Strategic Benefits of Stress Testing in an Uncertain Economic Environment

Having gone on many a camping trip over the years, the only consistency between these trips into the woods is that there is no consistency. While some trips might have beautiful weather, others might be plagued with storms, cold fronts, heat waves, or strong winds. The campsite may or may not have amenities. And most importantly, contending with the wildlife adds another variable that can’t be predicted. However, the key element of how the trip goes is how prepared we are. The trips where we assumed blue skies were by far the most stressful. If we prepared for different outcomes and weather based on the uncertainty of going into the woods, the trip could always be salvaged.

Banks and credit unions are currently facing a similar “into the woods” predicament, as the economic environment seems to grow more volatile and contradictory day by day. While hiring remains strong and unemployment continues to stay near historically low levels with the Bureau of Labor Statistics reporting 3.6% as of June 2022, other indicators are flashing warning signs.

Inflation concerns continues to plague the economy after accelerating to 9.1% in June 2022, the highest increase since November 1981. Drivers of inflation in the past several months include rising food and gas prices as global supply remains disrupted from Russia’s invasion of Ukraine and the remnants of the pandemic. Economists are taking notice, with nearly 70% of economists surveyed by the Financial Times and the Initiative on Global Markets believing that the National Bureau of Economic Research (NBER) will make a call at some point in 2023 identifying a recession.

These conflicting indicators are convoluting the economic forecast through the rest of 2022 and 2023, and the differing potential circumstances would have very different impacts on banks and credit unions. Though this uncertainty can certainly cause headaches and stress for banks and credit unions worried about their capital positions in a severely adverse economic scenario, stress testing can help to prepare your bank or credit union in the face of uncertainty and help to optimize strategic decisions.

Stress Test Overview

A stress test is defined as a risk management tool that consists of estimating the bank’s financial position over a time horizon – approximately two years – under different scenarios (typically a baseline and severely adverse scenario). The OCC’s supervisory guidance in October 2012 stated “community banks, regardless of size, should have the capacity to analyze the potential impact of adverse outcomes on their financial conditions.” 1 Further, the OCC’s guidance considers “some form of stress testing or sensitivity analysis of loan portfolios on at least an annual basis to be a key part of sound risk management for community banks.” 2 A stress test can be defined as “the evaluation of a bank’s financial position under a severe but plausible scenario to assist in decision making with the bank.” 3

There are a few different types of stress tests that banks and credit unions can utilize in estimating their financial position:

Transaction Level Stress Testing: This method is a “bottom up” analysis that looks at key loan relationships individually, assesses the potential impact of adverse economic conditions on those borrowers, and estimates loan losses for each loan.

Portfolio Level Stress Testing: This method involves the determination of the potential financial impact on earnings and capital following the identification of key portfolio concentration issues and assessment of the impact of adverse events or economic conditions on credit quality. This method can be applied either “bottom up,” by assessing the results of individual transaction level stress tests and then aggregating the results, or “top down,” by estimating stress loss rates under different adverse scenarios on pools of loans with common characteristics.

Enterprise-Wide Level Stress Testing: This method attempts to take risk management out of the silo and consider the enterprise-wide impact of a stress scenario by analyzing “multiple types of risk and their interrelated effects on the overall financial impact.” 4 The risks might include credit risk, counter-party credit risk, interest rate risk, and liquidity risk. In its simplest form, enterprise-wide stress testing can entail aggregating the transaction and/or portfolio level stress testing results to consider related impacts across the firm from the stressed scenario previously considered.

By utilizing one or more of these stress testing exercises, banks and credit unions can better position themselves for multiple different economic scenarios in order to assure they have sufficient capital and financial strength to withstand an economic downturn if there is one.

Economic Scenarios Overview

One question that often arises is: Given the uncertainty, what economic scenarios should we consider in our stress testing? While it is difficult to answer this question, the most recent Stress Test scenarios prepared by the Federal Reserve are described in a February 2022 report, 2022 Supervisory Scenarios for Annual Stress Tests Required under the Dodd-Frank Act Stress Testing Rules and the Capital Plan Rule, and provide some guidance to assist with this decision. The scenarios start in the first quarter of 2022 and extend through the first quarter of 2025. Each scenario includes 28 variables, nineteen of which are related to domestic variables in the U.S.

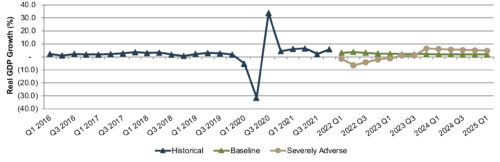

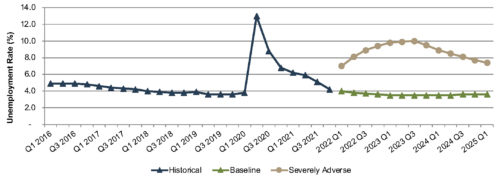

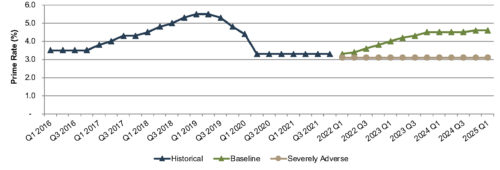

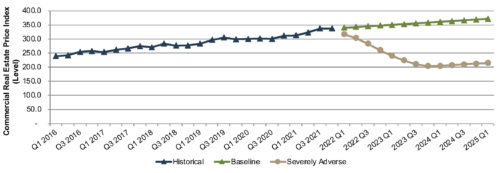

While the more global economic conditions detailed in the Fed’s supervisory scenarios may not be applicable to community banks or credit unions, certain domestic variables within the scenarios could be useful when determining the economic scenarios to consider. The domestic variables include six measures of real economic activity and inflation, six measures of interest rates, and four measures of asset prices. The baseline scenario includes an economic expansion over the 13-quarter scenario period, while the severely adverse scenario is a hypothetical scenario that includes a severe global recession, accompanied by heightened stress in commercial real estate and corporate debt markets. Below, we have included charts of some of the more relevant domestic variables (GDP, unemployment rates, the Prime Rate, and commercial/residential real estate prices) and their historical levels through year-end 2021 as well as the Fed’s assumptions for those variables in the baseline and severely adverse scenarios.

2022 Supervisory Economic Scenarios Overview

Benefits of the Stress Test

As the U.S. moves into a more uncertain economic environment, a financial institution’s preparation for its trip “into the woods” of this uncertain economic environment can reap dividends. Improved valuation, performance enhancement from enhanced strategic decisions, and risk management are some of these benefits. Greater clarity into the bank or credit union’s capital position, credit risk, and earnings outlook under different economic circumstances helps management to make more informed operational decisions.

Conclusion

We acknowledge that bank and credit union stress testing can be a complex exercise. The bank or credit union must administer the test, determine and analyze the outputs of its performance, and provide support for key assumptions/results. There is also a variety of potential stress testing methods and economic scenarios to consider when setting up their test. In addition, the qualitative, written support for the test and its results is often as important as the results themselves. For all of these reasons, it is important that bank and credit union management begin building their stress testing expertise sooner rather than later.

In order to assist financial institutions with this complex and often time-consuming exercise, we offer several solutions, including preparing custom stress tests for your institution or reviewing ones prepared by the institution internally, to make the process as efficient and valuable as possible.

To discuss your stress testing needs in confidence, please do not hesitate to contact us. For more information about stress testing, click here.