NYCB Incurs Heavy Dilution in Its $1.0 Billion Capital Raise

The other significant industry news from the first quarter was the $1.05 billion equity investment in New York Community Bank (NYSE: NYCB) by an investor group led by former Secretary of the Treasury Steve Mnuchin. The investment was necessary to boost loss absorbing capital and to shore up confidence to stem a possible deposit run after its share price collapsed during February following a surprise fourth quarter loss that was later revised higher for a $2.4 billion goodwill write-off.

The initially reported 4Q23 loss of $252 million was not catastrophic, especially considering the company reported net income of $2.4 billion excluding the goodwill write-off as a result of the bargain gain from the purchase of the failed Signature Bank; however, the fourth quarter loss that arose from a $538 million provision for loan losses highlighted investor concerns about NYCB’s sizable exposure to NYC rent-controlled apartments and offices.

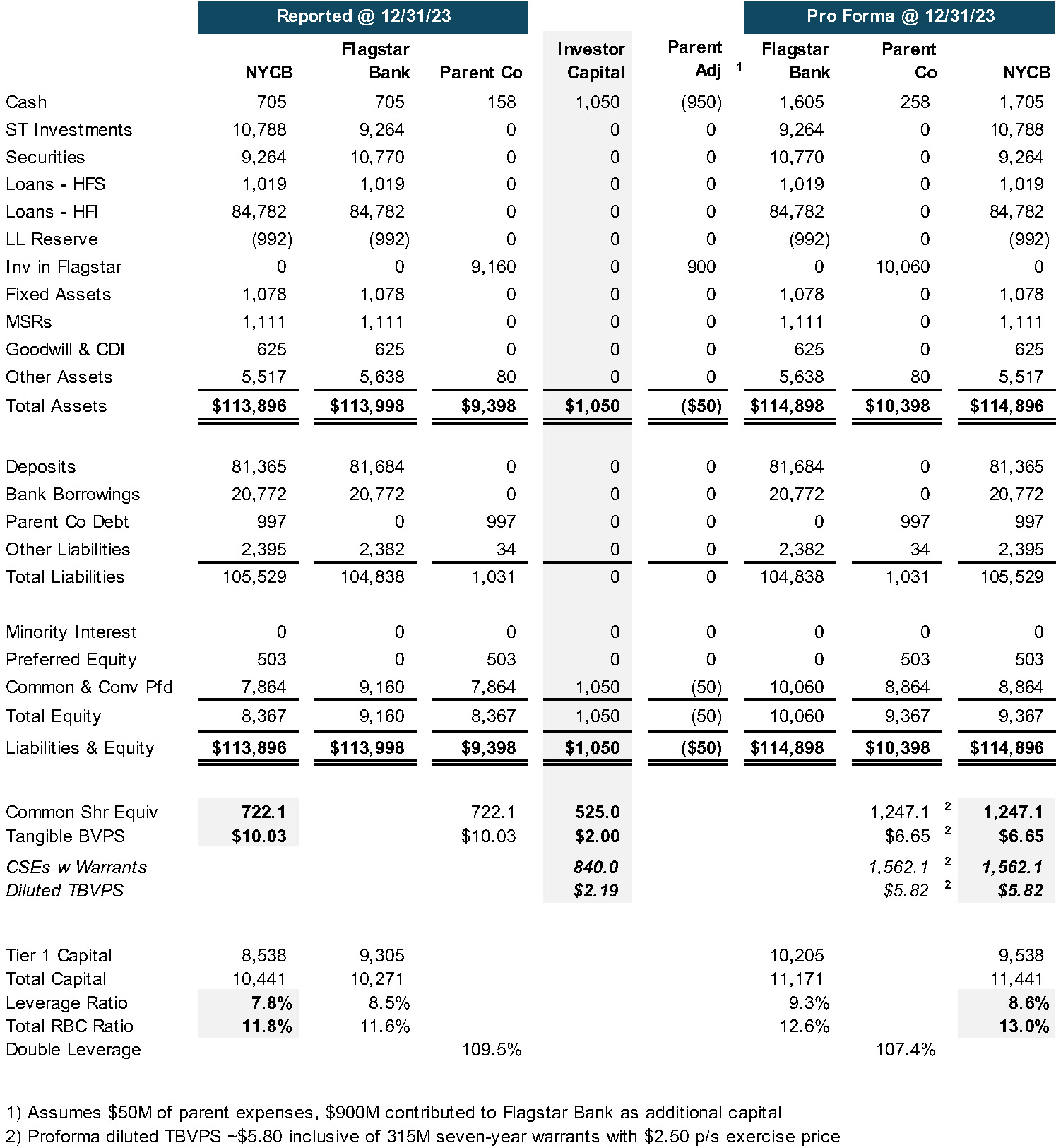

The figure on the right presents our proforma analysis of the transaction and its impact on the consolidated company (NYCB), the parent company in which the group invested, and wholly owned Flagstar Bank, N.A. The adage that capital is exorbitantly expensive if available at all when it must be raised comes to mind here with NYCB.

Source: Mercer Capital, NYCB SEC filings, and S&P Global Market Intelligence

We note the following:

- The investor group paid $1.05 billion for 525 million common share equivalents consisting of 59.8 million common shares for $2.00 per share and $930 million of Series B and C preferred stock with a 13% dividend that is convertible into 465 million common shares at $2.00 per share.

- Tangible book value per share (“TBVPS”) declined by about one-third from $10.03 per share as of year-end 2023 to $6.65 per share on a proforma basis.

- Inclusive of 315 million seven-year warrants with a $2.50 per share strike price, diluted proforma TBVPS is ~$5.80 per share.

- The 525 million common shares represent ~40% of the 1.25 billion proforma shares while dilution to existing shareholders exceeds 50% inclusive of the warrants.

- The capital injection boosted the Company’s consolidated leverage ratio by ~80bps to 8.6% and total risk-based capital ratio by ~120bps to 13.0%.

- NYCB will generate ~$1.4 billion of pretax, pre-provision operating income in 2024 and 2025 based upon consensus analyst estimates that will supplement the new capital to absorb loan losses.

- Given NYCB’s shares are trading around 50% to 60% of proforma TBVPS, investors are questioning the magnitude of loan losses to be recognized; whether more capital will be required; and long-term earning power.

Our additional thoughts on the transaction can be found HERE, and a link to NYCB’s investor deck announcing the transaction can be found HERE.

If we can assist your board with a capital raise or other significant transaction, please call us.