Estate Planning When Bank Stocks Are Depressed

Maybe not for the best of reasons, the stars have aligned for bank investors who have significant interests in banks to undertake robust estate planning this year.

Bank stock valuations are depressed as a result of the recession that developed from the COVID-19 policy responses, including a return to a zero interest rate policy (“ZIRP”) that is now known as the effective lower bound (“ELB”). The result is severe compression in net interest margins (“NIMs”), while the extent of credit losses will not be known until 2021 or perhaps even 2022.

As shown in Figure 1, bank stocks have produced a negative total return that ranges from -27% for the twelve months ended September 25, 2020 for the SNL Large Cap Bank Index to -36% for the SNL Mid Cap Bank Index. At the other extreme are tech stocks. The NASDAQ Composite has produced a one-year total return of 35%–a 70% spread between the two sectors.

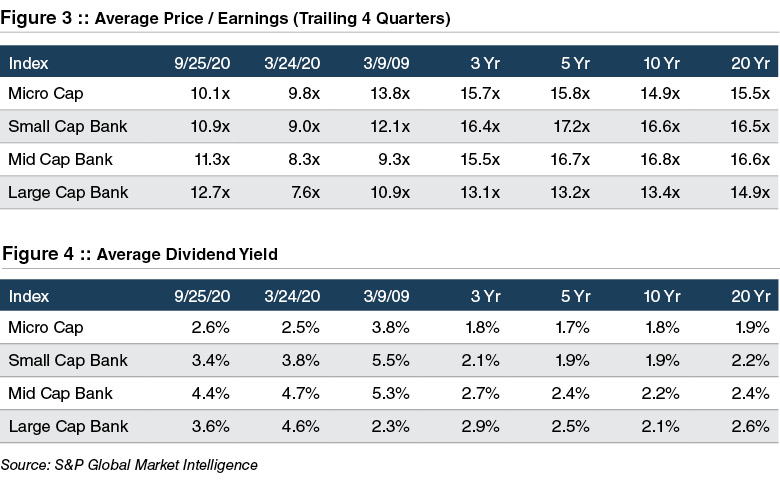

Valuations for banks are depressed and are comparable to lows observed on March 24, 2020 when market panic and forced selling by levered investors peaked and March 9, 2009 when investors feared a possible nationalization of the large banks. Price-to-tangible book value (“P/TBV”) multiples are presented in Figure 2, while price-to-earnings (“P/E”) ratios based upon the last 12-month (“LTM”) earnings are presented in Figure 3. (Note—while P/TBV multiples are little changed from March 24, 2020, P/E ratios have increased because reserve building and reduced NIMs have reduced LTM earnings).

No one knows the future, but assuming reversion to the mean eventually occurs bank stocks could rally as earnings improve once credit costs decline even if NIMs remain depressed, resulting in higher earnings and multiple expansion. Relative to ten-year average multiples based upon daily observations, banks are 30-40% cheap to their post-Great Financial Crisis trading history.

In effect, current gifting and other estate planning could lock in significant tax benefits assuming a Japan and Europe scenario does not develop in the U.S. where banks are “re-rated” and underperform for decades.

A second reason to consider significant estate planning transactions this year is the potential change in Washington if 2021 sees a Biden Administration backstopped with a Democrat-controlled Senate and House.

Vice President Biden’s proposed estate tax changes include the elimination of basis step-up, significant reductions to the unified credit (the amount of wealth that passes tax-free from estate to beneficiary) and gift tax exemption, and increasing current capital gains tax rates to ordinary income levels for high earning households. The cumulative effect of these changes is a substantial increase in high net worth clients’ estate tax liabilities if Biden’s current proposals become law.

Basis step-up is a subtle but important feature of tax law. Unusual among industrialized nations, in the United States the assets in an estate pass to heirs at a tax value established at death (or at an alternate valuation date). Even though no tax is collected on the first $11.6 million per person, the tax basis for the heir is “stepped-up” to the new value established at death. Other countries handle this issue differently, and Biden favors eliminating the step-up in tax basis. Further, he prefers taxing the embedded capital gain at death. Canada, for example, does this – treating a bequest as any other transfer and assessing capital gains taxes to the estate of the decedent.

Fortunately, there are several things bank shareholders can do now to minimize exposure to these potential tax law changes. Taking advantage of the current high-level of gift tax exemptions ($11.58 million per individual or $23.16 million per married couple) could save millions in taxes if Biden’s proposed lower exemption of $3.5 million per individual becomes law.

Other options include the formation of trusts or asset holding entities to transfer wealth to the next generation in a tax-efficient manner. Proper estate planning can mitigate the adverse effects of higher taxes on wealth transfers, but the window to do so may be closing if we have a regime change later this year.

Further, the demand (and associated cost) for estate planning services may go up significantly in November, so you need to apprise your clients of these potential changes before it’s too late.

In the 1990s, the unified credit (the amount of wealth that passes tax-free from estate to beneficiary) was only $650 thousand, or $1.3 million for a married couple. The unified credit was not indexed for inflation, and the threshold for owing taxes was so low that many families we now consider “mass-affluent” engaged in sophisticated estate tax planning techniques to minimize their liability.

Then in 2000, George W. Bush was elected President, and estate taxes were to be phased out. Over the past decade, the law has changed several times, but mostly to the benefit of wealthier estates. That $650 thousand exemption from estate taxes is now $11.6 million. A married couple would need a net worth of almost $25 million before owing any estate tax, such that now only a sliver of bank stock investors require heavy duty tax planning.

That may all be about to change.

Vice President Biden has more than gestured that he plans to increase estate taxes by lowering the unified credit, raising rates, and potentially eliminating the step-up in basis that has long been a feature of tax law in the United States.

Talk is cheap. But investors take heed; now may be the time to execute rather than plan.

Originally appeared in Mercer Capital’s Bank Watch, September 2020.