Mortgage Banking Lagniappe

2020 was a tough year for most of us. Schools and churches closed, sports were cancelled, and many lost their jobs. There were a select few, however, that thrived during 2020. Jeff Bezos and Elon Musk saw a meteoric rise in their personal net worth over the past 12 months. Mortgage bankers are another group showered with unexpected riches last year (and apparently this year).

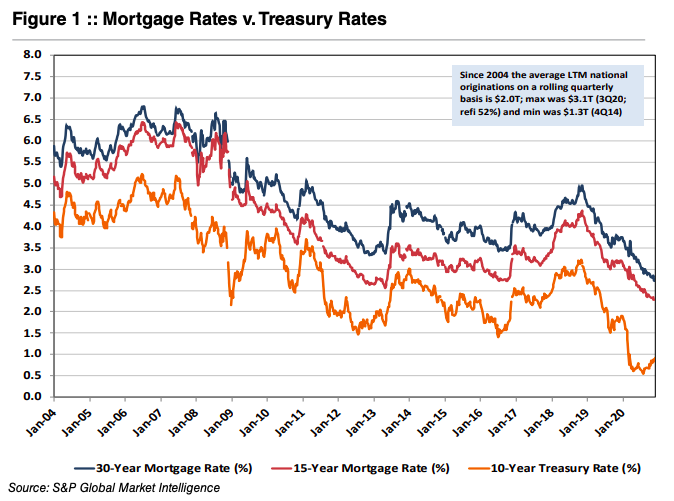

As shown in Figure 1, long-term U.S. Treasury and mortgage rates have been in a long-term secular decline for about four decades. Last year, long-term rates fell to all-time lows because of the COVID induced recession after having declined modestly in 2019 following too much Fed tightening in 2018. The surprise was not an uptick in refinancing activity, but that it was accompanied by a strong purchase market too. Housing was and still is hot; maybe too hot.

Overlaid on the record volume (the Mortgage Bankers of America estimates $3.6 trillion of mortgages were originated in 2020 compared to $2.3 trillion in 2019 and $1.7 trillion in 2017 and 2018) was historically high gain on sale (“GOS”) margins. The industry was capacity constrained after cutting staff in 2018 when rates were then rising.

Private equity and other owners of mortgage companies set their eyes on the public markets after many companies attempted to sell in 2018 with mixed success at best. During the second half of 2020, Rocket Mortgage ($RKT) and Guild Mortgage ($GHLD) made an initial public offering and began trading while seven other nonbank mortgage companies have either filed for an IPO or announced plans to do so. Also, United Wholesale Mortgage ($UWMC) went public by merging with a SPAC.

The inability of several (or more) mortgage companies to undergo an IPO at a price that was acceptable to the sellers has an important message. The industry was accorded a low valuation by Wall Street on presumably peak earnings even though many mortgage companies will produce an ROE that easily exceeds 30%. The assumption is that earnings will decline because rates will rise and/or more capacity will reduce GOS margins.

While it is likely 2020 will represent a cyclical peak, no one knows how steep (or gentle) the descent will be and how deep the trough will be. Mortgage companies may produce 20% or better ROEs for several years. One may question the multiple to place on 2020 earnings, but book value could double in three or four years if conditions remain reasonably favorable.

Community and regional banks with mortgage operations have benefitted from the mortgage boom, too. Although various bank indices were negative for the year, it could have been much worse given investor fears surrounding credit losses and permanent impairment to net interest margins given the collapse in rates. In a sense, outsized mortgage banking revenues funded reserve builds for many banks and masked revenue weakness attributable to falling NIMs.

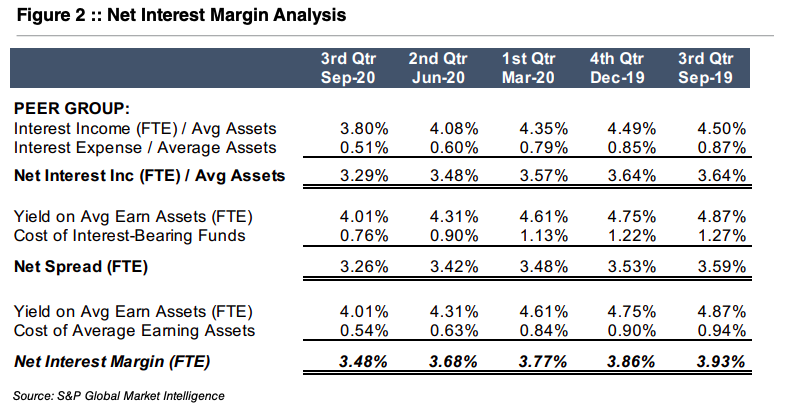

The average NIM for banks in the U.S. with assets between $300 million and $1 billion as of September 30, 2020 is shown in Figure 2. The NIM fell 45bps from 3Q19 to 3Q20 due to multiple moving pieces but primarily reflected an increase in liquid assets because deposits flooded into the banking system and because the reduction in the yield on loans and securities was greater than the reduction in the cost of funds.

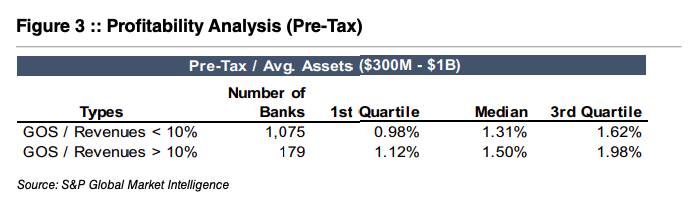

Unless the Fed is able (and willing) to raise short-term policy rates in the next year or two, we suspect loan yields will grind lower as lenders compete heavily for assets with a coupon (i.e., loans) because liquidity yields nothing and bonds yield very little. Deposit costs will not offset because rates are or soon will be near a floor. Fee income and expense management are more critical than ever for banks to maintain acceptable profitability. When analyzing the same group of banks (assets $300M – $1B), banks with higher GOS revenues as a percentage of total revenue tended to be more profitable. As shown in Figure 3, median profitability was ~15% greater in the trailing twelve months for banks more engaged in mortgage activity than those that were not.

Selling long-term fixed-rate mortgages for most banks is a given because the duration of the asset is too long, especially when rates are low. The decision is more nuanced for 15-year mortgages with an average life of perhaps 6-7 years. With loan demand weak and banks extremely liquid, most banks will retain all ARM production and perhaps some 15-year paper as an alternative to investing in MBS because yields on originated paper are much better.

As for 30-year mortgages, net production profits for 3Q20 increased above 200bps according to the MBA for the first time since the MBA began tracking the data in 2008. Originating and selling long-term fixed rate mortgages has been exceptionally profitable in 2020.

Mortgage banking in the form of originations is a highly cyclical business (vs servicing); however, it is a counter-cyclical business that tends to do well when the economy is struggling and therefore core bank profitability is under pressure. We have long been observers of the mortgage banking conundrum of “what is the earnings multiple?” It is a tougher question for an independent mortgage company compared to a bank where the earnings are part of a larger organization. Even when outsized mortgage banking earnings may weigh on a bank’s overall P/E, mortgage earnings can be highly accretive to capital.

In the February issue of Bank Watch, we will explore how to value a mortgage company either as a stand-alone or as a subsidiary or part of a bank to understand in more detail the true valuation impacts of mortgage revenue.

Originally appeared in Mercer Capital’s Bank Watch, January 2021.