Potential Impact of Baltimore Bridge Collapse on the Logistics Industry

It’s been hard to miss the news footage and video of the cargo ship Dali colliding with the Francis Scott Key Bridge across the Chesapeake Bay. The bridge collapse – as sudden as it is surprising – is another landmark in what has been a series of tumultuous years in the logistics industry. We recently wrote about global impacts on the supply chain, particularly East Coast ports, and this is another reminder about how unpredictable events can have a wide reach.

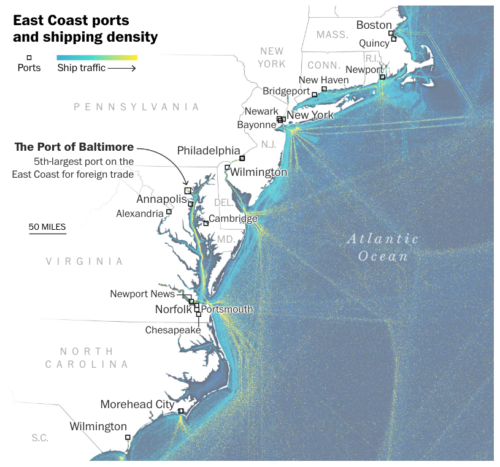

The Port of Baltimore

The Port of Baltimore is in the top twenty ports by volume in the United States and is the 5th largest port for foreign trade on the East Coast. The Washington Post estimates that the port handled over 50 million tons of foreign cargo with value in excess of $80 billion during 2023. The port is the 2nd largest exporter of coal from the U.S. (though still a relatively small player on a global scale) and is the largest port for imports of automobiles, sugar, and gypsum. Baltimore is also equipped to handle Neo Panamax ships passing through the Panama Canal.

Sharing the fortunes of several other East Coast ports of the last several years, the Port of Baltimore posted several records in 2023, including for the largest number of TEUs handled (1.1 million) and general cargo tons (11.7 million). Baltimore posts these growth records despite the overall decline in imports to the U.S. during 2022.

Potential Short-Term and Long-Term Impact

Short term impacts will include delays of cargo already in transit for East Coast ports, whether originally bound for Baltimore or not. Just as we saw chokepoints on the West Coast lead to a redistribution of cargo among ports, the loss of the Baltimore port for the foreseeable future will cause ripple effects throughout the industry.

Source: The Washington Post

Other East Coast ports will likely take up the bulk of cargo previously destined for Baltimore. In particular, soybean shipments are expected to transfer to Norfolk, Savannah, and Charleston, while containers are expected to be processed in either Philadelphia or Norfolk. In any case, the truck routes and rail cars that previously serviced Baltimore will need to be recentered on other ports.

However, this will be somewhat mitigated by global events that were already impacting East Coast ports—namely, the ongoing drought limiting capacity through the Panama Canal and the Houthi rocket attacks in the Red Sea, both of which had diverted some cargo away from East Coast ports prior to the bridge collapse.

An additional concern is the International Longshoreman’s Association contract, which covers port workers from Texas through the Northeast. The contract is set to expire in September 2024. Talks stalled in early 2023 before resuming again in February 2024.

The West Coast freight bottleneck that dominated transportation headlines in 2022 was brought on by labor disputes combined with a drastic increase in demand for shipping services due to COVID-fueled shopping. Conversely, the national freight market has been soft through 2023 and demand is not expected to rapidly escalate as it did a few years ago. This should limit long-term bottlenecks and chokepoints from forming on the East Coast.

Conclusion

Mercer Capital’s Transportation & Logistics team constantly watches the transportation industry and global events and economic factors that can impact the overall industry, the supply chain, or various aspects of transportation.

Mercer Capital provides business valuation and financial advisory services, and our transportation and logistics team helps trucking companies, brokerages, freight forwarders, and other supply chain operators to understand the value of their business. Contact a member of the Mercer Capital transportation and logistics team today to learn more about the value of your logistics company.