First Republic Bank & The Asymmetry of Banking

First Republic Bank’s first quarter 2023 earnings release said little, yet little needed to be said. The balance sheet “repositioning” induced by the deposit run is almost incomprehensible. Deposits at March 31, 2023, excluding the $30 billion placed by the biggest U.S. banks, fell to $74 billion, which is modestly below FRC’s year-end 2018 deposits. That is, four years of deposit growth was reversed in three weeks. Noninterest-bearing deposits dropped to $20 billion, thereby falling to a level last reported in 2016.

FRC illustrates the asymmetry of banking. Rising shareholder value results from the slow, grinding agglomeration of decisions made over years. The business model does not create overnight riches. However, that accumulation of value can unravel in an instant. The downside exposure results, in part, from the leverage inherent in banking’s business model. It is difficult to identify a more pure of this asymmetry between the gradual creation of value and its precipitous destruction than FRC.

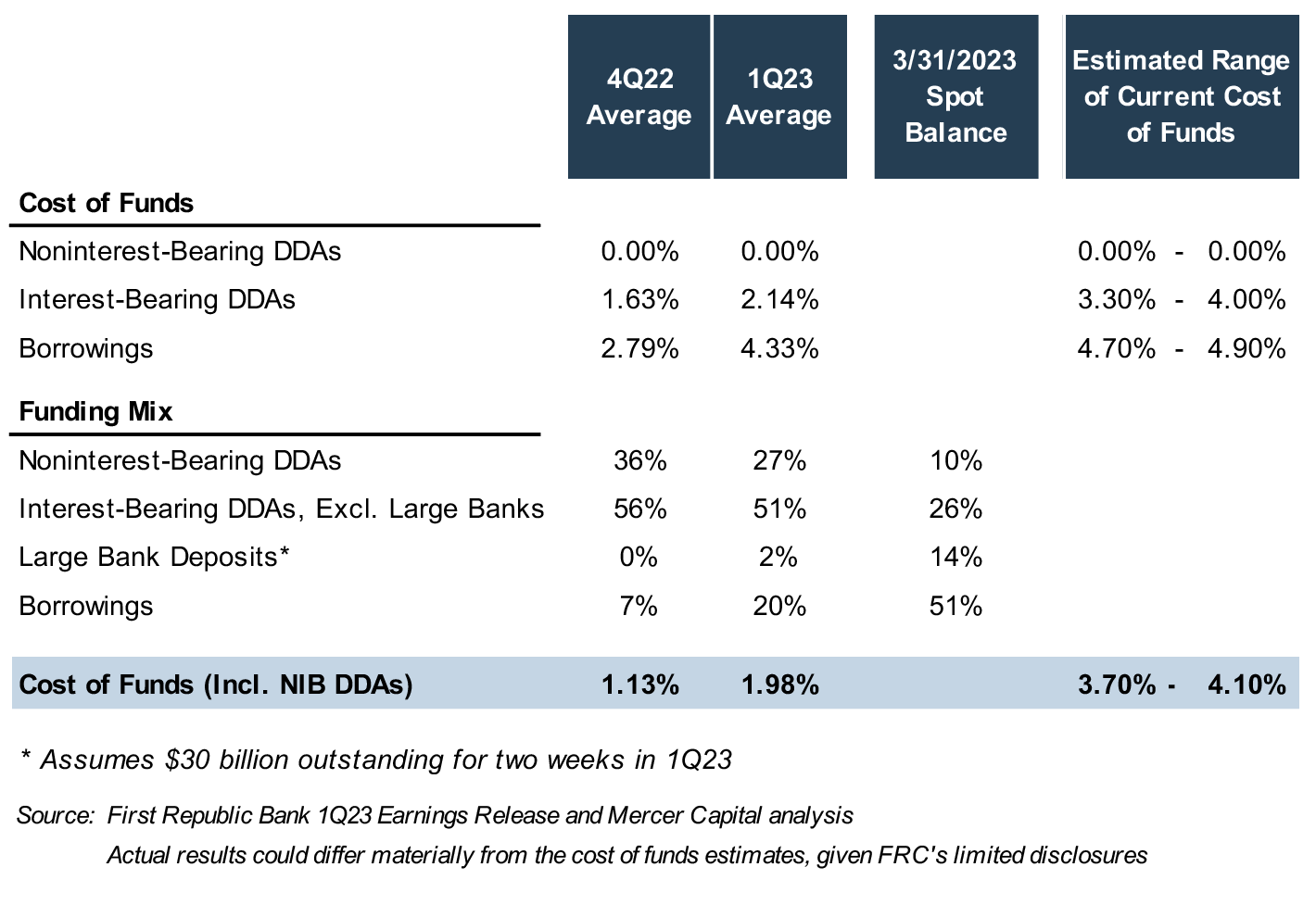

FRC did not disclose its post-run cost of funds, nor has the rate paid on the $30 billion deposited by large banks been disclosed to our knowledge. Using FRC’s paltry disclosures and our best estimates, the table on the right provides a rough approximation of FRC’s current cost of funds. We caution that, among other uncertainties, further contraction of noninterest-bearing deposits would cause even more funding cost pressure.

FRC’s yield on earning assets expanded by 15 basis points to 3.66% in the first quarter of 2023, as a 20 basis point expansion in the yield on loans (to 3.73%) was offset, in part, by an unexplained 29 basis point decline in the securities

portfolio yield.

The current yield on earning assets presumably is higher than in the first quarter of 2023 due to the continued (slow) repricing of loans and higher balances held at the Federal Reserve, but any such yield expansion is likely inadequate to produce a current net interest margin significantly greater than zero.

Interestingly, FRC did not recognize a valuation allowance against its net deferred tax asset, implying that it continues to believe the tax assets will be recoverable. Also, it maintained the held-to-maturity classification of most securities, indicating that recent events have not affected its intent and ability to hold the investments to maturity.

At the larger banks that funded the $30 billion deposit, we imagine that corporate development staff have been furiously creating scenarios over the last few weeks to preserve as much value as possible at FRC. The circumstances surrounding FRC are a throwback to the S&L crisis in which abundant—and quite creative—financial engineering was deployed. Remember supervisory goodwill? We will see what’s pulled out of the toolbox this time, if it’s not emptied entirely, to develop a solution for FRC’s woes.