Moo Deng’s Post-Election Outlook for the Banking Industry

While BankWatch’s focus on the banking industry remains as unrelenting as ever, we remain attuned to the latest social media phenomena. Therefore, BankWatch was swept up in the viral sensation of Moo Deng, a baby pygmy hippo. Moo Deng—whose name translates to “Bouncy Pork”—is a chubby, sassy little creature resident in a Thai zoo that captured the internet with antics like a moonwalking routine. While BankWatch has a soft spot for critters like Moo Deng, what really caught our attention was Moo Deng’s accurate prediction of the U.S. presidential contest.1 Outperforming many human forecasters (including those older than the four month old hippo), Moo Deng did not see the election as a toss-up. Instead, when faced with two bowls of food labeled Harris and Trump, she went straight for the Trump one.

Given Moo Deng’s stunning prognostication, what would the Oracle of the Khao Kheow Open Zoo expect for the next four years?

Animal Spirits

We are not sure if Moo Deng is familiar with John Maynard Keynes, who coined the term “animal spirits” to mean the emotional factors or herd instincts that can influence decision-making. But Moo Deng’s animal spirits apparently have lifted tourism to Thailand, with people waiting for hours to catch a glimpse of the hippo. For bank stocks, is the post-election boom a case of investors’ animal spirits, or is something else at work?

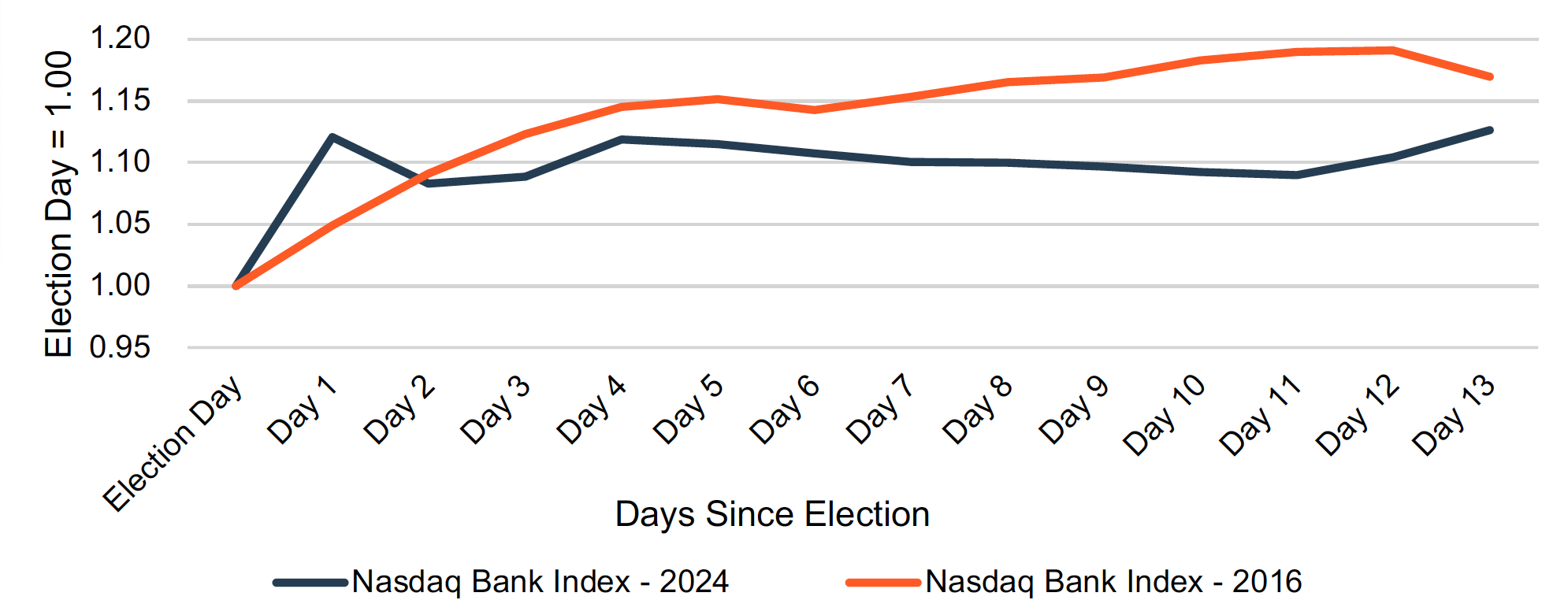

Post Election Performance: 13 Days After 2016 & 2024 Elections

Source: S&P Capital IQ Pro; Mercer Capital Analysis

We reviewed bank stock indices immediately after the 2016 and 2024 elections. Immediately after the 2024 election, bank stocks were almost as popular as Moo Deng, as the Nasdaq Bank Index rose by 12% the first day after the election (see chart above). Then, bank stocks remained relatively stable before increasing again 12 and 13 days after the election. The situation was somewhat different in 2016, with positive changes in the index compounding over many days. Of the first 13 trading days after the election, the Nasdaq Bank index increased for 11 days after the 2016 election versus only five days after the 2024 election. Cumulatively, the index increased by 13% the first 13 days after the 2024 election relative to 17% after the 2016 election. This compares to a 3.2% increase for the S&P 500 in the 13 days after the 2024 election, similar to the 2.9% increase after the 2016 election.

Several factors likely explain the recent market movement and foretell future trends:

- Bouncy Bouncy… After the Nasdaq Bank index declined by 24% between year-end 2021 and 2023, bank stocks were due for a rebound in 2024, as liquidity fears subsided, credit issues remained manageable, and profitability showed signs of improvement.

While the Nasdaq Bank index was flat the first half of 2024, an inflection point in net interest margins led to improving investor sentiment in the second half of 2024. Between year-end 2023 and election day, the Nasdaq Bank index bounced back by 15%. The election may have caused a realization among investors that bank stocks were relatively cheap (compared to the broader market), the worst fears regarding commercial real estate loan losses are not going to be realized, and EPS growth may well be relatively strong in 2025 and 2026 as net interest margins recover (even if returns on assets remain below long-term averages for another one to three years). The result was another 13% bounce in the Nasdaq Bank Index after the election.

- Cleaning up after a hippo. Any discussion of banks’ shifting fortunes after the election includes the regulatory environment. We are reminded of a quote by JP Morgan’s CEO, Jamie Dimon, shortly before the election regarding recent rulemaking activity: “I’ve had it with this s***.” While community banks are not directly affected by regulations like the Basel III endgame, Dimon’s blunt statement nevertheless captured the sentiment of many bankers.

The past four years have been marked by robust, to put it mildly, regulatory activity covering areas ranging from brokered deposits, CRA, credit card and overdraft fees, interchange fees, open banking, fintech, small business borrower data, and M&A. In addition, regulatory exams have appeared to sometimes take an adversarial tone, with exam issues being elevated to public enforcement actions more often. As one of the more heavily regulated industries, banks would stand to benefit more than most businesses from a deregulatory environment.

The pace of financial services rulemaking likely will slow after the election, but uncertainty surrounds which Biden era regulations will be, or can be, rolled back. Certain sectors, like fintech and crypto, are almost certain to benefit from deregulation, but this probably is not the type of deregulation bankers have in mind. In addition, Trump offered his own populist suggestions during the campaign that would not sit well with banks, such as capping credit card interest rates at 10%.

- Zookeepers. Managing Moo Deng’s celebrity status requires talented and dedicated zookeepers. Similarly, the banking regulatory agencies need experienced leaders that can (in a perfect world) design the least intrusive regulations that meet the agencies’ safety and soundness objectives. In the first Trump administration, well-regarded agency heads like Jelena McWilliams at the FDIC had a deregulatory bent but largely maintained the status quo.

Trump’s cabinet nominees have certainly been an, err, eclectic bunch so far, which complicates predicting the banking agencies’ future leadership. A more likely scenario is the agencies are staffed by individuals with banking industry experience, like Ms. McWilliams, who probably will maintain continuity with some loosening of regulations. The less likely scenario, and one more fraught with risk for the industry, is a “blow the place up” nominee. For banks that favor stability, this may introduce too much change, with the regulatory pendulum swinging widely depending on which party’s nominees are in charge of the banking agencies.

- Funding Moo Deng’s lifestyle. We do not know if Moo Deng is taxpayer supported, but we do know that in Trump’s first term the top corporate tax rate fell from 35% to 21%. Banks often benefit less than other industries from the tax preferences in the tax code, such as regarding accelerated depreciation and R&D. As a result, banks’ effective tax rates are closer to the marginal rate. Therefore, the change in the marginal rate under the Tax Cuts & Jobs Act—which was led by Speaker Paul Ryan to a greater extent than the Trump Administration—had a more significant impact on banks’ after-tax profitability than for many other businesses.

Trump has proposed lowering the marginal corporate tax rate from 21% to 15%, although numerous tax cut promises to other constituencies exist. Tax cuts fueled the performance of bank stocks during the first Trump administration and could again during the second Trump Administration. However, the benefit to banks’ after-tax net income of changing the corporate tax rate to 15% is an order of magnitude smaller than reducing the rate to 21% under the TCJA.

Animal Spirits, Again. Loan growth has been sluggish in 2024, although many community banks will be able to rely on widening NIMs to produce revenue growth for awhile longer. At some point, though, banks will need organic growth to maintain earnings momentum. If a combination of tax policy, deregulation, and greater confidence among consumers and businesses scrapes some barnacles off the economy’s boat, all the better from banks’ standpoint.

Feeding Frenzy

In the presidential picking contest that faced Moo Deng, she picked between “watermelon cakes” labeled Harris and Trump. If there is anything that makes bank investors more excited than Moo Deng when offered a juicy watermelon cake, it’s M&A.

Bank M&A has been in the doldrums since 2021, although activity has risen in 2024. There are a number of factors contributing to this dearth of deals:

- Lower stock prices, which meant that buyers were unable to meet sellers’ (nominal) pricing objectives

- Interest rate marks on loans and securities that affect buyers’ post-transaction regulatory capital and tangible book value earn-back

- Lower profitability, which convinced sellers to postpone M&A discussions

- Regulatory uncertainty

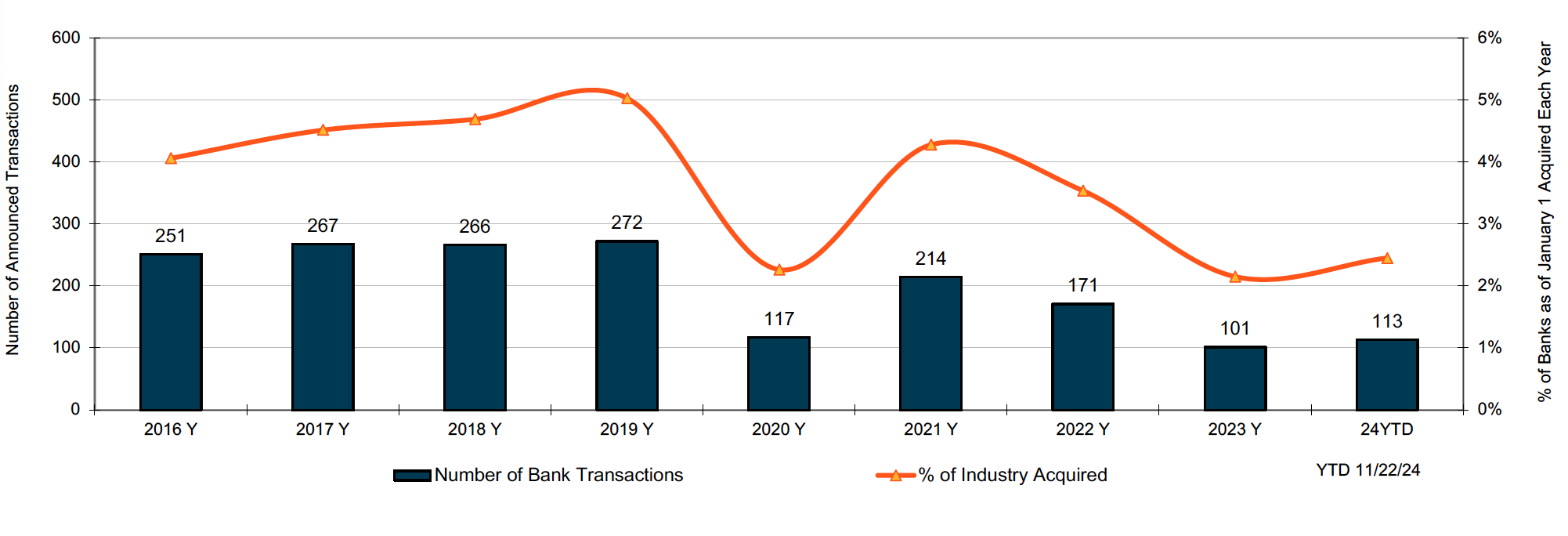

These factors led to the number of announced bank M&A transactions falling to 171 in 2022, 101 in 2023, and 113 through November 22. 2024 (see chart on the next page), or 2% to 4% of the prior year number of institutions. These factors should be alleviated, at least in part, in coming years:

- The Nasdaq Bank Index increased by 31% between June 30, 2024 and November 22, 2024. Buyers have stronger currencies for deals; even if the seller receives the same number of the buyer’s shares as they would have received in 2022 or 2023, the nominal deal value will be higher after the election.

- Interest rate marks will diminish. Lower interest rates, particularly in the intermediate part of the yield curve, reduced interest rate marks on debt securities and loans in banks’ third quarter financial reports.

Significant deficit spending may lead to higher interest rates, which complicates the outlook. Putting that issue aside, though, the passage of time will cure the rate mark issue. Loans originated in the 2020 and 2021 vintages with rates that were fixed at origination for five years will mature or reprice in the next one to two years. Regardless of what happens with rates, a significant share of loans originated in 2020 and 2021 will mature or reprice during the second Trump administration, eliminating the rate mark issue altogether for those loans. Long-term, low-rate bonds purchased in 2020 and 2021 will linger, though.

- Net interest margins have begun to improve for many banks, which should continue as rates on funding sources adjust downward while pandemic era assets mature or reprice. As NIM compression created negative operating leverage when interest rates increased—with revenue declining to a greater extent than operating expenses—banks will benefit from positive operating leverage as the rate cycle turns.

Further, an environment marked by a steeper yield curve may be a boon to bank earnings. Some investors may feel burned by asset/liability models that predicted banks would benefit from a large upward shock in interest rates, such as occurred in 2022. Therefore, investors may take a wait and see attitude towards yield curve steepening.

- In September 2024, the FDIC, the OCC, and the Department of Justice issued new policies on bank merger transactions. New regulations, coupled with a generally stricter regulatory environment, have led to longer merger approval timelines. Large bank M&A has been particularly hampered by regulatory uncertainty.

We are not aware of post-election efforts to roll-back the September 2024 FDIC, OCC, and DoJ policies; however, application of these policies to announced transactions will fall to the Trump administration’s regulators. In a deregulatory zeitgeist, it is difficult to believe that the Trump era bank regulators will be more restrictive towards bank M&A activity than during the Biden administration.

While the market may believe the Trump administration will grease the skids of bank M&A, there is another view, however. Vice President-elect Vance has spoken favorably of Federal Trade Commission head Lina Khan, the bete noire of CEOs of large businesses. In February 2024, Mr. Vance stated: “And I guess I look at Lina Khan as one of the few people in the Biden administration that I think is doing a pretty good job.”

Announced Bank M&A Transactions (2016 – November 22, 2023)

Click here to expand the image above

The preceding factors, a stable economy, and a deficit of deals since 2022 suggest to us (or should that be Moo Deng doing the suggesting?) that bank M&A should trends towards historical activity levels, with 4% to 5% of the industry absorbed annually through merger.

More Watermelon Cakes

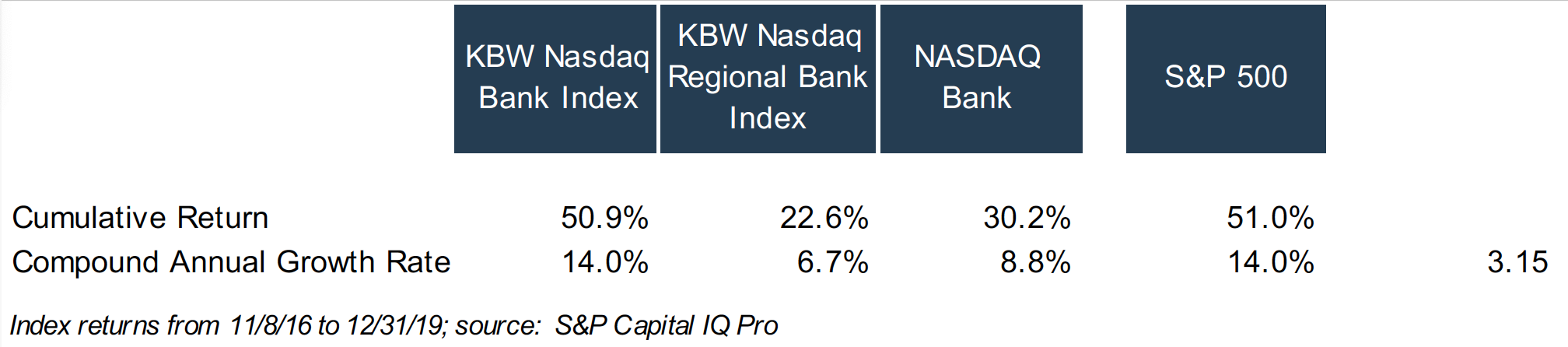

The table below shows bank stock index returns from November 8, 2016 (election day in 2016) to December 31, 2019 (pre-Covid). Index performance varied, but the Nasdaq Bank Index increased by a cumulative 30%, which equates to an 8.8% compound annual growth rate.

Trump Stock Index Returns (Pre-Covid)

What might happen if Moo Deng were to face another challenge: picking between watermelon cakes with signs indicating that the CAGR in the Nasdaq Bank Index would be above or below 8.8% during the Trump II administration? It would not surprise us if Moo Deng goes for the “over 8.8%” cake:

Banks are due for a rebound after poor performance in 2022 and significant underperformance in 2023 relative to the S&P 500.

While some larger banks may face earnings pressure from falling short-term rates, many banks will have an earnings tailwind from improving NIMs.

More M&A.

Tangible book value should at least grow by 8.8% in coming years, given that the recapture of unrealized losses on securities will augment retained earnings growth.

Incoming administrations, like baby hippos, can be unpredictable. Budget deficits, higher intermediate to long-term interest rates, trade wars, and shooting wars are among the factors that could cause us to consult Moo Deng’s expertise again.