Fairness Opinions – Evaluating a Buyer’s Shares from the Seller’s Perspective

Depository M&A activity in the U.S. has accelerated in 2021 from a very subdued pace in 2020 when uncertainty about the impact of COVID-19 and the policy responses to it weighed on bank stocks. At the time, investors were grappling with questions related to how high credit losses would be and how far would net interest margins decline. Since then, credit concerns have faded with only a nominal increase in losses for many banks. The margin outlook remains problematic because it appears unlikely the Fed will abandon its zero-interest rate policy (“ZIRP”) anytime soon.

As of September 23, 2021, 157 bank and thrift acquisitions have been announced, which equates to 3.0% of the number of charters as of January 1. Assuming bank stocks are steady or trend higher, we expect 200 to 225 acquisitions this year, equivalent to about 4% of the industry and in-line with 3% to 5% of the industry that is acquired in a typical year. During 2020, only 117 acquisitions representing 2.2% of the industry were announced, less than half of the 272 deals (5.0%) announced in pre-covid 2019.

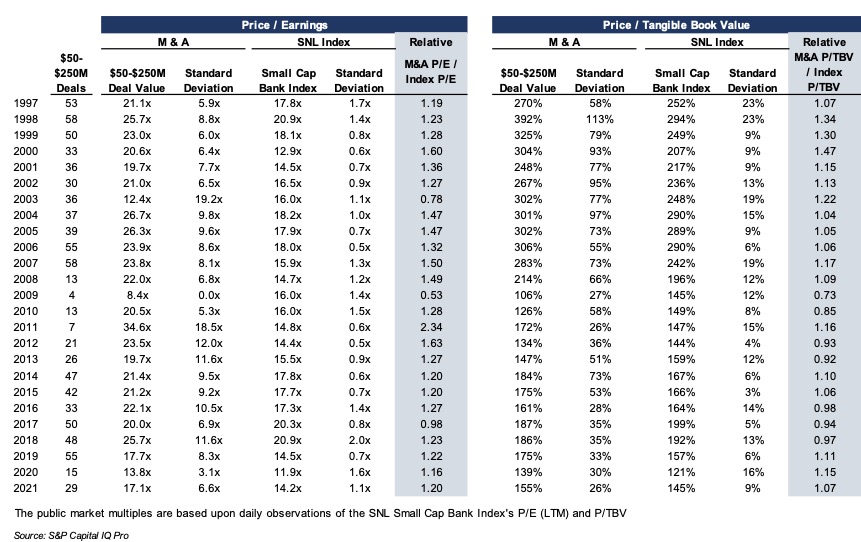

To be clear, M&A activity follows the public market, as shown in Figure 1. When public market valuations improve, M&A activity and multiples have a propensity to increase as the valuation of the buyers’ shares trend higher. When bank stocks are depressed for whatever reason, acquisition activity usually falls, and multiples decline.

Click here to expand the image above

The rebound in M&A activity this year did not occur in a vacuum. Year-to-date through September 23, 2021, the S&P Small Cap and Large Cap Bank Indices have risen 25% and 31% compared to 18% for the S&P 500. Over the past year, the bank indices are up 87% and 79% compared to 37% for the S&P 500.

Excluding small transactions, the issuance of common shares by bank acquirers usually is the dominant form of consideration sellers receive. While buyers have some flexibility regarding the number of shares issued and the mix of stock and cash, buyers are limited in the amount of dilution in tangible book value they are willing to accept and require visibility in EPS accretion over the next several years to recapture the dilution.

Because the number of shares will be relatively fixed, the value of a transaction and the multiples the seller hopes to realize is a function of the buyer’s valuation. High multiple stocks can be viewed as strong acquisition currencies for acquisitive companies because fewer shares are issued to achieve a targeted dollar value.

However, high multiple stocks may represent an under-appreciated risk to sellers who receive the shares as consideration. Accepting the buyer’s stock raises a number of questions, most which fall into the genre of: what are the investment merits of the buyer’s shares? The answer may not be obvious even when the buyer’s shares are actively traded.

Our experience is that some, if not most, members of a board weighing an acquisition proposal do not have the background to thoroughly evaluate the buyer’s shares. Even when financial advisors are involved, there still may not be a thorough vetting of the buyer’s shares because there is too much focus on “price” instead of, or in addition to “value.”

A fairness opinion is more than a three or four page letter that opines as to the fairness from a financial point of a contemplated transaction; it should be backed by a robust analysis of all of the relevant factors considered in rendering the opinion, including an evaluation of the shares to be issued to the selling company’s shareholders. The intent is not to express an opinion about where the shares may trade in the future, but rather to evaluate the investment merits of the shares before and after a transaction is consummated.

Key questions to ask about the buyer’s shares include the following:

Liquidity of the Shares – What is the capacity to sell the shares issued in the merger? SEC registration and NASADQ and NYSE listings do not guarantee that large blocks can be liquidated efficiently. OTC traded shares should be scrutinized, especially if the acquirer is not an SEC registrant. Generally, the higher the institutional ownership, the better the liquidity. Also, liquidity may improve with an acquisition if the number of shares outstanding and shareholders increase sufficiently.

Profitability and Revenue Trends – The analysis should consider the buyer’s historical growth and projected growth in revenues, pretax pre-provision operating income and net income as well as various profitability ratios before and after consideration of credit costs. The quality of earnings and a comparison of core vs. reported earnings over a multi-year period should be evaluated. This is particularly important because many banks’ earnings in 2020 and 2021 have been supported by mortgage banking and PPP fees.

Pro Forma Impact – The analysis should consider the impact of a proposed transaction on the pro forma balance sheet, income statement and capital ratios in addition to dilution or accretion in earnings per share and tangible book value per share both from the seller’s and buyer’s perspective.

Tangible BVPS Earn-Back – As noted, the projected earn-back period in tangible book value per share is an important consideration for the buyer. In the aftermath of the GFC, an acceptable earn back period was on the order of three to five years; today, two to three years may be the required earn-back period absent other compelling factors. Earn-back periods that are viewed as too long by market participants is one reason buyers’ shares can be heavily sold when a deal is announced that otherwise may be compelling.

Dividends – In a yield starved world, dividend paying stocks have greater attraction than in past years. Sellers should not be overly swayed by the pick-up in dividends from swapping into the buyer’s shares; however, multiple studies have demonstrated that a sizable portion of an investor’s return comes from dividends over long periods of time. Sellers should examine the sustainability of current dividends and the prospect for increases (or decreases). Also, if the dividend yield is notably above the peer average, the seller should ask why? Is it payout related, or are the shares depressed?

Capital and the Parent Capital Stack – Sellers should have a full understanding of the buyer’s pro-forma regulatory capital ratios both at the bank-level and on a consolidated basis (for large bank holding companies). Separately, parent company capital stacks often are overlooked because of the emphasis placed on capital ratios and the combined bank-parent financial statements. Sellers should have a complete understanding of a parent company’s capital structure and the amount of bank earnings that must be paid to the parent company for debt service and shareholder dividends.

Loan Portfolio Concentrations – Sellers should understand concentrations in the buyer’s loan portfolio, outsized hold positions, and a review the source of historical and expected losses.

Ability to Raise Cash to Close – What is the source of funds for the buyer to fund the cash portion of consideration? If the buyer has to go to market to issue equity and/or debt, what is the contingency plan if unfavorable market conditions preclude floating an issue?

Consensus Analyst Estimates – If the buyer is publicly traded and has analyst coverage, consideration should be given to Street expectations vs. what the diligence process determines. If Street expectations are too high, then the shares may be vulnerable once investors reassess their earnings and growth expectations.

Valuation – Like profitability, valuation of the buyer’s shares should be judged relative to its history and a peer group presently and relative to a peer group through time to examine how investors’ views of the shares may have evolved through market and profit cycles.

Share Performance – Sellers should understand the source of the buyer’s shares performance over several multi-year holding periods. For example, if the shares have significantly outperformed an index over a given holding period, is it because earnings growth accelerated? Or, is it because the shares were depressed at the beginning of the measurement period? Likewise, underperformance may signal disappointing earnings, or it may reflect a starting point valuation that was unusually high.

Strategic Position – Assuming an acquisition is material for the buyer, directors of the selling board should consider the strategic position of the buyer, asking such questions about the attractiveness of the pro forma company to other acquirers?

Contingent Liabilities – Contingent liabilities are a standard item on the due diligence punch list for a buyer. Sellers should evaluate contingent liabilities too.

The list does not encompass every question that should be asked as part of the fairness analysis, but it does illustrate that a liquid market for a buyer’s shares does not necessarily answer questions about value, growth potential and risk profile. The professionals at Mercer Capital have extensive experience in valuing and evaluating the shares (and debt) of financial and non-financial service companies garnered from over three decades of business. Give us a call to discuss your needs in confidence.