Bank Merger and Acquisition Review: A Look Back at 2010 and Look Forward to 2011

For several years now, industry experts have been predicting a wave of bank consolidation. The initial reasoning was that weaker banks would be absorbed by stronger banks, many against their will when faced with the choice of merger or failure. As time passed the industry realized that even the healthiest institutions were either unwilling or unable (sometimes both) to take on the debt, shareholder dilution, and asset quality problems that come along with an acquisition.

At present, the presumed M&A driver for the near-term is regulatory changes, which will place a substantial burden on institutions. The smaller the institution, the theory goes, the more onerous the burden and the more diminished the ability to absorb the associated costs. The only solution, many argue, is to grow organically (not easily done in the current environment) or find strategic combinations that will create a bank large enough to support the additional operating expense.

Is this wave of predicted merger activity finally coming to fruition? One might think so, based on the uptick in announced bank deals in 2010. According to SNL Financial, LLC there were 205 announced deals in 2010, compared to 175 announced in 2009. This does not include the 157 FDIC-assisted transactions which occurred during the year. Additionally, deal value was substantially higher in 2010, at $11.8 billion, compared to $2.0 billion in 2009. The increase in total deal value was supported by a few larger acquisitions, including BMO’s purchase of Marshall & Ilsley Corporation ($5.8 billion), Hancock Holding Company’s purchase of Whitney Holding Corporation ($1.8 billion), and First Niagara Financial Group’s purchase of NewAlliance Bancshares, Inc. ($1.5 billion).

However, the M&A story in 2010 lies within the realm of the community bank. As shown below, for deals in which pricing multiples and deal value are available (a total of 111 transactions), 84 transactions, or more than 75%, involved a seller with assets less than $500 million.

What is notable in the table above is that the size of the seller appears to be negatively correlated with the pricing multiples received, particularly on a book value basis.

The smallest banks were the only group which reported a median purchase price at a premium to book value, both reported and tangible. Of course, it is worth noting that the larger groups contain a fewer number of transactions, and perhaps reflect a more dire situation on the part of the seller, who presumably has little incentive to sell in the current pricing environment.

Cash remained king in 2010 as the most common form of transaction funding. Forty of the 111 transactions reporting multiples were all-cash acquisitions, followed closely by 38 which were some mixture of cash and other consideration (generally common stock). Capital contributions accounted for eighteen of the transactions and common stock was used as currency in six of the transactions. The remainder were unclassified or not reported.

The banking industry has always exhibited a proclivity to finance acquisitions using cash on hand. However, it is no surprise that buyers, who likely are facing their own problems with low stock valuations, are reluctant to dilute shareholders by using what many consider to be an undervalued asset to fund purchases. After all, pricing multiples in the public marketplace remain well off the highs of 2006 and 2007, when bank stocks commonly traded at price-to-earnings multiples approaching twenty times and book value multiples as high as three times. Additionally, with the universe of transactions focused on smaller institutions, many do not have publicly traded equity, and sellers often frown on accepting illiquid stock as transaction currency.

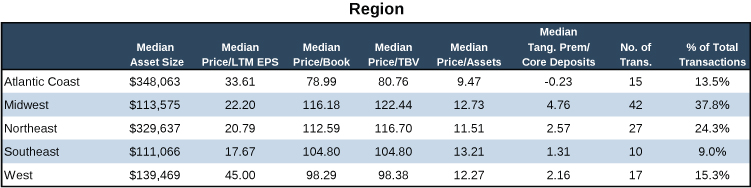

In terms of geography, there was a distinct relationship between the economic health of various regions and the volume of transaction activity. During 2010 the concentration of FDIC-assisted transactions (i.e., bank failures) centered around states with severely disrupted real estate markets, such as Florida (29 failures), Georgia (21 failures), Illinois (16 failures), California (12 failures), and Washington (11 failures). Perhaps not surprisingly, non-assisted transaction activity was highest in regions without a high level of bank failures, as shown in the table below (includes only those deals reporting pricing multiples).1

The next logical question is what will 2011 hold for bank M&A activity? While we do not have a perfectly clear crystal ball, here are a few things to consider:

- The new regulations that will come as a result of the Dodd-Frank Act, once they are written, will most likely hamper a bank’s ability to generate fee-based income, which is an increasingly large portion of the bottom line for most financial institutions.Many industry insiders believe there is a “magic” size that a bank will need to be in order to absorb the additional costs and lower revenues inflicted by the new regulations. Whether that number is $500 million or $1 billion in assets, popular figures at the moment, or some other amount, there will be a measurable number of banks that are below the threshold.While some may resist the urge to merge, and indeed some will face specific circumstances that allow them to survive despite their smaller size, there is certainly an impetus for mergers of equals and for smaller institutions to begin shopping themselves to the highest bidder.

- Because of increasing regulatory burdens, we have heard from life-long bankers on a number of occasions that they simply no longer enjoy what they are doing.Many, who are second and third generation bankers, have entertained the idea of selling the bank in order to avoid the extreme headache which comes along with increasing regulatory oversight. While these thoughts may be dampened somewhat when it comes time to put pen to contract, and particularly in light of the current pricing environment, it is a real trend that could lead to more institutions being marketed for sale in the next several years.

- While there may be more banks for sale and more incentive to merge, financing such purchases may be easier said than done.Capital remains difficult to come by for financial institutions, and both market and non-market forces are responsible culprits. First, regulators are requiring a higher capital cushion from banks, a requirement with which a large portion are not in compliance at present. It will take a number of years to build up adequate capital levels, particularly given that most increases in capital will likely have to come from retained earnings as investors remain hesitant to contribute additional capital to all but the healthiest banks. Secondly, the issuance of new trust preferred securities, which previously were a relatively cheap and accessible source of capital for financial institutions, has been virtually eliminated by the Collins Amendment to the Dodd-Frank Act, which prohibits this form of capital for larger institutions and only grandfathers in existing trust preferred securities for smaller banks.

- FDIC-assisted transactions are likely to continue at a rapid clip, as the problem bank list stood at 884 for the fourth quarter of 2010, compared to 702 banks at year-end 2009 leading into a year where we saw 157 bank failures.For banks that are actively pursuing a strategy involving growth by acquisition, there is little incentive to pay full market price for a healthy institution when the failed banks marketed by the FDIC are available at such extensive discounts, even despite the associated bidding, asset quality, and other problems related to purchasing a failed bank.

- While outside investors have, up to this point, been effectively shut out of the market for whole-bank purchases, the tide seems to be turning.A number of private equity acquirers participated in FDIC-assisted transactions in 2010, which previously had generally been frowned upon by the FDIC. Additionally, private equity firms have recently been allowed to file shelf charters which allow them to quickly form a bank holding company for purposes of acquiring an existing institution. Purchases of banks and bank holding companies must to be approved by regulators, who up to this point have shown a preference that the acquirer be another bank. An additional subset of buyers in the market can only serve to increase demand, transaction activity and, most likely, pricing multiples.

Will 2011 be the year of the bank merger? Signs remain mixed, but it appears conditions are favorable at the very least for an increase in merger activity. Then again, we have definitely heard that before.

ENDNOTES

1 The regions include the following states:

- Atlantic Coast – Delaware, Florida, Maryland, North Carolina, South Carolina, Virginia, West Virginia, Washington, D.C.

- Midwest – Iowa, Illinois, Indiana, Kansas, Michigan, Minnesota, Nebraska, North Dakota, Ohio, Oklahoma, South Dakota, Texas, Wisconsin

- Northeast – Connecticut, Maine, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, Vermont

- Southeast – Alabama, Arkansas, Georgia, Kentucky, Louisiana, Missouri, Mississippi, Tennessee

- West – Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, Nevada, New Mexico, Oregon, Utah, Washington, Wyoming

Originally published in Mercer Capital’s Bank Watch 2011-03, released March 2011.