Capital One Financial Corporation to Acquire Discover Financial Services

The four major credit card networks are American Express, Discover, Mastercard, and Visa. In 2023, Discover had only 2.1% of the total market share in the U.S. based on the value of transactions, compared to Visa’s 61.1% market share and Mastercard’s 25.4% market share.1 Prior to its acquisition of Discover, Capital One partnered with both Visa and Mastercard for issuing their credit cards. So, why would Capital One pay $35.3 billion to acquire Discover’s 2.1% market share?

Discover Financial Services operates as both a credit card issuer and credit card network. By owning its own credit card network, Discover is not partnered with any payment processors (Visa, Mastercard, etc.) and avoids “swipe fees” that payment processors collect. Therefore, one of Capital One’s primary objectives in acquiring Discover is to move its credit and debit cards onto Discover’s network over time and reduce its purchase volume on the Visa and Mastercard networks.

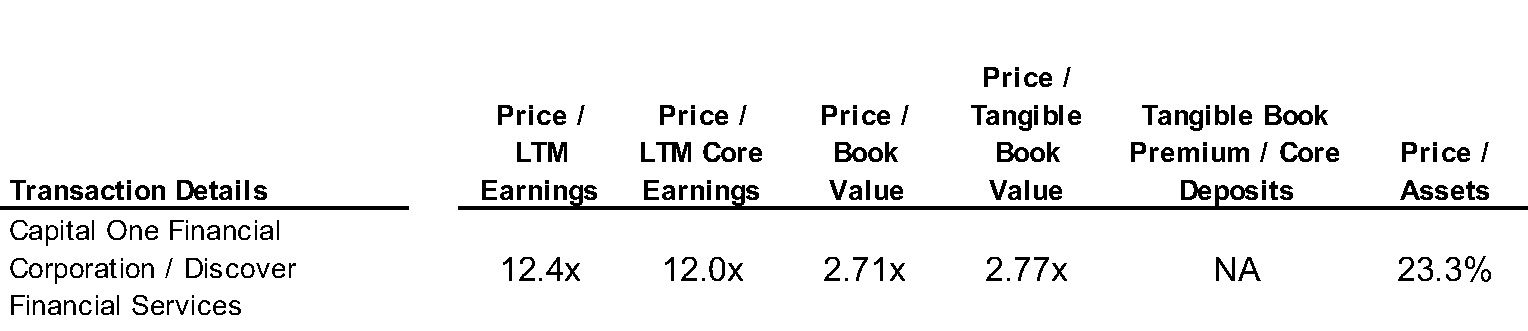

The two companies entered into a definitive agreement on February 19, 2024, in which Capital One Financial Corporation agreed to acquire Discover Financial Services in an all-stock transaction valued at $35.3 billion. The deal represents a 26.6% premium to Discover’s closing price of $110.49 (2/26/24) as Discover shareholders will receive 1.0192 Capital One shares for each Discover share. More details on the transaction as well as the companies’ financials as of fiscal 2023 are displayed on the right.

Summary of Transaction Analysis

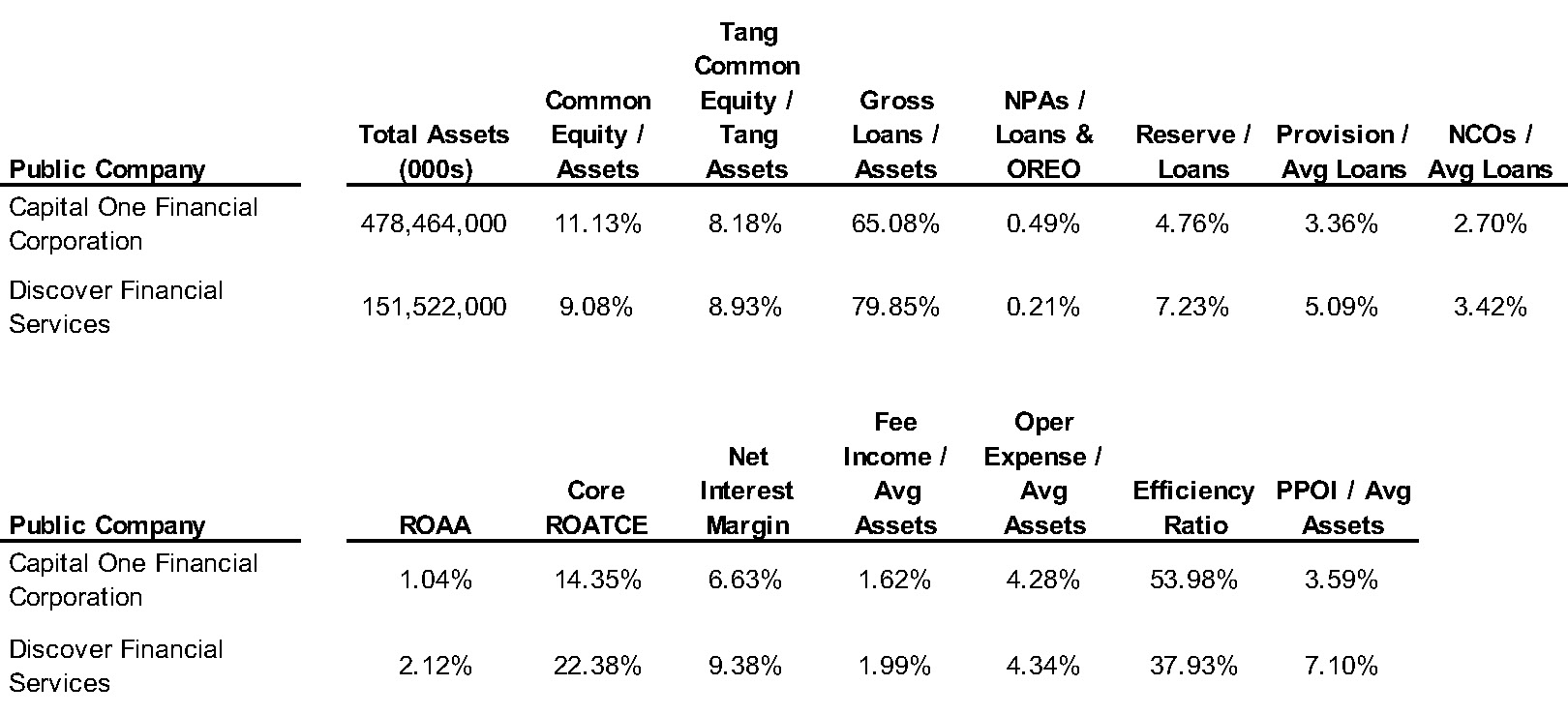

Financial Comparison

Preparing for the Future

As technology continues to advance, both traditional, tech-heavy banks and

Fintech companies have increased competition in the global payments industry. If the acquisition is approved, Capital One will surpass JPMorgan as the largest credit card company based on loan volume and become the third largest company based on purchase volume. With increased volume and market share, Capital One would be better prepared to compete against these other banks and Fintech companies. Richard Fairbank, the CEO of Capital One, strives to deal directly with merchants by owning his own payments network. This rare asset allows Capital One to create a closed loop between consumers and merchants, which better positions the company to deal with increasing threats from buy-now, pay-later companies (Affirm, Afterpay, Klarna, etc.).

Both Capital One and Discover customers may have a lot to look forward to in the future should the deal be approved. Capital One intends to move 25 million cardholders onto the Discover network by 2027 and offer more attractive rewards for both debit and credit cardholders. The proposed merger would expand both issuers’ physical presence, and Discover customers would gain access to physical bank locations. Capital One will also leverage its international presence to increase accessibility and convenience for Discover cardholders on an international scale. In terms of credit and debit rewards, the increased competition in the industry is expected to drive companies to bolster their rewards program to seem more attractive to consumers.

Regulatory Hurdles

The proposed deal between Capital One and Discover is expected to close by the end of 2024 or the beginning of 2025. However, the completion of the deal could depend on the results of the presidential election. Senators Elizabeth Warren and Josh Hawley have both expressed interest in blocking the deal as they believe the deal will create a “juggernaut” in the industry and lead to the extortion of American consumers. The Biden administration is more likely to block the deal or implement limitations and requirements in order for it to be executed.

On the other hand, the proposed deal could stop legislation that threatens credit card rewards. Congress is considering new legislation known as the Credit Card Competition Act (CCCA). The purpose of this legislation is to reduce the swipe fees paid by merchants by enabling access to a wider range of payment networks. If the legislation is approved, credit card networks and issuers would face reduced transaction fees causing issuers to potentially reduce the wide range of rewards offered. However, the primary objective of the CCCA could be accomplished through the proposed merger, as routing Capital One’s purchase volume through Discover’s payment network would create a more viable competitor to the Visa/Mastercard duopoly.

Conclusion

Mercer Capital has roughly 40 years of experience in assessing mergers, the investment merits of the buyer’s shares, and providing valuations of financial institutions. If you are considering acquisition opportunities or have questions regarding the valuation of your financial institution, please contact us.

1 Statista.com; Market share of Visa, Mastercard, American Express, Discover as general purpose card brands in the United States from 2007 to 2023, based on value of transactions