Third-Party Fairness Opinions in Continuation Funds: Lessons from Deep NAV Discounts

The Paramount Deal: A Reality Check on Valuations

On September 17, 2025, alternative asset manager Rith Capital Corp. (NYSE:RITM) agreed to acquire office REIT Paramount Group, Inc. (NYSE:PGRE) for $1.5 billion cash, or $6.60 per share. Paramount is an integrated REIT that manages and owns 13.1 million square feet of Class A offices (86% occupancy rate) in New York and San Francisco.

Word of the deal, but not the price, leaked because the shares rose 4% on September 16 to $7.39 per share on volume that was 5x above average. Relative to the pre-leak closing price on September 15, the deal price represented a 7% discount and equated to 48% of book value and 10.2x funds from operations (“FFO”).

By way of comparison, RITM’s shares as of year-end 2019 closed at $13.92 per share, which equated to 82% of book value and 14.5x LTM FFO. And for those who can time the market, the shares traded just below $4.00 per share immediately after “Liberation Day” and thereby provided a great five-month return.

When Book Value Isn’t Market Value

Paramount was not a high-flyer. The dividend was suspended in September 2024 after having been cut in June 2023 and December 2020. The stock traded below book value for years. The public market and change-of-control transactions imply the carrying value of the assets was too high though the 2024 10-K notes that real estate assets carried at cost less accumulated depreciation are individually reviewed for any impairment.

Aside from an impairment issue, GAAP did not dictate that the $8.3 billion land, buildings and improvements be marked-to-market so that book value could be directly equated with net asset value (“NAV”). Nonetheless, investors did so daily yet still over-estimated NAV that a competitive process revealed it to be in a change-of-control transaction.

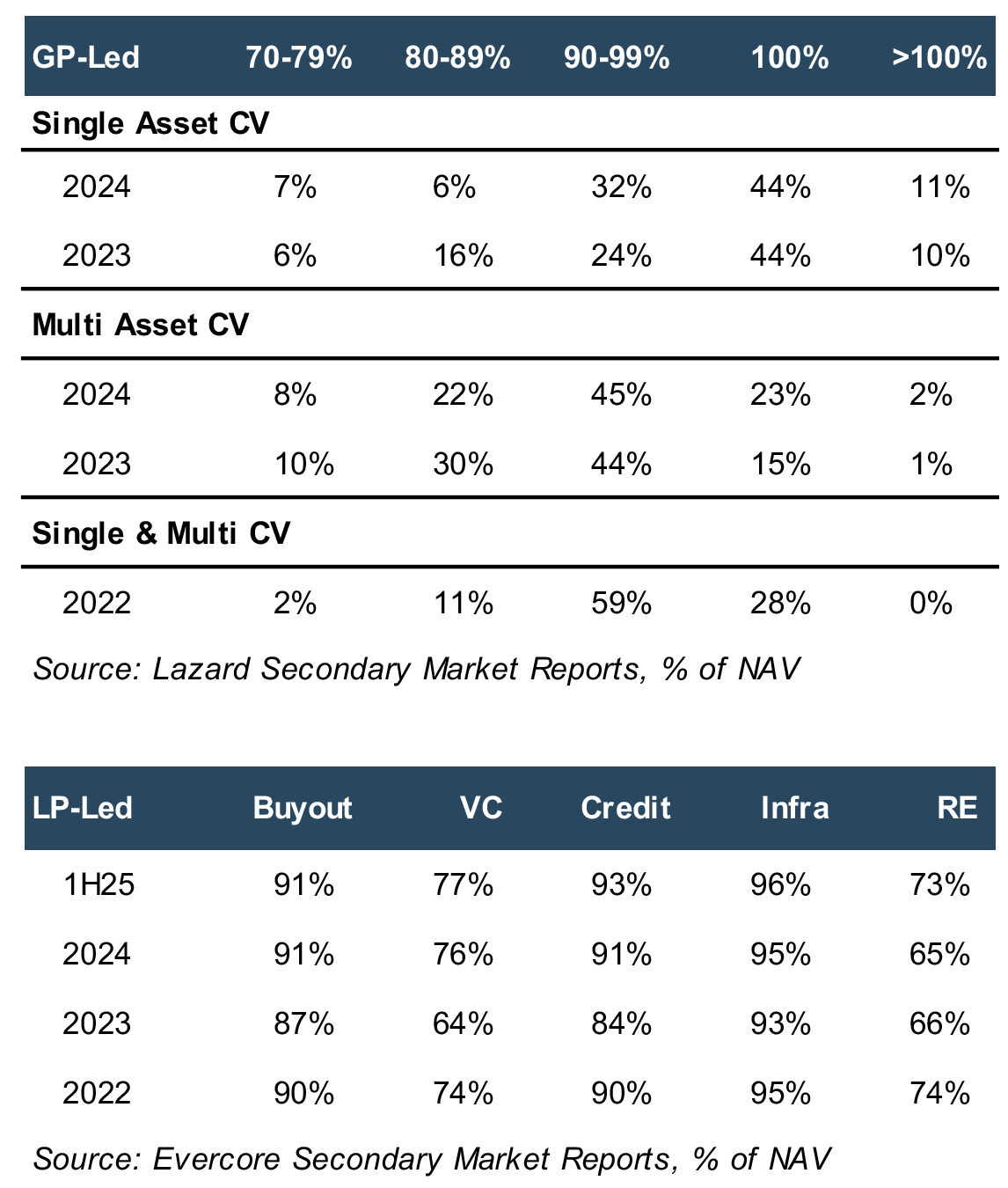

Secondary Pricing as % of NAV (by weighted average volume)

The Broader Challenge: Overstated NAVs in Private Markets

Paramount illustrates what some think is a pervasive issue in private equity and to a lesser extent private credit whereby fair value marks and therefore NAVs are too high. An unwillingness to recognize reality may be one reason PE exits are too low relative to investment. Assets are held in the hope that next year conditions will be better – the M&A market improves, the company’s earnings will be higher, etc.

Continuation Funds and Valuation Gaps

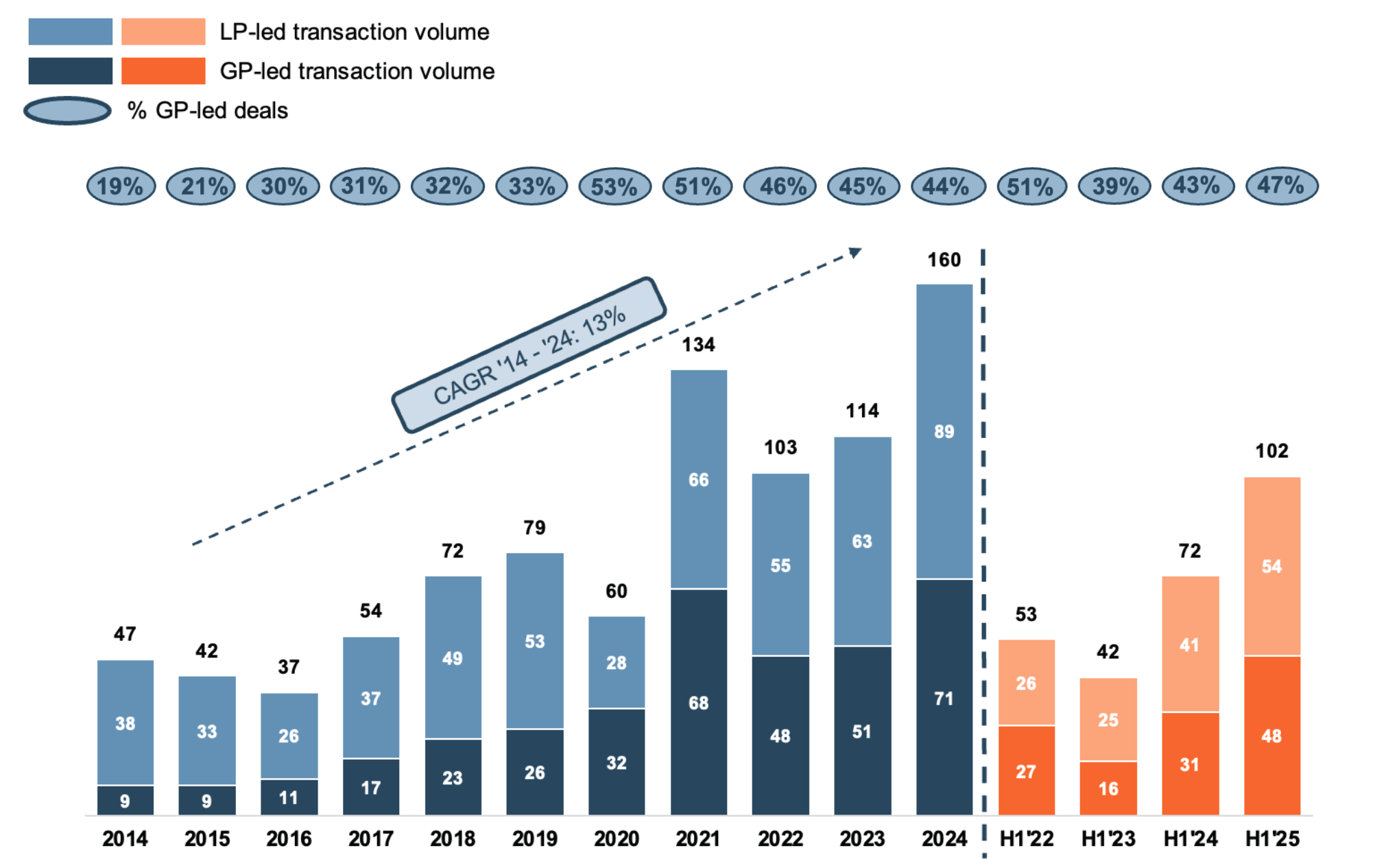

Continuation vehicles (“CV”) with five year lives that acquire assets from PE funds are a bridge to a potentially better tomorrow, but valuation gaps today based upon what the CV asset marketing process reveals vis-?-vis the current mark can be material though the data is nuanced. Evercore in its mid-year 2025 update estimates that 87% of GP-led secondaries transacted at less than NAV. Lazard estimates that 90% of single-asset and 70% of multi-asset GP-led secondaries transacted at 90% of NAV or higher in 2024. However, the data does not distinguish between cash paid at closing and contingent earn-out payments; so, the effective transaction price vs NAV may be wider.

LP-led secondaries offer additional perspective—albeit for a portfolio interest vs one or more ~plum assets—with discounts to NAV on the order of 10% for buyout interests vs 25% for venture and real estate assets. One could argue the LP discount or some portion of it reflects an illiquidity discount vs appropriateness of the NAV mark for

the portfolio.

Governance Under Pressure: The Business Judgment Rule

Directors of corporations operate under the long-held concept of the Business Judgment Rule (“BJR”) where courts generally will not second guess decisions as long as directors do not violate the fiduciary triad of care (informed decision making), loyalty (interests aligned with shareholders, conflicts fully disclosed), and good faith. Application of the BJR to GPs varies by state and will be viewed through the lens of the partnership agreement when disputes arise.

Secondary Market Transaction Volume Over Time ($bn)

BJR murkiness notwithstanding, GP-led secondary transactions are problematic from a governance perspective because GPs are both seller and buyer, and the GP has a financial incentive to extend the period on which management fees and carry are earned.

The Role of Fairness Opinions

The institutionalization of GP-led continuation funds has led to the development of a fair dealing process to address the loyalty question—at least outwardly—in which a third-party financial advisor markets the subject asset(s) to investors who would capitalize a CV. The proposal with the combination of the best price and terms with confirmed access to capital will be selected to transact subject to a conflict of interest waiver from the LP advisory committee (“LPAC”).

Third-party fairness opinions emerge as indispensable here for the LPAC, bridging process and price vis-?-vis the historical fair value marks. Unlike binary “fair/unfair” verdicts, these assessments—rooted in rigorous due diligence—evaluate the marketing process, transaction terms from a financial point of view, dissecting NAV assumptions, cap rates, and exit multiples against market comps.

Best Practices and Industry Guidance

For continuation funds, the stakes are higher: GPs must demonstrate that discounts reflect arm’s-length negotiations, not convenient happenstance. The CFA Institute research on ethics in private markets emphasizes competitive bidding processes to mitigate manager incentives—strong financial additions like promoted interests in the new fund can skew outcomes toward overvaluation. ILPA’s 2023 guidance amplifies this, urging 30-45 day timelines for LP re-underwriting, full disclosures on advisor conflicts, and LPAC pre-approvals to safeguard alignment.

Beyond a Checkbox: Upholding Fiduciary Integrity

Ultimately, fairness opinions are not mere check boxes; they are part of the governance protocol to address the care and loyalty duties that are the cornerstone of the BJR.

About Mercer Capital

Mercer Capital is an independent valuation and financial advisory firm founded in 1982, specializing in business valuation, corporate transactions, and financial opinions. With offices in Dallas, Houston, Memphis, Nashville, and Winter Park, we serve private equity sponsors, portfolio companies, and institutional investors in valuing complex, illiquid equity, credit, mezzanine and other such securities. Our fairness opinion practice, a cornerstone of our expertise, provides objective assessments for conflicted transactions such as GP-led secondaries and continuation funds. Drawing on deep market insights and rigorous due diligence, we help clients navigate governance challenges, ensure regulatory compliance, and maximize stakeholder alignment. For more, visit mercercapital.com.