Emerging Community Bank M&A Trends in 2017

As summer came to an end, the U.S. was treated with a historic event as the first total solar eclipse crossed the country since 1918. The timing of the event had social media and news outlets buzzing in a traditionally sleepy news month. For many, the event exceeded all expectations; for others, it was a dud that didn’t live up to the hype. My personal experience was a bit of both. The minutes of darkened skies were definitely memorable, but things returned to normal quickly as the sun shone brightly only minutes after.

Traditional M&A Trends

Community bank M&A trends also seem mixed. Rising regulatory burdens, weak margins from a historically low interest rate environment and heightened competition have crimped ROEs for years. Many pundits have predicted a rapid wave of consolidation and the demise of community banks in the years since the financial crisis. However, the pace of consolidation the last few years is consistent with the past three decades in which roughly 3-4% of the industry’s banks are absorbed through M&A yearly. The result is many fewer banks—5,787 at June 30 compared to about 15,000 in the mid-1980s when meaningful industry consolidation got underway.

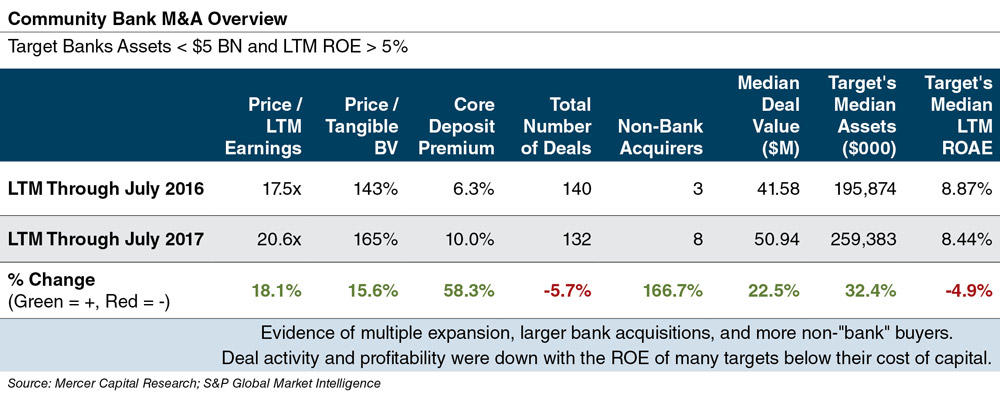

Somewhat surprisingly, the spike in bank stock prices following the November 2016 national elections did not cause M&A to accelerate. As would be expected, acquisition multiples increased in 2017 because publicly traded acquirers could “pay-up” with appreciated shares. As seen in the table on the next page, the median P/E and P/TBV multiples and the median core deposit premium increased for the latest twelve months (LTM) ended July 31, 2017 compared to the year ago LTM period. The ability of buyers—at least the publicly traded ones—to more easily meet sellers’ price expectations seemingly would lead more banks to sell. However, that has not happened as the pace of consolidation declined slightly to 132 transactions in the most recent LTM period compared to 140 in the year ago LTM time frame.

FinTech’s Impact on M&A

Another emerging M&A trend is the presence of non-traditional bank acquirers, which include private investor groups, non-bank specialty lenders, and credit unions. While a FinTech company has not yet announced an acquisition of a U.S. bank this year, several FinTechs have announced they are applying for a bank charter (SoFi, VaroMoney), and in the U.K., Tandem has agreed to acquire Harrods Bank.

So far, FinTech acquisitions of banks have been limited to a few acquisitions by online brokers and Green Dot Corporation’s acquisition of a bank in 2011. While FinTech companies have yet to emerge as active buyers, there have been some predictions that could change if regulatory hurdles can be navigated. Some FinTech companies are well-funded or have access to additional funding that could be tapped for a bank acquisition. In addition, an overlay of enhancing financial inclusion for the under-banked could mean bank transactions may not be as far-fetched as some may think.

Beyond serving as potential acquirers, FinTech continues to emerge as an important piece of the community banking puzzle of how to engage customers through digital channels as the costly branch banking model sees usage decline year-after-year. Many FinTechs are eager to partner with banks to scale their operations for greater profitability, thereby better positioning themselves for a successful exit down the road.

Consistent with this trend, we have also seen some acquirers (and analysts) comment on FinTech as a benefit of a transaction, as opposed to (or at least in addition to) the historical focus on geographic location, credit quality, asset size, and profitability. We will be watching to see if FinTech initiatives, whether internally developed or acquired, become a bigger driving force in bank M&A. If so, acquisitions of FinTech companies by traditional banks may increase (as discussed more fully in this article).

As these trends grow in importance, buyers and sellers will have to grapple with unique valuation and transaction issues that require each to fully understand the value of the seller and the buyer, assuming a portion of the consideration consists of the buyer’s shares. Whether that buyer includes a traditional bank whose stock is private or a non-bank buyer, such as a specialty lender or FinTech company, we have significant valuation and transaction expertise to help your bank understand the deal landscape and the strategic options available to it.

If we can be of assistance, give us a call to discuss your needs in confidence.

This article originally appeared in Mercer Capital’s Bank Watch, August 2017.