Beach Reading: Notice of Proposed Rulemaking – Qualified Business Income Deduction

Struggling to find a page-turning read for that late summer beach escape? May we recommend the 184 pages of blissful decadence that comprise the Internal Revenue Service’s August 2018 Notice of Proposed Rulemaking (NPR) regarding the Qualified Business Income (QBI) deduction under the Tax Cuts & Jobs Act (TCJA). Like a tightly wound murder mystery, the regulations weave a complex web. Tax code sections take the place of characters, the regulation’s intricacies unspooling as the narrative continues, relationships between Tax Code sections becoming (somewhat) clearer as the story (i.e., the regulation) progresses. As the NPR continues its inexorable march, certain storylines (i.e., planning opportunities) are forestalled, yet the NPR creates a glimmer of other opportunities.1

The Abridged Version of the NPR in One Sentence

Bank shareholders are eligible for the 20% Qualified Business Income deduction.2 Intrigued? If so, the story continues.

Prologue

Before examining the NPR, several tax-related trends are evident in 2018 regulatory filings.

- Effective tax rates are falling

- More banks are converting from S corporations to C corporations

- Securities portfolio allocations are evolving

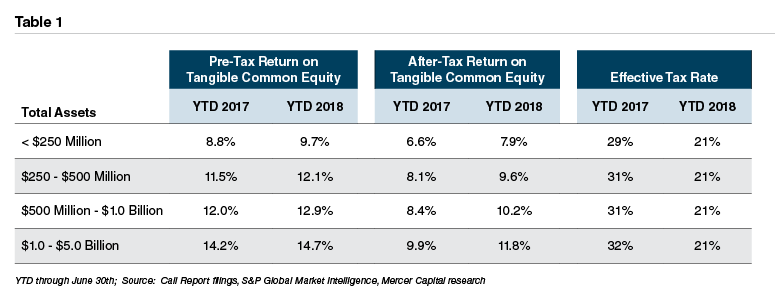

Despite the attention it receives, tax reform is not solely responsible for improving bank profitability in 2018. Table 1 illustrates that pre-tax return on tangible common equity (ROATCE) has expanded in 2018, consistent with widening net interest margins for many banks and constrained credit costs. Effective tax rates declined from approximately 30% in the first half of 2017 to 21% in the comparable 2018 period, allowing banks to leverage the 50 to 100 basis point pre-tax ROATCE expansion into 150 to 200 basis points of after-tax ROATCE expansion.

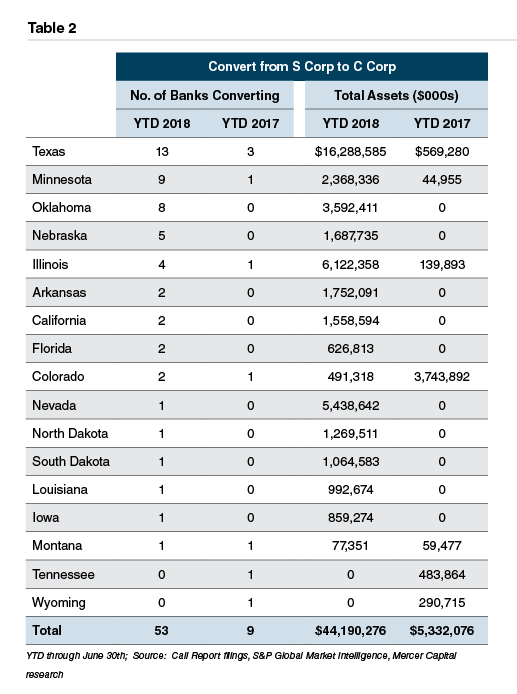

Table 2 indicates conversion activity from C corporation to S corporation status. Following tax reform, conversions increased significantly, as 53 banks changed their tax status in the first six months of 2018 versus nine in the prior year period. Nevertheless, this represents only a sliver of the approximately 2,000 banks taxed as S corporations. Several large S corporation banks elected to be taxed as C corporations in 2018; as a result, banks collectively holding $44 billion of assets converted in 2018, relative to only $5 billion in the prior year period.

After passage of tax reform, some observers speculated that more conversion activity from S corporation to C corporation status would occur in states with relatively high personal tax rates, due to the $10 thousand limitation on the deductibility of state and local taxes. However, this trend is not yet apparent in conversion activity, as the states experiencing the most conversion activity include jurisdictions with both higher and lower personal tax rates.

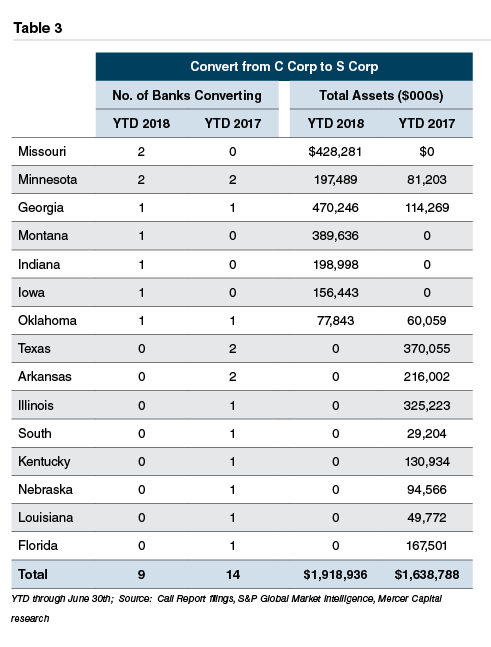

While more banks converted from S corporations to C corporations in 2018, relatively few did the reverse. As indicated in Table 3, nine banks converted from a C corporation to an S corporation in the first half of 2018, relative to 14 such conversions in the first half of 2017.

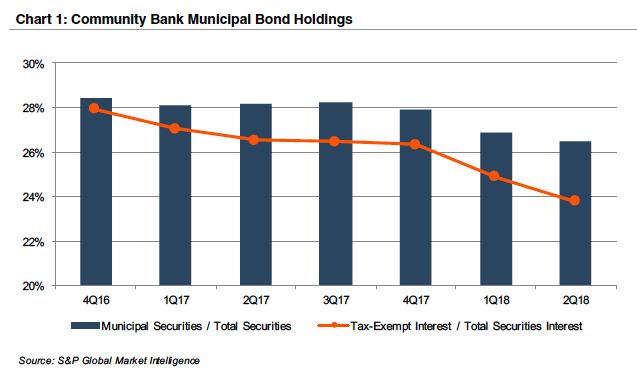

Third, tax reform may influence banks’ investment portfolio positioning. While portfolio allocations reflect many factors, Chart 1 suggests that tax reform has affected investment strategies. Municipal securities remained relatively stable throughout 2017 at 28% of total securities; however, the proportion of municipal securities dropped to 26.9% at March 31, 2018 and 26.5% at June 30, 2018. This trend is consistent with our experience, where banks are not liquidating municipal securities due to tax reform but, at the margin, may prefer taxable alternatives for new purchases.

Refresher

Internal Revenue Code Section 199A provides a 20% deduction against the income reported by owners of sole proprietorships, partnerships, and S corporations. If only tax code provisions could be described in one sentence, though. The deduction may be taken against income generated by a Qualified Trade or Business (QTB). A QTB, in turn, is any business, other than a Specified Service Trade or Business (SSTB).

In addition, certain W-2 income and asset limitations exist that may limit the 20% deduction. Lastly, individuals with income below certain levels may escape the SSTB and W-2 income/asset limitations; therefore, these owners would receive the 20% deduction whereas owners with higher incomes would not. The NPR provides guidance regarding, among other items, the definitions of QTBs and SSTBs.

Other Issues

While banks definitely are eligible for the 20% Qualified Business Income deduction, several other items covered by the NPR may be of interest to bankers.

Qualified Trade or Business Definition

An entity must be a Qualified Trade or Business to receive the 20% QBI deduction. From the TCJA, however, it was unclear if a QTB must be a “Section 162 trade or business.” While the Internal Revenue Code and regulations contain various definitions of a “business,” Section 162 contains a relatively restrictive definition. Unfortunately for taxpayers, the NPR adopts the Section 162 definition.

While Section 162 has existed for many years, the regulations and case law interpreting the provision remain somewhat vague. One significant concern is that certain real estate entities will not be deemed Section 162 trades or businesses, therefore becoming ineligible for the 20% QBI deduction. For example, entities holding properties subject to triple net leases may face difficulties meeting the Section 162 requirements. From a credit standpoint, banks should be aware that tax savings expected by owners of certain real estate entities may not materialize.

The TCJA’s Definition of an SSTB

Entities providing professional services generally are deemed SSTBs. The business reality, though, is that some companies provide both a tangible product (like a widget) and services that would meet the definition of an SSTB (such as educational services regarding widgets). Will a company offering some consulting services, no matter how small a share of revenues, be deemed an SSTB? Under the TCJA, it was unclear. The NPR creates a de minimis exception for companies with small amounts of service revenues, although the thresholds appear relatively low to us.

The TCJA also includes a “catch-all” provision deeming as SSTBs any businesses for which the reputation or skill of its owners or employees is a principal asset. This broad provision potentially captures a large swath of small businesses; for example, the reputation of a restaurant’s chef may result in the restaurant being deemed an SSTB. This result appears inconsistent with the TCJA’s statutory intent, and the NPR significantly limits the scope of the catch-all provision.

The “Crack and Pack” Strategy

Commentators noted that the TCJA created a tax planning opportunity for businesses deemed SSTBs. For example, consider a law firm that owns a building in which it operates. The law firm is an SSTB and its partners ineligible for the 20% deduction. The partners could transfer the building to a new real estate holding company, which is not deemed an SSTB. Therefore, the law firm partners have shifted income – via rent payments from the law firm to the real estate holding entity – from the SSTB (the law firm) to an entity qualifying for the QBI deduction (the real estate entity).

Alas, the IRS cracked down on the “crack and pack” strategy. The NPR provides that income from a commonly-controlled entity that provides services to an SSTB is ineligible for the 20% deduction. However, the NPR may not entirely foreclose on all planning strategies. While the NPR limits the QBI deduction for commonly-controlled entities, commonality is deemed to exist if the businesses share 50% or more ownership. Therefore, the law firm may transfer its building to an entity owned equally by the law firm partners, an accounting firm’s partners, and a physician group. Since common control does not exist (i.e., neither the attorneys nor the accountants nor the physicians control more than 50% of the real estate firm’s ownership), the owners of the various services firms would be eligible for the 20% deduction on the real estate entity’s earnings. To bankers, business reorganizations triggered by the deduction limitations applicable to SSTBs may trigger lending requirements.

Conclusion

Like a good novel, the NPR’s “plot” is not fully resolved – some questions remain unanswered and multiple interpretations of other provisions are possible. Perhaps a sequel to the NPR is in order.

Originally published in Bank Watch, August 2018.

1As for literary criticism, Mercer Capital does not render tax or legal advice, and readers should consult with appropriate professionals regarding the application of Section 199A to any specific circumstances.

2 To expound upon our arbitrary one sentence limitation, it was relatively clear in the Tax Cuts & Jobs Act that bank shareholders are eligible for the 20% Qualified Business Income deduction, but the August 2018

NPR confirms this eligibility.