Core Deposit Intangible Asset Values Remain Low

We ran an updated article in the October 2017 issue of Mercer Capital’s Bank Watch newsletter.

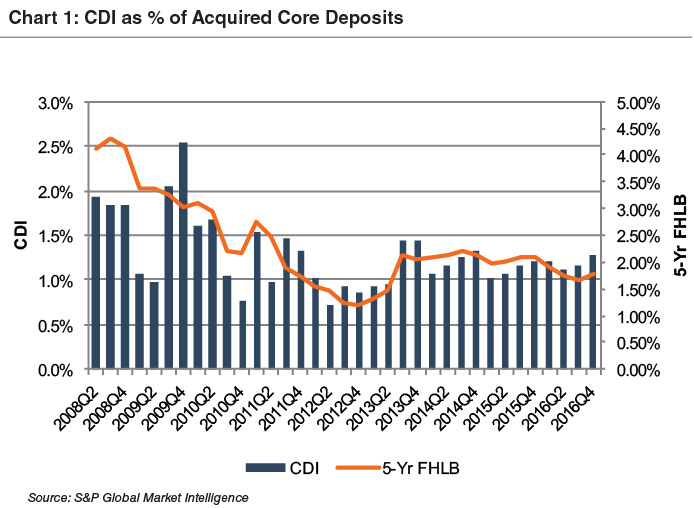

Other than goodwill, core deposit intangible assets are the most commonly recorded intangible assets in bank acquisitions, representing the benefit of having a low-cost, stable funding source. However, CDI values have decreased since the financial crisis, as deposits have less worth, so to speak, in a very low rate environment than in a “normal” environment that existed before the crisis. Using data compiled by S&P Global Market Intelligence, we analyzed trends in CDI assets recorded in whole bank acquisitions completed from 2008 through November 1, 2016. We compared CDIs recorded as a percentage of core deposits acquired to 5-year FHLB rates over the same period.

Since the start of the financial crisis, CDIs recorded in acquisitions have fallen from 1.5%-2.0% to stabilizing at approximately 1.0%-1.25% in the 2014-2016 period. As interest rates declined in the years following the crisis, the cheaper cost of alternative funds has made banks’ core deposit bases less valuable as a stable, cheap source of funding. Low rates also led to less attractive alternative investments for consumers, which has resulted in rising deposit balances and less competition for funds. In short, low rates have made funds easier and cheaper to access, reducing the value of core deposit intangible assets.

Despite the FOMC’s decision to begin a gradual increase in interest rates in late 2015, the cost of alternative funds such as FHLBs has not increased meaningfully since then. While the narrative around the economy and rates has shifted since the November 8th presidential election, it is unclear whether rates will increase more than the gradual pace the Fed has targeted since late 2015.

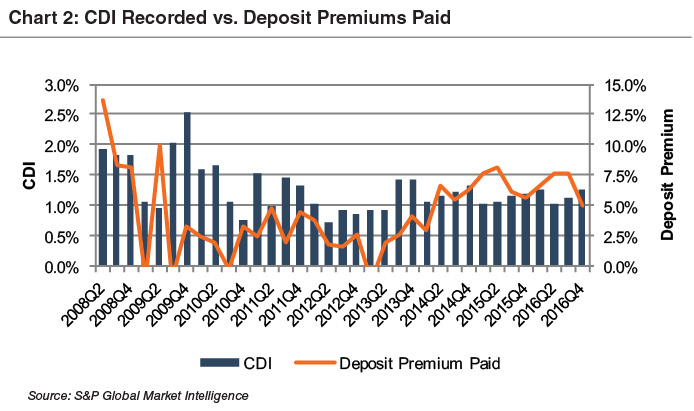

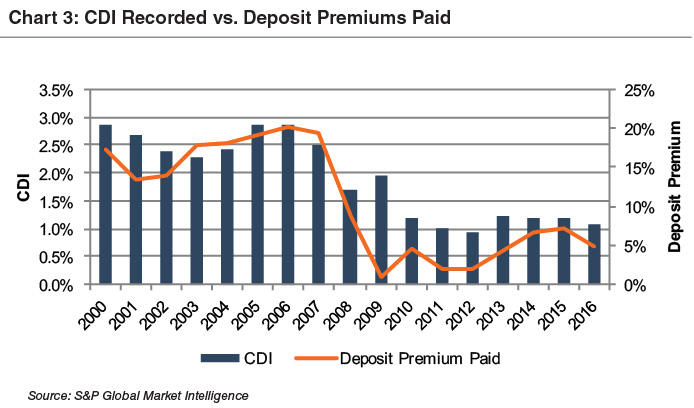

When interest rates were higher pre-crisis, both CDI levels and deposit premiums paid in acquisitions were higher than the levels observed in today’s environment. If rates do move meaningfully higher over the next few years, then deposit premiums should too (as would net interest margins).

Since the start of the financial crisis, improved deal values have resulted in some increase in deposit premiums paid in the past several years. However, the declining trend in CDI values has persisted even as deposit premiums have begun to tick back up.

For our analysis of industry trends in CDI values, we defined core deposits as total deposits, less accounts with balances over $100,000. In analyzing core deposit intangible assets for individual acquisitions, however, a more detailed analysis of the deposit base would consider the relative stability of various account types. In general, CDs tend to be more rate sensitive and less stable. Even in cases where a CD base is considered a stable customer base, given their relatively higher cost compared to non-time deposits, CDs often do not contribute to the core deposit intangible asset recorded. Furthermore, account types such as brokered or Qwickrate accounts and certain public funds that may be subject to a competitive bidding process are generally excluded from core deposits when determining the value of a CDI.

For more information about Mercer Capital’s core deposit services, feel free to contact us.