“I’m Not Broke. I’m Just Not Liquid.”

When confronted about falling behind on child support payments and the pending foreclosure of his 109-room mansion, Evander Holyfield, a former world heavyweight boxing champion, explained that he faced a liquidity crisis, not an issue of solvency. It is an apt metaphor for the ructions that began on March 8, 2023 when Silvergate Bank announced its intent to return depositor funds and wind-down. The astonishing events of the last few weeks are illustrated by a few numbers:

- $42 billion: The deposits reportedly withdrawn from Silicon Valley Bank after its failed capital raise, representing one-quarter of its year-end 2022 deposits.

- $109 billion: The peak Federal Reserve borrowings by First Republic Bank between March 10, 2023 and March 15, 2023, representing one-half of its year-end 2022 total assets1

- $147 billion: The increase in borrowings under the Federal Reserve’s Primary Credit and Bank Term Funding Program between March 8, 2023 and March 22, 2023.2

- $304 billion: The debt issued by the FHLB system between March 13, 2023 and March 17, 2023 consisting of notes that mature in less than a year and longer-term bonds. The $151 billion of longer-term bonds issued that week outstripped the monthly issuances for January and February of $130 billion and $50 billion, respectively. Outstanding FHLB advances are believed to exceed the levels observed in the 2008-09 financial crisis.3

A number of factors contributed to the recent bank failures, as well as the severe pressure on the stocks of certain banks that investors perceive as having similar issues. It’s a bit like a blues song where not one thing befalls the protagonist, but rather a cascading series of events leads to turmoil — like when the protagonist’s woman leaves him and also takes the dog. As Taj Mahal sings:

She caught the Katy

And left me a mule to ride…4

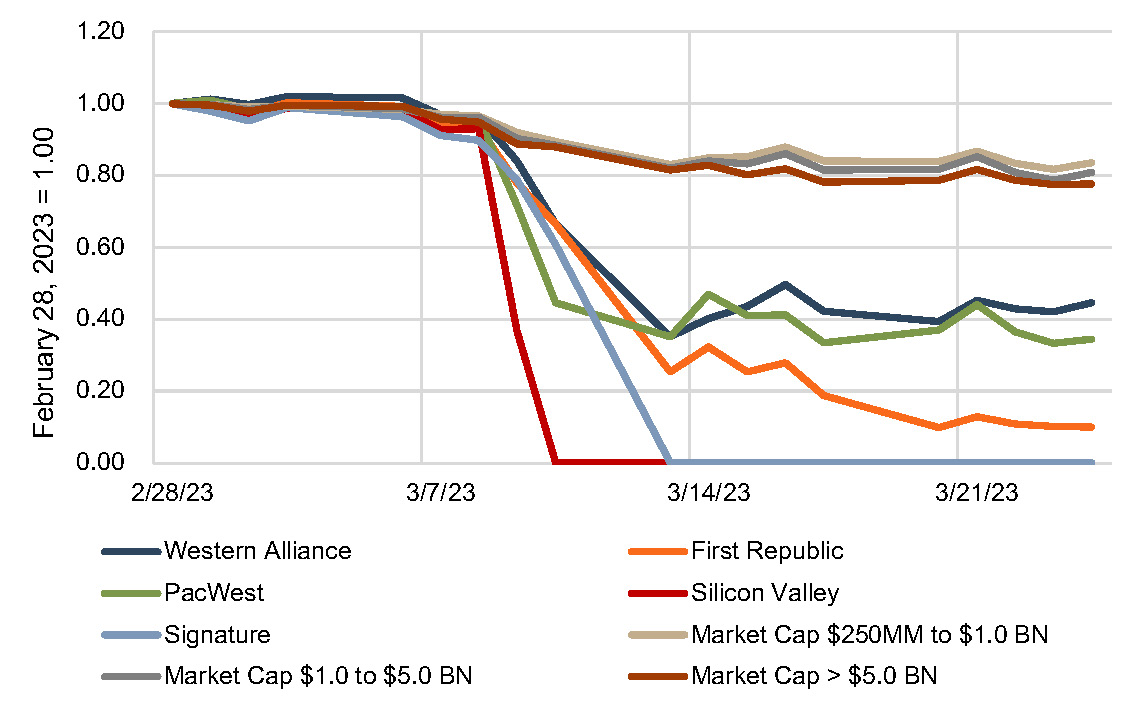

Figure 1 provides the market backdrop for March 2023, with various bank indices declining approximately 20% through March 24, 2023. We also include several banks in the market’s line of fire, including First Republic, PacWest, and Western Alliance.

Figure 1 :: Market Backdrop (March 2023)

Are Banks Broke?

While Evander, on a self-reported basis, was solvent, the issue is complicated for the banking industry. We start by defining insolvency as a bank’s assets being worth less than its liabilities. Media reports fixate on unrealized securities losses, but from a valuation perspective, a bond maturing in ten years with a 3% rate is not much different than a loan with a similar structure (putting aside credit risk). However, this analysis overlooks an important asset that is not recognized on the balance sheet—the value of the bank’s deposit portfolio.

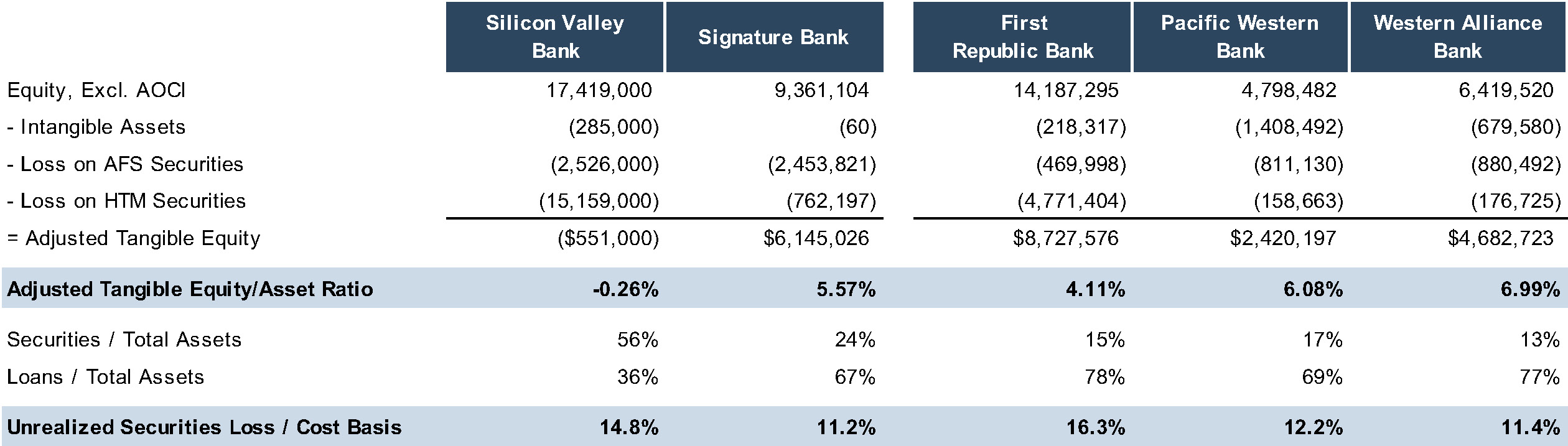

Figure 2 presents the tangible common equity/asset ratios for selected banks. While SVB’s bond portfolio duration and reliance on large dollar demand deposits no doubt were issues in its collapse, its balance sheet composition—with securities comprising 56% of total assets—contributed to the frenzy regarding SVB’s financial condition. If other banks had assets with observable prices equal to 56% of total assets, they might be in the same pickle. Note that SVB’s unrealized loss on securities (14.8%) is not the highest among these five banks.

Figure 2:: Tangible Common Equity/Asset Ratios For Selected Banks

Click here to expand the image above

In our opinion, it is a sideshow to focus on only one component of the balance sheet — the securities portfolio—to determine solvency or skill at avoiding the effects of rising interest rates. From our client work, we suspect that unrealized “losses” on loans are lower than for securities (as a percentage of cost basis), due to a shorter duration. However, in dollar terms the unrealized losses likely are significant vis-à-vis equity. Sharply higher deposit portfolio values and strong capital positions, which offset the downward loan and securities adjustments, suggest that most banks are not insolvent. However, even if most banks are not insolvent, headwinds remain. The risk of a ruinous deposit run that crystallizes losses is now a risk the market must discount. Larger unrealized losses on assets imply longer asset durations, which place net interest margins at risk if depositors become more rate sensitive. Last, M&A remains difficult to accomplish, as mark-to-market accounting effectively realizes a target’s unrealized losses.

A Failed Capital Raise

Into the febrile environment following Silvergate Bank’s announced wind-down, SVB launched a capital raise. While media reports indicate that a lead investor had been arranged and Goldman Sachs had soft orders for the remaining securities, the announcement of the offering—followed soon after by news of its difficulties—caused depositors to lose confidence in SVB’s financial strength and start the run on the bank. The failed offering raises several questions. First, was it a mistake to attempt the transaction in the immediate aftermath of Silvergate’s announced wind-down? Second, if SVB’s capital raise had closed before the bond portfolio restructuring was announced, would the deposit run even had occurred?

Across the Atlantic, Credit Suisse’s forced marriage to UBS led to the write-off of its contingent convertible (“CoCo”) bonds, with the CoCo holders faring worse than Credit Suisse’s shareholders. This inversion of the normal capital structure hierarchy, with shareholders faring better than some debtholders, caused yields to spike on CoCo bonds as the market repriced the risk of CoCo bonds. This raises a capital issue for some global banks. If stock prices are depressed and CoCo bonds are exorbitantly expensive to issue, then the only other capital raising alternative is to limit balance sheet growth with its attendant macroeconomic costs.

After SVB and Signature failed, First Citizens Bank purchased $72 billion of SVB loans at a $16.5 billion discount (23%) and Flagstar Bank purchased $12.9 billion of loans at a $2.7 billion discount (21%).5 While the nature of these loans was not disclosed, we assume that most of the discount was attributable to interest rate adjustments rather than credit exposure given the failed banks’ relatively low level of nonaccrual and delinquent loans at year-end 2022. Even if the FDIC was a distressed seller, the discounts indicate the potential capital hole that may exist in troubled banks as all the assets are marked to market.

These circumstances surrounding distressed banks point to difficulties in resolving interest rate induced solvency issues through additional capital. This differs from the Great Financial Crisis when the balance sheet problems could be isolated to, for example, land loans that represented 10% of total loans. In the current environment, “risk-free” assets like government bonds contribute significantly to solvency concerns; thus, a much larger proportion of a bank’s assets is underwater—though many of the assets are at no risk of credit loss.

Even if capital can be raised without triggering a deposit run, an offering that increases total equity by, say, 10% could be inadequate to resolve the market’s concern about capital and diminished earning power. The only remaining alternative for banks that become troubled is to backstop the banking system with liquidity in the hope that (a) banks have sufficient asset yields to cover higher funding costs, thus allowing them to gradually replace low yielding assets and/or (b) rates decrease.

Deposits Flow Out Faster than Back-Up Liquidity Flows in

Another perplexing thread in the story is the inability of SVB and Signature to access timely back-up sources of liquidity. As withdrawals accelerated in the afternoon of Thursday, March 9th, SVB sought funding from the FHLB and then the Fed. SVB missed an afternoon cutoff to process a large FHLB advance. Then, SVB attempted to transfer excess collateral from the FHLB to the Fed, but SVB’s transfer could not be processed before the Fed’s deadline. This left SVB with a negative cash balance of $1 billion on March 9th, leading to its closure the next day.6 Signature also faced issues borrowing from the FHLB as its deposit run intensified on March 10th. A request over the weekend to borrow $20 billion from the Fed was rejected, leading to Signature’s failure.7

An enduring question is whether these two failures had to happen, at least when they did. Not to diminish the financial issues involved, but depositors and the Fed/FHLB were moving at different speeds. It also is difficult to square Signature’s rejection by the Fed with First Republic obtaining, at one point, $109 billion from the Fed. This situation has some parallels to the Fed saving Bear Stearns but allowing Lehman Brothers to fail.

The Fed as Liquidity Provider and Liquidity Drainer

The Fed and FHLB have been essential in stabilizing the banking system, but the Fed’s reverse repo facility, used since 2013 to conduct monetary policy, also contributes to the volatility. Now, money market funds can park client funds at the Fed. Not only do these funds generate higher yields than most bank deposit accounts, but there is virtually no risk of the Fed collapsing. Therefore, uninsured depositors have the best of both worlds—higher yields than traditional deposit accounts and lower risk. Indeed, money market funds experienced inflows of $121 billion during the week that SVB failed.

Bill Dudley, a former president of the New York Fed, warned that allowing money market funds to access the Fed’s balance sheet could cause the “disintermediation of the financial system.” While depositors have not done this en masse, it suggests potential unintended consequences of current monetary policy.8

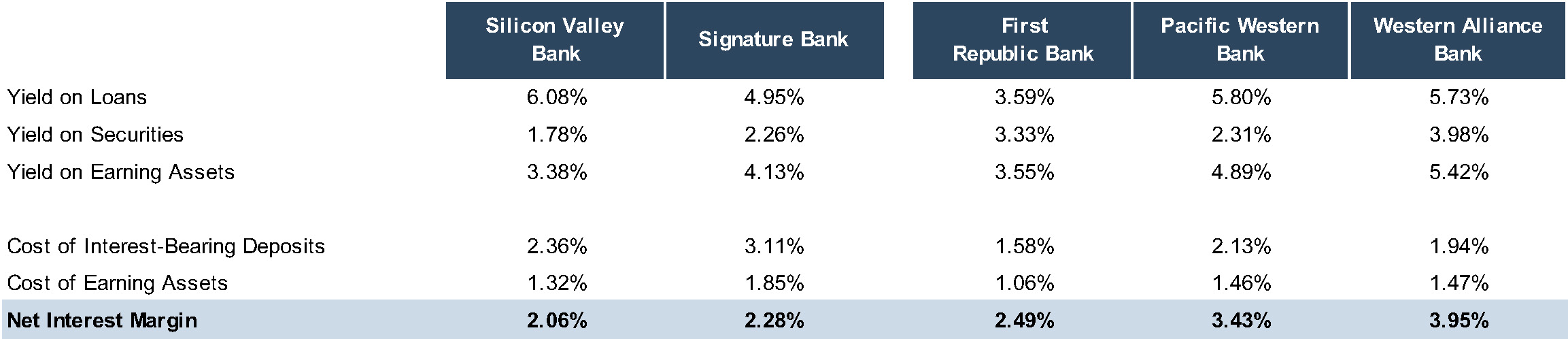

Mounting NIM Pressure

Even if SVB and Signature had been rescued, the rates on replacement funding for the deposit outflows likely would have exceeded their asset yields as may be the case with First Republic. As indicated in Table 2, the fourth quarter 2022 yield on earning assets was only 3.38% for SVB and 4.13% for Signature. Instead of an immediate failure, a low or negative NIM would have eroded capital. Did the banks have sufficient capital to absorb this gradual capital erosion while waiting for rates to decline? Given their asset durations, SVB’s and Signature’s failures may have been inevitable. PacWest and Western Alliance appear better positioned to handle the cost of replacing deposit outflows at market rates, while First Republic’s position is tenuous.

Both Silvergate and SVB cited NIM pressure, rather than deposit withdrawals, as the reason for liquidating securities. Silvergate’s CEO addressed an analyst question as follows:

Not knowing whether the deposit withdrawals were going to be temporary, we borrowed against our securities portfolio. That’s what it was there for. It was all pledgeable, high quality, and so we borrowed against it. But then to your point, when you’re borrowing, you’re borrowing at current rates, right? So if the securities portfolio was yielding a lower level at the end of the third quarter because it had been put in place and some of it was longer duration put in place in the past, then you could just connect the dots, right? We were borrowing at a higher level all in because the Fed had been raising rates so rapidly during 2022.

… How do we make sure we’re protecting the future capital? Well, it’s by selling the longest duration right now so that we can preserve the earnings power….9

SVB’s investor presentation regarding its capital raise described the transaction’s rationale as follows:

Today, we took strategic actions to strengthen our financial position–repositioning SVB’s balance sheet to increase asset sensitivity to take advantage of the potential for higher short-term rates, partially lock in funding costs, better protect net interest income (NII) and net interest margin (NIM), and enhance profitability. 10

The situation with NIMs for SVB, Signature, and First Republic is reminiscent of the S&L crisis. Fortunately, most banks have higher asset yields than this trio. This suggests several lessons. First, the gap between the rates on core deposits (1.58% for First Republic’s interest-bearing deposits, for example) and wholesale borrowings means that large core deposit losses can quickly devolve into severe NIM erosion, despite the most robust asset/liability modeling. Second, uncertainty will continue to cloud the outlook for banks with low yielding, long-term assets for which NIM preservation is reliant on depositors remaining insensitive to higher rates available elsewhere.

Figure 3 :: Yields, Cost of Funds, and Margins For Selected Banks

Click here to expand the image above

Some Historical Perspective

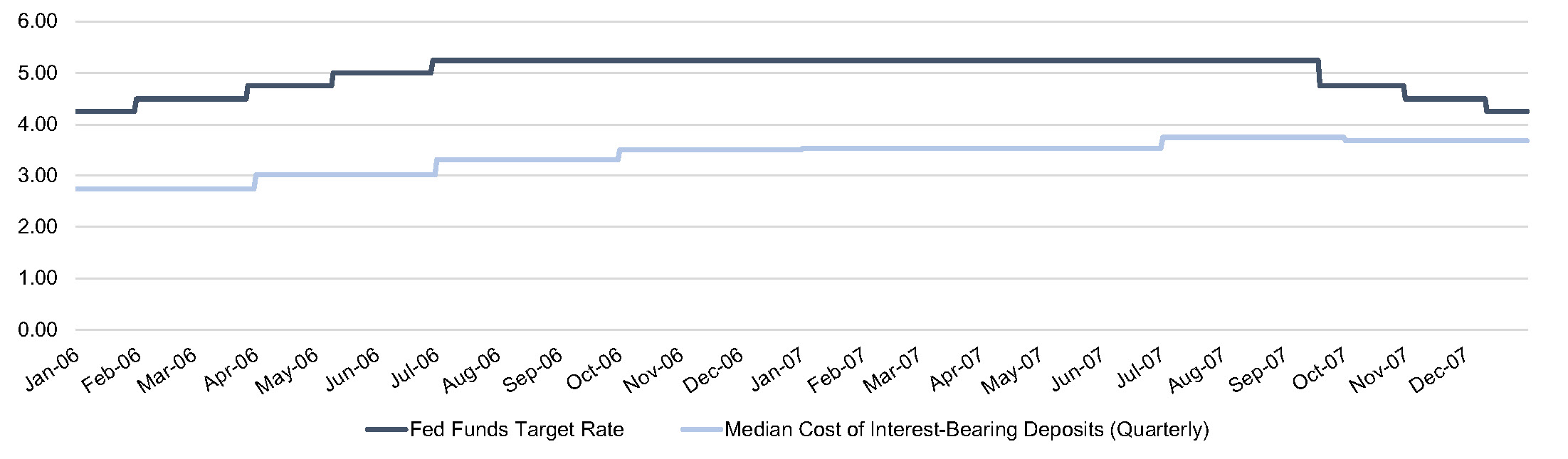

The current rate environment is not unprecedented, but memories have faded as the long bull market for bonds continued unimpeded. In 2006 and 2007, the Fed Funds target rate remained in the 5% range, similar to the current target rate. Mercer Capital obtained data for banks with year-end 2022 total assets between $100 million and $3 billion that reported historical financial data over the entire period from 2000 to 2022.

During the 2006 to 2007 period, this group of banks reported a median cost of interest-bearing deposits in the 3.50% range.

Figure 4 :: Progression of the Fed Funds Target Rate (Jan. 2006 – Dec. 2007)

Click here to expand the image above

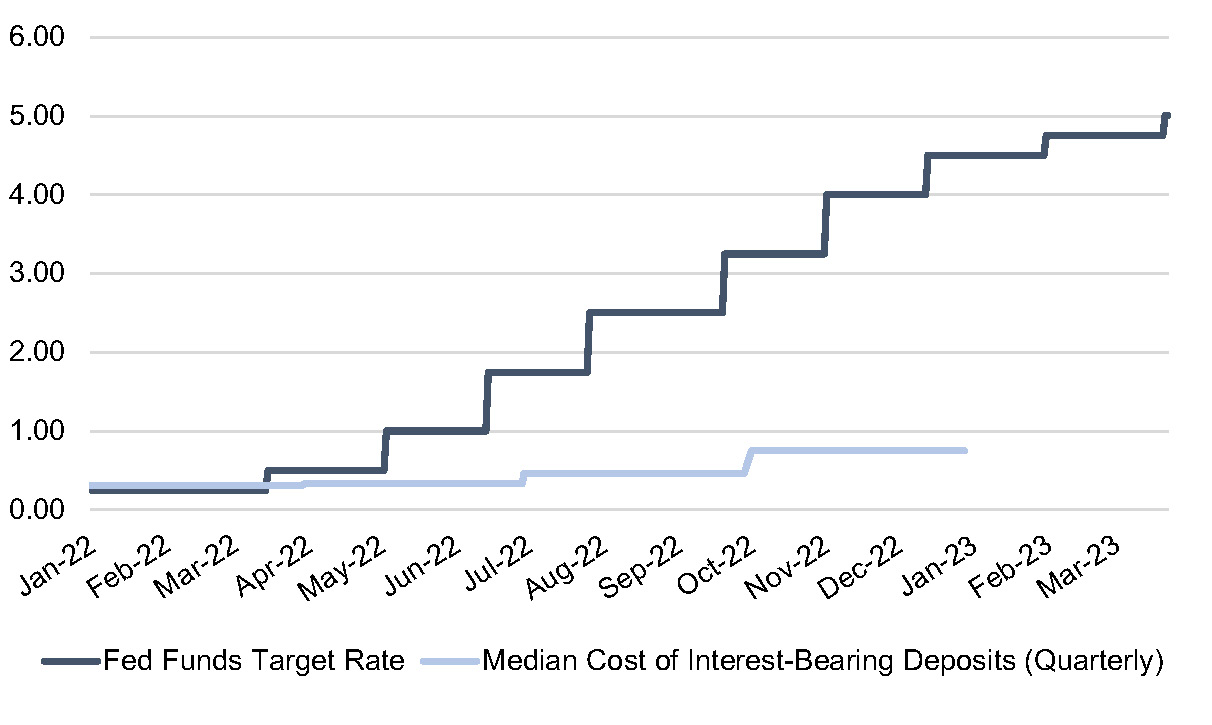

By contrast, Figure 5 shows the progression of the Fed Funds target rate and cost of interest-bearing deposits for the peer group in 2022. Though still rising, the cost of interest-bearing deposits was 0.75% in the fourth quarter of 2022. Deposit funding costs are almost exactly reversed from their level in late 2007. In the fourth quarter of 2007, 99% of banks had a cost of interest-bearing deposits over 2.00%, whereas 97% of banks had a cost of deposits under 2.00% in the fourth quarter of 2022.

Figure 5 :: Progression of the Fed Funds Target Rate (Jan. 2022 – Mar. 2023)

It is interesting to speculate on depositor behavior in the current interest rate environment. Perhaps depositors are desensitized to higher rates after the long zero rate environment, despite the ease with which funds can be transferred to other alternatives. There are many more investment alternatives now than in 2006 and 2007. Thus, rate sensitive funds may have already fled bank deposit accounts for higher yielding alternatives, leaving the remaining depositors stickier than in past higher rate environments. Customers could be more appreciative of the technology and services offered by banks than in the 2006 to 2007 period.

Conclusion

Like the Katy leaving the station, the banking industry is embarking into the unknown after the failures of SVB and Signature. Most banks will remain as sturdy as the mule left behind, though not without greater uncertainty until the gap narrows between the book value and fair value of bank assets and funding costs stabilize.