Time Will Tell: Diverging Perspectives on BDC Portfolio Values

We observed last spring that 2015 would likely mark a turning point in portfolio valuations with the degree of difficulty likely to increase during the year. With the Q4 earnings season for BDCs complete, we take an opportunity to check in on portfolio marks and market sentiment over the year. The key takeaway from the year is that the valuation perspectives of investors and portfolio managers began to diverge.

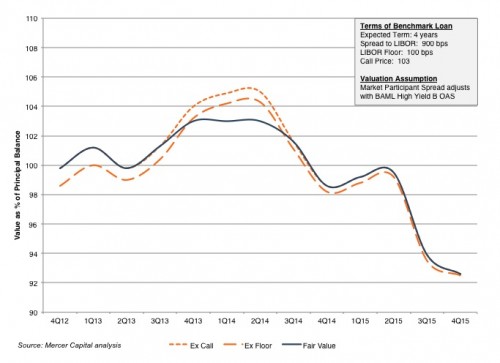

The following chart depicts our benchmark loan mark for the past three years. After the sharp decline in 3Q15, the fair value of the benchmark loan fell again in the fourth quarter, falling from 93.9% of principal to 92.6%.

As we have noted on numerous occasions, the fair value of actual loans is determined by a host of issue-specific factors in addition to the market-wide indicators captured in the benchmark loan. However, for broad portfolios of loans, it does provide a measure of sensitivity of fair value to changes in credit spreads.

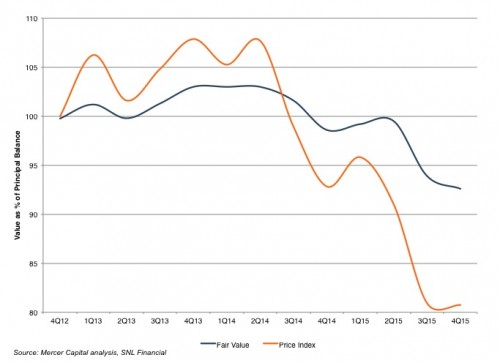

For BDCs, the benchmark loan fair value has been correlated to investor sentiment regarding BDC portfolio values. The next chart compares the benchmark loan fair value to a price index of a group of the largest BDCs over the period. Since BDC balance sheets are levered, the sensitivity of BDC share prices to the value of loan portfolios is magnified.

Since fair value is intended to reflect a market participant perspective, one would expect portfolio marks and investor perspectives to reconcile over time. However, current BDC share prices imply an even more dim view of BDC portfolio asset values on the part of investors than that indicated by our benchmark loan index. This would seem to suggest one of two potential scenarios: (1) investors have over-reacted to the impact of credit-spread widening on loan portfolio values, or (2) investors have adopted a skeptical posture toward the underlying credit quality of BDC portfolios. We do not hazard a guess at this point as to which will prove to be the more accurate explanation.

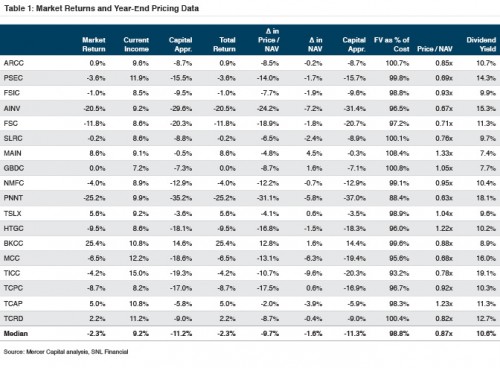

Table 1 summarizes 2015 market returns for 18 of the largest BDCs.

Total returns were negative for 11 of the BDCs analyzed, with share prices declining for all but one. Falling share prices were attributable to lower NAVs (median decrease of 1.6%) and shifting investor sentiment, with price/NAV ratios posting a median decrease of 9.7% for the year.

On December 31, 2015 BDC balance sheets, reported portfolio fair values stood at 96.7% of amortized cost. Investors, however, seem to be marking the portfolios a bit lower, with the median price/NAV ratio for the group at 0.87x. Current dividend yields suggest that, at least for some names, the sustainability of current payouts is being questioned; beyond direct credit concerns, this may also be weighing on BDC share prices.

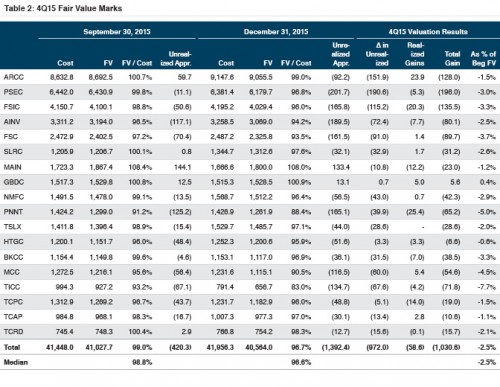

During the fourth quarter, the BDCs in Table 1 reported aggregate fair value writedowns of just over $1.0 billion, or 2.5% of beginning cost basis. As noted in Table 2, the writedowns for individual BDCs ranged from 7.7% for beleaguered TICC to 0.6% for tech-focused HTCG. Only one BDC, GBDC, reported a net writeup during the quarter.

It is interesting to note that the BDCs with the lowest marks at the beginning of the quarter took, on average, larger writedowns during the quarter than those with higher marks. The nine funds with the highest ratios of fair value to cost basis at September 30, 2015 (median: 100.1%) reported a median writedown of 2.1% during 4Q15, while the bottom half (funds with a median ratio of fair value to cost basis of 96.5%) reported a median writedown of 3.3% during the quarter.

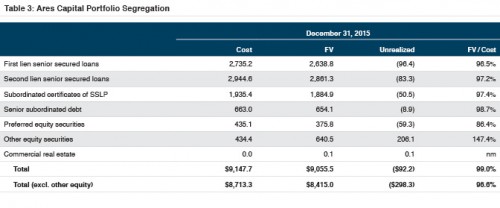

Asset mix varies among the portfolios analyzed. For example, significant unrealized gains on equity positions within a portfolio can have a material effect on the overall portfolio mark. As shown in Table 3, non-preferred equity positions for industry leader ARCC accounted for just 4.7% of the total portfolio at amortized cost. However, ARCC reported fair value of that portion of the portfolio at nearly 1.5x cost, for a total unrealized gain of over $200 million, which raised the overall effective mark on the portfolio from 96.6% to 99.0% of amortized cost.

If 2015 was the year of increasing degree of valuation difficulty, perhaps 2016 will be the year in which we learn whether portfolio managers have been able to stick their valuation landings, or if portfolio marks will be subject to continuing market skepticism in coming quarters. In the end, the market perspective wins – BDC share prices will either recover to levels consistent with December 31, 2015 marks or the portfolio marks will trend toward the market-implied levels. Time will tell.