Evaporating Gains

Comments by Federal Reserve Board Chairman Ben Bernanke in the second quarter of 2013 resulted in significant increases in Treasury rates during the quarter, particularly for longer-term securities. In May, Bernanke testified before Congress and outlined the Fed’s eventual approach for exiting its accommodative monetary policy, which has included very low interest rates as well as purchases of mortgage-backed securities and Treasuries. Bernanke noted that the Fed would likely begin its exit strategy by gradually reducing asset purchases, prior to a focus on increasing interest rates. Prior releases by the Federal Open Market Committee indicated that rate increases likely will not begin until the unemployment rate has fallen below 6.5%, assuming inflation projections remain in line with longer-term goals. Bernanke’s comments before Congress suggest, however, that some tightening of monetary policy could come earlier, through the reduction in asset purchases. In response to Bernanke’s comments, longer-term interest rates began to tick up through May and into June.

On June 19th, Bernanke said in a press conference that the Fed could begin to reduce its asset purchases as early as the end of 2013 and could potentially cease such purchases in mid-2014. The near-term timeline for reducing asset purchases spurred a spike in interest rates that compounded the effect of the already-increasing trend in rates observed through May. Rates continued to exhibit volatility throughout the rest of June as markets reacted to Bernanke’s comments.

Treasury Rates

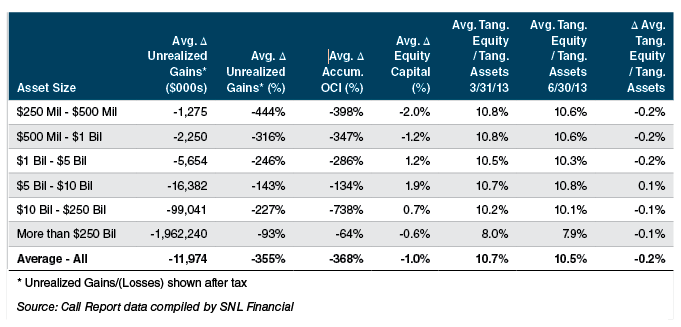

The interest rate increases in the latter part of second quarter resulted in the evaporation of unrealized gains in banks’ bond portfolios, which had been at very high levels given the persistently low rate environment. The table below summarizes the extent of losses in unrealized bond gains for banks in the second quarter. The number of banks with assets over $250 million reporting unrealized gains embedded in their bond portfolios fell from 1,985 at March 31, 2013 to 1,018, or 49% fewer, while the number of banks reporting embedded losses tripled from 477 to 1,427.

At March 31, 2013, banks reported unrealized gains representing an average of 1.97% of their total Available for Sale (“AFS”) portfolios. That figure declined to 0.84% at June 30, a decline in unrealized gains of 1.13% of total AFS. On average, banks lost more than 350% of reported amounts of unrealized gains embedded in bond portfolios, resulting in commensurate reductions in accumulated other comprehensive income. The impact of the lost AOCI on tangible equity, however, was moderated by the trend of improving earnings in the industry, and on average, equity capital declined by just 1%, while the average tangible equity/tangible assets ratio fell from 10.7% at March 31, 2013 to 10.5% at the end of second quarter.

The effect of volatility in unrealized bond gains may create fluctuations in tangible equity capital, but its effect on regulatory will be much more modest, given the recent issuance of the final Basel III capital rules, which require only banks with more than $250 billion in assets to include such gains in regulatory capital measures beginning in 2014. Most smaller banks will not be required to include unrealized gains in regulatory capital calculations, with the exception of banks with foreign exposures exceeding $10 billion.