The Importance of Size, Profitability, and Asset Quality in Valuation

The question for most financial institutions is not if a valuation is necessary, but when it will be required. Valuation issues that may arise include merger and acquisition activity, an employee stock ownership plan, capital planning, litigation, or financial planning, among others. Thus, an understanding of some of drivers impacting your bank’s value is an important component in preparing for these eventualities.

Data Analysis & Quantitative Factors Affecting Your Bank’s Value

Determining the value of your bank is more complicated than simply taking a financial metric from one of your many financial reports and multiplying it by the relevant market multiple. However, examination of current and long term public pricing trends can shed some light on how certain quantitative factors may affect the value of your bank.

To analyze trends, we focus our discussion on P/TBV ratios since this is one of the most commonly cited metrics for bankers. While all banks can be affected by overall macroeconomic trends like inflation rates, employment rates, the regulatory environment, and the like, we explore relative value in light of three factors we consider in all appraisals – size, profitability, and asset quality.

Size

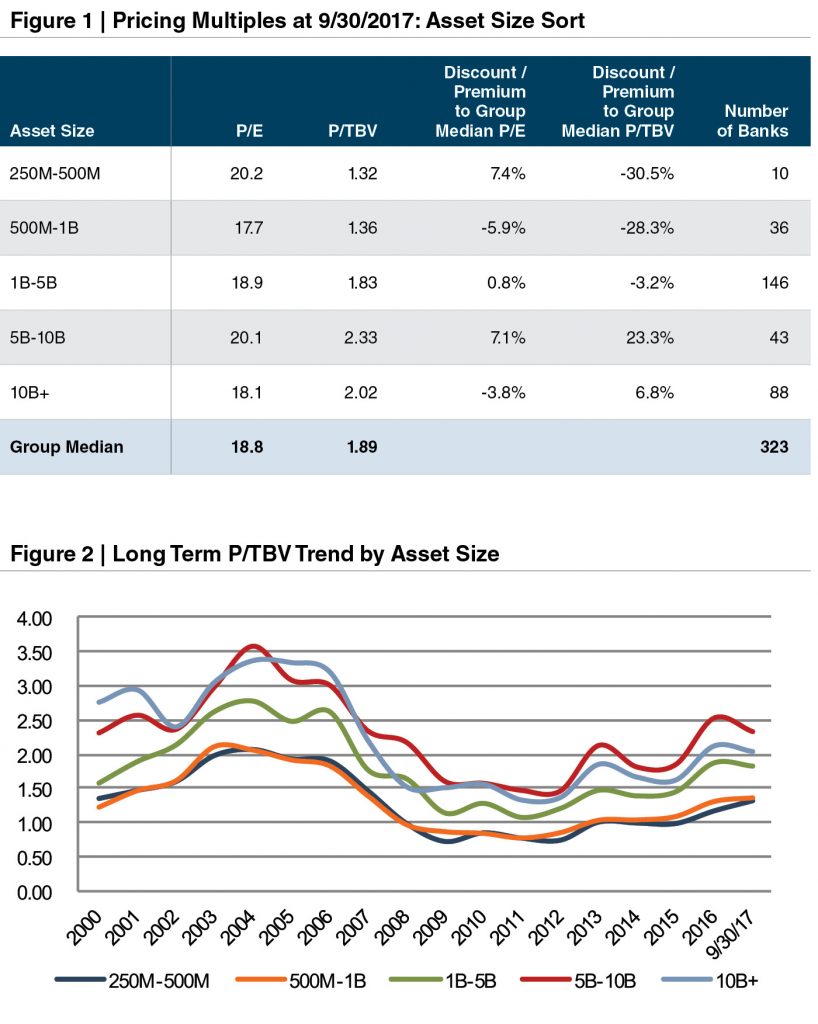

Size differentials generally encompass a range of underlying considerations regarding financial and market diversity. A larger asset base generally implies a broader economic reach and oftentimes a more diverse revenue stream which can help to mitigate harmful effects of unforeseen events that may adversely affect a certain geographic market or industry. Furthermore, larger banks tend to have access to more metropolitan markets which have better growth prospects relative to more rural markets. Figures 1 and 2 on the next page illustrate that, to a point, larger size typically plays a role in value, as measured by price / tangible book value multiples. The sweet spot for asset size seems to be between $5 and $10 billion in total assets. Banks in this category traded at the highest P/TBV multiple as of September 30, 2017 and have generally outperformed all other asset size groups over the long term.

Profitability

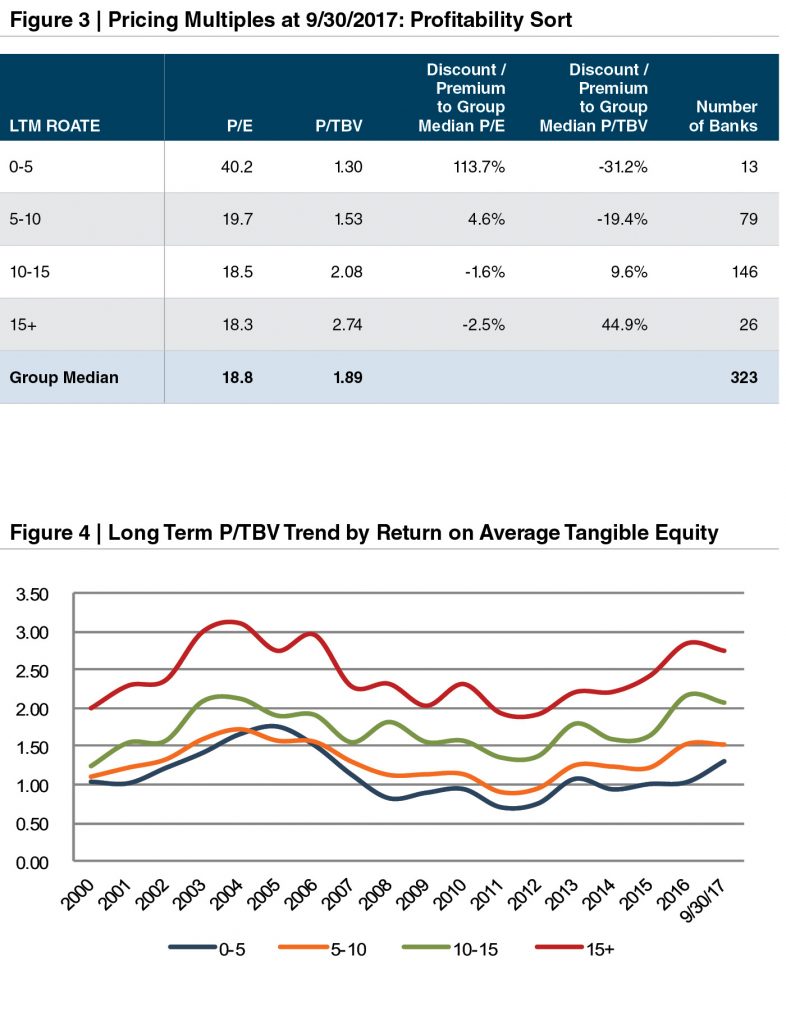

To examine how profitability affects the value of your bank, we compare median P/TBV multiples for four groups of banks segmented by return on average tangible equity (Figures 3 and 4 on the prior page). A bank’s return on equity can be measured as the product of the asset base’s profitability (or return on assets) and balance sheet leverage. Balancing these two inputs in order to maximize returns to shareholders is one goal of bank management. A bank’s return on equity measures how productively the bank invests its capital, and as one would expect, the banks with the highest returns on equity trade at the highest P/TBV multiple.

Asset Quality

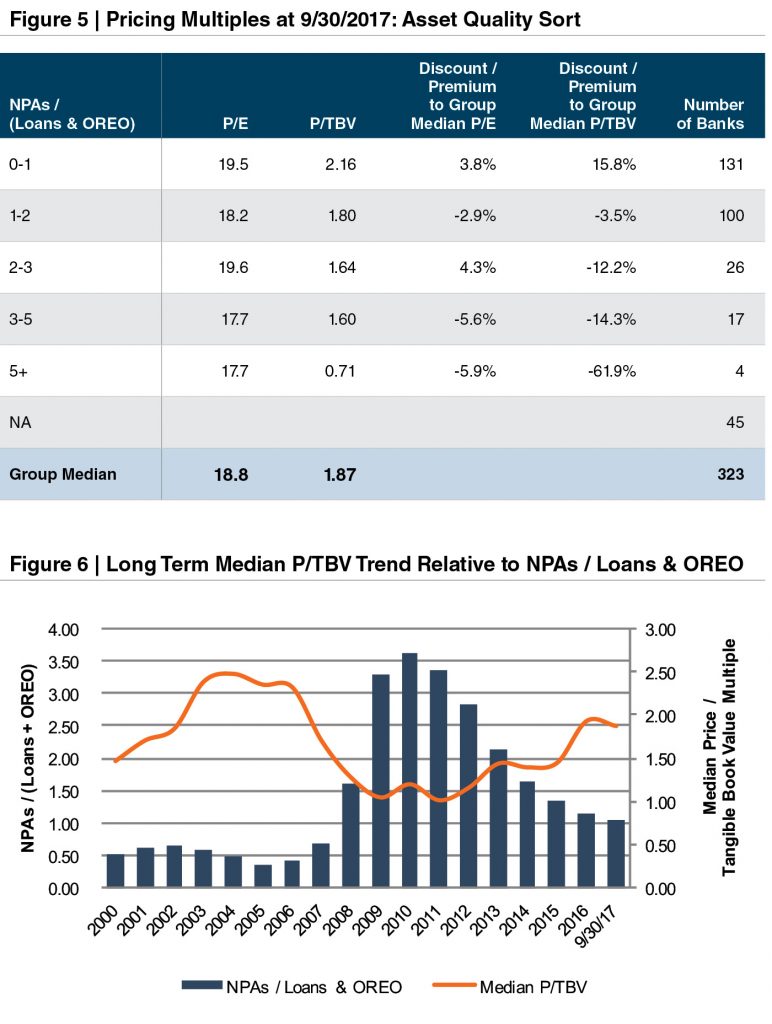

Inferior asset quality increases risk relative to companies with more stable asset quality and may limit future growth potential, both of which may negatively impact returns to shareholders. In addition, it makes sense that a bank with high levels of non-performing assets might trade below book value. Book value of the loans (or other non-performing assets) may not reflect the true market value of the assets given the potential for greater losses than those accounted for in the loan loss reserve and the negative impact on earning potential. Figure 5 illustrates how pricing is affected by higher levels of non-performing assets. As shown in Figure 6, P/TBV multiples plummeted at the start of the economic recession and have yet to recover to pre-crisis levels.

Conclusion

Size, profitability, and asset quality are factors to consider in your bank’s valuation. From an investor’s perspective, your bank’s worth is based on its potential for future shareholder returns. This, in turn, requires evaluating qualitative and quantitative factors bearing on the bank’s current performance, growth potential, and risk attributes.

Mercer Capital offers comprehensive valuation services. Contact us to discuss your valuation needs in confidence.

This article originally appeared in Mercer Capital’s Bank Watch, November 2017.