NADC 2019 Spring Conference Recap

I recently attended the 2019 Spring Conference of the National Auto Dealers Counsel (NADC) in Dana Point, California. This article provides a couple of key takeaways from the day and a half sessions on the current conditions in the industry.

Vehicle Subscription Services

Car subscription services are becoming a popular alternative to leasing. Each service varies in structure and is operated by dealers, manufacturers, and third parties. Some offer reasonable traditional leases or allow customers to make monthly payments, but allow more flexibility/frequency in swapping vehicles for changing preferences and needs.

Some manufacturers are only initially offering subscription services regionally, or in specific markets (BMW and Mercedes-Benz are offering vehicle subscription services in the Nashville market).

Effect of Tariffs on New Vehicle Cost Differences

There has been a lot of talk in the news recently about impending tariffs in the auto dealer industry. Many unknowns and questions remain—Will President Trump enact tariffs? How will they affect the auto industry?

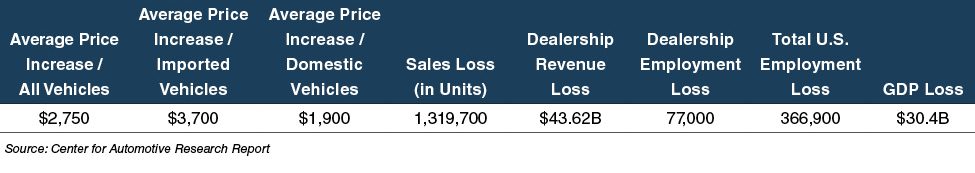

The Center for Automotive Research Report has compiled statistics to show the likely effects of tariffs on new/ used vehicle pricing, estimated losses for dealers, and projected employment and GDP loss (as seen below). With so much at stake, the auto dealer industry will keep a close eye on monitoring any new developments.

Tax Reform Act – Pass Through Entities vs. C Corporations

Amid the many changes that have resulted from the recent tax reform (the Tax Cuts and Jobs Act (TCJA)), here are a few directly impacting the auto dealer industry:

- Interest Expense Deduction – Auto dealers are allowed to deduct total interest expense (including floor plan interest) up to 30% of their adjusted taxable income (“ATI”) and still recognize bonus depreciation on their qualified tangible property. If total interest expense is less than 30% of ATI, then the full amount is deductible along with bonus deprecation. If total interest expense is greater than 30% of ATI, auto dealers can deduct the full amount of interest expense, but lose the recognition of the bonus depreciation.

- Sale/Dissolution Planning – During the year of a potential sale, auto dealers should understand the ramifications of closing the sale earlier in the year versus later in the year. An earlier sale in the year could limit the wages for that year’s tax return that could offset a large ordinary income event from LIFO and depreciation recapture and other ordinary income. Whenever possible, contact your accountant or tax planning consultants to discuss the timing of a proposed sale.

- Pass Through Entities vs. C Corporations – While there are many other legal considerations for choosing your entity structure, the TCJA has had an impact on the valuation of C Corporations. Specifically, the value of C Corporations has increased by approximately 15%, all other factors, due to the decline in the corporate tax rates. To learn more about the impact of the changing corporate tax rates on C Corporation valuations, read this recent article.

Originally published in the Value Focus: Auto Dealer Industry Newsletter, Year-End 2018.