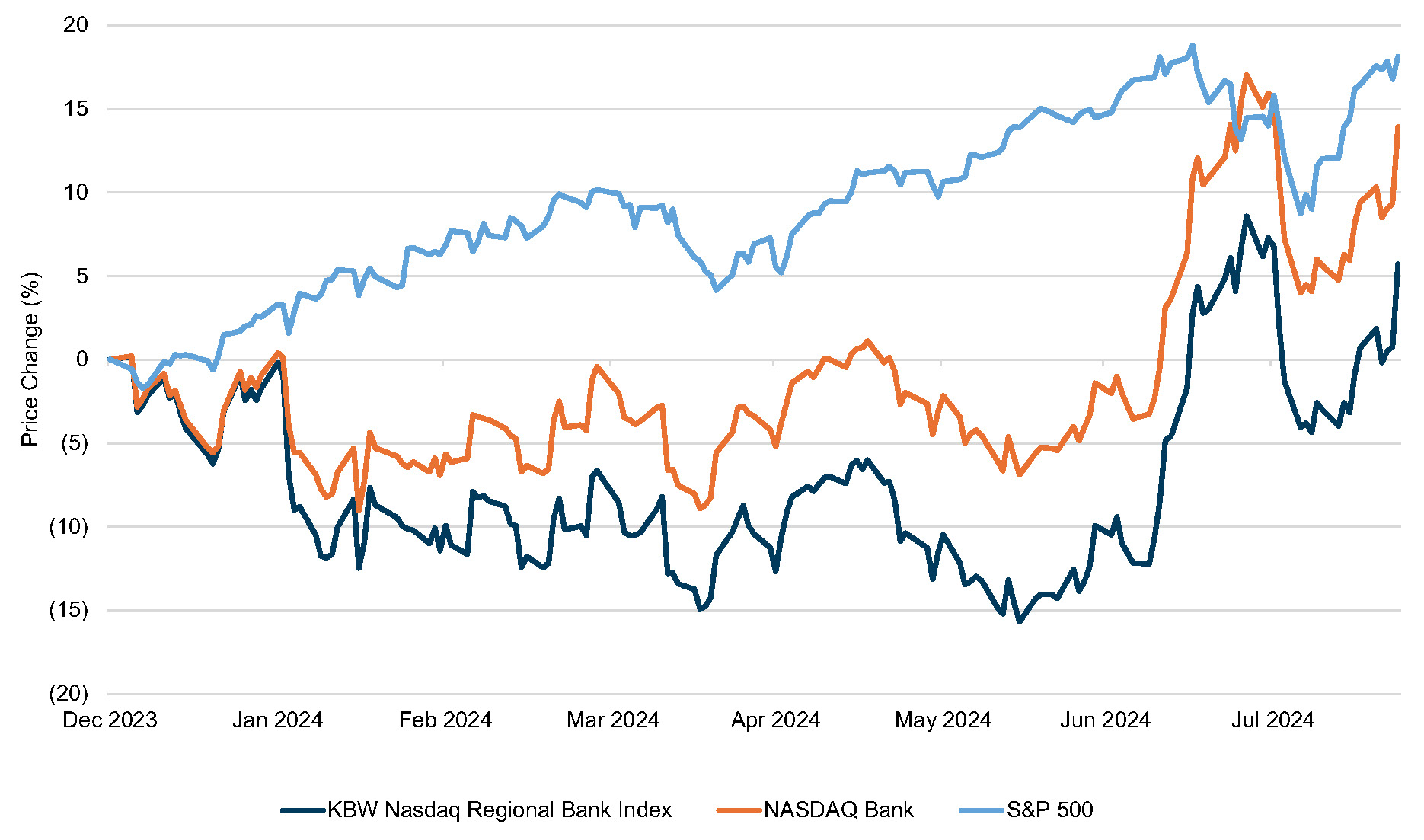

Year-to-date through August 23, the Nasdaq Bank Index and the KBW Nasdaq Regional Bank Index appreciated by 14% and 6%, respectively, compared to 18% appreciation by the S&P (see Figure 1). Through June, bank stocks were flat to down from year-end 2023 but rallied in July to outperform the broader market with the Nasdaq Bank Index and the KBW Regional Bank Index appreciating by 17% and 19%, respectively, compared to 1% appreciation for the S&P in the month of July.

After a period of underperformance due to earnings pressure from rising rates and falling margins, banks rallied strongly during the reporting of 2Q24 earnings in July as it became apparent NIMs for most banks had or soon would stabilize and prospectively widen as the Fed moves to reduce short-term policy rates.

Figure 1: Index Performance (12/31/2023 – 8/23/2024) Source: S&P Capital IQ Pro

Source: S&P Capital IQ Pro

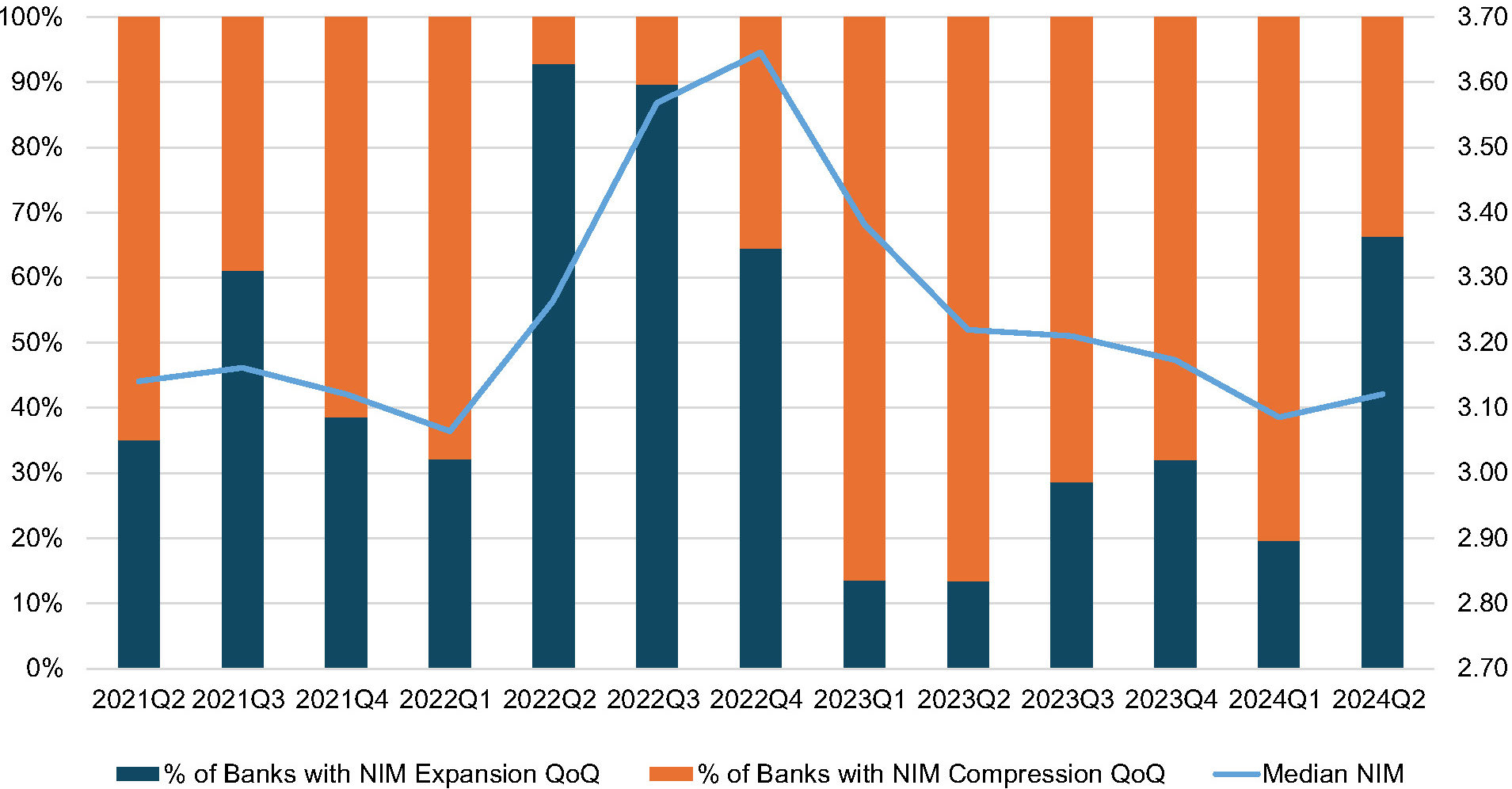

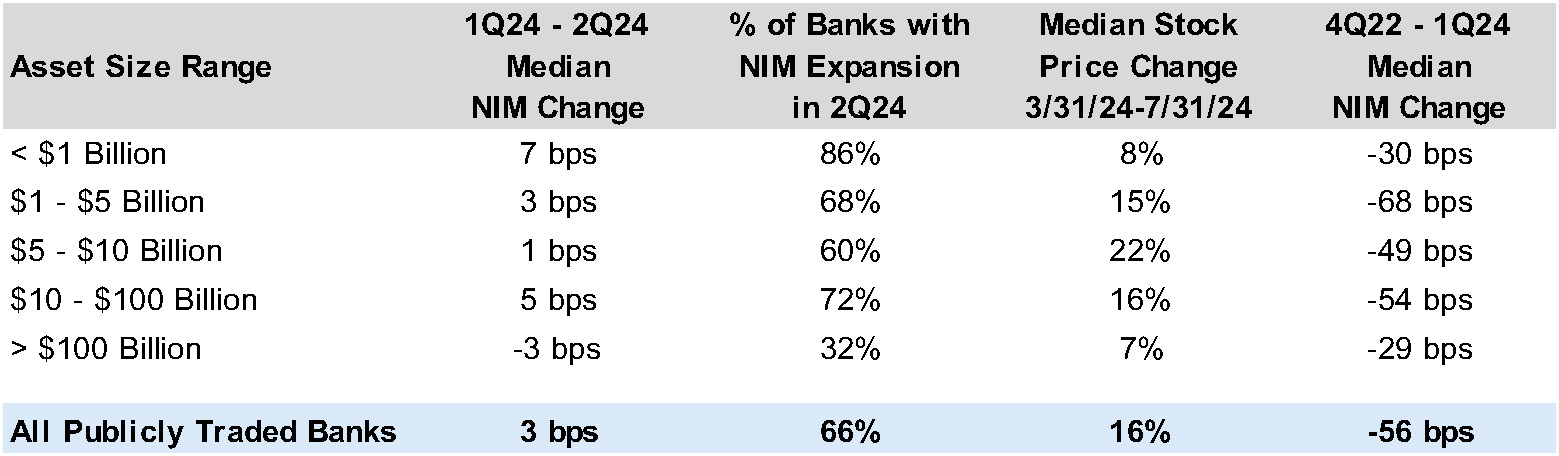

After steadily declining from a peak of 3.65% in the last quarter of 2022, the median net interest margin for all banks traded on the NYSE and Nasdaq widened by 3 bps in 2Q24 compared to 1Q24. Furthermore, as shown in Figure 2, 66% of all banks reported net interest margin expansion quarter-over-quarter, compared to just 20% in the first quarter of the year. Margin improvement was less prevalent for the biggest banks as only 32% of banks with assets over $100 billion reported net interest margin expansion in 2Q24, and the group as a whole reported median net interest margin compression of 3 bps (see Figure 3).

Figure 2: Trend in Median Net Interest Margin & QoQ Change in NIM

Source: S&P Capital IQ Pro, Mercer Capital Research

Stock price appreciation was greatest for the banks with total assets between $1 billion and $100 billion, in part reflecting investor optimism for earnings improvement for banks that faced the most margin compression from 4Q22 to 1Q24.

As shown in Figure 3, banks with assets less than $1 billion or greater than $100 billion reported stock price appreciation of 7%-8% from March 31, 2024 to July 31, 2024 compared to a 16% median increase for all banks.

Figure 3: Change in Net Interest Margin by Asset Size Range Source: S&P Capital IQ Pro

Source: S&P Capital IQ Pro

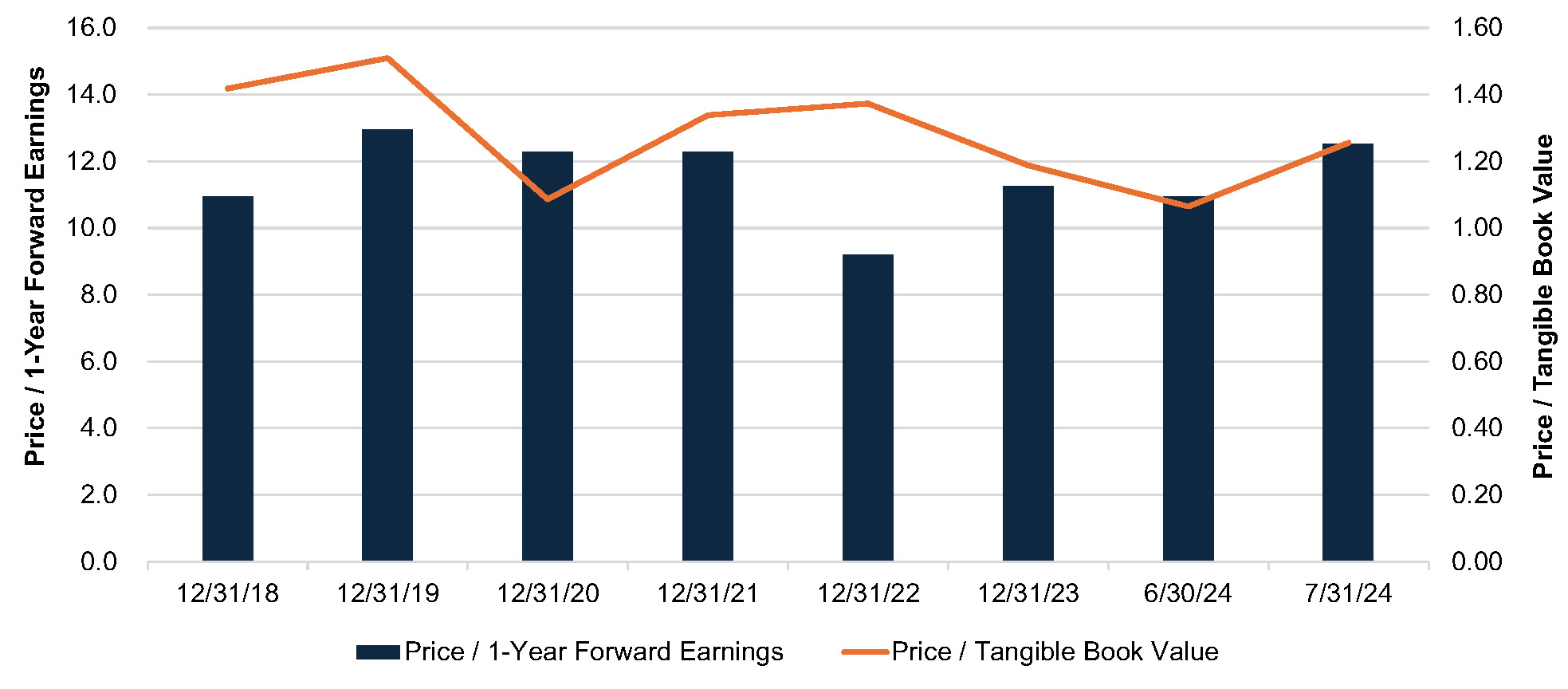

As illustrated in Figure 4, valuation multiples increased significantly with the rally in stock prices in July. Publicly traded banks with assets between $1 and $15 billion reported a median price/one year forward earnings multiple of 12.5x and a price/tangible book value multiple of 1.26x as of July 31, 2024, up from 10.9x and 1.06x as of June 30. In addition to higher forward P/Es, Analysts’ estimates for 2024 EPS were 12% higher as of July 31 compared to estimates for 2024 EPS available as of year-end 2023.

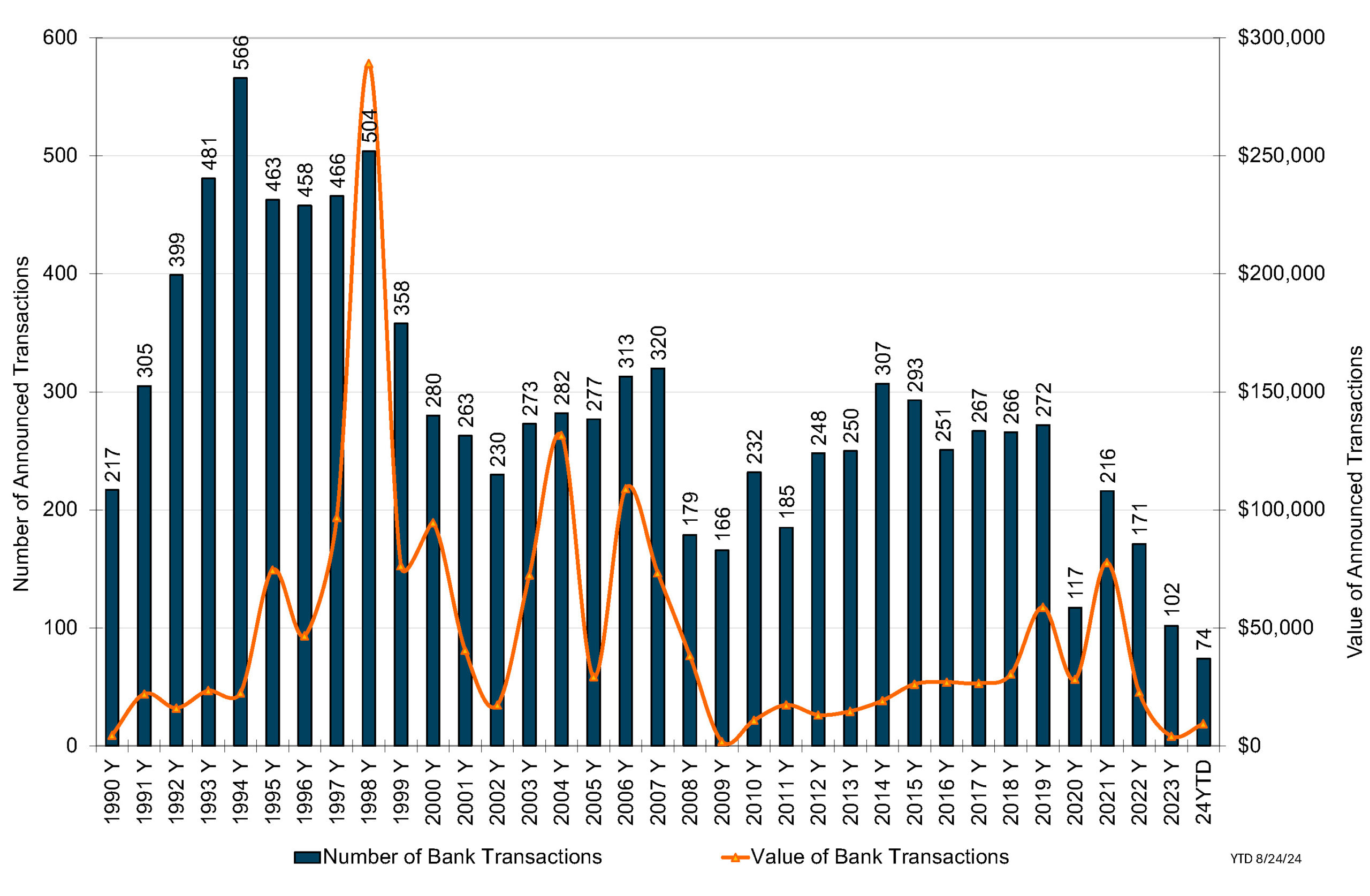

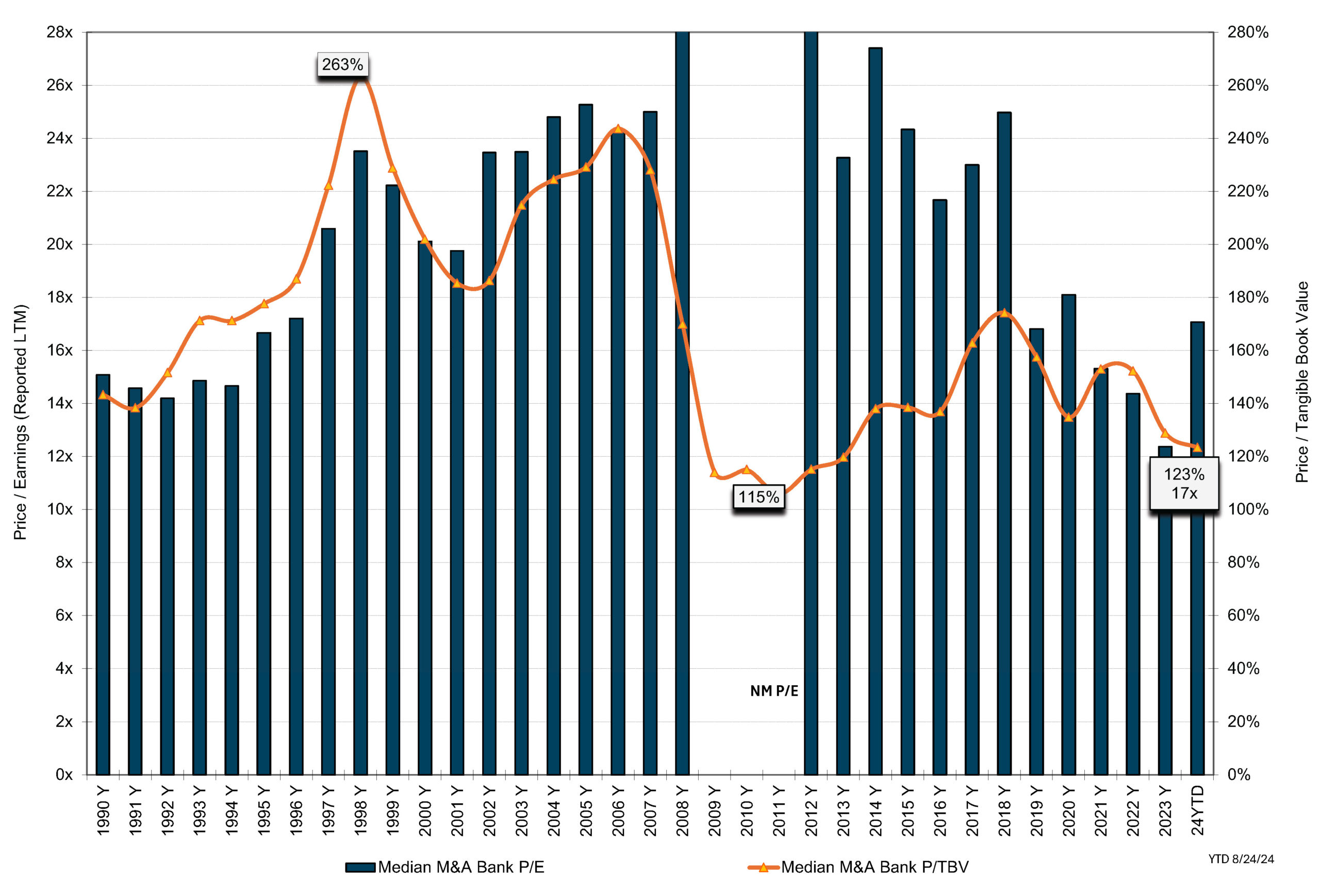

According to data provided by S&P Capital IQ Pro, there were 74 announced M&A transactions through August 24, compared to 102 announced transactions for the entirety of 2023. Notably, aggregate deal volume reached $9.4 billion, which exceeds the $4.2 billion in announced deals in all of 2023 as shown in Figure 5. After a period of subdued activity, the bank M&A market is showing signs of recovery. Three deals valued at over $1 billion have been announced in 2024 compared to just one in 2022 and 2023, and the median P/E multiple increased from 12.4x in 2023 to 17.1x in 2024.

Figure 4: Pricing Multiples (Banks with Assets between $1-$15 Billion) Source: S&P Capital IQ Pro, Mercer Capital Research

Source: S&P Capital IQ Pro, Mercer Capital Research

Figure 5: Deal Value and Volume Source: S&P Capital IQ Pro

Source: S&P Capital IQ Pro

Figure 6: Long-Term Trend in Pricing Multiples Source: S&P Capital IQ Pro

Source: S&P Capital IQ Pro

After a tumultuous period for the banking industry marked by bank failures, liquidity concerns, margin pressure, depressed valuations, and subdued M&A activity, the outlook for the remainder of 2024 is cautiously optimistic. EPS estimates are trending higher, M&A activity is showing signs of improving, and net interest margins are poised to expand. Potential deterioration in asset quality remains the dark cloud on the horizon for the banking industry as margin pressures ease alongside weakening economic conditions.

After a tumultuous period for the banking industry marked by bank failures, liquidity concerns, margin pressure, depressed valuations, and subdued M&A activity, the outlook for the remainder of 2024 is cautiously optimistic. EPS estimates are trending higher, M&A activity is showing signs of improving, and net interest margins are poised to expand. Potential deterioration in asset quality remains the dark cloud on the horizon for the banking industry as margin pressures ease alongside weakening economic conditions.