Estate of Giustina v. Commissioner

Case Citation

Estate of Natale B. Giustina v. Commissioner, T.C. Memo 2011-141, June 22, 2011.

Summary of Key Issues

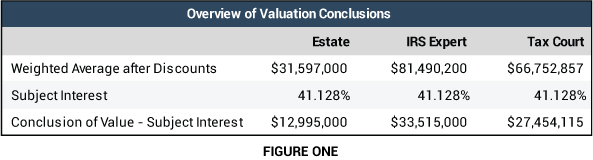

The Tax Court determined the value of a 41.128 percent limited partner interest in Giustina Land & Timber Company, an operating business limited partnership engaged in timberland operations as a going business. The underlying net asset value of the partnership substantially exceeded the capitalized earnings value. The Tax Court also determined the applicability of an accuracy-related penalty under Section 6662 of the Internal Revenue Code.

Key Take-aways

- The Court did not allow for tax-effecting the pretax earnings of this tax pass-through entity, since it determined that the discount rate was determined to be derived from pretax level rates of return.

- The Court modified (reduced) the discount rate in the Cash Flow method based on its own estimate of a partnership-specific equity risk premium.

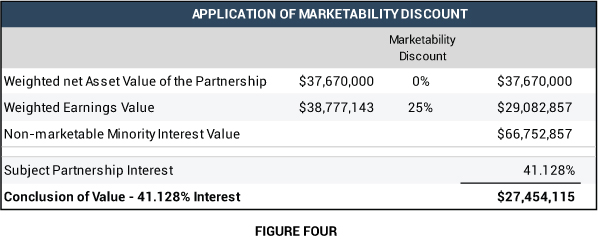

- There was a large spread between the capitalized Cash Flow value ($51.7 million) and the Net Asset value ($150.7 million). In dealing with the Net Asset value component, the Court did not allow for a minority interest discount (no lack of control discount) nor did they allow for a discount for lack of marketability. The Court stated that the inability to cause the sale of the timberland (for the 41.128% interest) was already reflected in the 25/75 percentage weighting, with only 25% allocated to Net Asset value. Further, no discount for lack of marketability was allowed in the Net Asset value method since the stipulated value of the timberland (the bulk of the assets) already included a 40% discount to reflect delays in selling the land. Yet, that 40% discount reflects the “inside assets” and does not appear to address a marketability discount for the security interest (the 41.128%) in the entity that holds those assets.

Background

Natale B. Giustina passed away on August 13, 2005, holding a 41.128% limited partnership interest in Giustina Land & Timber Company Limited Partnership (“Partnership”). The Partnership was formed effective January 1, 1990, and at the valuation date owned 47,939 acres of timberland in the area of Eugene, Oregon, and employed approximately 12 to 15 people.

The Partnership was engaged in growing trees, cutting them down, and selling the logs. The Partnership was governed by a written partnership agreement from the day the Partnership was formed, including several amendments.

The disparity among the three indications of value by the Estate, the IRS and the Tax Court are summarized below:

Commentary

The Estate and the IRS each provided expert testimony at trial.

The Estate relied on four approaches:

- Asset Accumulation method

- Cash Flow method

- Capitalization of Distributions method

- Guideline method (but not a Net Asset Value method).

The IRS relied on three approaches:

- Cash Flow method

- Guideline method

- Net Asset Value method.

Each expert applied different weights to their individual methods, but the Court determined that only two methods should be considered: the Cash Flow Method and the Net Asset Value method.

Asset Value Method

The parties were in agreement as to the value of the underlying real estate, and other Partnership assets. The value of the timberlands, which constitute most of the Partnership’s assets is agreed to be $142,974,438. The value includes a 40% discount for the delays attendant to selling the Partnership’s approximately 48,000 acres of timberland. Total assets of the Partnership were worth $150,680,000.

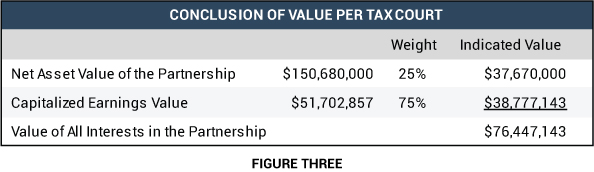

The Estate’s expert did not give weight to the Asset Value, while the IRS expert gave that value a 60% weighting. The Court concluded a 25% weighting to the asset value. Recognizing that the owner of a 41.128% interest could not alone cause the Partnership to sell the timberlands, the Court considered that there were various ways in which a voting block of limited partners with a two-thirds interest could cause the sale. Accordingly, while admitting some uncertainty, the Court estimated the probability of the sale at 25%. The Court did not apply any marketability discount to the asset value component.

Cash Flow Method

The Court did not find the IRS expert’s Cash Flow estimates to be persuasive, and essentially dismissed them.

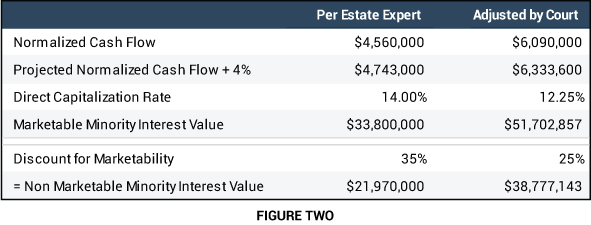

The Court focused on the Estate’s expert with regard to the Cash Flow analysis. This analysis extrapolated cash flow from five consecutive years. However, the expert reduced each year’s predicted cash flows by 25% to account for the income taxes that would be owed by the owner of the respective partnership interest. The Court found this inappropriate, since the expert’s discount rate was a pretax rate of return, not a post-tax rate of return. The Court further modified the expert’s discount rate from 18% to 16.25% by applying their own Partnership-specific equity risk premium. Based on the change in the calculation of cash flows and the change in the discount rate, the Court determined the marketable minority interest value of the Partnership at $51,702,857 by this method.

The Estate expert had applied a 35% discount for lack of marketability, while the IRS expert applied 25%, both derived from two types of studies: 1) restricted stock studies and 2) pre-IPO studies. Based on testimony that the pre-IPO studies tend to overstate the marketability discount, the Court adopted a marketability discount of 25%. After the application of the marketability discount, it was clear to the Court that there was a significant spread between the Asset Value and the Cash Flow value. Recognizing that disparity, and the possibility of actually achieving that value with a voting block of limited partners, the Court assigned a 25% weight to the Asset Value method and 75% to the Cash Flow method.

Conclusion of Value

Although the two experts considered other approaches, the Court relied upon only two: the Asset Value and Cash Flow. The Court did not apply the marketability discount to the Asset Value, but did apply the 25% discount for lack of marketability to the Cash Flow method, resulting in a non-marketable minority interest value at $66,752,857, or $27,454,115 for the 41.128% interest.

Prospective Penalty

The underpayment of tax on the Estate’s tax return resulted from its valuation of the 41.128% limited partner interest. The valuation was made in good faith and with reasonable cause. The estate was not held liable for the Section 6662 penalty.

Activist Court

The Court received the reports and testimony from two experts, and utilized its own perspective on value and risk outcomes to adjust the calculation of cash flows, the discount rate and the marketability discount.