eSports: An Emerging Industry

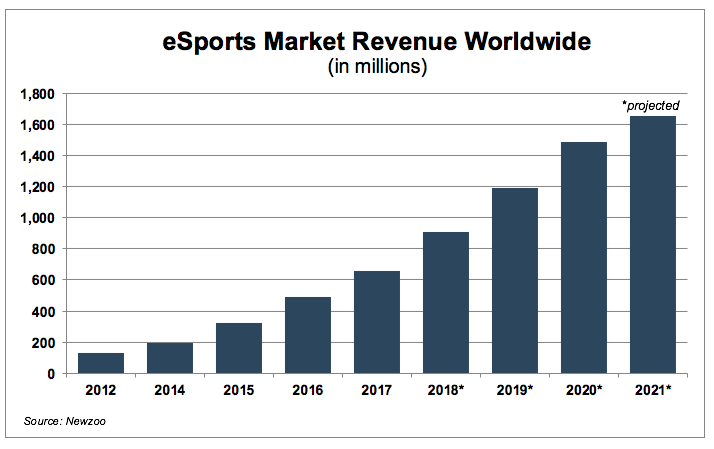

eSports is a rapidly expanding industry that has drawn viewers and investments alike. The introduction of streaming platforms as well as the improvement in mobile technology has allowed the industry to grow from its arcade hall beginnings in the 1970s to competitors streaming games to millions of viewers globally. In addition to being highly visible (192 million frequent viewers in 2017), the eSports industry is also lucrative ($906 million projected industry revenue in 2018).

The History of eSports

Sprouting from humble beginnings, researchers trace the roots of the eSports industry to informal competitions held at video game arcades in the 1970s. One of the first breakthroughs came in 1980 when Atari’s National Space Invaders Championship drew 10,000 participants across the U.S. As a spectator sport, eSports first took off in South Korea, when cable networks broadcast StarCraft tournaments in the early 2000s. By 2004, StarCraft stadium events in South Korea drew 100,000 fans. In the U.S., the coming of age moment arrived in 2013 when 13,000 people flooded the Staples Center to watch the world championship final of League of Legends.

A Growing Audience

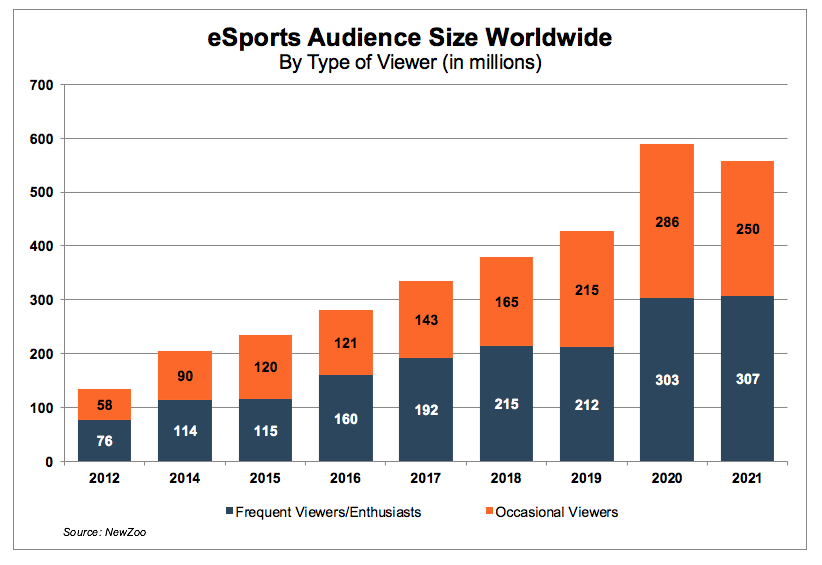

The eSports industry has experienced rapid growth in recent years. According to data from Newzoo, an eSports researcher, the global eSports audience totaled 204 million in 2014. Approximately 56% (114 million) were considered frequent viewers/enthusiasts while the remaining 44% (90 million) were categorized as occasional viewers. By 2017, the global audience grew to 335 million, a compound annual growth rate of approximately 36% and the viewership ratio was approximately the same (57% categorized as frequent viewers/enthusiasts and 43% as occasional viewers).

The number of frequent viewers grew at a compound annual growth rate (CAGR) of 36% from 2014 to 2017 and is projected to grow at a CAGR of 12.5% to 2021.

By comparison, occasional viewers grew at a CAGR of 35% from 2014 to 2017 and are projected to grow at a CAGR of 15% to 2021.

Livestreaming Platform

The primary delivery method for eSports is Twitch, a livestreaming video platform owned by Twitch Interactive, a subsidiary of Amazon. Twitch was introduced in 2011 and, as of February 2018, the platform has 2 million monthly broadcasters and 15 million daily active users. Twitch operates like traditional television in that the broadcasters can be “channels” that are not necessarily broadcasting 24/7, differentiating it from on-demand platforms like YouTube and Netflix.

Twitch is unique in its ad revenue model, which supports the livestreaming aspect of the platform. The top 17,000 streamers, which include professional eSports players, participate in an ad-revenue-sharing program, where the players, not Twitch, decide in real time when the ads run during their streaming sessions. For example, a top eSports player might practice on Twitch and draw thousands of viewers then when the player takes a quick break, he asks viewers to watch an ad. Despite encroaching competition from YouTube, Twitch out-streams other platforms and, given its momentum, it continues attracting sponsors to reach the growing audience.

eSports Tournaments and Viewship

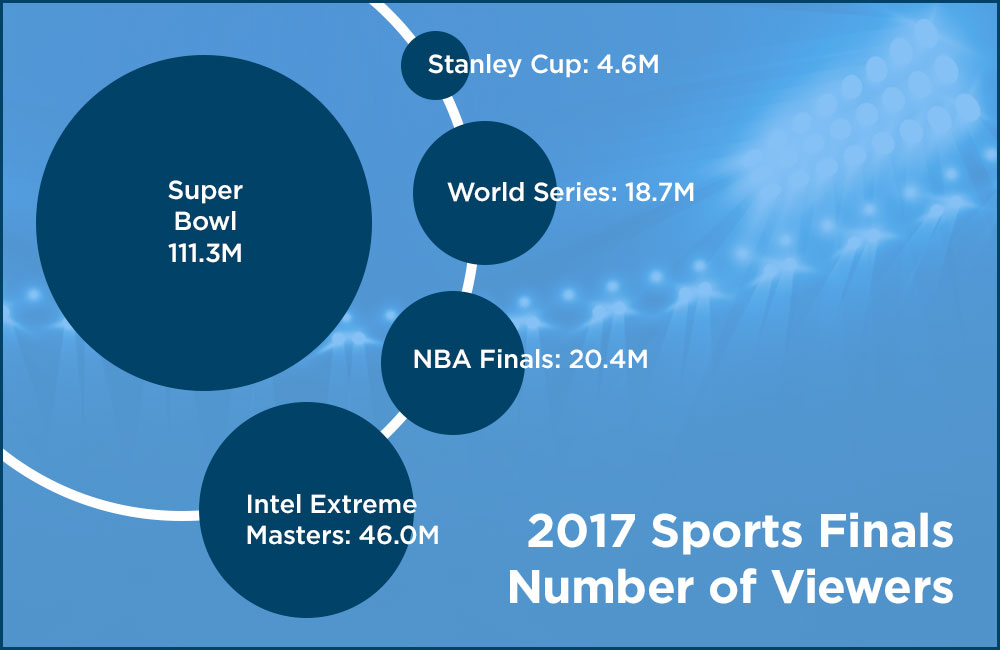

Like traditional sports, eSports have occasional tournaments that draw big audiences. In 2017, the Intel Extreme Masters (IEM) in Katowice, Poland drew 46 million unique viewers. IEM featured three games with a total prize pool of $688,750. This viewership figure was exceeded only by the Super Bowl, which drew 111.3 million U.S. viewers in 2017.

By comparison, the 2017 baseball World Series had average viewership of 18.7 million U.S. viewers over seven games. Therefore, the average viewership of the 2017 World Series would rank 14th on a list of worldwide eSports tournaments ranked by viewership from 2012 to 2017. The 2017 NBA Finals, which featured the Golden State Warriors against the Cleveland Cavaliers for the 3rd year in a row, averaged 20.4 million U.S. viewers over a five game series. The 2017 Stanley Cup Final trailed the other three major sports with average viewership of 4.6 million in the U.S. over six games.

To underscore the growing popularity of eSports, the combined average viewership of the championship series for three of the major sports in the United States was less than the viewership for one eSports tournament (IEM) in 2017.

The large tournament viewership has attracted the attention and dollars of global brands. Coca-Cola sponsors the League of Legends World Championship, one of the largest global eSports competitions. Since 2006, Intel has sponsored Intel Extreme Masters alongside the Electronic Sports League (ESL), the longest running eSports tournament in the world. To support the growing demand, investments in eSports sponsorships will continue to rise.

New Game Releases

Since its introduction on July 25, 2017, Fortnite has become a global phenomenon. As of June 3, 2018, Fortnite ranked as the top game watched on Twitch with 4.43 million hours watched. Counter-Strike: Global Offensive ranked second with 2.7 million hours watched (approximately 40% less hours watched than Fortnite). Other games ranking in the top 10 include: League of Legends, Dota 2, IRL, PlayerUn- known’s Battlegrounds, Overwatch, Hearthstone, Path of Exile, and FIFA 18. Releases of new games can attract viewers to those games. A challenge for Twitch broadcasters is to be up-to-date on new games so that viewers don’t get bored with older games.

Growing Revenue

Newzoo defines industry revenue as the amount generated through the sale of sponsorships, media rights, advertising, publisher fees, tickets, and merchandising. Global eSports revenues are projected to reach $906 million in 2018. North America is projected to account for approximately 38% ($345 million) of global eSports revenue in 2018. Global revenue for eSports is projected to reach $1.65 billion in 2021.

Despite the tremendous growth, eSports fan spending is lower than traditional sports. According to Newzoo, eSports enthusiasts spent an average of $3.64 per person compared to basketball fans who spent an average of $15 per person. The primary factor for this gap is that eSports content is largely available for free and spending on merchandise remains relatively small.

eSports Industry Transactions

Stack Sports Transactions

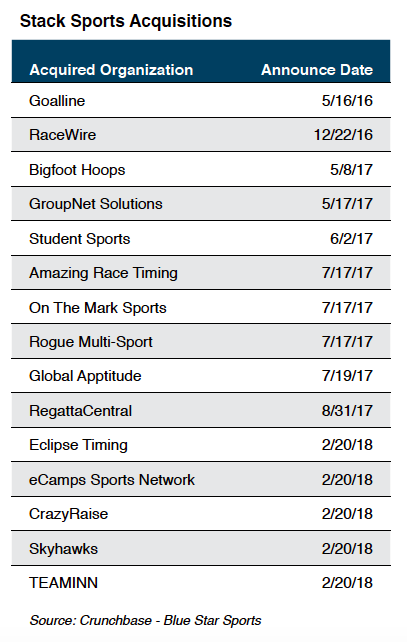

Originally named BlueStar Sports, Stack Sports began in April 2016 with the goal of transforming youth sports. With this goal in mind, Stack has acquired 20 companies as of July 2018 in order to provide a variety of services. Services provided by Stack Sports include league and competition management, athlete and team solutions, event solutions, brand advertiser solutions, and payment solutions. The company’s various tools include building team websites, online registration for leagues and tournaments, and software that analyzes game day video.

The accompanying chart was compiled using data from Crunchbase and shows Blue Star/ Stack acquisitions from May 2016 to February 2018.

Unikrn Acquires ChallengeMe.gg

Uinkrn is a Seattle based eSports betting startup. Founded in 2014 as a platform for eSports betting, Unikrn has since added hosting physical tournaments to its services. Mark Cuban, owner of the Dallas Mavericks is among the investors in the company.

ChallengeMe.gg is an eSports matchmaking service headquartered in Berlin, Germany. While an exact dollar amount was not disclosed, Unikrn CEO Rahul Sood said it was “a multi-million dollar acquisition.”

Nazara Technologies Acquires 55% Stake in Nodwin Gaming

Headquartered in Mumbai, Nazara aims to create a full eSports system including competitive online and offline play, localized leagues, and global events. Nodwin Gaming was started in 2014 and has exclusive rights for ESL (Esports League) in India, the Intel Extreme Masters qualifiers for India, and the Electronic Sports World Cup India Qualifiers. In acquiring a majority stake in Nodwin, Nazara hopes to leverage Nodwin’s relationships to create an Indian eSports ecosystem. India’s eSports audience is still developing with only 2 million enthusiasts and an additional 2 million occasional viewers according to market researchers Frost & Sullivan and Newzoo.

Unity Technologies Buys Multiplay for $25.2 Million

Multiplay is a division of UK-based Game Digital. Multiplay provides server hosting for games such as Titanfall 2, Day Z, Rocket League, and Rust. The terms of the deal provide that Unity pay $22.7 million at the time of acquisition (November 2017) and $2.5 million in July 2019. The Multiplay division includes a digital business and an eSports and events business.

Other Investments into Team Sponsorships

The growth of eSports has attracted the attention from high profile investors. For example, in November 2017 Jerry Jones along with John Goff acquired the eSports team Complexity. Complexity was founded in 2003 by Jason Lake and currently competes in six games: CS GO, DOTA 2, Call of Duty, Rocket League, HearthStone, and Gwent. Complexity will move facilities to The Star, which also houses the Dallas Cowboys World Headquarters in Frisco, Texas.

Magic Johnson and motivational speaker Tony Robbins partnered acquire ownership interest in Team Liquid, an eSports team based in Santa Monica, California. Another former Laker, Shaquille O’Neal is a co-owner of NRG eSports. The teams mentioned above compete with other eSports teams from around the world in various tournaments held throughout the year.

Conclusion

Esports is a relatively new industry with potential. Advances in streaming and mobile technology have allowed the industry to expand in recent years. Newzoo projects the global eSports audience will be approximately 557 million in 2021, a compound annual growth rate of 14.4% from 2016. In addition to a growing global audience, Newzoo projects global revenue for the eSports industry to reach $1.65 billion by 2021, a CAGR of 27.4% from 2016.

The potential growth has drawn interest from a wide range of investors as approximately 84% of 2021 global revenue is projected to be from brand investments such as media rights, advertising, and sponsorship.

Mercer Capital will continue to follow the industry and discuss the valuation issues facing the industry in future articles.

Originally published in Mercer Capital’s eSports: An Emerging Industry whitepaper.