Four Reasons to Consider a Stock Repurchase Program

Bank stocks rallied in the first few weeks of November 2020 as the market’s Thanksgiving dinner came early, and it digested several issues including positive news on the COVID-19 vaccine candidates. While significant uncertainty still exists on credit conditions, COVID-19, and the economic outlook, bank valuations and earnings expectations also benefitted from the yield curve steepening as evidenced by the 10-year Treasury moving up from ~50 bps in early August to ~85 bps in mid-November.

Despite the recent rise in bank stock pricing, bank stock valuations are still depressed relative to pre-COVID levels as a result of the recession that developed from the pandemic and ensuing policy responses. A primary headwind for banks is the potential compression in net interest margins (“NIMs”) following a return to a zero interest rate policy (“ZIRP”) that is now known as the effective lower bound (“ELB”). Additionally, credit risk remains heightened for the sector compared to pre-pandemic levels as the extent of credit losses resulting from the pandemic and economic slowdown will not be known until 2021 or perhaps even 2022.

Amidst this backdrop, many banks and their directors are evaluating strategic options and ways to create value for shareholders. While the Federal Reserve has prohibited the largest U.S. banks from share repurchases, the current environment has prompted many community banks to announce share buyback plans. According to S&P Global Market Intelligence, more than forty U.S. community banks announced buyback plans in the third quarter and the trend has continued in the fourth quarter with another 36 buyback announcements, including new plans, extensions of existing plans, and reinstatements of previously suspended plans, in October. In our view, there are four primary reasons that many community and regional banks are announcing or expanding share repurchase programs in the current environment.

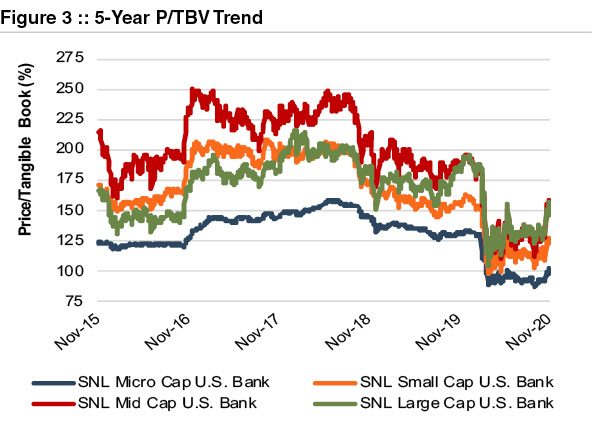

1) Valuations are Lower Relative to Historical Levels

Since the onset of the COVID-19 pandemic, the banking sector has underperformed the broader market due to concerns on credit quality and a prolonged low-interest rate environment. Despite the November rally, bank stocks are still trading at lower multiples than observed in recent years. Furthermore, many banks are finding themselves with excess liquidity in light of weaker loan demand and growing deposits.

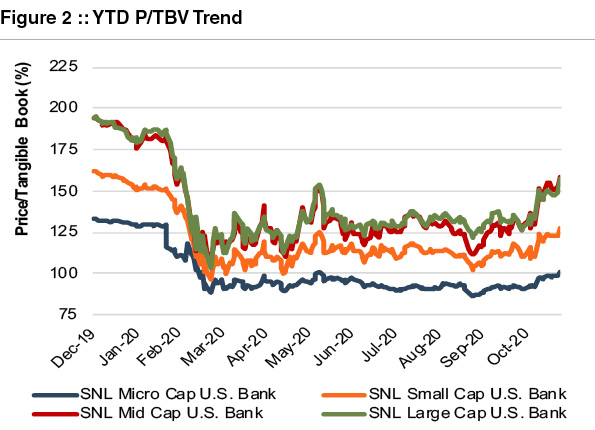

In a depressed price environment, share repurchases can be a favorable use of capital, particularly when pricing is at a discount to book value and is accretive to book value per share. As shown in the chart below, the average P/TBV multiple has declined for all of the SNL market capitalization bank indices since the beginning of 2020. The decline has been most pronounced for the Micro Cap index, with the average P/TBV multiple for banks with a total market capitalization of less than $250 million falling from 133% to 102%.

2) Favorable Tax Environment for Shareholders Seeking Liquidity

Capital gains tax rates are low relative to historical levels and the potential for higher capital gains tax rates has risen under President-elect Biden. As part of his tax plan, Biden has proposed increasing the top tax rate for capital gains for the highest earners from 23.8% to 39.6% (akin to ordinary income levels), which would be the largest increase in capital gains rates in history. While the ability for Biden’s tax plan to become reality is uncertain, many community banks have an aging shareholder base with long-term capital gains and it is an issue worth watching and planning for as poor planning can leave significant tax consequences for the shareholder or his or her heirs. A share repurchase program can provide liquidity to shareholders who may be apt to take advantage of the current capital gains rates that are low by historical standards and lower than the rates proposed by President-elect Biden.

3) Relatively Low Borrowing Costs and Sufficient Capital for Many Community Banks

Despite the unique issues brought about by the pandemic and the uncertain economic outlook, many community banks are well capitalized and have “excess” capital at the bank level and perhaps even an unleveraged holding company. We have written previously about the idea of robust stress testing and capital planning given the economic environment but note that a recent survey indicated that most bankers believe capital levels are sufficient to weather the economic downturn. Our research also indicates that rates on subordinated debt issuances issued in September of 2020 averaged ~5% compared to ~6% average for 2018 and 2019. These lower borrowing costs and ample capital for many banks in combination with lower share prices enhance the potential internal rate of return for share repurchases when compared to other strategic alternative uses of capital.

4) Enhancing Shareholder Value and Liquidity

Board members and management teams face the strategic decision of allocating capital in a way that creates value for shareholders. Potential options include growing the balance sheet organically or through acquisition (perhaps a whole bank or branch), payment of dividends, or a stock repurchase program. While M&A has been a constant theme, activity has slowed during the COVID-19 pandemic and Bank Director’s 2021 Bank M&A Survey noted that only ~33% say their institution is likely to purchase a bank by the end of 2021, which was down from the prior year’s survey (at ~44%). Key challenges to M&A in the current environment include conducting due diligence and evaluating a seller’s loan portfolio in light of COVID-19 impacts and economic uncertainty.

Organic loan growth expectations have also been muted for many banks in light of the economic slowdown resulting from COVID-19. With organic and acquisitive balance sheet growth appearing less attractive for many banks in the current environment, dividends and share repurchases have climbed up the strategic option list for many banks. A share repurchase program can have the added benefit of enhancing liquidity and marketability of illiquid shares, which potentially enhances the valuation of a minority interest in the bank’s stock.

Conclusion

If your bank’s board does implement a share repurchase program, it is critical for the board to set the purchase price based upon a reasonable valuation of the shares. While ~5,000 banks exist, the industry is very diverse and differences exist in financial performance, risk appetite, growth trajectory, and future performance/outlook in light of the shifting landscape. Valuations should understand the common issues faced by all banks – such as the interest rate environment, credit risk, or technological trends – but also the entity-specific factors bearing on financial performance, risk, and growth that lead to the differentiation in value observed in both the public and M&A markets.

At Mercer Capital, valuations are more than a mere quantitative exercise. Integrating a bank’s growth prospects and risk characteristics into a valuation analysis requires understanding the bank’s history, business plans, market opportunities, response to emerging technological issues, staff experience, and the like.

For those banks considering a share repurchase program, Mercer Capital has the experience to provide an independent valuation of the stock that can serve to assist the Board in setting the purchase price for the share repurchase program.

Originally appeared in Mercer Capital’s Bank Watch, November 2020.