S Corporation Banks Beware

While most banks and their directors are generally aware of the tax benefits of an S election, there are some potential disadvantages. One disadvantage is the potential for S elections to encounter additional volatility to the equity account and lower capital ratios relative to C corporations when losses are incurred (all else equal).

When banks are profitable, the impact of the tax election on equity for S and C corporation banks is relatively muted as both pay out a portion of earnings to cover taxes either in the form of a direct payment of the federal tax liability as a C corporation or in the form of a cash distribution to shareholders to cover their portion of the tax liability as an S corporation. However, S corporations are typically limited relative to C corporations in their ability to recognize certain tax benefits when losses occur. The equity accounts of most C corporations benefit from the ability to recognize tax loss carrybacks and deferred tax assets following the occurrence of losses, which serve to soften the direct impact of the loss on capital. S corporations are generally precluded from any tax benefit after the recognition of losses and the resulting loss is directly deducted from equity. A few nasty quirks of book and tax income can make the situation even worse for shareholders and the S corporation bank.

To help illustrate the point further, consider the following example which details how losses realized as an S corporation can flow directly through to equity without the tax benefit recognized by a C corporation. As detailed below, the capital account of the S corporation was impacted more adversely following the recognition of losses than the C corporation (all else equal).

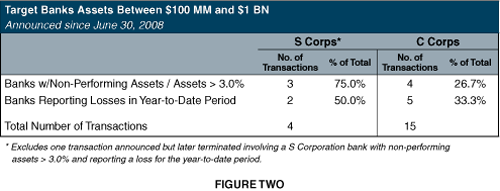

In a recent survey of bank transaction activity nationwide conducted by Mercer Capital, we noticed some evidence of this disadvantage surfacing among S corporation banks. Of transactions (whole bank sales) involving target banks with assets between $100 million and $1 billion announced since June 30, 2008, the majority of S corporation banks sold were distressed, defined as either having non-performing assets as a percentage of assets greater than 3.0% (three out of four transactions involving S corporation targets) or reporting a loss in the most recent year-to-date period (two out of four transactions involving S corporation targets). This trend is illustrated more fully in the chart below and is notable especially when compared to transaction activity of C corporations over this period.

We found some additional evidence that S corporation banks may be experiencing the detrimental impact of additional capital volatility in a review of bank failures. Of 8 total S corporation bank failures since 1998, five have occurred since January 1, 2008, with three occurring since December 1, 2008.

While it is too early to tell whether this evidence of increased transaction activity and failures among distressed S corporations is purely a coincidence or early indications of an emerging trend of capital volatility for S corporation banks, this analysis prompted a number of questions:

- Should a conversion to a C corporation be considered by an S corporation prior to recognizing losses?

- Should a conversion to a C corporation be considered even if no immediate losses are expected as a matter of conservatism?

- Should the exploration of acquisition possibilities by S corporations be accelerated prior to recognizing losses so that a C corporation buyer could recognize any tax benefits potentially unavailable to the S corporation or its shareholders?

- Should S corporations be managed more conservatively than C corporations given the added potential for volatility in the capital account?

- Should an increase in merger and recapitalization activity, bank failures, or conversion back to C corporations among troubled S corporation banks be expected for the remainder of 2009 and beyond?

- Do the shareholder limitations of S corporations limit their ability to raise capital, thereby forcing a distressed S corporation bank to pursue merger partners when substantial losses arise?

If your bank is dealing with any of these issues, feel free to give us a call to discuss the situation confidentially.