Critical Issues in the Trucking Industry – 2020 Edition

Every year the American Transportation Research Institute (“ATRI”) publishes its report, Critical Issues in the Trucking Industry. A key piece of this annual report is a survey of key risk factors in the industry. While some of the risks of 2020 were not anticipated at the beginning of the year, some of the industry’s largest risk factors remain major concerns.

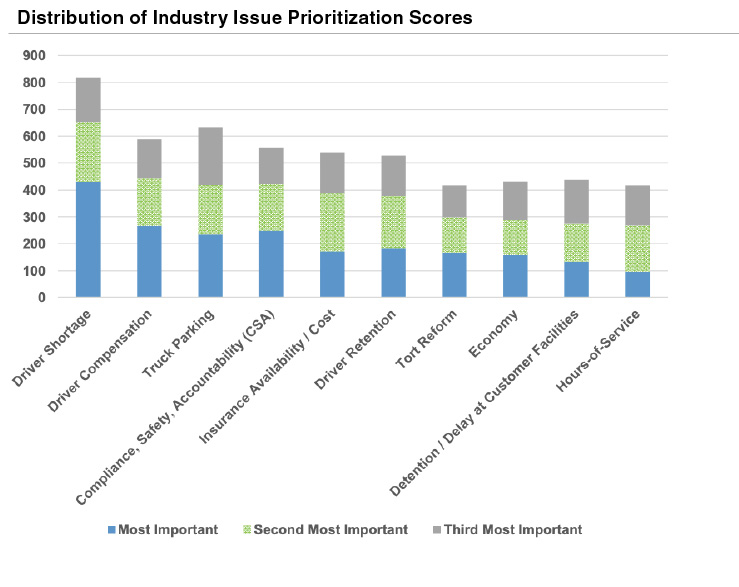

Driver shortages and driver compensation continue to be at the forefront of peoples’ minds. This year marks the fourth year that driver shortages have topped the list and over a quarter of survey participants marked it as one of their three largest concerns. While parts of the industry have been hit hard by COVID-19 (for example, automobile shippers or marine port logistics companies), freight demand continues to grow. The pool of available drivers – already pruned by rules changes and more stringent drug testing – shrunk further as COVID limited company’s abilities to hire and train more drivers. The American Trucking Association (“ATA”) estimated that the driver shortfall at over 60,000 drivers.

Driver compensation ranked as the second largest concern, up from the third largest in 2019. Driver compensation and driver shortages are closely linked – in order to encourage driver retention, companies are reconsidering base pay and benefits.

Driver compensation ranked as the second largest concern, up from the third largest in 2019. Driver compensation and driver shortages are closely linked – in order to encourage driver retention, companies are reconsidering base pay and benefits.

Truck parking first appeared on the top ten list in 2012. With just over 20% of respondents listing it as one of their top three concerns, truck parking availability reached its highest position yet. Once again, the COVID-19 pandemic underlies part of the issue – many states closed rest areas during the early stages of the pandemic. Lack of truck parking was a greater concern among owner-operators and independent contractors than among company drivers.

Compliance, safety, and accountability have been a top five concern for seven of the last ten years and has ranked in the top ten since 2010. The FMCSA has updated standards during its ten-year history, but transparency, details, and legal classifications continue to cause uncertainty and unrest in the industry.

The cost and availability of insurance ranked as the fifth highest concern. In a 2019 report, ATRI estimated that insurance costs per mile increased 12% between 2017 and 2018 and 5.6% on a compound annual basis since 2013. The impact of large court verdicts, increased vehicle values, and higher levels of traffic have all driven insurance prices up.

COVID-19 ranked 13th in the survey, although the impacts of the pandemic bleed through into other industry concerns. ATRI found that the COVID-19 pandemic tended to impact smaller carriers and owner-operators on a larger scale than bigger companies.

ATRI ultimately discusses the ten highest-ranked concerns in its report. The transportation and logistics industry continues to evolve as new risks and concerns rise in importance.