Credit Quality at a Crossroads

Last week, the Mercer Capital Bank Group headed south for a scenic trip through the fields of the Mississippi Delta, including the town of Clarksdale located about 90 miles from Memphis. Clarksdale’s musical heritage runs deep with such performers as Sam Cooke, John Lee Hooker, Son House, and Ike Turner born there, while Tennessee Williams spent much of his childhood there. Explaining the Delta’s prolific artistic output, Eudora Welty, a Mississippi writer, noted the landscape stretching to the horizon and the juxtaposition of societal elements – all these forces churning like the Mississippi river nearby.

Despite its gritty roots, Clarksdale now is experiencing its own hipster renaissance. It may not be Brooklyn, but the Bank Group noticed signs for last weekend’s Clarksdale Film Festival. Visitors can stay at a refurbished cotton gin, enjoying their Sweet Magnolia Gelato made from locally sourced ingredients. Presumably, craft cocktails are available as well, this being the Delta.

Beyond these recent additions to the tourist landscape, though, one attraction put Clarksdale on the map – the Crossroads. At the intersection of Highways 49 and 61, the bluesman Robert Johnson (who lived from 1911 to 1938), as the story goes, met the Devil at midnight who tuned his guitar and played a few songs. In exchange for his soul, Johnson realized his dream of blues mastery.

The point of this article is not that Lucifer lurked behind the revaluation of asset prices in the fourth quarter of 2018. Instead, the market gyrations laid bare the dichotomy between bank expectations regarding asset quality and the market’s view of mounting credit risk that was overlaid by a need to meet margin calls among some investors. Indeed, credit quality faces its own crossroads.

Highway 49

Along Hwy. 49 lies the town of Tutwiler, about 15 miles from Clarksdale. There, in 1903, the bandleader W.C. Handy heard a man playing slide guitar with a knife, singing “Goin’ where the Southern cross’ the Dog.” Handy adapted the song, which references the juncture of two railroads, thereby making it one of the first blues recordings.

From Call Report data, which includes 3,644 banks with total assets between $100 million and $5 billion, signs of credit quality deterioration remain virtually undetectable.

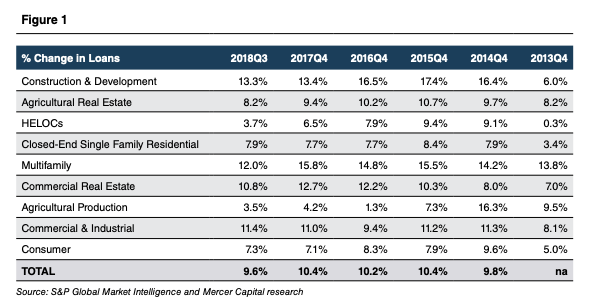

- Loan growth continued apace in 2018, maintaining the community banking industry’s recent 10% annual growth rate (Figure 1, which shows the trailing twelve month change in loans). Notably, commercial real estate loan growth decelerated in 2018. Although this presumably pleases the regulatory agencies, competition from non-banks (e.g., insurance companies) and budding risks surrounding certain sectors (e.g., retail) likely explain the slowdown.

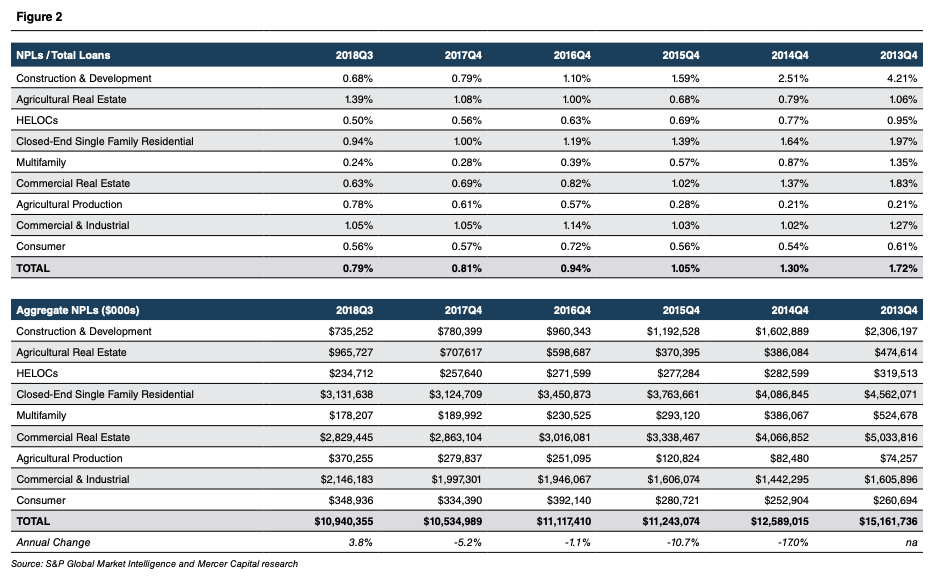

- In absolute terms, nonperforming loans (nonaccrual loans plus loans more than 90 days past-due) declined in each year between 2014 and 2017 (Figure 2). As of September 30, 2018, however, NPLs increased by 4% over December 31, 2017, led by farmland NPLs (up 37%, or $258 million), agricultural production NPLs (up 32%, or $90 million), and commercial and industrial NPLs (up 8%, or $149 million). Given loan growth, though, the ratio of NPLs to loans continued to decline, falling slightly from 0.81% to 0.79% between December 31, 2017 and September 30, 2018.

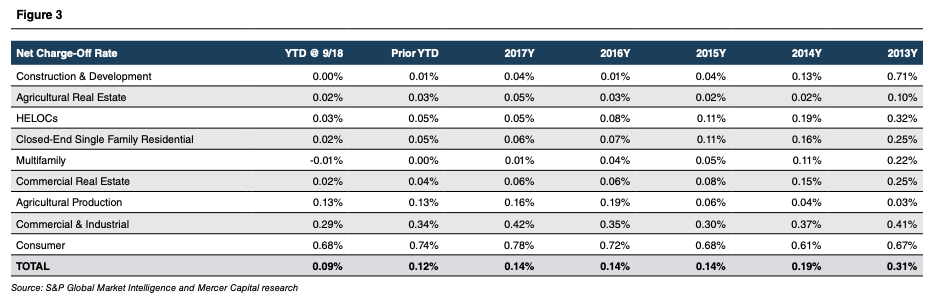

- Annualized charge-offs for the year-to-date period ended September 30, 2018 also compare favorably to the comparable prior year period, foreshadowing a possible post-recession low in the net charge-off ratio for fiscal 2018 (Figure 3).

As they are wont to do, regulatory agencies noted some concerns regarding asset quality. However, consistent with our research into the community banking industry’s asset quality trends, the OCC also observed that “credit quality remains strong when measured by traditional performance metrics.”1 Despite its view of building credit risk, the OCC rated 95% of banks’ underwriting practices as satisfactory or strong in 2018, virtually unchanged from the 2017 level.2 Economic growth, corporate profits, and employment trends also support a sanguine view of credit quality.

While also observing weaker underwriting – for example, covenant concessions – rating agencies predict better credit performance among leveraged loans and commercial mortgage backed securities in 2019. For 2019, Fitch Ratings projects a 1.5% leveraged loan default rate, down from 1.75% in 2018. Further, commercial mortgage-backed security delinquencies, which declined by 103 basis points to 2.19% between year-end 2017 and 2018, are expected to range between 1.75% and 2.00% in 2019. The Amazonification of the retail sector, which led to retail bankruptcies and defaults on loans secured by regional malls, contributed to higher delinquency and default rates in 2018 but may subside in 2019.

The view from Hwy. 49, before reaching the Crossroads, looks favorable from the banking industry’s standpoint.

Highway 61

In the words of the writer David Cohn, the Mississippi Delta begins in the lobby of the Peabody Hotel (in Memphis) and ends on Catfish Row in Vicksburg, Mississippi.3 While his observation alludes to the economic as well as the geographic extremes of the Delta region, Highway 61 is the Delta’s spine connecting Cohn’s poles.

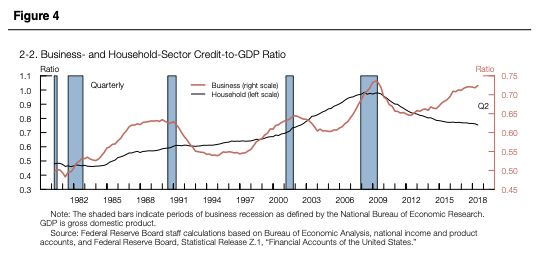

One of the more concerning statistics is the level of corporate debt. Though household debt trended down following the Great Recession (see Figure 4), nonfinancial business debt has reached near record levels as a percentage of GDP.4 According to Morgan Stanley, BBB-rated corporate debt surged by 227% since 2009 to $2.5 trillion. This leaves approximately one-half of the investment grade corporate bond universe on the cusp of a high-yield rating. Moody’s migration data suggests that BBB-rated bonds have an 18% chance of being downgraded to non-investment grade within five years, which may overwhelm the high-yield bond market.5

Regulatory agencies also observed looser underwriting. For new leveraged loans, the Federal Reserve noted that the share of highly leveraged large corporate loans – defined as more than 6x EBITDA – exceeds previous peak levels in 2007 and 2014, while issuers also are calculating EBITDA more liberally by making aggressive adjustments to reported EBITDA.6 From the OCC’s perspective, competitive pressures from banks and non-banks, along with plentiful investor liquidity, have led to weaker underwriting particularly among C&I and leveraged loans. According to the OCC, community banks are not immune. An example of weaker underwriting cited by the OCC is “general commercial loans, predominately in community banks” for which it compiles a list of shortcomings: “price concessions, inadequate credit analysis or loan-level stress testing, relaxed loan controls, noncompliance with internal credit policies, and weak risk assessments.”7

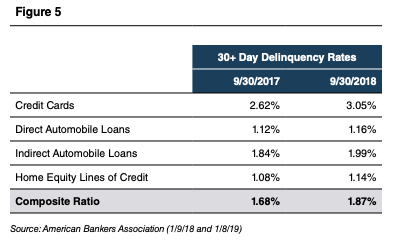

Despite unemployment rates below 4% and some evidence of rising wages, consumer loan delinquency rates have risen in 2018 (Figure 5). Some lenders, such as Discover, already have begun reducing exposure to heated sectors like unsecured personal loans.

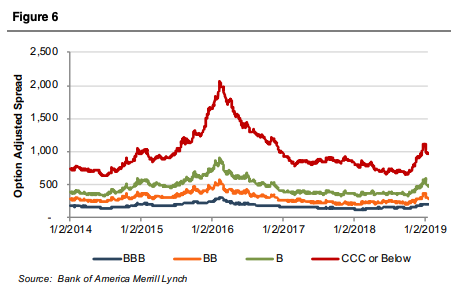

Fears of a downturn crystallized in the fourth quarter of 2018 with the Federal Reserve’s December rate increase, trade friction with China, and signs of economic slowdowns in countries such as Germany. Option-adjusted spreads on corporate debt, after remaining quiescent through 2017 and most of 2018, widened suddenly, approaching levels last observed in 2016 when oil prices collapsed (Figure 6). According to Guggenheim, the fourth quarter spread widening implies a 3.2% high yield corporate debt default rate, up from 1.8% for 2018.8

The perspective gleaned from Hwy. 61 is not necessarily alarming, but it does suggest that, directionally, risk is rising.

The Crossroads

Credit lies at a crossroads, consistent with a late cycle economic environment. Reported credit metrics are not improving significantly, nor are they worsening; conditions suggest continued low charge-offs and loan loss provisions in the nearterm. However, the market sniffs rising risks in various corners of the economy, most notably in corporate debt. Howlin’ Wolf sang, “Well I’m gonna get up in the morning // Hit the Highway 49.” Where are banks headed? Macroeconomic conditions ultimately will be determinative, but banks should avoid complacency in this environment marked by conflicting signals and aggressive competition. The poorest loans, in retrospect, often are originated in times such as these.

End Notes

1 OCC Semiannual Risk Perspective, Fall 2018, p. 1.

2 OCC Semiannual Risk Perspective, Fall 2018, p. 22.

3 Cohn, David, Where I Was Born and Raised, 1948.

4 Federal Reserve, Financial Stability Report, November 2018, p. 18.

5 Guggenheim Investments, Fixed Income Outlook, Fourth Quarter 2018, pp. 1 and 8.

6 Federal Reserve, Financial Stability Report, November 2018, p. 20.

7 OCC Semiannual Risk Perspective, Fall 2018, pp. 11 and 24.

8 Guggenheim Investments, High Yield and Bank Loan Outlook, January 2019.