FreightTech Update

Automated Trucks, VC Frenzy, and the Rise of Brokerages

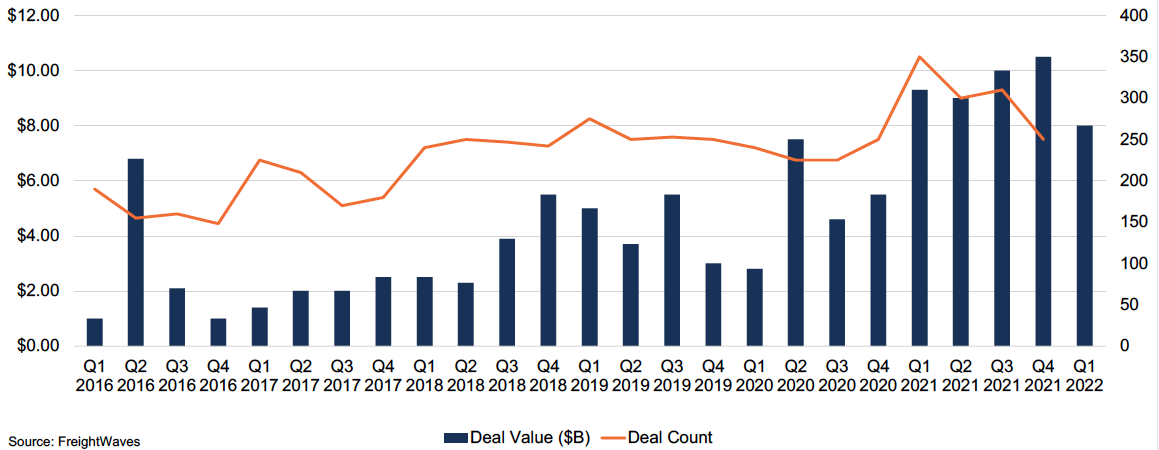

The COVID-19 pandemic brought economic hardship to many. The second quarter of 2020 might go down as one of the quickest economic downturns ever recorded. However, in an effort to protect the economy, the Fed created an extremely hospitable environment for venture capital, and with the glaring supply chain issues, FreightTech became a cushy landing place for investor’s money. We have written about venture capital and FreightTech before, and it has only gotten bigger since then.

In the fourth quarter of 2020, American and European FreightTech companies raised a combined $4.1 billion from venture capitalists. This was a 21% increase quarter-over-quarter, and an increase of 49% on an annual basis. In less than twelve months, 2020 went from a dark and gloomy place for businesses to a 4th of July fireworks parade, during which $12.6 billion was poured into 555 deals in America and Europe.

The parade continued marching into 2021, with average pre-money valuations increasing by 28.4% to $30 million, and late-stage valuations increasing by 95.3% to $120 million. During these six quarters, companies like Loadsmith continued to introduce digital technologies that seek to revolutionize the brokerage industry and allow smaller brokerages and 3PLs to compete with the largest asset-based carriers.

Click here to expand the image above

Self-driving trucks have also remained a point of focus. Though one of our clients maintains that self-driving trucks are “always ten years away,” they are the holy grail of FreightTech. The trucking industry has long struggled with an exodus of workers, and during COVID a large portion of its aging labor force decided to either retire due to fears of contracting the virus or moved on to less-regulated sectors. To prevent driver shortages and reduce turnover, many companies are increasing driver pay. For example, Walmart began paying their drivers $110,000 in their first year. With a fleet of 12,000 drivers, that is a very expensive endeavor, so it is no surprise that companies like TuSimple, that develop self-driving trucks, already have deals in place with ready-to-pay customers. The CEO of Werner Enterprises was quoted as saying that “We look forward to building a hybrid world where drivers continue to haul freight while autonomous trucks supplement rising demand,” showing that self-driving freight modes are no longer only a fantasy of Silicon Valley, but a future of the industry.

Despite all the positive growth between the third quarter of 2020 and the fourth quarter of 2021, the proverbial truck ran into a roadblock. As the Federal Reserve increased interest rates in its efforts to tame inflation, the first quarter of 2022 recorded decreases of 3.6% and 20.4% on a quarterly and annual basis, respectively. Startups raised only $14 billion. The number of IPO listings decreased dramatically, alongside the average valuations of FreightTech firms.

While the number of new FreightTech startups has decreased, an opportunity in the form of higher gas prices, created by the Russia-Ukraine conflict, emerged. High gas prices have made electric vehicles much more attractive both to the consumer as well as the manufacturers. Ford begun production on the first ever electric pickup truck (beating Tesla’s Batmobi…excuse me Cybertruck to the punch), and GM has promised to release its own fully electric truck in the spring of 2023. Artificial intelligence has also evolved in the FreightTech world, running robots in warehouses (which exponentially increases efficiency in over-capacity facilities) and even analyzing space and creating the mathematically most optimal way of storing items in a container for maritime shipping.

Even though the current economic outlook can appear somewhat gloomy, the transportation sector can still expect money to be available for startups, though it might be harder to get. Ryan Schreiber, Vice President of Growth and Industry for supply chain consultant Metafora stated that “One founder described it to me as saying in early ’21, if you had any revenue, you could raise and at a valuation you preferred,” compared to the current situation where “You’ve got to have a $1.5 million annual recurring revenue, and you are going to be grateful to get any valuation.” Schreiber advises FreightTech firms to not burn through their runway, and to not sell equity unless for a very good reason.

There is also good news for FreightTech entrepreneurs. A McKinsey survey revealed that 77% of supply chain executives intend on investing in supply chain visibility, among other things. That combined with the growth of the e-commerce industry, it is fair to anticipate a decent amount of investment to still be poured into the sector.

The best inventions often came from times of crisis. Nuclear fission was invented during World War II, antiseptic disinfectant was invented to stop a cholera epidemic in Germany, and in the midst of the ‘08 financial crisis, Beyonce released her hit single “Single Ladies.” So it is no surprise that the COVID-19 pandemic and the Russia-Ukraine war have sparked a new wave of innovation in the FreightTech industry. And while, perhaps, startups are no longer getting as much funding as they did in 2021, it is clear that it will remain a hot sector for as long as we face supply chain bottlenecks and restrictions.