For more information on this topic, please see "Community Bank Stress Testing."

The following article provides an illustrative example of the primary steps to construct a “top-down” portfolio-level stress test.

Determine the Economic Scenarios to Consider

While this step will vary depending upon a variety of factors, one way to determine your bank’s economic scenario could be to look to utilize the supervisory scenarios announced (in November 2012) by the Federal Reserve for the stress tests of the largest financial institutions in the U.S. While the more global economic conditions detailed in the supervisory scenarios may not be applicable to community banks, certain detail within the scenarios presented could be useful when determining the economic scenarios to model at your bank. Consider the following U.S. economic conditions included in the scenarios presented by the Federal Reserve:

Supervisory Adverse Scenario. Includes a moderate recession in the U.S. beginning in late 2012 and lasting until early 2014, including further weakening in housing (a decline of 6% in house prices during 2013), a decline in equity prices of approximately 25% in 2013, and the unemployment rate rising to above 9% in early 2013 and reaching 10% by mid-2015.

Supervisory Severely Adverse Scenario. Includes a substantial weakening in economic activity, including further weakening in housing (a decline of more than 20% in house prices by 2014), a decline in equity prices of more than 50%, and the unemployment rate reaching 12% by mid-2014.

Based upon these scenarios, one might then decide to consider applying the following two scenarios within your community bank’s stress test:

Community Bank Adverse Scenario. Includes a moderate recession in the U.S. and moderately weak economic conditions within the local communities served by the bank, which will include a decline in collateral values (notably housing and CRE of roughly 5-10%) and a rise in the unemployment rate to over 9%; and,

Community Bank Severely Adverse Scenario. Includes a strong recession for both the U.S. and very weak economic conditions within the local communities served by the bank, which will include a decline in collateral values (notably housing and CRE of more than 20%) and the unemployment rate reaching 12.0%.

Segment the Loan Portfolio

This step entails segmenting the loan portfolio into smaller groups of loans with similar loss characteristics. One way cited in the OCC guidance is to segment the loans through Call Report categories in Schedule RC-C (such as construction and development, agricultural, commercial real estate, etc.). Additional segmentation may be needed beyond Call Report categories to address other key elements such as risk grade, collateral type, lien position, loan subtype, concentration risk and/or the vintage of the loan portfolio (i.e., loans primarily originated pre- or post-financial crisis). Other assets that could decline significantly in value, such as the investment portfolio and/or other real estate owned, may also need to be considered. Further, certain loans (or segments of loans) such as larger, higher risk grade loans may need to be segregated as they lend themselves to a more “bottom up” type of analysis (i.e., evaluated individually to determine their likely loss rate in a stress environment).

Estimate Loan Portfolio Stress Losses

Once the assets have been segmented appropriately, the next step involves estimating the potential loan losses over a two-year stress test horizon (or potentially longer) for the entire loan portfolio. In order to estimate the losses, the OCC guidance suggests using the bank’s historical default and loss experience during prior recessions or financial stress periods as a starting point. Beyond that, the bank may also look to outside references for ranges of loss rates for community banks during stress periods and/or certain other peer average loss rates during financial stress periods.

Let’s assume that the subject bank is headquartered in Chicago, has $500 million in loans, and has experienced historical loss rates moderately in line with its peers (one comprised of banks located in the same geographic area and the other consisting of banks located throughout the U.S.). To estimate the appropriate loss rates during the stress periods, one might then consider annual charge-off rates as a percentage of average loans of the two peer groups for each loan portfolio segment (Construction & Development segment shown below).

Severely Adverse Scenario. To estimate stress period losses under the severely adverse scenarios, one might rely primarily on the peer group losses observed from 2009 through 2011. For perspective, the unemployment rate in the Chicago MSA was 11.8% in January of 2010 and above 10% from May 2009 through August 2010. The S&P Case Sheller Home Price Index for the Chicago MSA was 125.11 in January of 2010, down 25.8% since peaking in September of 2006.

Adverse Scenario. To estimate losses under the adverse scenario, one could focus on periods when economic conditions were still relatively weak but improved from the depth of the financial crisis and consider the charge-off levels observed in 2008 and 2012. A similar process could then be repeated for other loan portfolio segments to derive the appropriate two-year stressed loss rates.

The following table details a hypothetical example of estimating loan portfolio stress period losses (loss rates shown for the C&D portfolio are based on Figure 1 while loss rates for the other segments are for illustrative purposes only).

Estimate the Impact of Stress on Earnings

Now that the loan portfolio losses have been determined, the next step entails estimating the potential impact on net income from the scenario(s) analyzed previously. Estimating pre-provision, pre-tax income in the different scenarios can be tricky as the impact of higher non-performing assets on revenue (i.e., nonaccrual loans) and expenses (i.e., collection costs) should be considered. Further, the impact on liquidity (i.e., funding costs) and interest rate risk (i.e., net interest margin) should also be considered.

Once pre-provision, pre-tax income has been determined the next step entails estimating the appropriate provision over the stressed period. The provision can be broken into two components: the provision necessary to cover losses estimated in Figure 2 and the portion of provision necessary to maintain an adequate allowance for loan losses (ALLL) at the end of the two-year period. When determining the portion of provision necessary to maintain an adequate ALLL at the end of the stress period, management should consider that stressed environments may increase the need for a higher ALLL. Finally, the income tax expense/benefit arising from the estimate of pre-tax income should be applied.

The following table details an example of this step.

Other key considerations here might include: How will loan migrations in the different scenarios impact pre-provision net income? How might the economic scenarios forecast impact pre-provision net income? How will the elevated level of losses over the stress periods impact the provision necessary to maintain an adequate ALLL? How will the losses impact the bank’s tax expense/benefit?

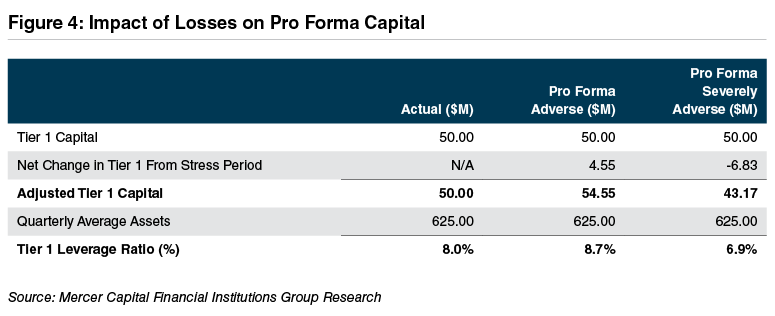

Estimate the Impact of Stress on Capital

This step entails estimating the bank’s capital ratios at the end of the stressed period. To accomplish this, the estimated changes in equity, Tier 1capital, average assets, and risk-weighted assets during the stressed period should be considered.

The following table details an example of this step.

Other key considerations here might include: What are the potential impacts on capital and risk-weighted assets from Basel III? What is the projected balance sheet growth/contraction over the stressed period?