Equity Capital Raises

The banking zeitgeist is evolving: 2023 was about a liquidity crisis that claimed three banks who were members of the S&P 500; 2024 is shaping up as the year of capital raises by a handful of regionals to deal with the aftermath of the Fed’s ultra-low-rate environment.

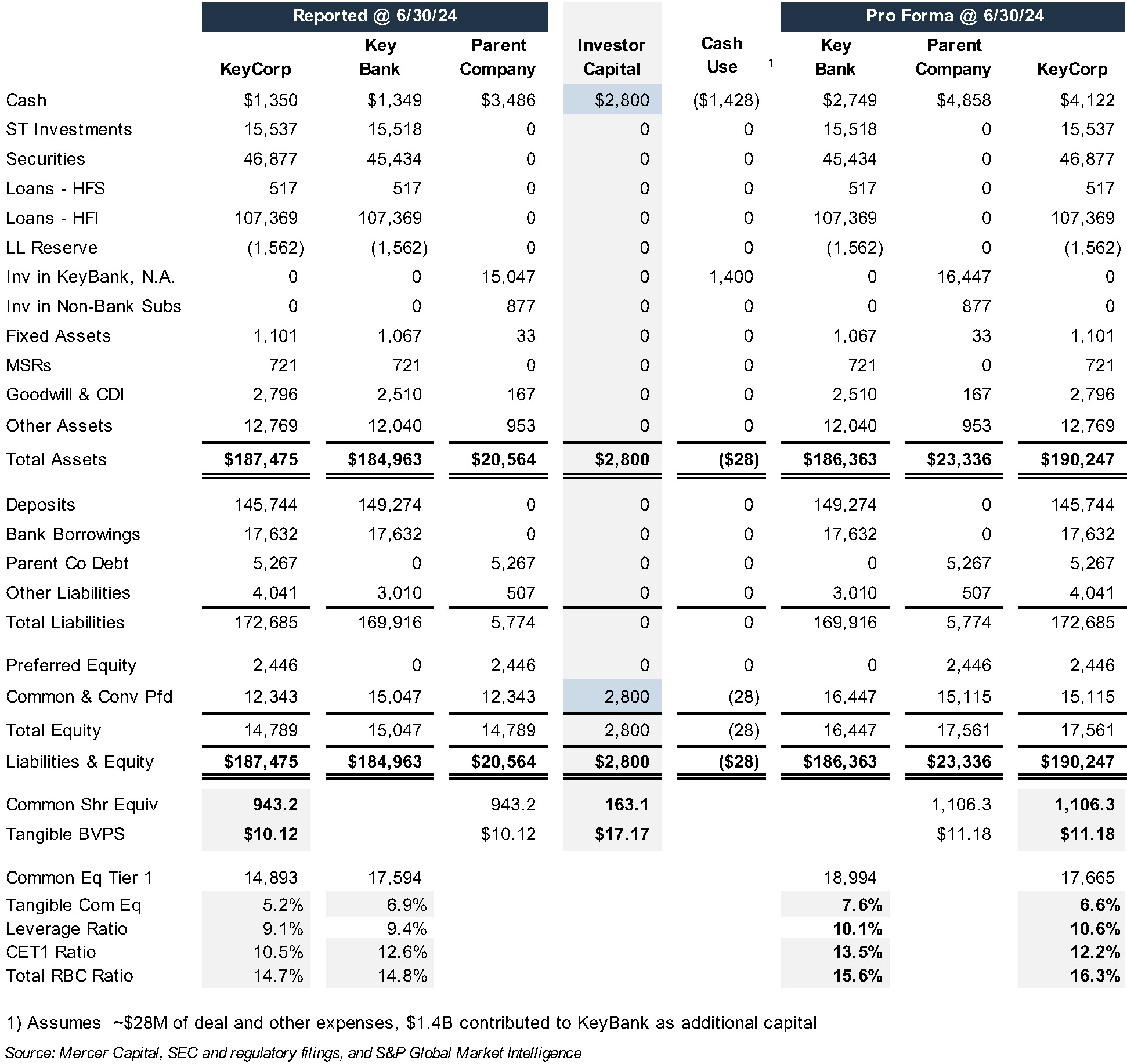

KeyCorp (NYSE:KEY) was the latest bank to raise capital. The Bank of Nova Scotia (TSX:BNS) will purchase ~163 million newly issued common shares in a two-step transaction that once consummated will result in Scotia owning 14.9% of the common shares.

The $17.17 per share issue price equates to:

- 15% premium to the ten-day volume weighted average price through August 9;

- ~1.50x pro forma tangible book value; and

- 10.8x consensus 2025 EPS estimate.

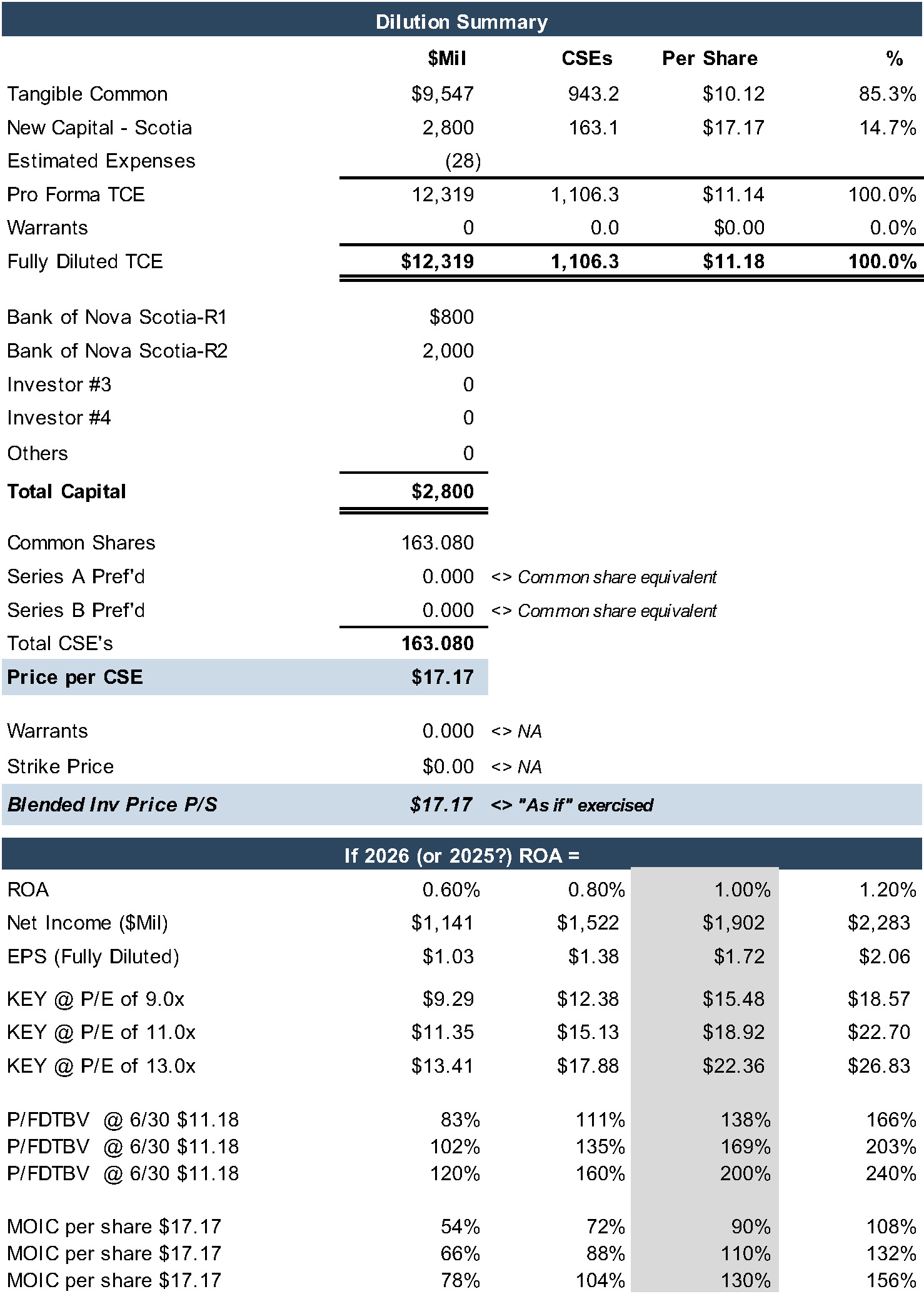

The market was surprised by the investment because KEY’s and KeyBank’s common equity tier 1 ratios were 10.5% and 12.6% respectively as of June 30, 2024. However, the respective tangible common equity ratios were 5.2% and 6.9% given sizable unrealized losses in the AFS bond portfolio and receive fix/pay variable swaps book. KEY has earmarked about one-half the capital to absorb losses from restructuring the balance sheet.

Unlike the New York Community Bancorp (NYSE:NYCB) and First Foundation (NASDAQ:FFWM) capital raises that occurred at significant discounts to the market and tangible BVPS, KEY’s shares traded up on the announcement. Investors took the investment price as a form of validation of KEY’s credit marks, plus there is the potential for the “strategic minority” investment to become a control position via acquiring the remaining common shares one day.

Figure 1: Bank of Nova Scotia Equity Investment in KeyCorp

Figure 2: KEYCORP Pro Forma Balance Sheet