Bank M&A 2022 — Turbulence

At this time last year, we thought bank M&A would be described as a second year of “gaining altitude” after 2020 was spent on the tarmac following the short, but deep recession in the spring of 2020. Our one caveat was that bank stocks would have to avoid a bear market following a strong performance in 2021 because bear markets are not conducive to bank M&A.

The caveat was correct. Bear markets developed in both bank stocks and fixed income that included the most deeply inverted U.S. Treasury curve since the early 1980s. Among the data points:

- The NASDAQ Bank Index declined 19% through December 28;

- The Fed raised the Fed Funds target rate 425bps to 4.25% to 4.50%;

- The yield on the 10-year US Treasury rose 236bps to 3.88%; and

- Credit spreads widened, including 150bps of option adjusted spread (OAS) on the ICE BofA High Yield Index to 4.55% from 3.05%.

The outlook for deal making in 2023 is challenged by significant interest rate marks (i.e., unrealized losses in fixed-rate assets), credit marks given a potential recession, soft real estate values, and the bear market for bank stocks that has depressed public market multiples. For larger deals, an additional headwind is the significant amount of time required to obtain regulatory approval.

However, core deposits are more attractive for acquirers than in a typical year given rising loan-to-deposit ratios, the high cost of wholesale borrowings and an inability to sell bonds to generate liquidity given sizable unrealized losses. A rebound in bank stocks and even a modest rally in the bond market that lessens interest rate marks could be the catalysts for an acceleration of activity in 2023 provided any recession is shallow.

A Recap of 2022

As of December 28, 2022, there have been 167 announced bank and thrift deals compared to 216 in 2021 and 117 in 2020. During the halcyon pre-COVID years, about 270 transactions were announced each year during 2017-2019.

As a percentage of charters, acquisition activity in 2022 accounted for 3.5% of the number of banks and thrifts as of January 1. Since 1990, the range is about 2% to 4%, although during 2014 to 2019 the number of banks absorbed each year exceeded 4% and topped 5% in 2019. As of September 30, there were 4,746 bank and thrift charters compared to 4,839 as of year-end 2021 and about 18,000 charters in 1985 when a ruling from the U.S. Supreme Court paved the way for national consolidation.

Also notable was the lack of many large deals. Toronto-Dominion’s (NYSE: TD) pending $13.7 billion cash acquisition of First Horizon (NYSE: FHN) represents 61% of the $23 billion of announced acquisitions this year compared to $78 billion in 2021 when divestitures of U.S. operations by MUFG and BNP and several larger transactions inflated the aggregate value.

Pricing—as measured by the average price/tangible book value (P/TBV) multiple—was unchanged compared to 2021. As always, color is required to explain the price/earnings (P/E) multiple based upon reported earnings.

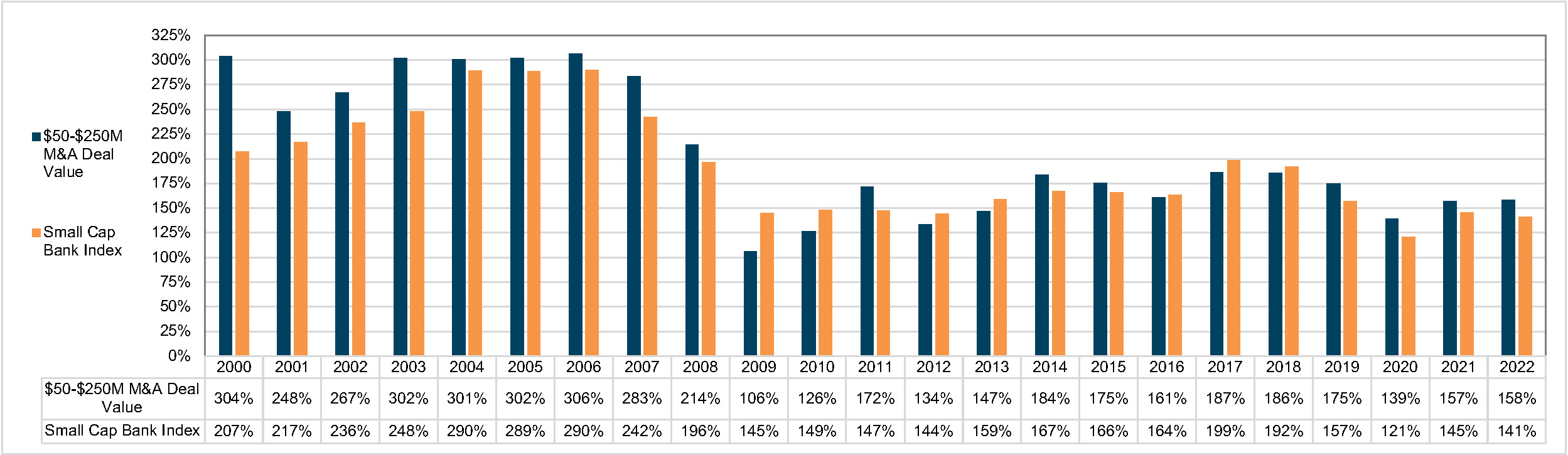

The median P/TBV multiple was 154% in 2022. As shown in Figure 1, the average transaction multiple since the Great Financial Crisis (GFC) peaked in 2018 at 174% then declined to 134% in 2020 due to the impact of the short but deep recession on economic activity and markets.

The median P/E in 2022 eased slightly to 14.6x from 15.3x in 2021; however, buyers focus on pro forma earnings with fully phased-in expense saves that often are on the order of 7x to 8x unless there are unusual circumstances. Accretion in EPS is required by buyers to offset day one dilution to TBVPS and to recoup the increase in TBVPS that would be realized on a stand-alone basis as investors expect TBVPS payback periods not to exceed three years.

Figure 1 :: 1990-2022 National Bank M&A Multiples

Click here to expand the image above

Public Market Multiples vs Acquisition Multiples

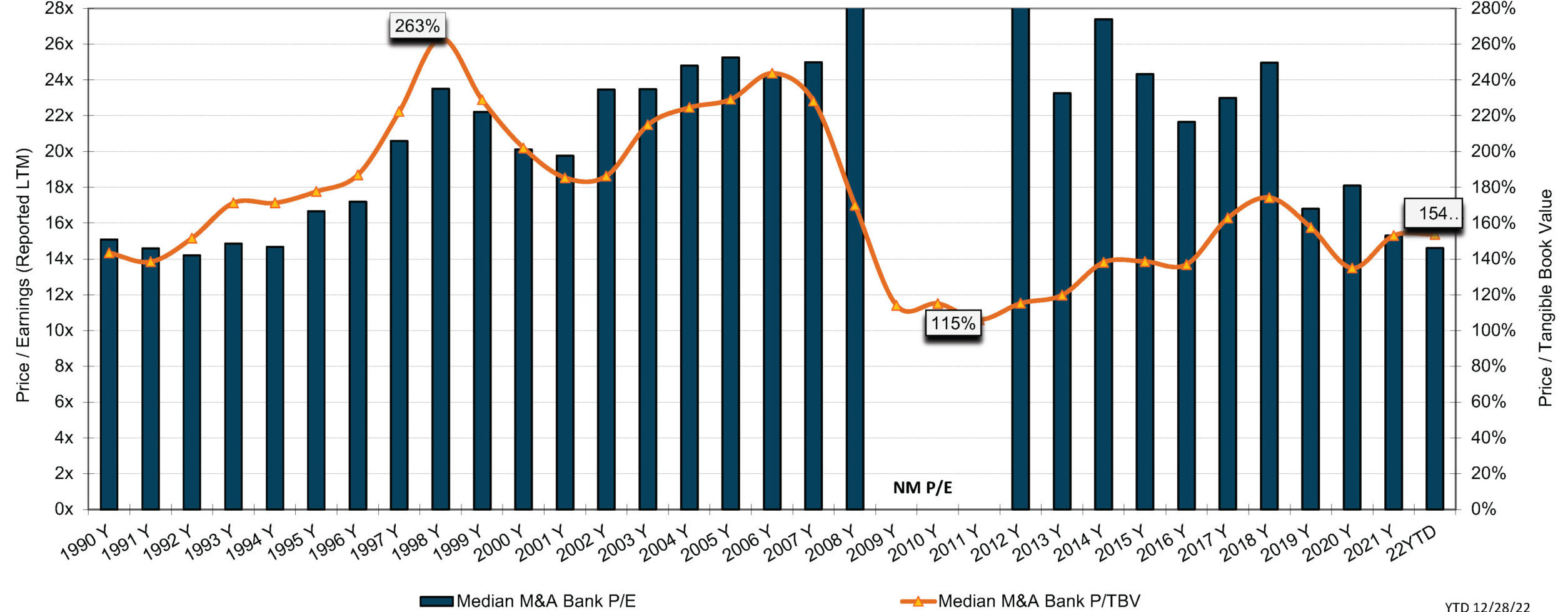

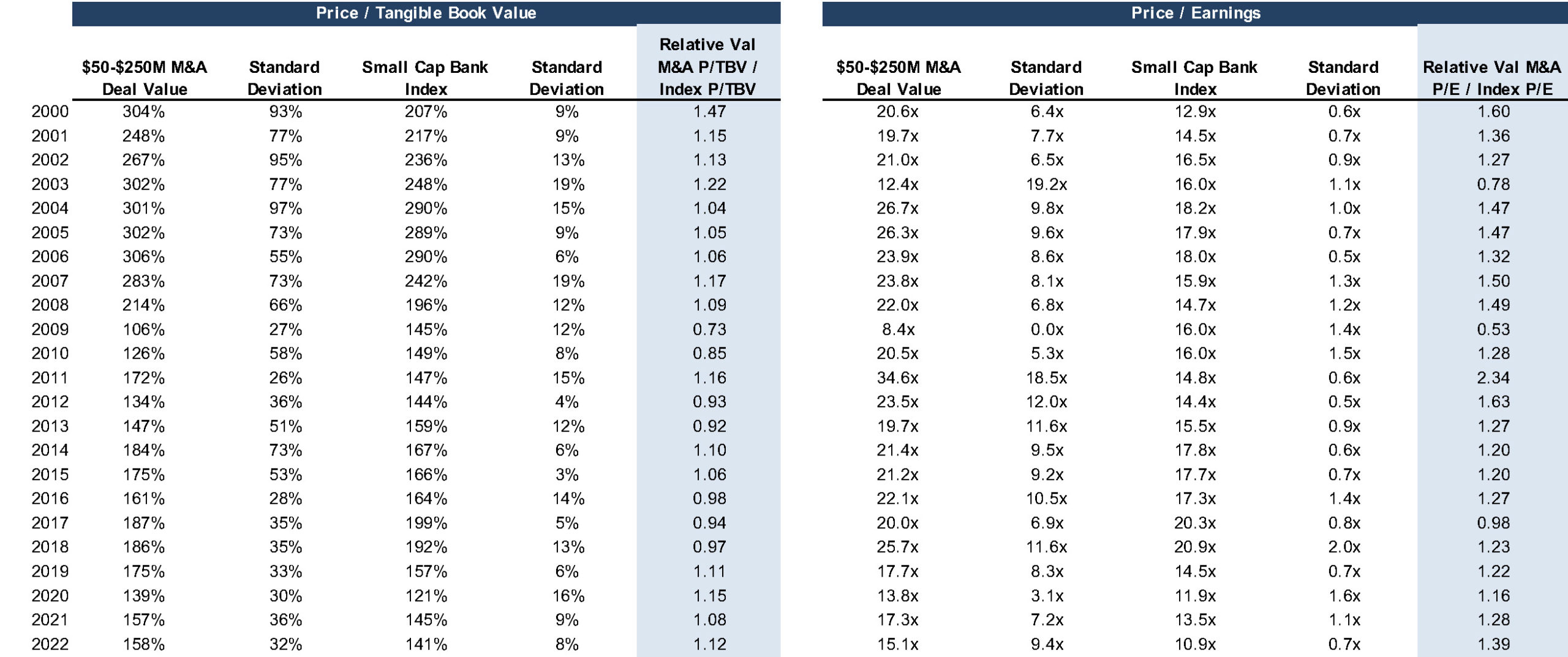

Figure 2 compares the annual average P/TBV and P/E for banks that were acquired for $50 million to $250 million since 2000 with the average daily public market multiple each year for the SNL Small Cap Bank Index.1 Among the takeaways are the following:

- Acquisition pricing prior to the GFC as measured by P/TBV multiples approximated 300% except for the recession years of 2001 and 2002 when the average multiples were 248% and 267%.

- Since 2014, average P/TBV multiples have been in the approximate range of 160% to 180% except for 2020.

- The reduction in both the public and acquisition P/TBV multiples since the GFC reflects a reduction in ROEs for the industry since the Fed adopted a zero-interest rate policy (ZIRP) other than 2017-2019 and 2022.

- Since pooling of interest accounting ended in 2001, the “pay-to-trade” multiple as measured by the average acquisition multiple relative to the average index multiple has remained in a relatively narrow range of roughly 0.9 to 1.15 other than during 2009 and 2010.

- P/E multiples based upon unadjusted LTM earnings have approximated or exceeded 20x prior to 2019 compared to 14-18x since then.

- Acquisition P/Es have tended to reflect a pay-to-trade multiple of 1.25 since the GFC but the pay-to-trade multiples are comfortably below 1.0x to the extent the pro forma earnings multiple is 7-8x, the result being EPS accretion for the buyer.

Figure 2 :: 2000-2022 Acquisition Multiples vs Public Market Multiples

Click here to expand the image above

Figure 3 :: 2000-2022 M&A TBV Multiples vs. Index TBV Multiples

Click here to expand the image above

Premium Trends Subdued

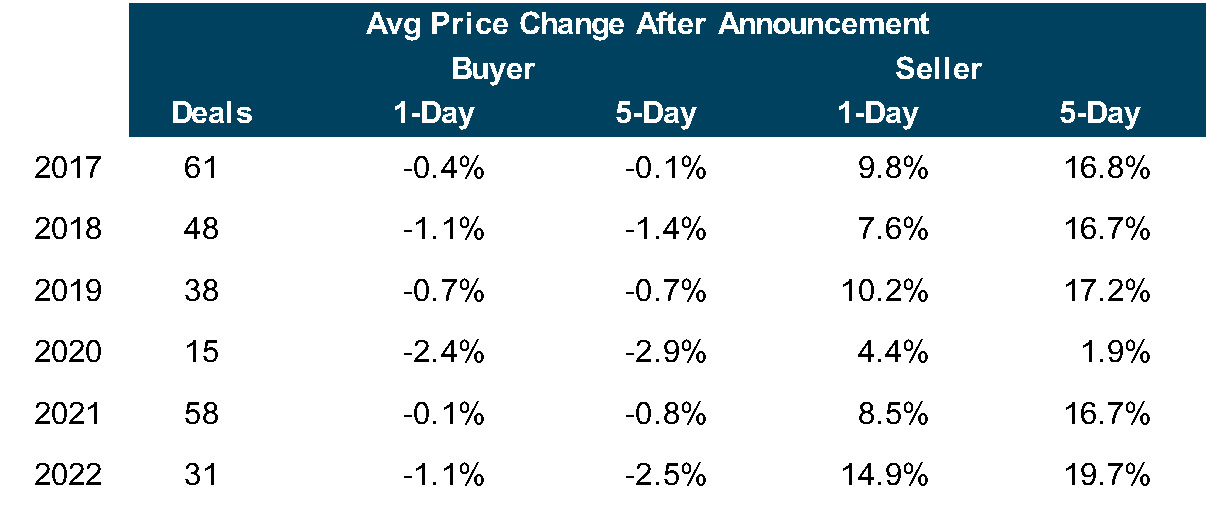

Investors often focus on what can be referred to as icing vs the cake in the form of acquisition premiums relative to public market prices. Investors tend to talk about acquisition premiums as an alpha generator, but long-term performance (or lack thereof) of the target is what drives shareholder returns.

As shown in Figure 4, the average five-day premium for transactions announced in 2022 that exceeded $100 million in which the buyer and usually the seller were publicly traded was about 20%, a level that is comparable to recent years other than 2020. For buyers, the average reduction in price compared to five days prior to announcement was 2.5%. There are exceptions, of course, when investors question the pricing (actually, the exchange ratio), day one dilution to TBVPS and earn-back period. For instance, Provident Financial (NASDAQ: PFS) saw its shares drop 12.5% after it announced it would acquire Lakeland Bancorp (NASDAQ: LBAI) for $1.3 billion on September 27, 2022.

Figure 4

About Mercer Capital

M&A entails a lot of moving parts of which “price” is only one. It is especially important for would be sellers to have a level-headed assessment of the investment attributes of the acquirer’s shares to the extent merger consideration will include the buyer’s common shares. Mercer Capital has 40 years of experience in assessing mergers, the investment merits of the buyer’s shares and the like. Please call if we can help your board in 2023 assess a potential strategic transaction.