Credit Marks on Acquired Loan Portfolios Trend Down During 2013

Merger related accounting issues for bank acquirers are often complex. In recent years, the credit mark on the acquired loan portfolio has often been cited as an impediment to M&A activity as this mark can be the most critical component that determines whether the pro-forma capital ratios are adequate. As economic conditions have improved in 2013, bank M&A activity has also picked up and we thought it would be useful to take a look at the estimated credit marks for some of the larger deals announced in 2013 (i.e., where the acquirer was publicly traded and the reported deal values were greater than $100 million) to see if any trends emerged.

As detailed below, the estimated credit marks declined during 2013 with only one deal reporting a credit mark larger than 4% after the first quarter of 2013 compared to all deals being in excess of 4% in the first quarter of 2013. The reported estimated credit marks for 2013 were also generally below those reported in larger deals in 2010, 2011, and 2012 when the estimated credit marks were often in excess of 5%.

This trend reflects a number of factors including most notably:

- Improved economic trends. Economic data from the Federal Reserve of St. Louis indicates that real GDP was up 1.9% through the first nine months of 2013 while the unemployment rate was down to 7.0% in November 2013 compared to 7.9% in January M2013.

- Higher real estate values. For perspective, the 10- and 20-city composites of the S&P/Case-Shiller Home Price indices increased 10.3% and 13.3% through September 30, 2013 (per SNL Financial). Additionally, economic data from the Federal Reserve of St. Louis indicated that commercial real estate prices in the U.S. were up 10.6% over the 12 months ended June 30, 2013.

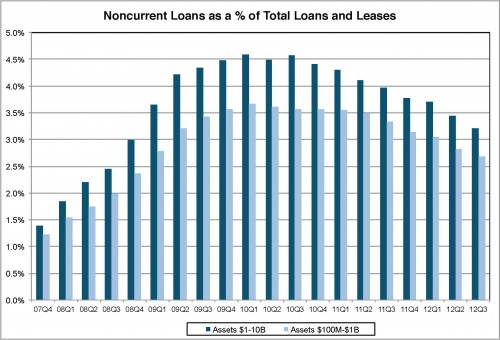

- Reduced levels of noncurrent loans. As detailed below, credit migration continued to be positive throughout 2013 and levels have declined to almost pre-financial crisis levels (third quarter 2013 levels approximated levels last observed in the fourth quarter of 2008).

Mercer Capital has provided a number of valuations for potential acquirers to assist with ascertaining the value and estimated credit mark of the acquired loan portfolio. In addition to loan portfolio valuation services, we also provide acquirers with valuations of other financial assets and liabilities acquired in a bank transaction, including depositor intangible assets, time deposits, and trust preferred securities.

Feel free to give us a call to discuss any valuation issues in confidence as you plan for a potential acquisition.