Premise of Value: Why It Is a Critical Aspect of Business Continuity and Financial Restructuring

The conventions for defining value may never be more important than when making decisions related to business continuity and financial restructuring. Countless clients have demonstrated a sense of confusion regarding the various descriptors of value used in valuation settings. More than a few valuation stakeholders have mused that the value of anything (a business or an asset as the case may be) should be an absolute numerical expression and unambiguous in meaning. Unfortunately for those seeking simplicity in a trying time, the conditional cliché “it depends” is critical when defining value for the assessment of bankruptcy decisions and workout financing. The elements that underpin the Premise of Value provide a convenient base for introducing some of the vocabulary used in the bankruptcy and restructuring environment. Gaining a thorough familiarity with the Premise of Value provides a cornerstone for understanding the financial considerations employed in valuing business assets and evaluating financial options.

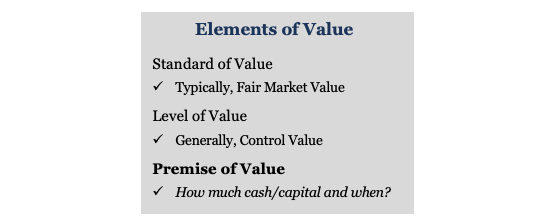

Defining value is a science of its own and can be subject to debate based on facts and circumstances. With respect to business enterprises and assets, as well as business ownership interests, there are numerous defining elements of value. These elements generally include the Standard of Value, the Level of Value, and the Premise of Value. More confusing is that real property appraisers, machinery & equipment appraisers and corporate valuation advisors may not use the same value-defining nomenclature and may have varied meanings for similar vocabulary. When the question of business value or asset value arises, the purpose of the valuation, the venue or jurisdiction in which value is being determined and numerous other facts and circumstances have a bearing on the defining elements of value.

Everyone has seen the “inventory liquidation sale” sign or the “going out of business” sign in the shop window. For the merchant and the merchant’s capital providers, the ramifications of how assets are monetized for the purposes of optimizing returns on and of capital is a key focus of the valuation methods employed in the restructuring and bankruptcy environment. The international glossary of business valuation terms defines the Premise of Value and its components as follows:

- Premise of Value – an assumption regarding the most likely set of transactional circumstances that may be applicable to the subject valuation; for example, Going Concern, liquidation

- Going Concern Value – the value of a business enterprise that is expected to continue to operate into the future. The intangible elements of Going Concern Value result from factors such as having a trained work force, an operational plant, and the necessary licenses, systems, and procedures in place.

- Liquidation Value – the net amount that would be realized if the business is terminated and the assets are sold piecemeal. Liquidation can be either “orderly” or “forced.”

- Orderly Liquidation Value – liquidation value at which the asset or assets are sold over a reasonable period of time to maximize proceeds received.

- Forced Liquidation Value – liquidation value, at which the asset or assets are sold as quickly as possible, such as at an auction

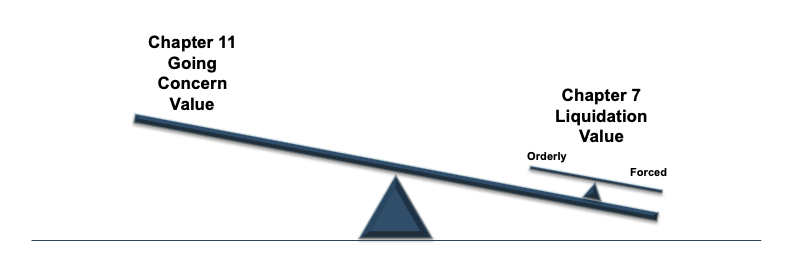

The Premise of Value is a swing consideration for distressed businesses and their lenders. For businesses in financial distress, achieving a return on capital shifts to the priority of asset protection and capital value preservation via a deliberate plan to mitigate downside exposures. In most situations where a business is dealing with an existential financial threat, the preference for the business is to remain a Going Concern (at least initially), whereby the business continues to operate as a re-postured version of its former self. In the context of bankruptcies and/or restructurings, the business that remains a Going Concern is referred to as the Debtor in Possession (DIP).

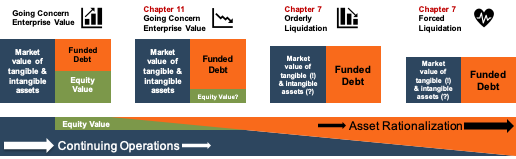

DIPs remain a Going Concern using the protection of Chapter 11 bankruptcy to achieve a fresh start where their financial obligations are restructured through modification and/or specialized refinancing. Chapter 11 involves a detailed plan of reorganization, which may be administered by a trustee and is ultimately governed under the specialized legal oversight of the courts. Reorganization under Chapter 11 is the preferred first step for most operating enterprises whose business assets are purpose?specific and for which the break-up value of the assets would be economically punitive to capital investors. Intuitive to the Going Concern premise are valuation methods and analyses that study potential business outcomes using detailed forecasts and the corresponding potential of the resulting cash flows to service the necessary financing to achieve the outcome. One valuation discipline among numerous possibilities is the establishment and testing of a value threshold at which the capital returns are deemed adequate to their respective providers (e.g. an IRR analysis) based on the risks incurred. If remaining a Going Concern delivers an acceptable rate of return under a plan of reorganization, then liquidation might be avoided or forestalled.

The alternative to remaining a Going Concern involves the process of liquidation. In bankruptcy terms, a business entity files for Chapter 7 and begins the cessation of business operations and seeks a sale of assets to re-pay creditors based the creditors’ respective position in the capital stack. The “liquidation” premise is generally a value-compromising proposition for the bankruptcy stakeholders with the economic consequences are scaled to whether the liquidation is achieved in an orderly process or a forced process.

Modern, global economies and increasingly technology inspired business models have resulted in a certain amount of disruption, the consequences of which often compromise the value of purpose-specific business assets in obsoleting or excess-capacity industries (e.g. coal in the face of growing energy alternatives and concerns for climate change). Assets that have productive capacity are typically sold in an orderly market and may achieve a value commensurate with the capital asset expenditures expectations of industry market participants. Real property assets and operating assets that can be successfully transitioned or re-purposed are often liquidated in an orderly fashion to maximize value. Specialized assets and/or assets with inferior productive capacity or which are positioned in unfavorable circumstances likely lack the ability to attract buyers due to the deficiencies and/or inefficiencies of relevant markets. Accordingly, the time value of money and the demands of the most senior creditors may suggest or dictate that a forced liquidation sooner is more favorable than a deferred outcome.

Most restructuring and bankruptcies involve a total rationalization of operating assets and business resources. For large integrated businesses, it often occurs that a combination of value premises applies to differing types of tangible and intangible assets based on the go-forward strategy of the business and the availability of markets in which to monetize assets. For example, an initial liquidation may occur with respect to certain business operations and properties to create the resources necessary to achieve debt restructuring or DIP financing. Accordingly, advisory engagements often take into consideration a wide range of options based on the timing of asset sales and the sustainability of continuing operations. The Premise of Value is a quiet but critical defining element for assessing the collective value proposition associated with a plan of reorganization.

Many bankruptcy advisory projects necessarily involve comparing the Going Concern value to Liquidation value. Each premise involves an inherently speculative set of underlying models and assumptions about the performance of the business and/or the timing and exit value achieved for business assets. And, each may be developed using a variety of scenarios with differing outcomes and event timing. Setting aside the qualitative aspects of decision making, the Premise of Value with the best outcome is typically the path of pursuit based on the necessity for an objective criterion required under the legalities of the bankruptcy process and the priority claims of creditors.

A fundamental understanding of the defining elements of value is critical to distressed businesses and their creditors. Valuation advisors are required to clearly detail the defining elements of value employed in the determination of asset values and enterprise valuations. The Premise of Value must be comprehended in the context of other defining elements of value. If you have a question concerning the design and valuation of varying plans of reorganization or bankruptcy strategies, please contact Mercer Capital’s Transaction Advisory Group.

About the Author

Key Contacts

Insights

-

Transaction Advisory

Bankruptcy and Restructuring Advisory

-

Articles , Bankruptcy & Restructuring , Insights

Standard of Value in Bankruptcy

-

Articles , Bankruptcy & Restructuring , Insights

Neiman Marcus: A Restructuring Case Study

-

Articles , Bankruptcy & Restructuring , Corporate Valuation

Valuation Considerations in Bankruptcy Proceedings